Apps are changing the world of online marketing. The apps allow the implementation of the latest strategies for business growth. You can make the most of them if you know the right ones.

There are tons of options out there for managing your money. You have traditional desktop applications, web-based software, and now mobile apps. These apps can help you better manage your budget and personal finances.

In the worst of times, financially and mentally, people fall back on their credit cards to deal with bills as they come. In most cases, it’s a short-term solution to a short-term problem.

As a side note, I have compiled a list of best apps like grain credit, to help you track your money management.

Best Apps like Grain Credit – Our Top Pick👌

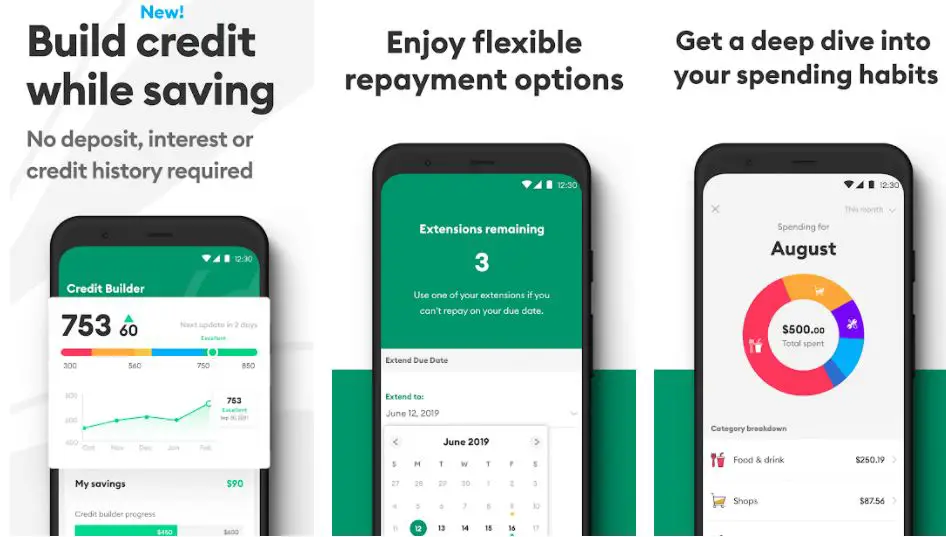

1. Brigit: Apps like grain credit To Borrow, Build Credit & Save

Brigit Financial is one of the best Apps like Grain Credit that has helped thousands of people get cash when they need it most.

Their service is fast, affordable, and secure. The process is simple: Connect your bank account, and they’ll deposit funds within one business day.

Brigit has a wealth of knowledge that you may put to good use. They serve more than 1 million members and have 4.5 ratings in the google play store. And unlike banks and credit card companies, we don’t add fees.

You may also use their alerts to track your credit, get a credit score, and check your credit record.

Download the App from Google Play Store

Download the App from Apple App Store

2. NerdWallet

The NerdWallet app is an excellent, straightforward way to track and budget your money.

Use the app to maximize credit card rewards, get more cashback, track your credit score, save for a large purchase, pay off debt, and more. And as always, NerdWallet is free.

So whether you’re looking for handy dandy money-saving tips or have a significant financial question, take out your phone and download The NerdWallet app today.

It is the fast, free way to make better money moves. We all have money decisions, and they’re here to help.

Download the App from Google Play Store

Download the App from Apple App Store

3. Greenlight

Greenlight has been created to help parents teach kids money management from a young age. It’s a prepaid debit card that works like a regular bank account but with some differences.

Greenlight is one of the best Apps that help children spend more wisely by using a prepaid debit card for kids and teens. Parents manage the account through an app.

They choose where their children can spend money based on which stores will have the best learning opportunities or work for goods and services. This allows kids to understand the value of money.

Download the App from Google Play Store

Download the App from Apple App Store

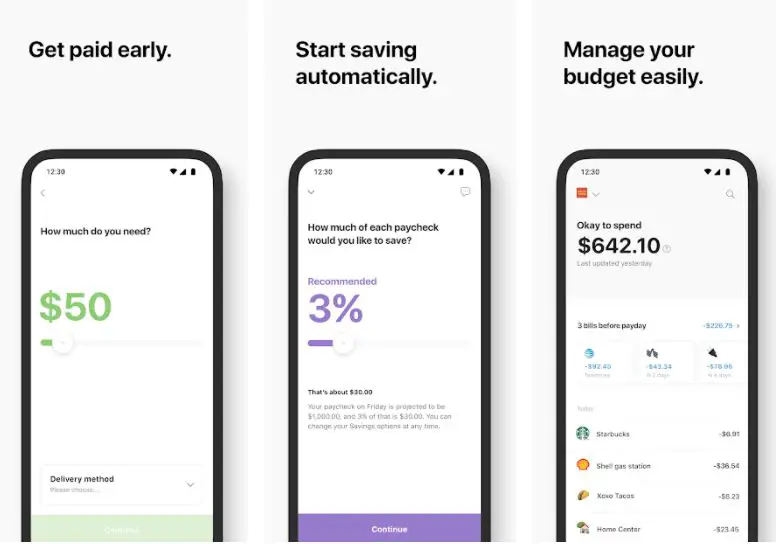

4. Even App

Financial security is hard to come by. And if you don’t have money saved up already, it can be tough to get started.

