In 2014, Afterpay was introduced to the Australian market as an alternative to traditional credit providers. In the UK, it’s called Clearpay, although it’s the same corporation from the same firm.

Before exploring the best Alternative Apps like Afterpay, I want you to know some basic details about some basic functions of these apps.

Let’s get started.

What are Buy Now, Pay Later (BNPL) companies?🤔

The buy Now Pay Later (BNPL) concept is simple and has been around for decades, if not centuries: allowing customers to break payments into smaller, more “affordable” installments at the point of sale. So, what’s the big deal now?

BNPL is now redefining the customer journey by effortlessly integrating as a checkout option into e-commerce. It also typically charges no interest and, in certain cases, no late penalties, so client uptake is brisk, particularly among Gen Z and Millennials.

Merchants adore it because, at its core, it’s a technique to increase sales, improve payment checkout conversion rates, and lower interchange fees from debit and credit cards to other payment methods.

As the “new” trend in consumer finance, BNPL is cutting down on the $4 trillion credit card market, but it won’t be easy.

Firepower is not an issue, however: the number of companies in this field has increased from 44 in 2016 to more than 105 in 2021, and the VC funding in this space has increased from €150M in 2016 to €3.5B YTD.

With the rise of BNPL companies offering financing options at the point of sale, the concept is becoming more popular amongst entrepreneurs and investors worldwide.

BNPL players have raised over $2.1B in equity fundraising over 20 agreements in 2022, a new annual funding record.

The BNPL market is expanding beyond traditional e-commerce categories like clothes and beauty into areas such as healthcare, travel, entertainment, and home improvement.

What is Afterpay?🤷♂️

Afterpay is a “buy now, pay later” (BNPL) platform that allows you to buy something now, receive your products, and pay them back in biweekly installments afterward.

You can buy everything from clothes and makeup to drugs and flights with this app, launched in 2015 in Sydney, Australia.

As of December 2019, Afterpay was being used by nine percent of Australians, primarily among the country’s younger population. While retailers offering Afterpay may notice a rise in sales, the flip side for customers is the risk of overspending, over-commitment, and debt spiral.

Afterpay is a platform that serves as a go-between for businesses and customers. Once the platform has paid the store upfront for the products, the customer must reimburse Afterpay for the amount paid.

You’ll have to make four fortnightly payments over eight weeks to achieve immediate gratification. These payments are interest-free and equivalent in value for each order.

It does not charge interest to merchants who provide the service, but Afterpay does charge merchants and customers who miss payments late fees.

With Afterpay, users don’t have to enter into a loan or credit facility like they would with many other payment options. This may appear to benefit the client, but fewer safeguards exist for them.

It was discovered in an ASIC study of BNPL schemes that one out of every six customers had trouble keeping up with payments. It’s easy to succumb to the lure of those seemingly insignificant repayments, especially when combined with the immediate gratification of obtaining your products.

With Afterpay, you can make purchases at thousands of retailers while deferring payment and avoiding interest! The process is very similar to the others on our list. Log in with your credit card or debit card to get started.

The only thing left is to wait for Afterpay to process the payment. Several applications like Afterpay on the market provide the same service but with different plans and retailers.

It is not the only one. Let’s get started, shall we?

Best Apps Like Afterpay – Our Top Pick👌👌

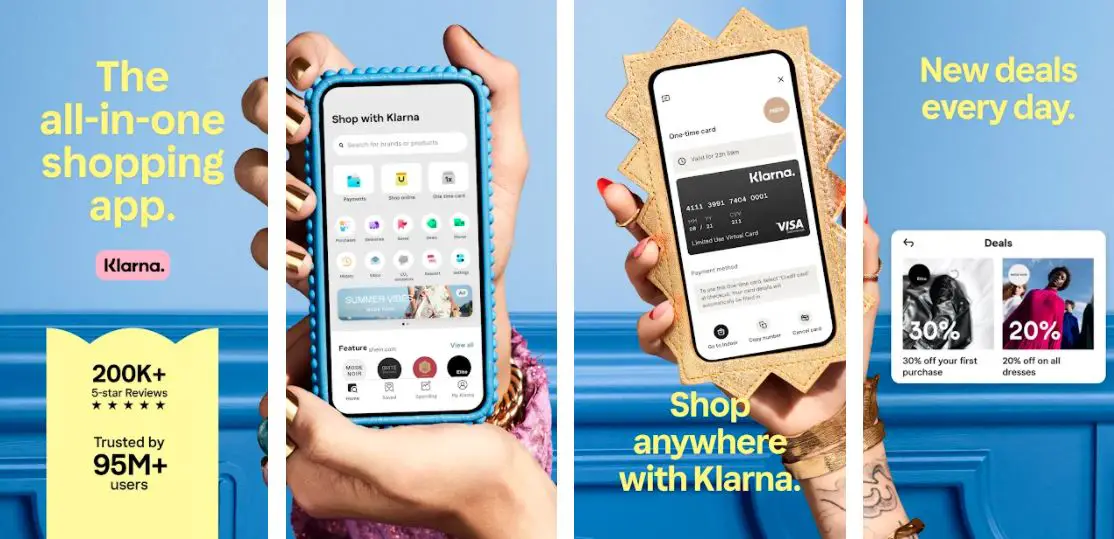

1. Klarna – Apps like afterpay with no down payment

Online financial services, such as payments for online stores and direct payments, are provided by Klarna Bank AB (often abbreviated to “Klarna”).

