Bundll is one of the leading “Buy Now, Pay Later (BNPL) platforms known for its versatility, flexible repayment options, availability at a very large scale, and more importantly, payments without interest!

From food to fuel, grocery to entertainment, train tickets to traveling, you can use this amazing app for literally everything!

However, like every other great thing, there are a few cons associated with Bundll, add, there is no reason why you should not look for similar platforms or applications providing the same BNPL services.

Although you don’t have to pay any interest with Bundll, you may have to deal with a late fee of up to $10, and if you are unable to pay for extra 14 days, it charges an extra $2.50. And, I think this can be a problem for a lot of people!

In addition to this, if you are not impressed with the platform due to any reason, there is good news for you!

Fortunately, there are so many apps like Bundll, which allow you two pushes the items of your requirements, and pay later according to your comfort.

Let’s have a comparative look at some of the best applications like Bundll.

A few words of caution though…

Yes, “Buy Now Pay Later” sounds too exciting, but can definitely be A cause of concern, especially for those who don’t have regular monthly incomes.

I strongly recommend you to please check out all the terms and conditions available on each of these apps before finally deciding to use them for your advantage.

And, if you are a student, still looking for a job, or you don’t have a regular source of income, there is no way you should even think about using any of these apps!

It might sound cool if you get an option of paying later for your purchases, but can put you in immense trouble if you are unable to pay your bills on time! Be wise, stay informed of both pros and cons of BNPL, and always stay away from any type of trouble.

Best Apps like Bundll – Our Top Pick 👌👌

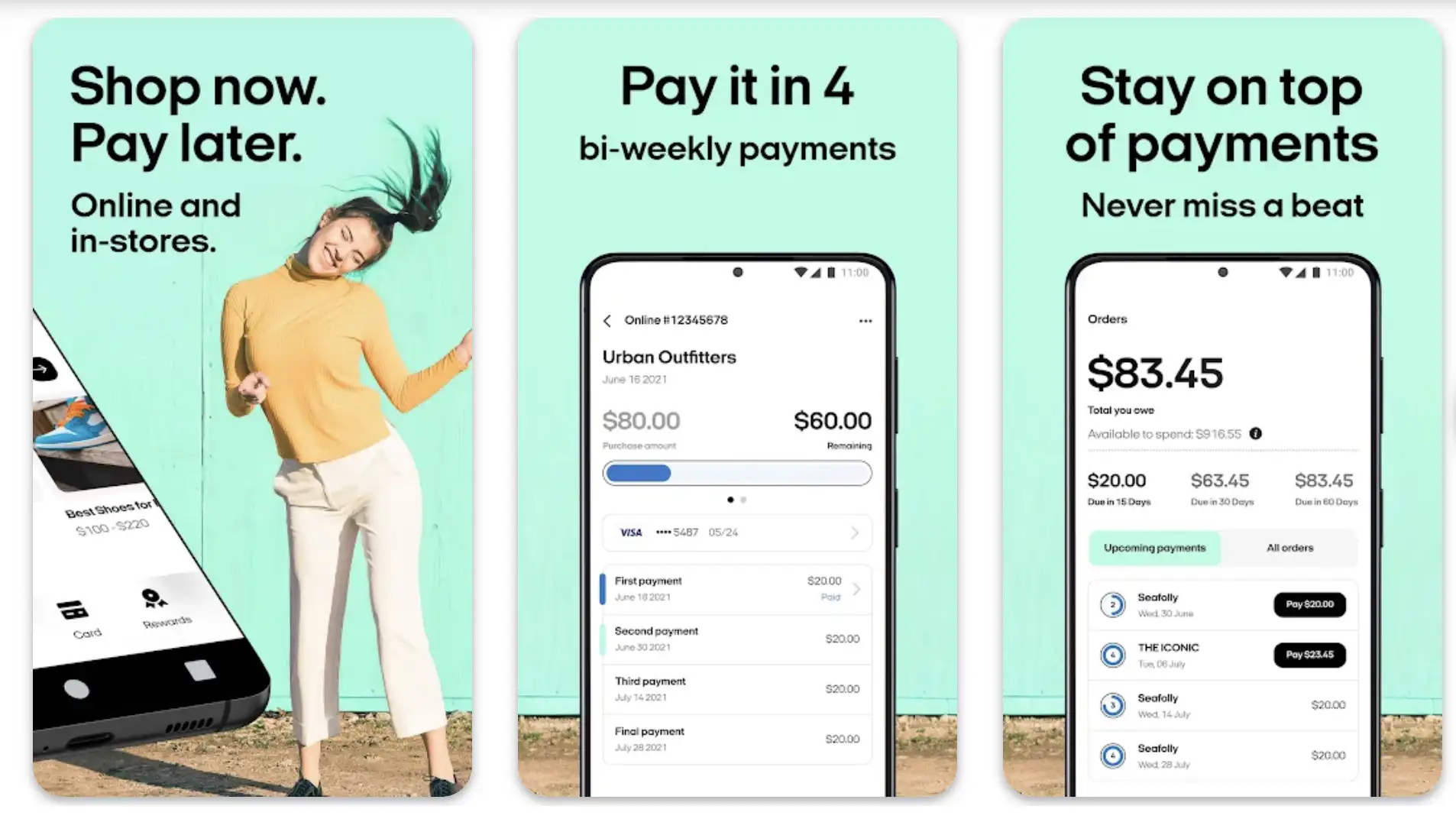

1. Afterpay: Shop now. Pay later

Afterpay allows you to shop today, and pay comfortably in four simple fortnightly installments. The app contains one of the largest shopping directories and allows you to browse not only the latest stores but all the required shopping inspirations.

In addition, you can also check out different local shops and small businesses around your area! The platform is only getting bigger and better, as new brands are constantly being added.

How does the app work? All you have to do is to download it and sign up to get started. You can start exploring different types of items across categories straightaway. Browse endless brands and stores, search for your favorite brands, and shop whatever you want.

The app even gives you the option of paying the first installment straight away, then the rest of the amount every fortnight.

If you are good enough with timely payment, you won’t have to pay anything extra. And, of course, it’s always interest-free!

Afterpay also gives you excellent transparency please stay on top of all your payment limits and manage your orders effectively. Want to pay at offline stores? You can do it as well simply by creating a barcode in various participating stores.

If you want to shop the latest beauty, fashion, tech, homeware, and other items even while staying under your budget, Afterpay can be a perfect destination for you!