That’s where Even comes in. Make money on demand with Even’s paycheck advances and get paid into your bank account or cash out at Walmart.

The Even app is a financial empowerment platform that provides customers control and transparency over their pay and spending.

The platform boasts 10 Lakh installs across iOS and Android and thousands of new users signing up daily with 4.8 ratings on the app store.

Download the App from Google Play Store

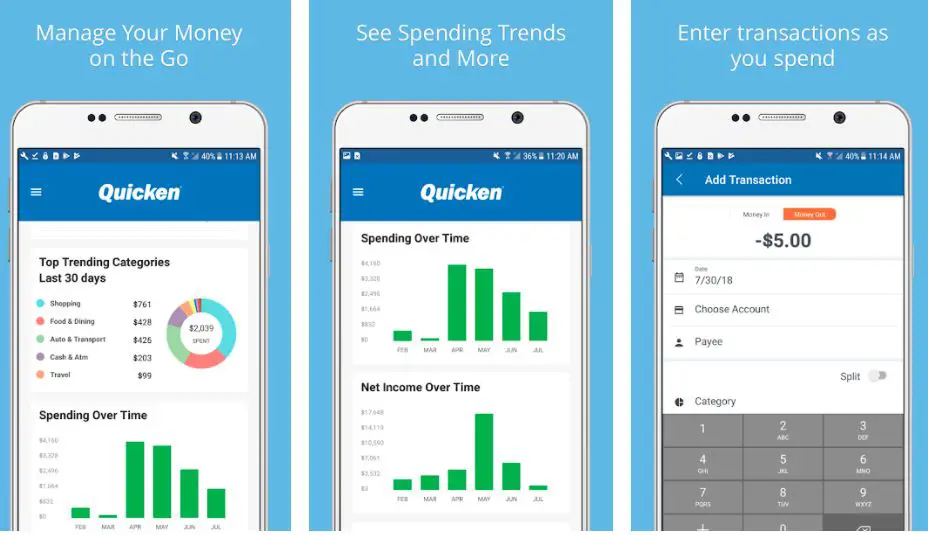

5. Quicken

Get all your finances in one place with Quicken, available for both iPhones and iPad. The best features of this platform are now on the go.

Sync your data between desktop and mobile so you can see where you stand no matter your device. Get expert help with our tools and tips to manage your money better.

The Quicken Mobile Companion App for iPhone and iPad sync with Quicken desktop, so you can make intelligent decisions with your money no matter where you are.

The app has over 5 Lakh downloads on iOS and Android, with thousands of new users signing up daily.

Download the App from Google Play Store

Download the App from Apple App Store

6. Root – Good drivers save money

The Root is a more convenient and cost-effective way to ensure your belongings.

The Root is another of the best Apps like Grain Credit that may save you a lot of money on auto insurance because there are no online forms to fill out, and you get a personalized rate based on your driving habits.

Root’s pricing is better than what the big insurance companies offer. You’ll also never have to leave your home: we’re available 24/7 via phone and chat.

With Root, accessing and managing your coverage and payments and locating your closest Root agent—it doesn’t get much easier than that!

Root offers homeowners, apartment dwellers, and renters insurance that’s better for you. Root provides the high-quality yet affordable coverage that you need.