We ranked Klarna as one of the top Alternative Apps like Afterpay on our list. It allows you to pay for your products over time and avoid paying interest.

Like other applications, Klarna has a four-payment plan that requires 25% of the whole payment up front and the remaining 75% over six weeks. Nevertheless.

There’s also a nice thirty-day payment plan available. This is advantageous since it allows you to test products before making a purchase decision, and there is no obligation to pay until 30 days have elapsed.

Additional financing options are available through Klarna, but they are the same as using a credit card. As a result, we recommend using them with caution because they may report unpaid bills to credit bureaus, but they do not inform all of your payments.

When you make a purchase that you can’t pay off in 30 days or even six weeks, Klarna offers paid financing solutions, most of which are set up as credit cards.

Depending on your personal information and the shop selling the product, your payment plans will vary, with monthly installments ranging from six to thirty-three months.

In addition, merchants may conduct special promotions on specific purchases, such as offering discounted or postponed interest.

Download the App from Google Play Store

Download the App from Apple App Store

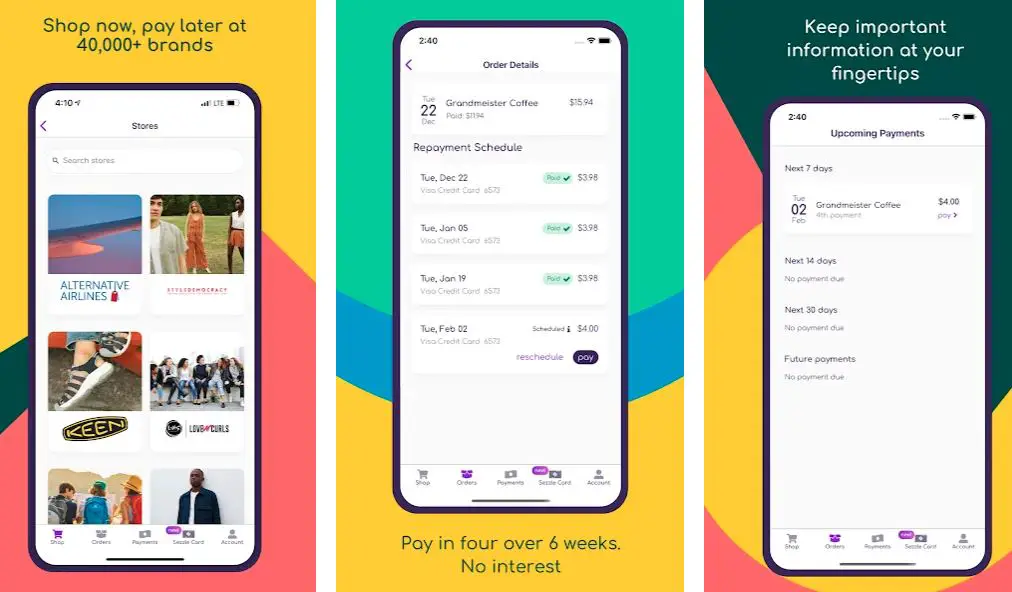

2. Sezzle – Apps like afterpay To Buy Now at 40000+ Brands

Sezzle is another app like Afterpay because it allows you to make four interest-free payments over four months.

It’s easy to use and gets applications approved quickly so customers can shop at more than 27k stores and websites. Anyone is eligible to apply for Sizzle’s credit, which can be used on any platform.

Customers of participating online retailers can split the payment for their purchases into four installments thanks to the Sezzle e-commerce payment platform introduced in 2017.

The first payment is made at the time of purchase, and the remaining three are payable over the next six weeks at regular intervals.

Sezzle’s service is free for users. Recurring customers who have made timely payments on prior purchases might borrow money to pay for more expensive items.

Customers can use the platform to pay for goods and services at participating retailers by selecting it as an alternative payment method at the time of purchase. The Sezzle app and website allow customers to do more than just browse for products.

Since FICO scores alone cannot be used to determine credit risk accurately, the underwriting system at Sezzle evaluates each transaction individually, considering a variety of parameters such as a soft credit score check, the customer’s order history at Sezzle, as well as the total purchase amount.

Unlike Afterpay, it will have no negative influence on your credit score, making it a great Afterpay substitute. There are a few alternatives for making monthly payments with it.

You will get four interest-free installments to complete your EMI purchase. Due to the split payment system, customers can shop in-store and online without worrying about running out of money.

It makes it easier for customers to collect all their favorite things offline and in-store because the total payments will be spread out over several months, including tax.