Features of Afterpay:-

- Shop now, pay later according to your preferences and comfort

- Allows you to browse various stores and brands

- Comfortable and easy payments in four fortnights

- Gives you complete control over your finance management

- Exclusive offers and extraordinary payment flexibility

Device – Android and iOS

Ratings on Apple Store – 4.9 / 5 | Ratings on Google Play Store – 4.7 / 5

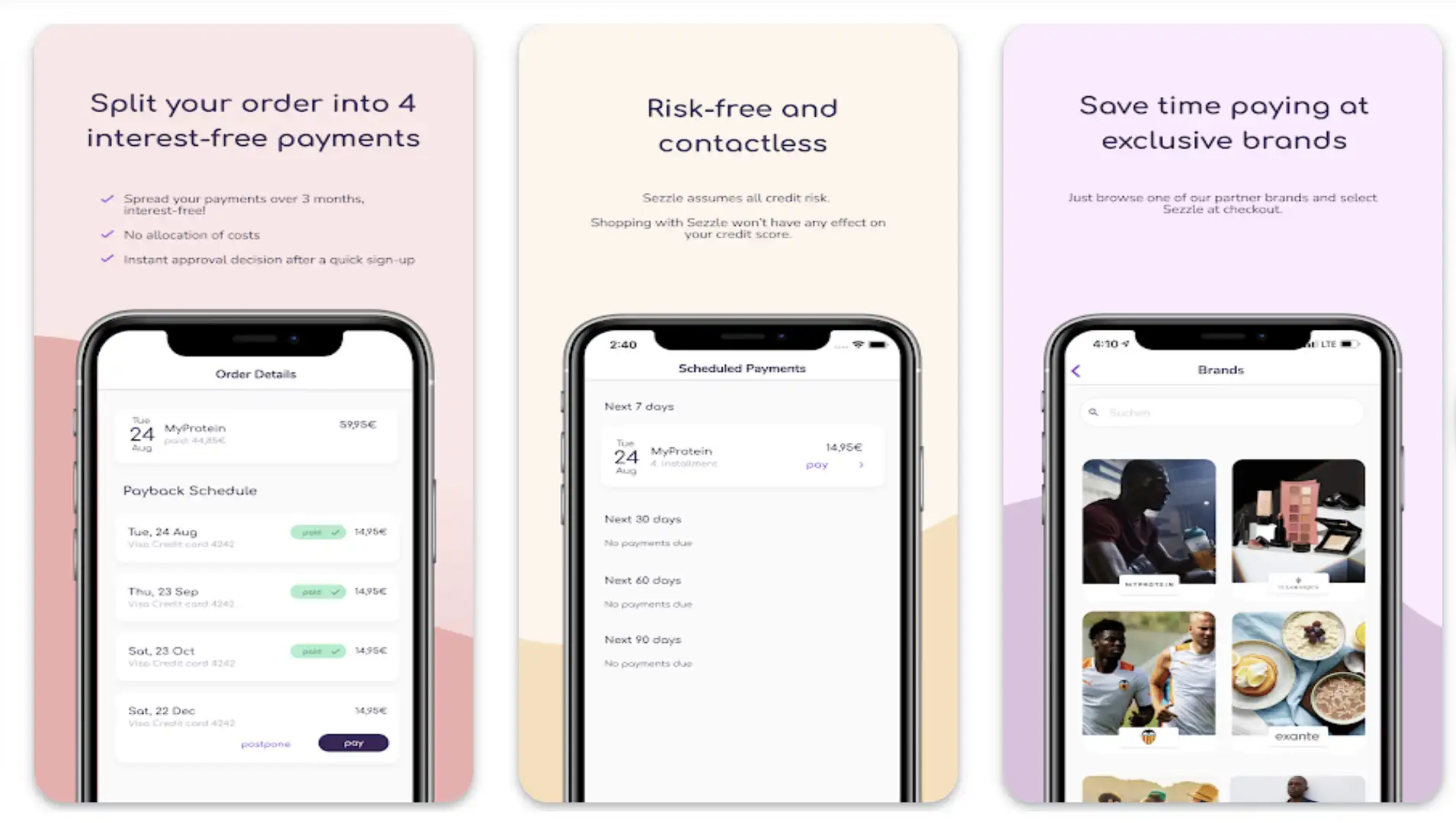

2. Sezzle | The way forward

Becoming financially empowered and enjoying stress-free shopping got easier than ever with one of the best apps like Bundll.

Sezzle is a powerful digital payment platform that supports you in taking control of your financial future, shopping convenience, as well as spending responsibly!

When you shop with the app, you are allowed to make 4 split payments over six weeks, and more importantly, without any interest! And, you don’t have to worry about any type of impact on your credit as well!

Getting started with the app is as easier as you can think! Download, sign up, and experience hassle-free and flexible shopping right from the comfort of your home!

Sezzle app can be your ultimate destination to discover more than 47,000 brands offering the latest trends in fashion, beauty, home goods, and more!

From some of the finest global brands to local small businesses, you can discover something new almost every day. The app supports you with the purchasing power you need to make your life easier.

In addition to managing your existing orders, you can also change payment methods, reschedule future payments, as well as get instant notifications ahead of your next payment!

If you love certain brands, you can easily add them to your favorites list simply by tapping the heart icon in the app. This will automatically create a separate category, and you will be able to shop directly from your favorites whenever you want!