Download the App from Google Play Store

Download the App from Apple App Store

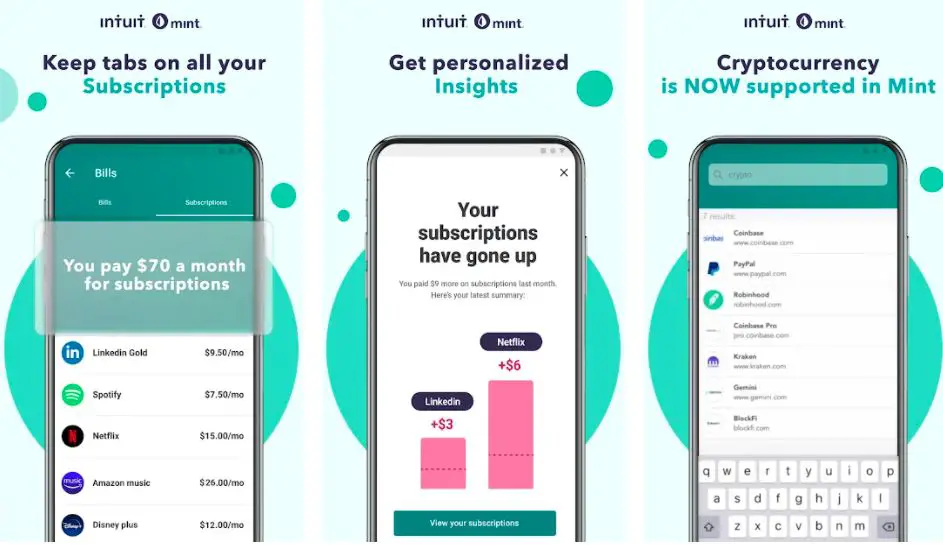

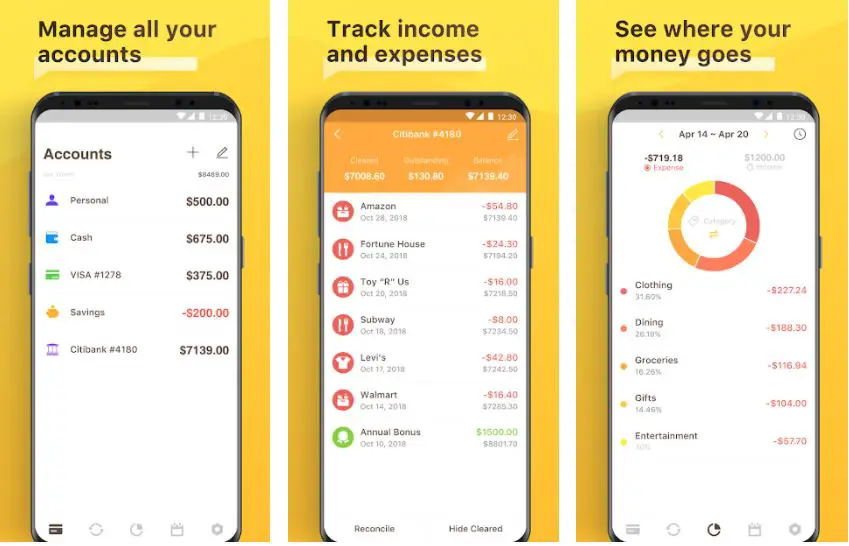

7. Mint: Apps like grain credit For Budget planning & tracker

With over a million installations on iOS and Android and thousands of new users joining up daily, the platform has a 4.5 rating on the app store.

Managing your accounts requires a lot of time and work. Mint.com gives you the insight and control to monitor your spending and better manage your budget.

It’s free and easy and can help you reach your financial goals. Check up on important dates, bills, and more within seconds.

See where you stand for new savings opportunities with customized budgets, personalized insights, and bill reminders.

If crypto is a component of your financial plan, you may link your Mint account to examine your whole financial portfolio.

Download the App from Google Play Store

Download the App from Apple App Store

8. Stash – Apps like grain credit To Invest & Build Wealth

Stash is the new way for people to get started investing. Stash Beginner, Stash Growth, and Stash+ are their three subscription options. Each plan is tailored to specific requirements and objectives and includes unique strategies to save and invest.

Stash is a personal finance software that makes it simple to keep track of your spending, manage your savings and investments, and meet your financial objectives.

Move beyond the basics with a powerful yet simple mobile experience that helps you see where you can improve or invest with little to no money.

They make it easy, simple, and even fun to begin taking control of your financial life. Its mission is to create comprehensive investing accessible to all Americans.

Download the App from Google Play Store

Download the App from Apple App Store

9. YNAB (You Need A Budget)

Your budget is a robust financial planning and tracking tool that gives you a detailed view of your money. YNAB makes it simple to succeed, whether you’re attempting to get out of debt, save for a trip, or prepare for retirement.

YNAB streamlines the budgeting process and makes it easy for anyone to get started and stay on plan.

Users like you can say goodbye to paycheck-to-paycheck life and take control of their finances by creating a budget and learning to survive on last month’s earnings.

On iOS and Android, the app has over 10 LaKh installs, with thousands of new users joining daily.

Download the App from Google Play Store

Download the App from Apple App Store

10. EveryDollar: Apps like grain credit To Budget Your Money

Start saving and making your money work hard for you. Track your net worth, create a budget, and save money with EveryDollar – the budget planner and expense tracker app from Dave Ramsey.

Millions of people have saved by using this app. It has already helped people retire years earlier than they thought possible.

EveryDollar helps you take control of your spending and save more. It’s free, easy to use, and puts the power back in your hands.

The app has over 10 LaKh downloads on iOS and Android, with thousands of new members coming daily and a 4.2 rating in the app store.