If you’re paying in three installments, you’ll have to pay 25% of the entire order upfront (also known as your “down payment” or “first installment”), with the rest due in three weeks.

There are no interest or other charges and no hidden costs. There aren’t any fees as long as you pay your installments on time!

Download the App from Google Play Store

Download the App from Apple App Store

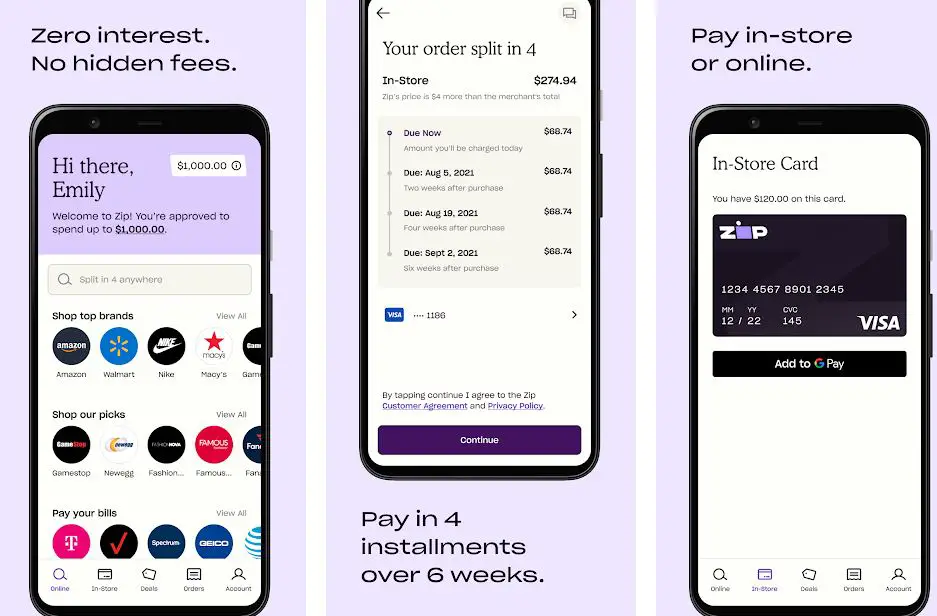

3. ZIP – Buy now, pay later in four

Zip (formerly Quadpay) is another alternative app like Afterpay that allows you to buy things with a 25% upfront payment and the interest-free balance payments are spread over the following six weeks. There are no annual or hidden fees on the site, but you will be charged if you miss a payment.

Zip payment is incorporated into nearly all popular websites, allowing you to make a payment immediately without waiting days for clearance.

Additionally, Zip has connections with tens of thousands of brick-and-mortar retailers, including those selling food, gadgets, and apparel.

These services are offered to accounts having a balance of less than or equal to $1000. For the first three months, there is no fee for using Zip Money for transactions totaling more than $1000.

Zip has around 2 million satisfied consumers in Australia and New Zealand.

Download the App from Google Play Store

Download the App from Apple App Store

4. Affirm – Apps like afterpay for amazon

Affirm is the greatest alternative to Afterpay because it doesn’t impose late fees or other extra fees.

The only difference between Affirm and the other apps on this list is that Affirm only offers 0% interest for a select few stores. Three payment options are three months, six months, and a year.

There are no surprises with Affirm. You’ll know exactly how much interest you’ll have to pay if you have to pay any interest. The Affirm application process will not affect your credit score because it is only a soft credit check.

Affirm’s lower interest rates and improved transparency appeal to millennials, while retailers like Affirm assume all loan risks. Additionally, retailers’ sales are up due to increased consumer spending.

Rather than waiting weeks to learn if they’ve been accepted.

Affirm looks at more than just a FICO score when determining a borrower’s financial responsibility. It is a great substitute for the app we discussed first, Afterpay.