Features of Sezzle:-

- Allows you to shop at thousands of online and offline stores

- Helps you manage all your payments in one place

- Top exclusive deals on a wide range of categories

- Makes organizing your favorite brands simpler

- Exclusive Visa-powered Sezzle card to shop at offline stores

Device – Android and iOS

Ratings on Apple Store – 4.9 / 5 | Ratings on Google Play Store – 4.7 / 5

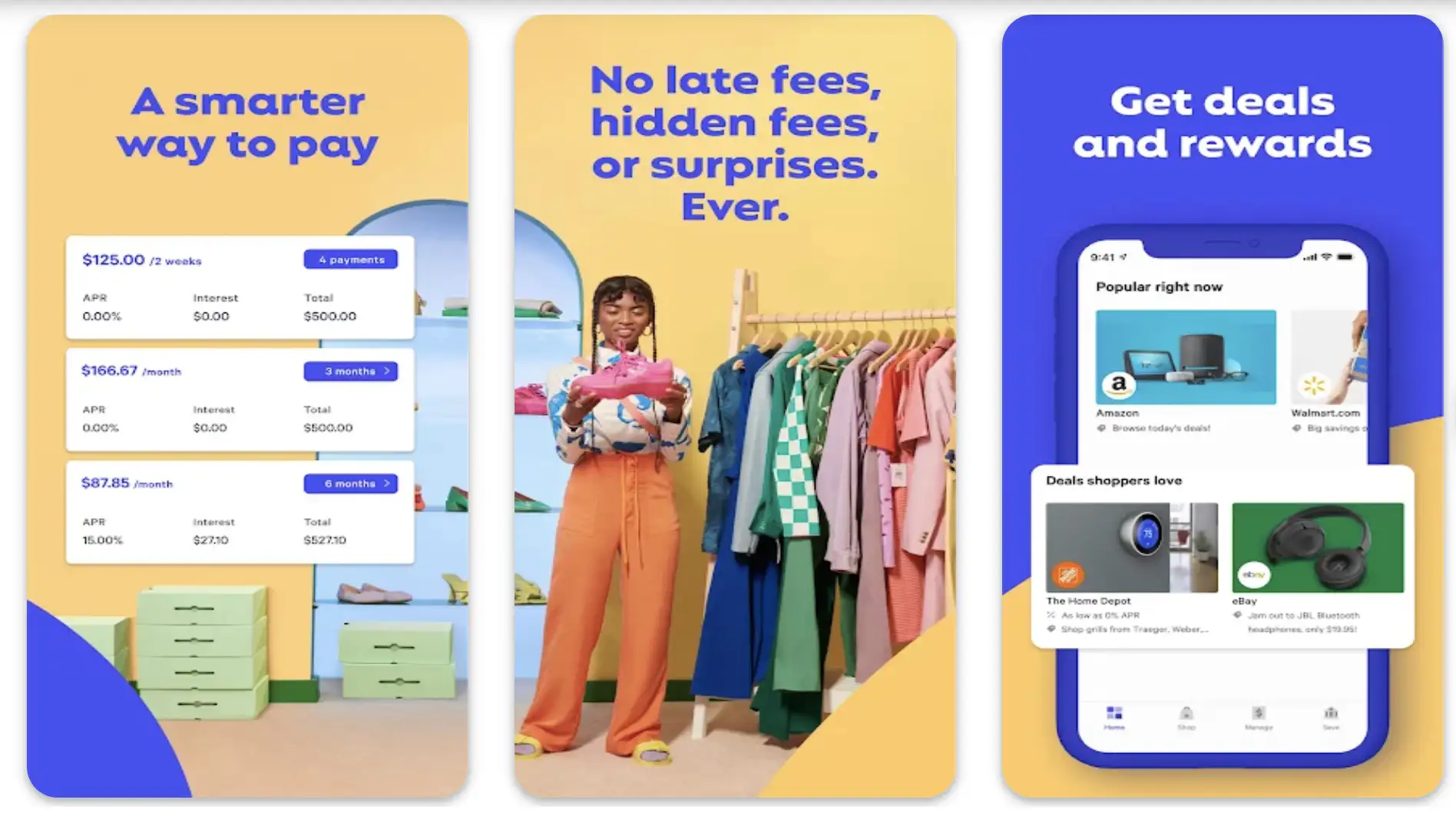

3. Affirm – Apps like bundll and zippay To Buy now, pay over time

Affirm is also one of the most popular play later apps like Bundll, and is packed with some very useful features. The app ensures you can shop stress-free at a wide range of online and offline stores and pay over a fixed time with multiple flexible payment plans.

Add, guess what? You don’t even have to think about the late fee, hidden fee, or any type of search surprises ever!

What makes Affirm a must-have app? The app gives you the freedom to shop now and pay later at almost every online and offline store. You can check your eligibility whenever you want on the app and can be reassured if you thinking about your credit score impact as well.

The app always offers exclusive deals along with very special rates for new users. In addition to checking them out, you can also open a high-yield saving account with no extra charges or no minimum amount.

With the app, you can find your favorite shopping destinations, fill your cart with whatever you want, and select multiple flexible payment options that suit your budget. The app will instantly check your eligibility, and will tell you if you are ready to go!

With the extraordinary flexibility of the app, you can enjoy shopping at various stores, and don’t have to think about paying all the money at once.

You will get detailed information about what you are exactly paying right when you pay with the app. And, I can tell you with some assurance that you don’t have to even think about late fees, hidden costs, or penalties of any type.

The best part about the app is, that it offers three very flexible payment plans ranging from 3, 6, and 9 months, along with other options.

Features of Affirm:-

- Buy now, pay later option across hundreds of online and offline stores

- Multiple flexible split payment plans to suit your budget

- Exclusive deals across various categories

- Allows you to manage your account and payments very easily

- Gives you the option of opening high yield savings account without any fee

Device – Android and iOS

Ratings on Apple Store – 4.9 / 5 | Ratings on Google Play Store – 4.6 / 5

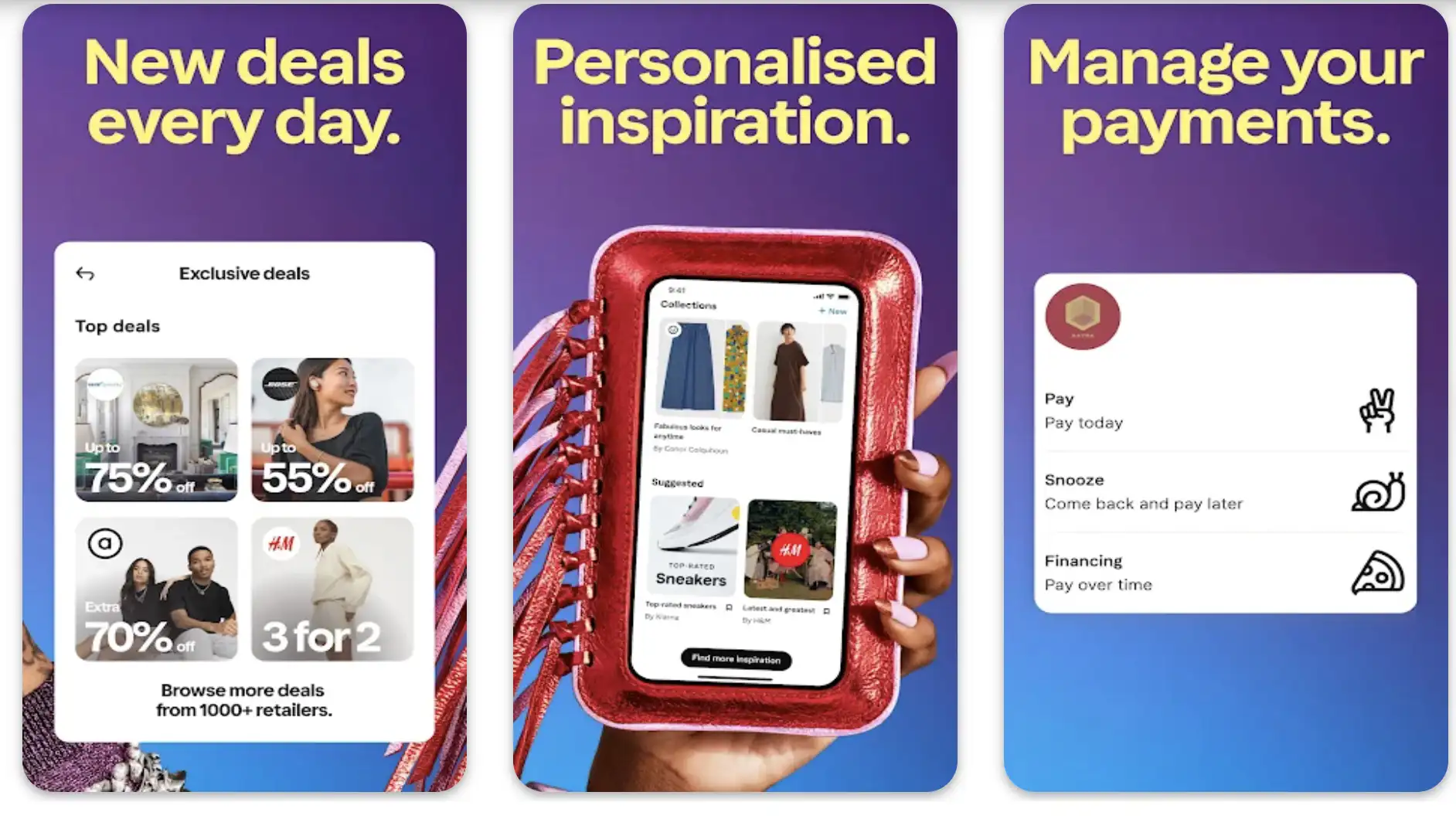

4. Klarna | Shop now. Pay later

Another very useful shop now, pay later app with some handsome features. You can shop anywhere without worrying about paying instantly with the Klarna app.