Download the App from Google Play Store

Download the App from Apple App Store

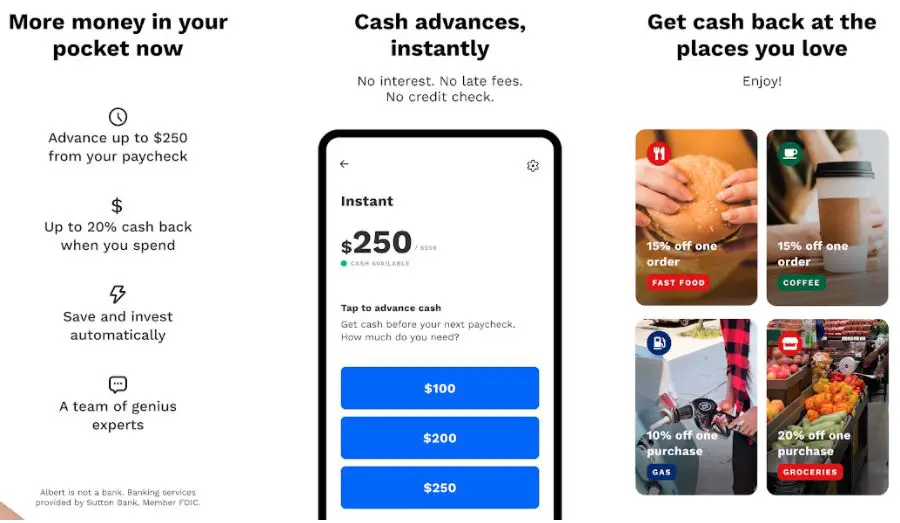

11. Albert: Apps like grain credit for Android

Albert makes it easy to save money and pay bills on time. Albert is not a robot. It is your friend in finance.

Albert guides you through life’s financial questions with friendly reminders, breaking down what you owe into simple numbers, helping you budget better with goals, and breaking down your goals into steps.

This app offers investment options, insights to help you save money, smart reminders to help you pay bills, an emergency cash cushion for unexpected expenses, and even a fresh look at your finances, now led by artificial intelligence.

It has millions of installations with 3.9-star of ratings on the app store.

Download the App from Google Play Store

Download the App from Apple App Store

12. Personal Capital

Personal Capital is one of the best Apps like Grain Credit, to help you manage your finances. This platform lets you view your accounts in one place, including bank accounts, stocks, retirement funds, and investments.

When it comes to money management, the amount of knowledge you have is equally as significant as how you invest.

Using this app will make it easier to take control of your money. The app is available for web browsers and Android and Apple devices.

Create budgets and get alerts to help you stay on track. Get customized guidance on investing. Discover what is holding back your portfolio’s growth.

Download the App from Google Play Store

Download the App from Apple App Store

13. Spending Tracker

Spending Tracker is an essential app for anyone who wants to manage their everyday expenses, income, and bills. This ultimate easy-to-use personal finance app lets you record all your transactions daily.

The app works on a daily, weekly, or monthly basis so that you can see if your budget is being maintained or not.

This way, you can easily track your finances without spending hours working out what you have spent. On iOS and Android, the app has over a million downloads and a 4.6 rating in the play store.

Download the App from Google Play Store

Download the App from Apple App Store

14. Fudget: Apps like grain credit For Budget and expense tracking

Fudget, the easy budgeting app for iPhone, Android, and iPad, has been featured on Fox 5 Atlanta tv station.

Fudget is an excellent tool for tracking your spending and expenses and has received excellent user ratings, such as 4.8/5 stars.

“Fudget” is a real-time expense tracking app with a modern and intuitive interface. It allows you to easily track your money quickly,, and intuitively.

It’s so simple that creating a new budget takes just 1 minute — but powerful enough to satisfy even the most experienced user.

Download the App from Google Play Store

Download the App from Apple App Store

15. Mvelopes

Mvelopes is a personal finance company that focuses on helping its users pay off debt, build savings, and live better all around by using the power of the envelope budget system. They have an app that makes saving money for your future easy.

You have to create an account and link it to your bank or savings account, and you’re all set!

You can plan how much money you want to put into each category in your envelope, whether paying off credit cards or an emergency fund.

Download the App from Google Play Store

Download the App from Apple App Store

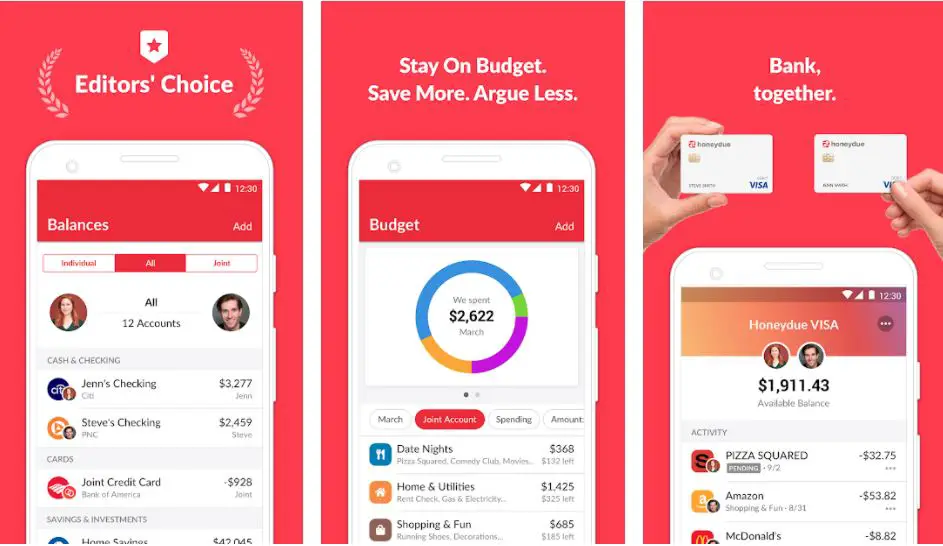

16. Honeydue

Honeydue is the best way to manage money with your spouse or significant other. All of your accounts, including joint statements, are visible in one spot, and all this information is automatically updated on your partner’s phone.