Download the App from Google Play Store

Download the App from Apple App Store

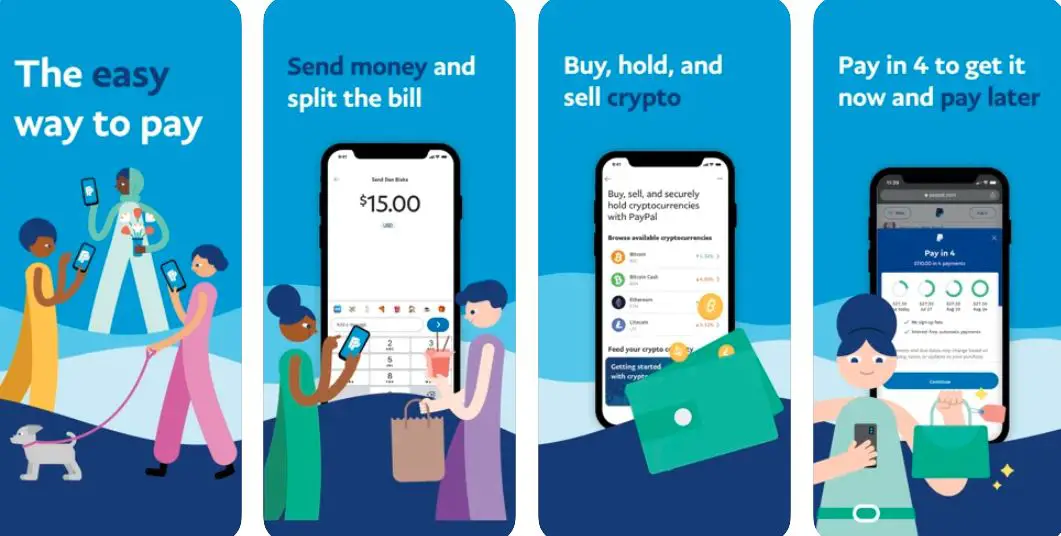

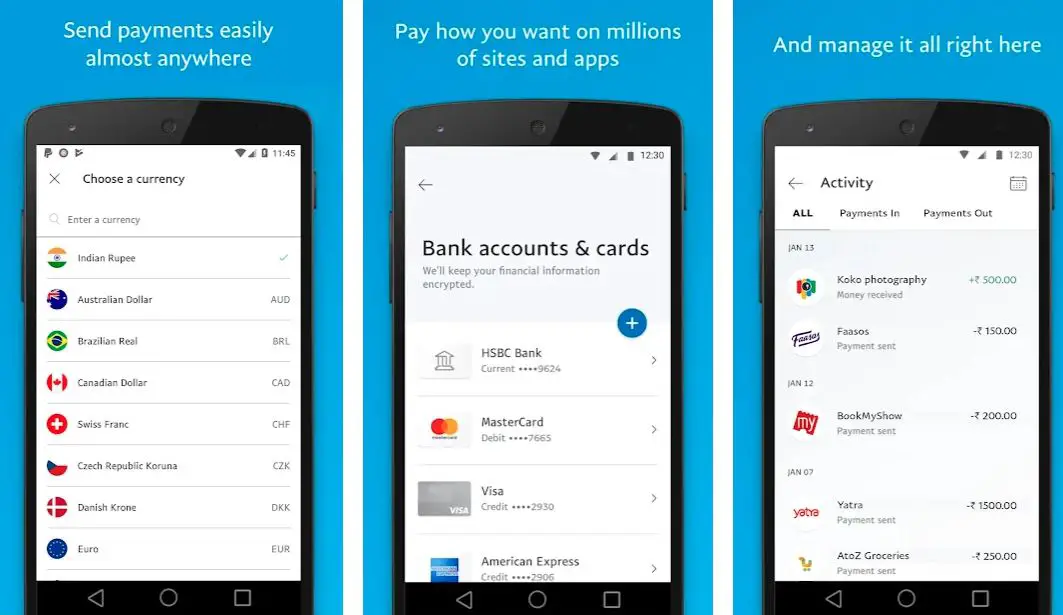

5. PayPal

Purchasing now and paying later is now possible thanks to PayPal, the world’s largest payment processor! Using your existing PayPal account is the easiest part because you won’t have to create anything new.

Choose PayPal as your payment method and pay later. There will be a 25% down payment, and the remaining 75% will be paid over six weeks after purchase.

When you pay with PayPal, you can select which of your bank accounts, credit cards, or debit cards to use.

If you opt not to override the default payment method, you will be charged using that one by default.

PayPal allows you to do more than just send and receive money. Any money you get is stored in your PayPal account and can be used to pay for goods and services, with the amount being replenished by your specified cards or bank account.

Alternatively, you can make a money transfer to one of your designated bank accounts or cards. A fee may be charged to your PayPal account when you receive money.

The vast majority of uses are free for you to utilize personally. Transferring money to friends or relatives using PayPal accounts is completely free, as long as no currency exchange is required.