When you use the app to shop at your favorite online or offline stores, you can easily split time tire payment into three smaller, interest-free payments.

The app works as easily as it gets, even with Google Pay as well! It makes it very easier for you to get what you want today and play whenever it is comfortable for you.

It is not only about paying with the app according to your comfort, you get some excellent curated suggestions to buy the app as well.

In the inspiration feed, you can explore curated suggestions for exciting deals, complete looks, product collections, and editorials tailored perfectly for your shopping.

It doesn’t matter whether you are interested in beauty, fashion, tech, or whatever for that matter, the app has to offer at least something for you! With the app on my, you can seamlessly track everything you are interested in.

Browse multiple online stores, save your favorites, share the items you love with your family and friends, and do more!

The app also gives you instant information on all your purchases and allows you to track them right from the store to your doorsteps. You also get exciting price drop alerts whenever an item is in your cart.

That way, when there is a price drop, you will automatically get to know and get the best deals. If you have to send something back, the app won’t ask any questions, and it will allow a hassle-free return.

Features of Klarna:-

- An all-in-one shopping application with pay later option

- Allows you to shop at various online and offline stores

- New deals every day to help you save your hard-earned money

- Personalized suggestions based on your shopping preferences

- Helps you manage all your payments in one place

Device – Android and iOS

Ratings on Apple Store – 4.8 / 5 | Ratings on Google Play Store – 4.6 / 5

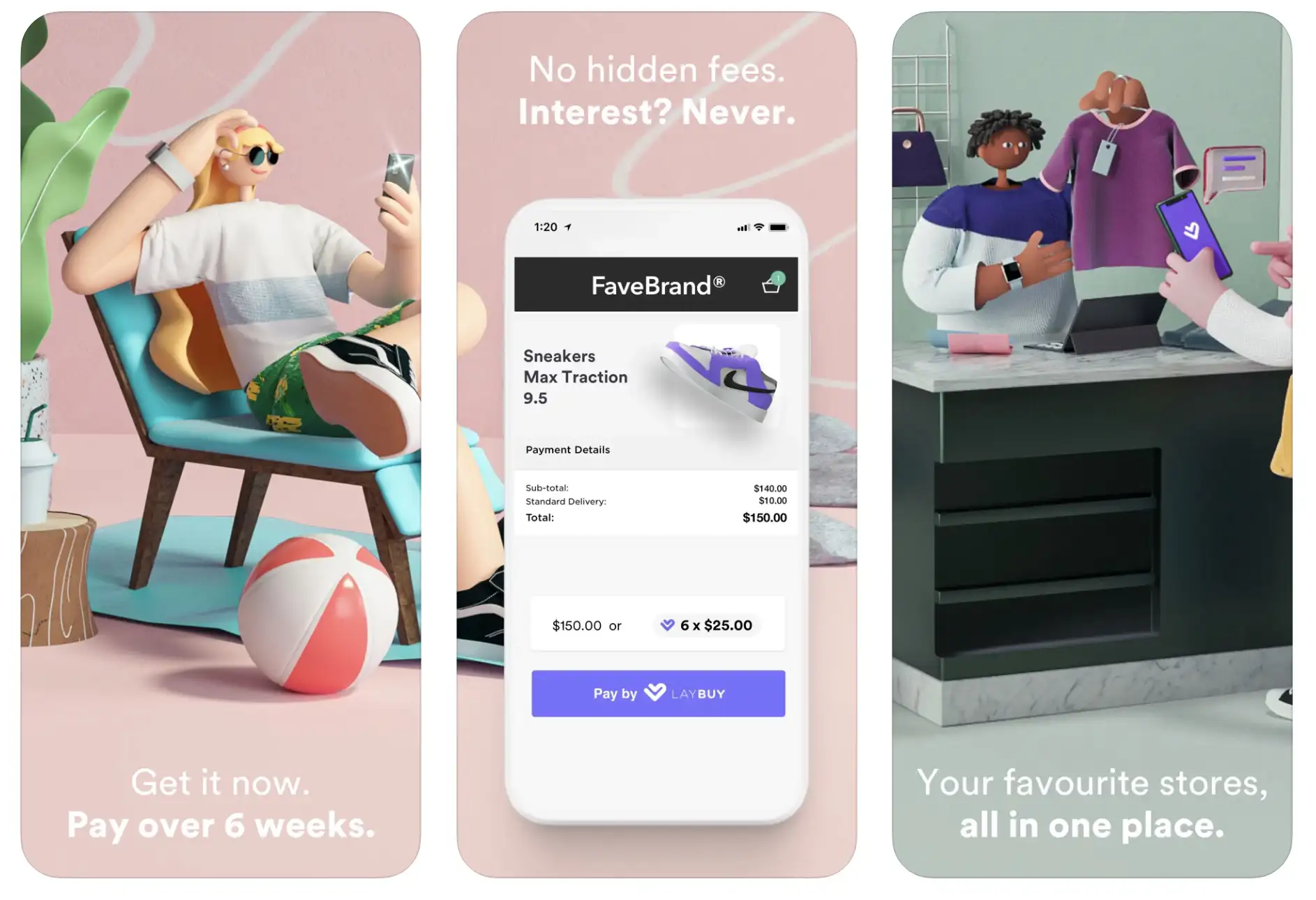

5. Laybuy

Laybuy is also one of the most notable by now, pay later apps like Bundll, “bundled” with multiple positive attributes. The app allows you to buy your favorite stuff and play later according to your comfort, over 6 weekly, interest-free installments.

Very simple to use, the app offers you access to thousands of retailers from different parts of the world. You can pay using this app at a wide range of online as well as offline stores. As far as safety is concerned, you can easily pay at thousands of retailers only by using a single login.

The app also supports you with a faster way to pay with personalized barcodes. Managing your budget and payments gets a lot easier with the app, thanks to its enhanced user interface.

You can always stay informed about all your upcoming payments, pay for your orders earlier than the expected date, or simply open the app to check out your credit score, all while enjoying your cup of coffee!

The massive directory in the app lists thousands of retailers, including some of the most reputable of them all! And, of course, have the option of finding the latest trends, and most exciting deals, and making the best decision while shopping for your favorite items!

Thanks to a recent update, the shop directory in the app have got even better with product and keyword search in addition to favorite and featured merchants.