Honeydue makes it easy to keep important financial information in one place, where you can access it easily. It allows you to create unique categories and be notified when you pay your debts.

Download the App from Google Play Store

Download the App from Apple App Store

17. PocketGuard

Being managed is simpler when you have a program that allows you to track and manage your bank accounts’ cash flow.

A tool like PocketGuard’s Budget Planner will help you do just that and control every dime.

Even though it is easy to get into debt, PocketGuard is here to help: by automating all your finances and ensuring you stay on top of your budget, they make managing your finances the most straightforward thing ever.

Since they rely on intelligent algorithms, everything can be done online – no more tedious trips to the bank!

Download the App from Google Play Store

Download the App from Apple App Store

18. Empower

With Empower, saving, budgeting, and banks more wisely is easy. Empower is a free personal financial management tool that combines the power of your unique money personality with the freedom of a mobile application.

By downloading this app, you will access saving tools, custom automated saving goals (like vacations, purchases, or goals!), daily spending reminders, budgets (whether for bills or goals, like vacation savings!), and more! It has over a million downloads and a 4.6-star rating in the play store.

Download the App from Apple App Store

19. Cleo

Cleo is a digital financial assistant who can hold any conversation about your money – from tracking your spending to upcoming planning expenses.

Cleo uses artificial intelligence to help you save, earn and grow. It’s like having a world-class finance pro in your hand.

Cleo is ready to help you make the most of your hard-earned cash. Cleo’s powerful tools help you spend smarter, save more, and grow your money like a boss, from instant financial snapshots to tracking bills and creating savings goals.

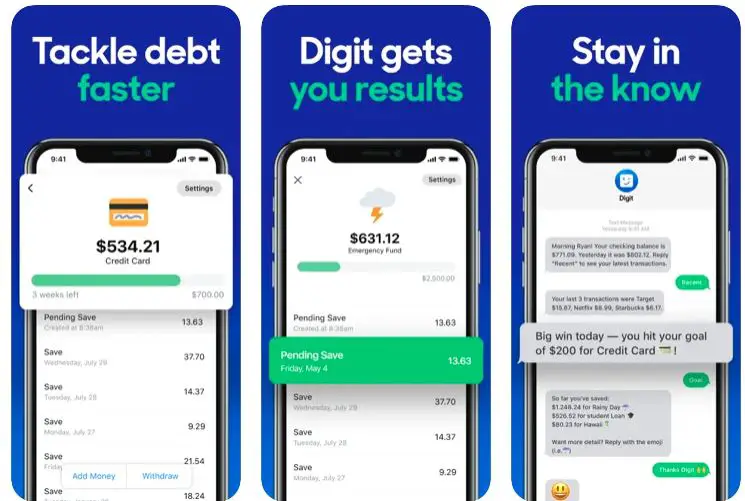

20. Digit: Save Money & Invest

Digit’s beautifully crafted tools are built to help you get results effortlessly. Dashboard. Progress bar. Clear statements and breakdowns.

These tools help you stay committed to your goals and help you efficiently reach them.

Digit knows budgets and metrics can be challenging to maintain independently, so they simplify it. No need to deal with spreadsheets or multiple apps when Digit can provide all of the insight you need in one place.

With Digit, get help saving money, staying on budget, getting out of debt – and never thinking about your finances again.

It has gotten excellent consumer reviews, with over a million downloads and a 4.5/5 star review.

Download the App from Google Play Store

Download the App from Apple App Store

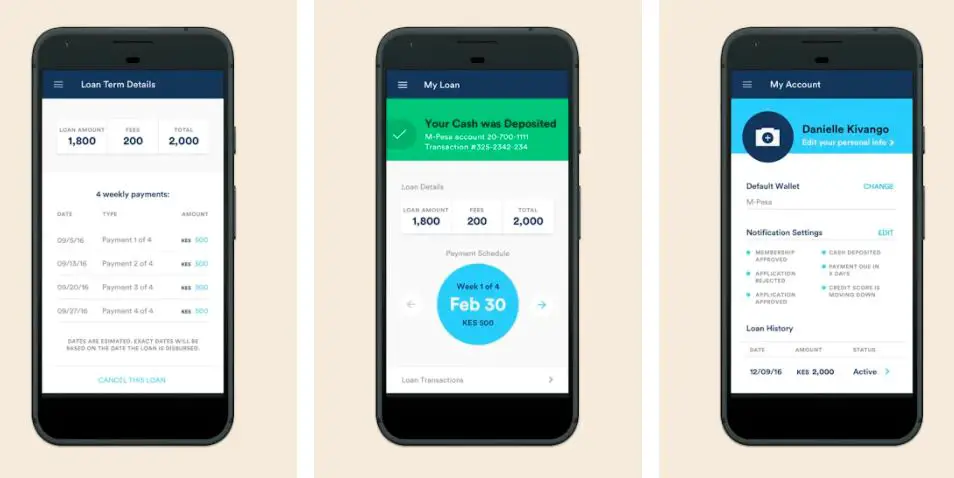

21. Branch – Personal Finance App

Branch helps you budget your wage and access a portion of earned wages before payday.