Download the App from Google Play Store

Download the App from Apple App Store

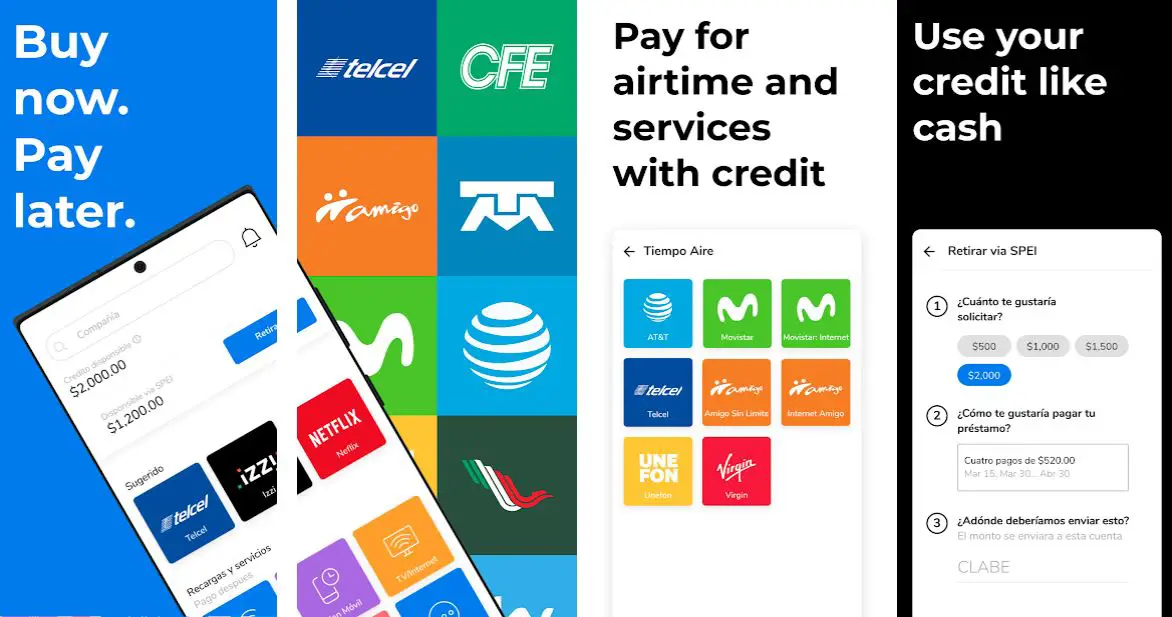

6. Nelo – Apps like klarna

Millennials are familiar with the term Nelo. Payments are made in installments until the stuff is paid in full, at which point it is yours.

When you use an app like Afterpay, you can choose to “purchase now, pay later” and pay in four equal installments over four weeks.

In Contrast to traditional Nelo, the best part is that you get to leave the store with the goods before even completing your first purchase.

Payment is made every two weeks, and the total cost is limited to the item’s retail price.

The “purchase now, pay later” option, followed by Apps like Afterpay, transforms this interaction. This isn’t like a standard layaway arrangement in that you’ll get the goods before you make your first payment.

Download the App from Google Play Store

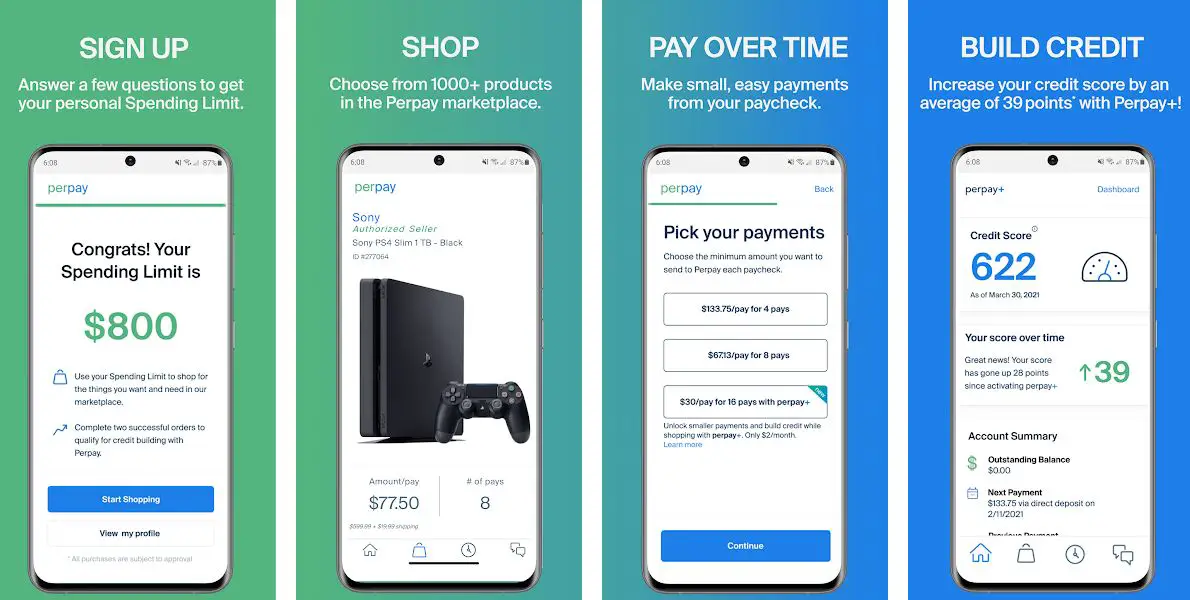

7. Perpay – Buy Now, Pay Later, Build Credit

Perpay is financial software that allows customers to buy and pay for items over time with simple, recurring installments. There are no hidden costs, no interest charges, and no credit reports to worry about.

Shop your favorite brands on the PerPay Marketplace, then submit your application for approval after you’ve finished shopping.

Prepay, a financial app similar to Afterpay, was created in 2014. It is a financial platform that enables customers to buy certain brands’ products and pay for them in monthly split installments.

It’s a good payday loan substitute where you set up your bank account and allow the app to collect payments from each paycheck to repay the cost of an item.

Because the Perpay staff cares so much about the success of its customers, they read every piece of feedback they receive.

Perpay+, the company’s latest credit-building tool, was made possible thanks to this meticulous process, and it’s helping clients gain even more control over their financial destinies.