Features of Laybuy:-

- Allows you to shop whenever you want, and pay over six weeks

- No interest, no hidden fee, or service charge

- All types of online and offline stores in one place

- Meets setting up an account a lot easier and quicker

- Powerful shop directory with product and keyword search

Devices – iOS Devices Including iPhone and iPad

Ratings on Apple Store – 4.8 / 5

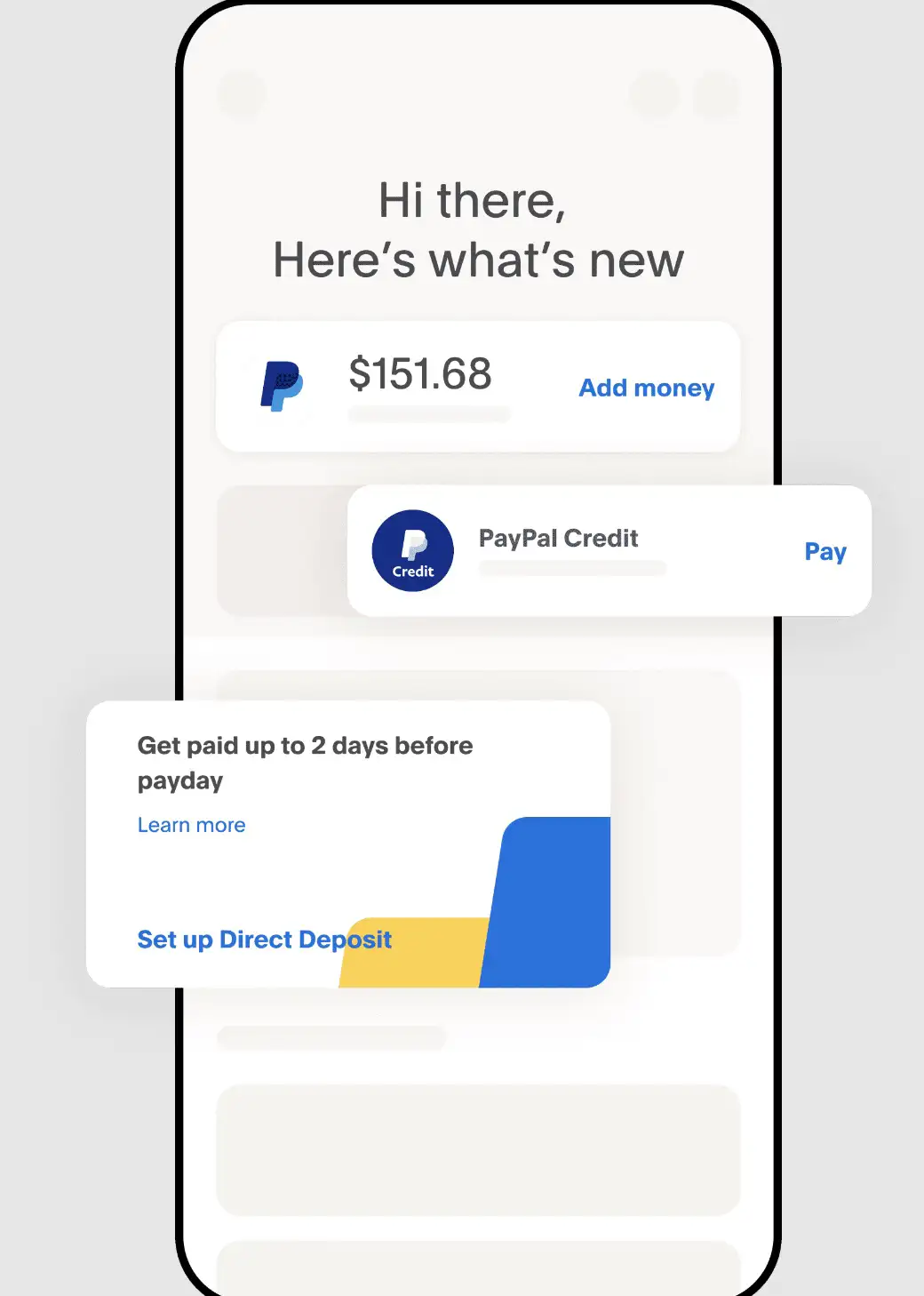

6. “Pay in 4” by PayPal

I don’t think I have to say much about the global payment giant – PayPal! Yes, because we all know how amazing this platform has been not only to buy, but to sell, and send money across different parts of the world!

But I thought I should definitely put some light on the buy now pay later feature of the app if you are not yet introduced to it!

The global financial system has recently launched its very own BNPL product known as “Pay in 4”, which has been proving simply amazing, especially for those people who are trying to find a reliable, short-term financing option with 0% interest.

This feature of the app allows you to make but chases across various categories, and make payments in four installments over six weeks. However, you have to pay the first installment right at the time of purchase.

The best part about “Pay in 4” is, that it is free from any type of late fee, and also does not send any report to the credit bureaus. So, you don’t have to worry about your credit scores at all!

How can you use PayPal’s “Pay in 4” feature? It’s as simple as using PayPal for all other types of purchases you make! You simply have to pay with PayPal when you shop online, of course, on the eligible transactions.

You will then see “Pay in 4” as one of the available payment options. And, you can select for it, pay the first installment, and the remaining 3 over 6 subsequent weeks.