With a branch, you don’t need to worry about your cash flow and can use your funds for anything from paying bills and buying gas to tackling emergencies or splurges. The branch offers easy 24/7 online access to your earnings.

Branch puts your money back in your hands. It keeps you on track with your payday. It’s easy, it’s practical, and you’ll love it!

It has garnered excellent user reviews, with over 5 lakh downloads and a rating of 4.4/5 stars.

Download the App from Google Play Store

22. Checkbook

Checkbook is a simple, easy-to-use accounting application. Its primary purpose is to maintain check register type information. The application features all the standard accounting features.

With over 1 lakh downloads and a 3.8/5 star rating, it has received rave user reviews. It offers a clean & intuitive user interface and supports multiple currencies.

Checkbook is designed to be user-friendly and easy to use, yet still powerful and flexible enough to handle the demands of serious users.

Their objective is to give you a tool you can use daily while being valuable and robust.

Download the App from Google Play Store

Download the App from Apple App Store

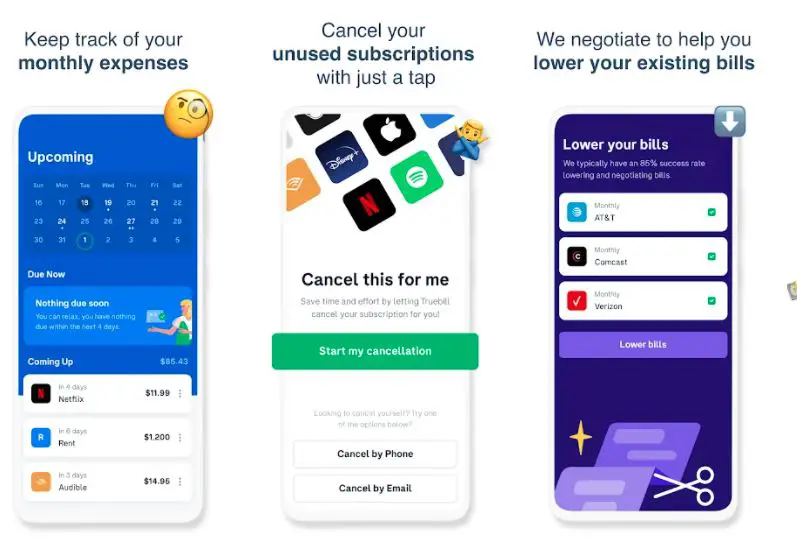

23. Truebill

Truebill acts as your automated financial assistant, helping you control your money so you can spend it on things you care about.

With millions of downloads and a 4.4/5 star rating, it has received rave user reviews.

Truebill can save you money by doing the work for you. It finds discounts, hidden fees, and billing errors.

It also cancels unwanted subscriptions and tracks spending to help you make informed decisions about your bills.

Download the App from Google Play Store

Download the App from Apple App Store

24. Goodbudget

Goodbudget is a home-based personal financial manager and cost tracker. It’s a modern take on your grandmother’s tried-and-true budgeting method: the paper envelope budget.

It assists you in staying on top of your bills and money by allowing you to track your incomings and outgoings in real time.

Goodbudget is built by people who are passionate about personal finance. It syncs between Android, iPhone, and the web, allowing you to share your budget with those who matter most to you.

It’s friendly, trustworthy, and works on your terms so you can sleep at night. It has gotten excellent reviews from consumers, with over a million downloads and a 4.5/5 star rating.