The social impact-driven fintech startup allows customers to finance large-ticket purchases from its eCommerce marketplaces, such as new furniture or a washer and dryer, depending on their income rather than their credit score.

Each pay period, affordable monthly installments are deducted immediately from the clients’ paychecks, ensuring that consumers never miss a payment or overdraft their accounts.

And, unlike other lending choices for people with bad credit (think payday lenders and rent-to-own companies), there are no late penalties or interest charges.

Download the App from Google Play Store

Download the App from Apple App Store

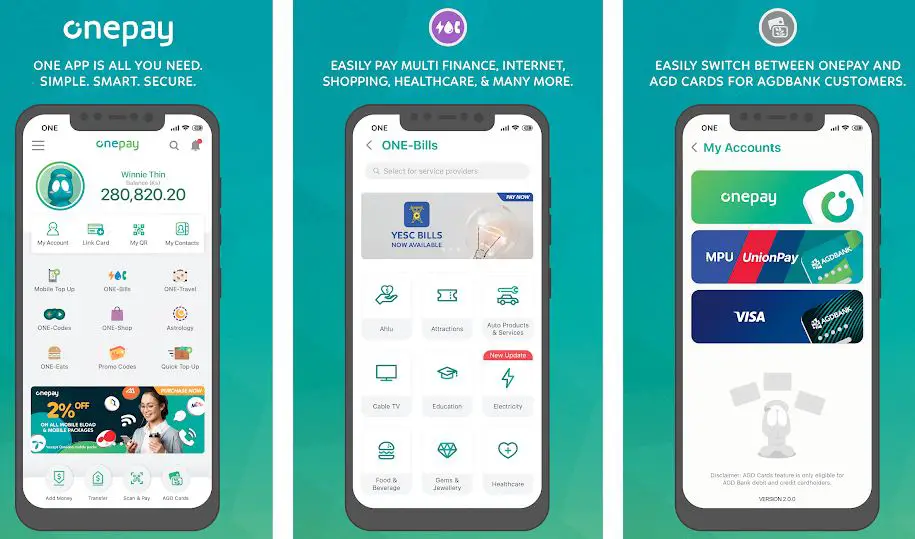

8. Onepay – Apps like afterpay no credit check

OnePay is another great Alternative App like Afterpay that you must try. Several online stores currently offer the OnePay option. For purchases up to $10,000, you can arrange a 12-month financing period.

Once it has verified your information, you can shop at any retailer partner of OnePay. Start with a payment plan that fits your budget; you’ll pay your first installment while checking out, and any outstanding balance will be paid throughout the following month or week.

To build your business in one place, OnePay gives you all the fundamental payment features you need, from payments to billing and vaulting to tokenization. There’s no need to go out and get anything else.

The Onepay lifestyle app is built to be secure while also providing simplicity, better interoperability, and consolidation of numerous payment platforms, all connecting its users and merchants in the ecosystem.

Download the App from Google Play Store

Download the App from Apple App Store

9. Zebit

Founded in San Diego, Zebit is an eCommerce firm dedicated to improving the lives of more than 120 million credit-challenged Americans.

It gives consumers access to a wide range of products and the flexibility to pay for those things over six months without additional fees or penalties. Zebit is undoubtedly one of the greatest apps like Afterpay for making payments over time on a wide range of goods.

It was introduced in 2015 and is now accessible in all 50 states. Since going public on the Australian Securities Exchange (ASX) in October 2020, the company has raised over $90 million in venture capital funding.

Are you interested in selling your goods on Zebit? Reach Zebit’s 1MM+ customers, who browse 120,000 products in 25+ categories, including electronics, furniture, home goods, clothes, and much more.

Zebit will provide you with a credit of up to $2,500 that you can use to purchase the things you desire. We don’t charge for membership, and there are no “gotcha” costs.

At checkout, the price you see is the amount you’ll pay, and nothing more. Zebit does not access your FICO® score in any way.

Zebit collects information about you from specialized credit reporting bureaus as part of its verification procedure, although this does not affect your FICO® score.

Zebit must be able to verify your identification, your income, and your work, and you must be at least 18 years old or of legal contracting age.

Online purchasing should be accessible to everyone, regardless of their financial situation. That’s Zebit’s goal. Our goal at Zebit is to become the most trusted eCommerce brand in your wallet, one that everyone can be happy to use and endorse.