Features of “Pay in 4” by PayPal:-

- Flexible partial payment option for over 6 weeks

- Enables you to shop across various categories at different online stores

- Supports multiple international currencies

- Trusted by millions of customers and merchants across the world

- Very suitable option for low-end purchases

Device – Android and iOS

Ratings on Apple Store – 4.8 / 5 | Ratings on Google Play Store – 4.4 / 5

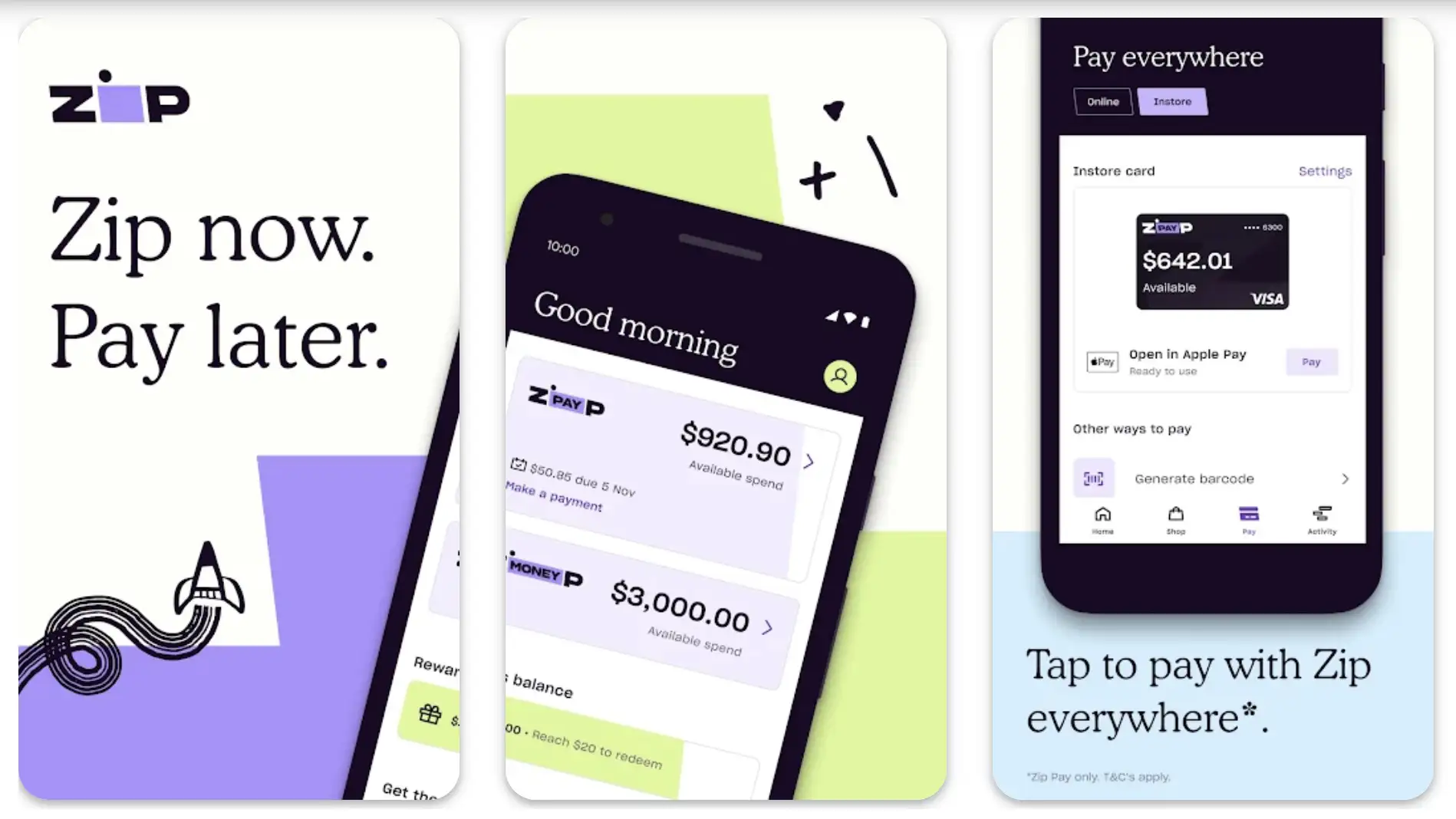

7. Zip – Shop Now, Pay Later

Zip lets you purchase stuff you love a lot, and pay later whenever it is compatible for you! Buy now, pay later at almost every online store, at literally every location.

Using the app for paying for your online shopping is easy, fast, as well as secure! You can effortlessly manage your account, and shop just about everything and everywhere – online or in-store, from one secure place to another!

As far as the options are concerned, you can’t only manage your account on the app, but can also find the best deals of the day, buy gift cards for your family and friends, pay different types of bills, as well as get exciting online bargains.

More than 26,000 retailers are registered on the app directory, and you get all the options while shopping type on the main screen.

In addition to finding the stuff you love the most, you can also discover some great new ones. You can enjoy all the features of the app simply with a single login.

The app also allows you to create a virtual shopping cart, and complete your shopping in a jiffy. Finding it difficult to pay your bills? You can do that seamlessly with the app as well.

Whether you want to pay mobile phone bills, Internet bills, insurance bills, electricity bills, water bills, or any type of utility bill, you can pay them all with the pay later feature of the app.

Features of Zip:-

- Enables you to pay with a single tap across multiple stores

- Allows you to manage your expenses smartly and effectively

- A wide range of exclusive deals to explore

- Makes managing all types of bills easier and more effective

- Multiple repayment options and methods are available

Device – Android and iOS

Ratings on Apple Store – 4.9 / 5 | Ratings on Google Play Store – 3.7 / 5

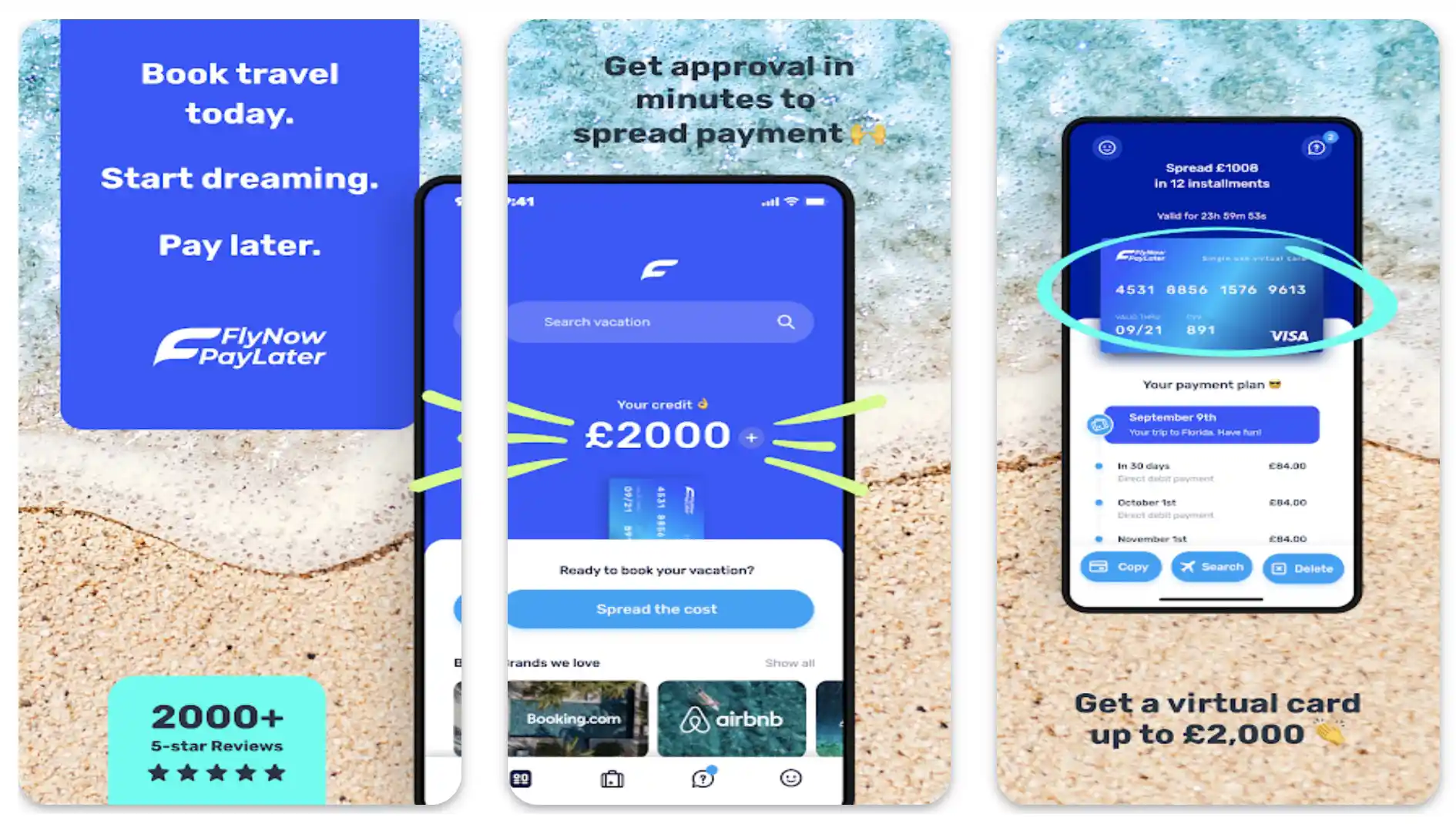

8. Fly Now Pay Later – Apps like zip

If you are a regular traveler, here is one of the most useful pay-later apps like Bundll for you! Fly Now Pay Later app is all about helping you pay for all your trips booked with your preferred travel booking platforms.

You can get the best out of this app whenever you are struggling with your budget, but you must travel! Once your next destination is decided with your travel brand, all you need to do is to return to the app, check out various payment options, and finalize your payment with the app.

The app makes flying to your dream destinations easier with the help of 12 flexible monthly installments, more importantly, at 0% interest.

You can’t only use the app for paying for your flight tickets but can also book hotels, attractions, cruises, and more. If you are interested in package vacations, there are so many flexible options available on the app!