Download the App from Google Play Store

Download the App from Apple App Store

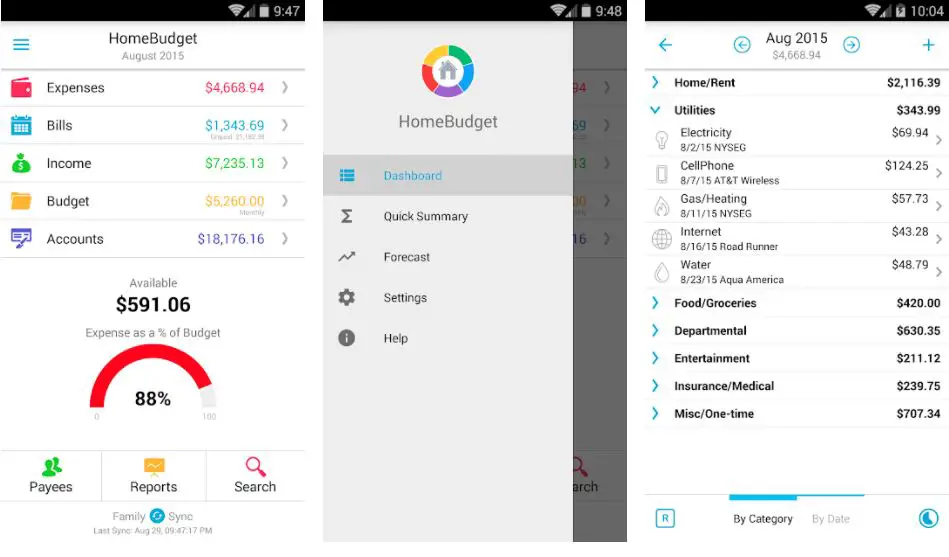

25. HomeBudget Lite

HomeBudget is a complete money manager for home budgets.

It is a free version of HomeBudget, a human-friendly total expense tracker designed to help your family track your purse/wallet, income, bills due, and account balances.

HomeBudget Lite organizes your spending and saving by breaking down bills into understanding categories based on where you spend your cash.

Start tracking your expenses to view how much you’re spending. Income Breakdown will help determine how much cash you’re swimming in or staring at!

The built-in net worth calculator is a handy tool that will help determine the actual value of your family’s financial position.

Download the App from Google Play Store

Download the App from Apple App Store

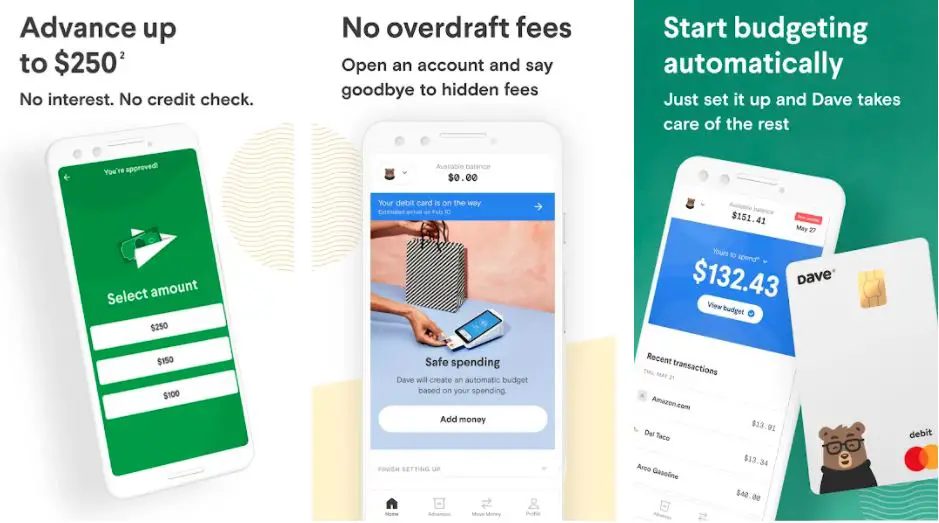

26. Dave

Budgeting seems like a scary word, but Dave’s here to help.

With no credit checks and a cash advance up to $250, Dave can help you get your financial health back on track, from paying down debt to making rent even when your paycheck doesn’t cover it all.

Start balancing your budget today with Dave ― the free online personal finance tool that will improve your financial health.

With over a million installations and a 4.5/5 star rating, it has received rave user reviews.

Download the App from Google Play Store

Download the App from Apple App Store

📗FAQ

What other apps are like Grain Credit?

Some apps similar to Grain Credit include Brigit, MoneyLion, Dave, and Earnin.

What app gives you a line of credit?

Apps like Brigit, MoneyLion, and Dave offer lines of credit to their users.

What app saves money and builds credit?

Apps like Self, Credit Strong, and Tomo help users save money and build credit simultaneously.

Can you get a credit increase with Grain Credit?

Yes, you may be eligible for a credit increase with Grain Credit after you have consistently repaid your loans on time.

Does Cash App let you borrow money?

Yes, Cash App offers a feature called Cash App Loans, allowing users to borrow money for a fee.

Can you have multiple Grain Credit accounts?

No, you can only have one Grain Credit account at a time.

What app lets you borrow money ASAP?

Apps like Earnin, Brigit, and MoneyLion allow users to receive money quickly when needed.

How can I borrow $200 from Cash App?

To borrow $200 from Cash App, you can apply for a Cash App Loan within the app and follow the instructions.

What app will loan me $200?

Apps like Dave, Earnin, and Brigit may offer loans up to $200, depending on your eligibility.

How do I build instant credit?

Building credit takes time, but you can start by making on-time payments on loans or credit cards. Some apps, like Self and Credit Strong, offer credit-building services to help you establish credit.

What is Kikoff Credit?

Kikoff Credit is an app that helps users build credit by offering loans and other services.

How much does Grain Credit approve you for?

Grain Credit approves users for loans ranging from $50 to $10,000, depending on their creditworthiness.