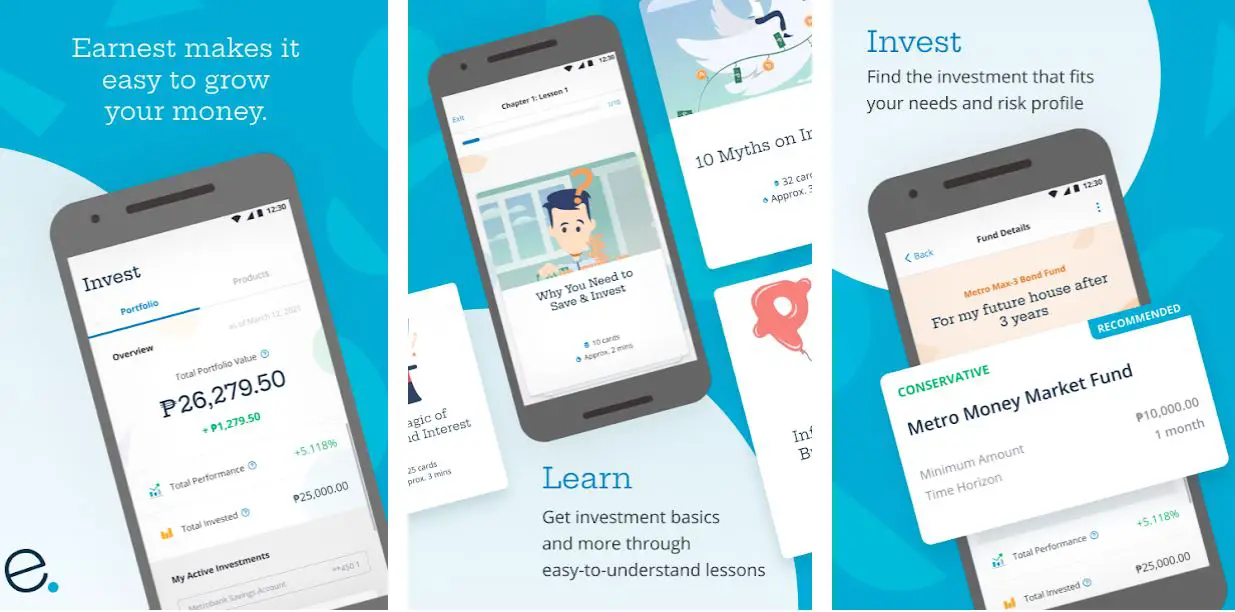

10. Earnest

Earnest is a San Francisco-based fintech lender focusing on education lending, including refinancing student loans and providing private student loans.

Additionally, the corporation looks at an applicant’s credit score (often referred to as a FICO score) to get a complete financial picture before making a decision.

“Merit-based lending” is used to describe this sort of loan. Earnest is a financial education and investment website.

It allows you to learn the foundations of money and start saving anytime and wherever you want.

We’ve all watched family and friends struggle to pay for college. As a result, it became apparent that our purchasing habits needed to evolve.

That’s how Earnest entered the fray. Earnest gives all responsible borrowers a chance to continue their education while repaying their student debts. Student loans, they claim, are created with simplicity in mind.

The software is designed with ease of use in mind, with clear language and an intuitive UI to help you along the way. You can contact the company’s customer service agent by phone, chat, or email if you need additional assistance.

Because they treat you as an individual rather than a customer, they work relentlessly to provide some of the most competitive interest rates.

Download the App from Google Play Store

11. Splitit

Splitit, as the name implies, is a wonderful Afterpay substitute for making purchases now and paying for them later. Except for one feature, it’s much like the rest of the apps on this list.

Splitit does not charge late fees or interest or run a credit check. Create an account for free to get started. It’s possible to pay for purchases over time with a payment plan that includes three, six, twelve, or twenty-four equal monthly payments.

However, some retailers restrict the number of payments you can make. Since Splitit does not charge late fees, it’s an excellent Afterpay substitute.

You will be charged for the first installment once Splitit confirms you have sufficient credit to cover your purchase.

Splitit may place a pre-authorization hold equivalent to your remaining balance, which will appear as a pending transaction on your statement.

The authorized amount will decrease as you make additional payments until the outstanding balance is paid as a whole.

Things to keep in mind before using a BNPL platform-

On the surface, “buy now, pay later” (BNPL) services are tempting. Your purchase and then pay it off in predetermined installments rather than everything at once.

This makes dealing with large bills much easier, especially if you don’t have enough savings to pay in full. And, unlike zero-interest credit cards, you don’t need good credit to qualify because no credit check is normally necessary.

Despite the benefits of BNPL, there are a few ways it might get you into trouble. If you’re considering using a BNPL service, you should know how it could cost you money or harm your credit.

1. It makes you want to buy things you don’t need.

Overspending is by far the greatest hazard of BNPL. If you’ve seen BNPL offers, you’re familiar with how this makes you feel. When an item, such as a tablet or an exercise bike, costs $1,000, you have to ask yourself if it’s worth it.

However, it becomes significantly cheaper when you consider that you could also purchase it for just $42 a month for 24 months. You’ve still shelled out the cash, however.

Only now will you have to spend the next two years attempting to make up lost ground. Your monthly payments may not seem like much, but that’s money you might be putting into the stock market or a savings account.

Financing a purchase with BNPL can indeed be advantageous. You only have to think about how significant the purchase is to you before you commit to paying it back over several months or years.

2. Late payments are subject to steep fines

BNPL will be a good fit if you’re on top of your payments. You won’t be charged any fees or interest, and the payments will positively impact your credit history. However, the deal is off the rails if you skip a payment.