The app makes planning your entire vacation a lot easier and more comfortable for you thanks to a wide range of available options.

Whatever you are planning, whether it’s a lifetime adventure are you are planning to see your family, you can trust the app to convert your entire payments into flexible monthly installments.

Thousands of explorers are already enjoying the app, and there is no reason why you can’t be the next to join them!

Features of Fly Now Pay Later:-

- Helps you slice up your payments into multiple flexible parts

- A wide range of popular travel brands are available to explore

- Thousands of happy customers are already enjoying the services

- Very simple, clean user interface

- Virtual card for regular travelers to finalize travel booking instantly

Device – Android and iOS

Ratings on Apple Store – 4.7 / 5 | Ratings on Google Play Store – 4.7 / 5

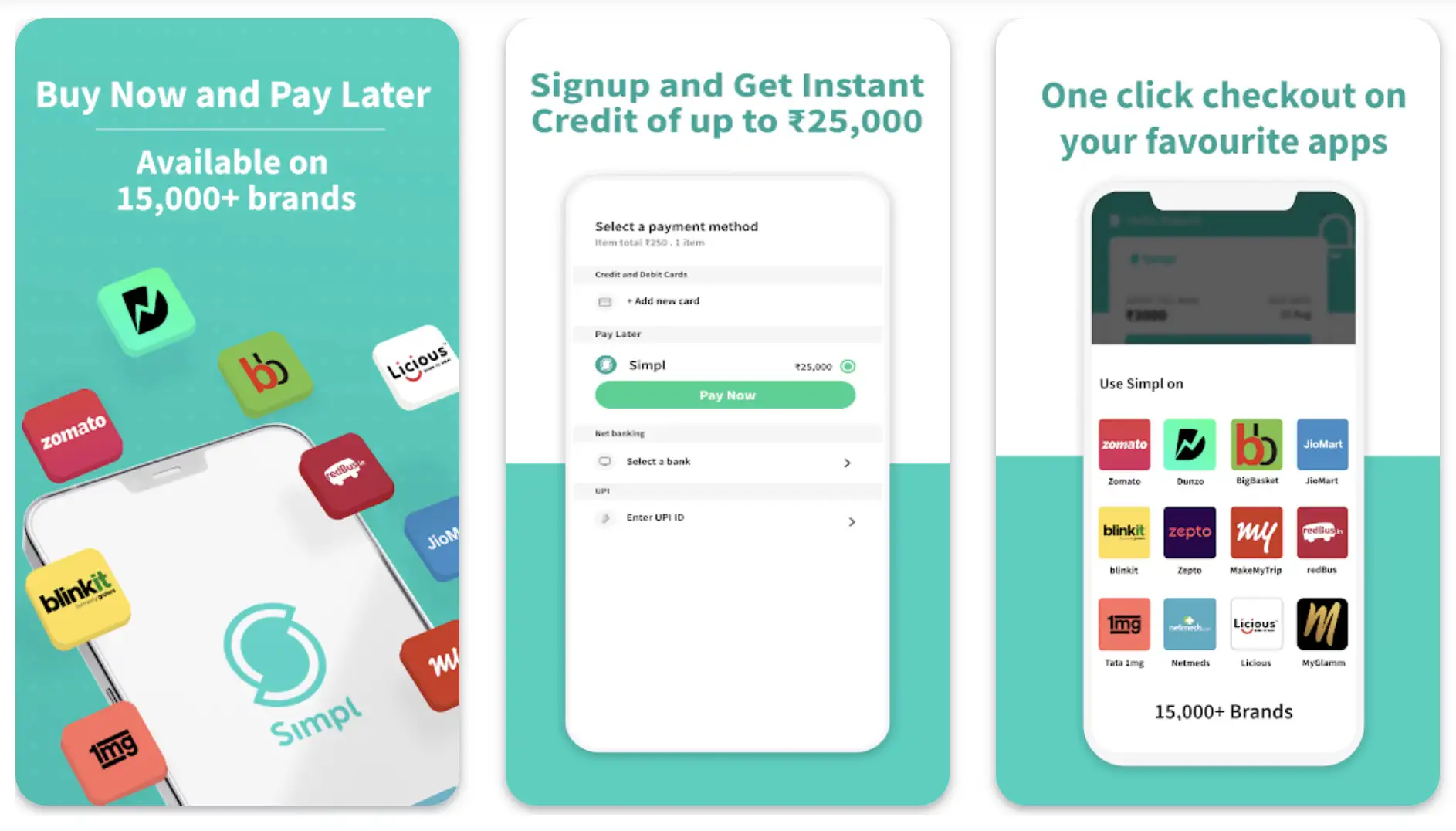

9. Simpl Pay Later

With Simpl Pay Later, you are welcome to enjoy an extraordinary buy now and pay later experience. If you would have asked me to describe this app in one word, I would say “convenience” without any hesitation!

The app makes shopping, billing, and recharging your phone number add easier as you would think! No passwords, no OTPs, no failed transactions, just one tap, and your payment is successful! I have been using this app for a long time, and I would say that it has certainly made life a lot easier!

From ordering food, medicines, groceries, buying travel tickets, and renting a vehicle, to paying your utility bills without much fuss, and much more, you can rely on the app for almost all types of daily transactions.

Simpl helps you with a cycle of 15 days to repay your bills. This means you can without any hesitation pay for different types of stuff in different categories, and pay for it after 15 days – without any extra charge or hidden fees.

It has been one of the most loved BNPL apps and allows you to track your expenses on different brands, with only one consolidated bill.

With the app, you can finally say goodbye to hefty payment charges, and don’t even have to worry about those annoying hidden fees! In case you have to cancel an order, you don’t have to wait for refunds even for a day!