Why is the Grain Credit app not working?

There could be several reasons why the Grain Credit app is not working, including a poor internet connection, outdated app version, or server issues. Try updating the app or contacting customer support for assistance.

Does Grain Credit give you a card?

No, Grain Credit does not offer a physical credit card. All loans and credit are managed within the app.

Does Venmo loan money?

No, Venmo does not currently offer a loan feature.

How do I use Cash App boost for $100?

To use Cash App Boost for $100, navigate to the Boost section in the app and select the $100 boost. Make sure you use your Cash Card to purchase to take advantage of the boost.

Does PayPal let you borrow money?

Yes, PayPal offers a feature called PayPal Credit, allowing users to borrow money for a fee.

How long does it take to get money from Grain Credit?

After your loan is approved, receiving the funds in your bank account typically takes 1-2 business days.

What is the Grain Digital Credit Card?

Grain Credit does not offer a digital credit card. All loans and credit are managed within the app.

Is Grain Credit a hard inquiry?

Yes, applying for a loan with Grain Credit may result in a hard inquiry on your credit report.

How can I borrow $100 instantly?

Apps like Earnin, Brigit, and MoneyLion may allow users to borrow $100 instantly, depending on eligibility.

What is PockBox?

PockBox is an app that offers users short-term loans and other credit-building services.

Is Money Lion legit?

Yes, MoneyLion is a legitimate app that offers financial services like loans and credit-building tools.

How do I borrow $1,000 from Cash App?

To borrow $1,000 from Cash App, you can apply for a Cash App Loan within the app and follow the instructions provided. Remember that approval is subject to eligibility requirements and may not be guaranteed.

How can I borrow money with bad credit?

If you have bad credit, borrowing money from traditional lenders may be more difficult. However, apps like MoneyLion and Brigit offer loans and credit-building tools to help users with poor credit.

Why can I only borrow $25 from Cash App?

Cash App offers a feature called Cash App Loans, which allows users to borrow money. However, the amount you can borrow is based on your eligibility and may be limited to a smaller amount initially.

What app lends you $250?

Apps like Earnin, Brigit, and MoneyLion may offer loans up to $250, depending on your eligibility.

How can I get money right now?

If you need money urgently, consider using apps like Earnin, Brigit, or MoneyLion that offer quick loans to eligible users. You can also consider selling unwanted items, doing odd jobs, or driving for a rideshare service for quick cash.

How much can I borrow with fast cash?

The amount you can borrow with fast cash varies depending on the lender and your eligibility. Some apps, like MoneyLion and Brigit, offer loans up to a few thousand dollars.

How to get a 300 credit score fast?

Improving your credit score takes time and effort. Start by making on-time payments on any current debts and keeping your credit utilization low. You can also consider using apps like Credit Strong or Self to build credit.

How to get a 600 credit score fast?

Building your credit score to 600 takes time and effort. You can start by paying your bills on time, keeping your credit utilization low, and paying off any outstanding debts. Apps like Self and Credit Strong may also offer credit-building tools to help you improve your score.

Can you get a car loan with a 500 credit score?

It may be more difficult to get a car loan with a credit score of 500, but it’s not impossible. You may need to work with lenders that specialize in subprime loans or consider a co-signer to increase your chances of approval.

Is Kikoff legit?

Yes, Kikoff is a legitimate app that offers credit-building tools and loans to help users establish credit.

Is Self a legit app?

Yes, Self is a legitimate app that offers credit-building tools and loans to help users establish credit.

What is Self Credit Builder?

Self Credit Builder is an app that offers loans and credit-building tools to help users establish and improve their credit.

Is Tomo a secured credit card?

Yes, Tomo is a secured credit card that requires a cash deposit as collateral.

What sites are like Grow Credit?

Apps like Self, Credit Strong, and Tomo offer similar credit-building tools and services to help users establish and improve their credit.

Is Grain running out?

There is no indication that Grain Credit is running out or will cease to operate shortly.

How long does it take for Grain to verify your identity?

Verifying your identity with Grain Credit can take up to 24 hours.

What cards give you free money?

Some credit cards offer cashback rewards, which can be considered free money. However, rewards vary depending on the card and the spending categories.

Conclusion

Wealth is among the most crucial aspects of your life to consider. However, several more reasons why keeping track of expenditures should be required.

To stay healthy, eat only healthy food (not because you’re on a diet; eating healthy food will make your body healthier); to be productive, learn to say no (to social events that distract you from your goals); and maybe even invest in generating passive income.

Credit cards are often the first thing that comes to mind when discussing debt. While there are tons of credit card companies to choose from, each one has its options that make them unique. With the right planning and budgeting, any of these cards can be used to gain financial freedom.

Credit cards can be intimidating. There are several solutions available that provide a diverse variety of services. If you know what you’re looking for, finding a credit card that matches your needs is easy.

We’ve produced a list of the best applications like grain credit to help you narrow your options. I hope you find this valuable information in your search for the right credit app!