You may be charged a late fee if it occurs. The service provider determines the price, and our research on BNPL services revealed wide price variations.

Some companies, like Affirm, don’t charge late fees. It’s true for the vast majority of people. Paying with PayPal Credit, which charges up to $39, and paying with Afterpay, which charges up to 25% of the initial order value, are the most expensive options.

The service provider may charge you interest if you don’t make your payment on time. If you miss a payment for more than 30 days, your credit report may reflect this, resulting in a reduction in your credit score.

3. Failure to pay off your debt on time can result in tremendous interest charges.

When you use BNPL, you can pay off your purchase at any time without incurring interest. This, of course, will not continue indefinitely. The supplier will impose interest if you don’t pay in full within the interest-free term.

The minimum payment isn’t always sufficient to cover the balance owing. You must perform the arithmetic to ensure you’re paying the correct amount.

As a result of our research, Affirm (30 percent), PayPal Credit (23.99%), and FuturePay all charged interest: Affirm (a $1.50 financing fee for every $50 unpaid balance).

Those interest rates are excessive even when compared to those of credit cards. The benefits of using BNPL services are undeniable. They provide easy, no-hassle financing with no pre-approval criteria.

These advantages, however, make it easier for BNPL customers to go into debt. It’s critical to exercise caution while making purchases to avoid accruing debt for things you don’t require.

You should always pay your bills on time and before the interest-free term expires if you utilize BNPL.

📗FAQ

Who is Afterpay biggest competitor?

Sezzle, PayPal Credit, Affirm, Klarna, Splitit, etc., are among the biggest Afterpay competitors and provide the choice of making a now-and-pay-later payment.

Which is better, affirm or Afterpay?

Beyond the traditional pay-in-four lending services, Affirm provides payment options. Customers are given various financing options during the checkout process, allowing them to select the period and payment amount that work best for them.

Beyond its pay-in-four loans, Afterpay does not currently provide any more financing choices. Instead, it concentrates on these brief, interest-free loans as it continues to expand internationally and build out its merchant network.

Because Affirm offers a variety of payment alternatives, does not impose late fees, and may help you establish credit through your on-time payments, it is our preference over Afterpay.

In addition, a credit card that enables eligible purchases to be paid off over time without incurring any additional fees or interest will also soon be available.

How is Splitit different from Afterpay?

There are additional website categories where AfterPay has stronger usage coverage. Including 20 categories: Sports, Home & Garden, E-commerce & Shopping, and Lifestyle.

Retailers who accept Afterpay can anticipate getting their money 48 hours after the buyer pays.

Most nations rank it first, including the United States, Australia, New Zealand, the United Kingdom, and 143 other countries.

With Splitit, retailers can select the package that best meets their company needs and decide whether they want to get paid upfront or according to the customer payback schedule.

Splitt has recently grown, although it still trails AfterPay in every market share category. Simply in Myanmar, SplitIt is in the lead.

What sites let you pay in installments?

Affirm, Sezzle, Afterpay, Splitit, Klarna, etc., are some leading platforms that allow you to pay in installments thanks to the powerful “Buy Now Pay Later” structure.

What, buy now, pay later, no credit check?

Affirm, Klarna, Amazon BNPL. Zip, PayWithFour, etc., are some of the most preferred services that offer a buy now, pay later option without requiring you to go through the credit check.

Does Splitit do credit checks?

Splitit doesn’t run credit reports. As long as your Visa or Mastercard has enough credit available to cover the purchase’s full cost, you are eligible to use Splitit.

Furthermore, Splitit does not submit information to credit bureaus; however, the installment charges will probably submit data about your payment history on which the installment charges appear.

Does Sezzle check credit?

Sezzle performs a soft credit check when you apply for credit through the site; this check does not affect your credit score.

Without a thorough credit check, this inquiry provides the business with sufficient data to assess its creditworthiness. There is no credit reporting associated with Sezzle’s normal service.

Still, if you wish to use the program to establish your credit history, you can enroll in Sezzle Up’s revolving line of credit.

How do you get approved for Quadpay?

You must have at least 25% of the item’s purchase price, the first of four installments, accessible on your balance to purchase Zip (previously Quadpay).

Quadpay won’t approve the order if you don’t have that sum. Of course, if you have several unpaid orders, that is another thing to consider.

Conclusion

It’s nearly impossible to keep a family budget on track today. Many people are strapped for cash, so they always look for cheaper options and better bargains.

Most people can now shop for thousands of things on a pay-over-time basis using apps like Afterpay and others. However, there are a few things to keep in mind. It’s critical to weigh the interest costs against the benefits of the purchase.

Using services that allow you to spread your payments over a longer period is sometimes worthwhile.

Also, remember that they are credit services, so you’ll have to apply and get accepted. If you fail to make your payments on time, it will impact your credit score.

When unemployment is rampant and people are frequently in debt, it’s nice to have a little leeway on their payment terms.

These services offer a wider range of payment options, which is advantageous to businesses and customers.