Features of Simpl Pay Later:-

- Supports you with buy now and pay later facility across brands and services

- More than 15,000 different brands are exclusively available

- Your credit increases with regular usage and punctual payments

- Exclusive Billbox to pay all your utility bills

- One tap check out on all your favorite shopping apps

Ratings on Google Play Store – 4.6 / 5 | Ratings on Apple Store – 4.4 / 5

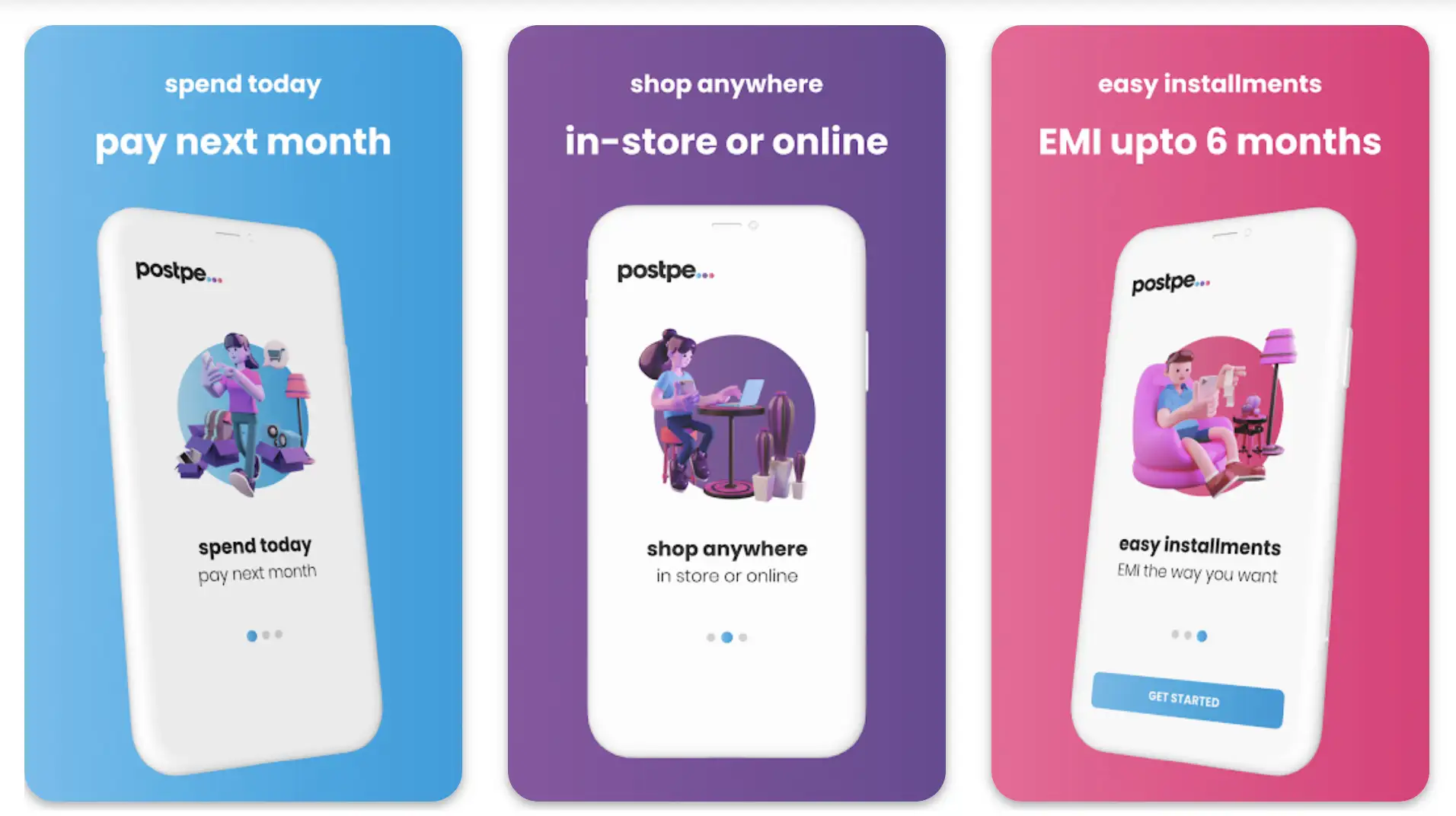

10. postpe

postpe is one of the fastest-growing play later apps like Bundll that offers you flexible payment options for anything and everything from pizzas to mobile phones.

The app offers excellent financial freedom to you and enhances your ability to track monthly spending. The app also gives you interest-free credit for up to one month along with an option of converting your bills into low-interest EMIs.

You can use the app to pay everywhere using the QR code. How does the app work? It assigns you a limit based on your credit score and monthly income. While you can pay the entire bill at month-end, see you can of course settle in or convert your bill into convenient EMIs.

The app also gives you an exclusive postpe Card that you can use anywhere for both online as well as offline shopping. Guess what? The card can also be used to transfer money to your bank account as well as contacts.

With the app, you can easily unlock exciting rewards and cashback, which you can use at multiple places. The app smartly aggregates all your transactions and generates a single bill for repayment next month. Overall, a very convenient pay later option for people with regular monthly income.

Features of postpe:-

- Allows you to spend it today and pay next month

- EMI option at very low interest is also available

- Makes it very easy for you to shop anywhere – online or in-store

- Also enables you to transfer money to your bank account and contacts

- Very simple to set up, and easy to start

Device – Android and iOS

Ratings on Google Play Store – 4.4 / 5 | Ratings on Apple Store – 4.0 / 5

✅FAQ

What apps let you make monthly payments?

Affirm, Sezzle, Afterpay, Splitit, and Perpay, etc. are among the most popular applications to let you make monthly payments.

What app lets you Buy Now, Pay Later on bills?

Afterpay, Sezzle, Klarna, Affirm, LayBuy, and “Pay in 4” by PayPal, etc. are various leading applications to let you buy now and pay later on different types of bills and makes fairly simple with complete control of finance management, comfortable payments in fortnights, easy to pay at various brands and stores, and much more.

What are some buy now pay later sites?

Sezzle, Affirm, Klarna, Afterpay, Spliit, etc. are among the most prominent buy now and pay later websites, and offer a wide range of features to simplify the entire concept of pay later.

What is Shopabunda?

Shopanunda is a leading e-commerce platform that allows consumers to buy a wide range of products now, and pay later with multiple, simple payment plans. You can use this service to purchase millions of products on Amazon and pay later according to your financial preferences and comfort.

Shopanunda partners with multiple leading fintech companies like PayPal, ViaBill, and Klarna, and offers flexible payment options to customers.

How many Sezzle orders can you have at once?

All Sezzle premium brands support a maximum open order limit of two purchases. You have to pay off at least one of your previous premium purchases to order again with multiple premium brands.

How much does Sezzle approve you for?

Sezzle has a $2500 limit, mainly for old customers. If you are using the service for the first time, you may not get the approval to use the full $2500. Your limit will increase steadily over time with successful usage.

How do I get a high Sezzle limit?

You have the option of requesting a high Sezzle limit only after maintaining a good payment history. There isn’t any specific requirement listed on the website or anything like a qualification scenario for a limit increase.

However, if you are very good with your repayment history, you can surely request a credit limit increase. It completely depends on the company, if they accept your request based on your eligibility.

Does Amazon use Sezzle virtual card?

Yes, Sezzle premium members are allowed to use their Sezzle virtual card on Amazon for online shopping. However, you must have to be a premium subscriber, as well as approved for the virtual card.

And, of course, an Amazon account is required. Sometimes, the payment authorizations may take up to 48 hours if you are using Sezzle Virtual Card for purchases on Amazon.

Does Amazon have a pay-later option?

Yes, Amazon offers a pay-later option to select users based on decent usage history. In addition, you can also pay for your purchases on Amazon using EMIs ranging from 3 to 12 months.

Based on different products, the online shopping giant offers both no-cost as well as affordable EMIs from different banks.

How do I use Amazon Afterpay?

Add the products you want to purchase to your Amazon cart. When you are ready to pay, click the Amazon checkout and confirm your shipping details. Don’t forget to check if you are logged in or not. Add the payment page, select your preferred payment method, and select add a debit or credit card.

You should see a “Buy Now Pay Later” button if you are already approved for using “Afterpay” for payments. Remember NOT to set Afterpay as a default payment method. Tap “Buy Now” enter the remaining details, and confirm your payment schedules.

Conclusion on Apps like bundll

“Buy Now Pay Later (BNPL)” is without any doubt an excellently convenient option for shoppers with regular monthly incomes. And, these extraordinary BNPL apps like Bundll take this concept to a completely different level.

You have got as many as ten options if you want to buy your favorite stuff now and pay later according to your convenience. Try some of these apps, and check out which one suits you the most according to your requirements, preferences, and income.