Klarna is known amongst e-commerce platforms and online shopping apps. There are numerous e-commerce and online shopping platforms but not many have ideal payment options therefore flexible payment installments got more fame with time.

All over the world people loved the idea of paying cash in the form of installments. Klarna as I said earlier, is one such app that has not only established its name among purchase now pay later apps but also among online shopping and e-commerce platforms.

The app is providing its level best for the users who want online payments for online storefronts and pay up directly. However, with time, there are different names available in the market, apps like Klarna that can replace Klarna.

In this article, we have jotted down some of the apps like Klarna. With some exclusive features, users can go for Klarna’s alternatives that have some initiative features, best offers, and deals as well as different installments offers.

Best Apps like Klarna – Our Top Pick👌👌

Let’s get started with our list of apps and sites that a user looking for Klarna’s alternatives can go for.

1. Affirm: Shop and pay over time

Affirm is one of the dominant names that pops up whenever we talk about apps like Klarna as the list can never be completed without mentioning it. It is attached to almost every known shop out there such as Walmart, Wayfair, and last but not least Casper.

The company has renovated its services and operations by going on a new path with numerous offline and online retailers. Affirm has played all of its premium cards as in the app users can now shop without worrying about minimum credit score.

But, to access all of these exclusive features, approval of a credit check is mandatory. As claimed by Affirm, its users on an average basis loan $750 and usually pay back their loans with 18% APR and in a total of nine months.

The amount claimed by Affirm makes it one of the most thriving online loan providers, therefore, I’m resting my case by saying that do not make your opinion based on what you are reading give it a chance, and then make up your mind.

The app is available in the market for both operating systems, Android and iOS so no one would feel left out and can use the expenses provided by Affirm.

Download the App on Google Play Store

Download the App on Apple App Store

2. Sezzle – Buy Now, Pay Later

Sezzle has collected the fame in past few years since its launching in the market. The app has expanded a lot and that is clearly shown in its swift approval procedures. These procedures include verifying users with credit checks.

Just after you become a verified account, you will be pinged up with an approval decision, and after all the procedure is completed, you can start your journey of purchasing things. But users can keep in mind that failed credit check won’t affect their credit score.

Just like some other apps (coming up later), Sezzle also asks its users to pay one of the installments at the time of check out. And the other remaining three installments every two weeks.

This platform is available for Android as well as iOS so you can go to either the Play Store or App Store to download it.

Download the App on Google Play Store

Download the App on Apple App Store

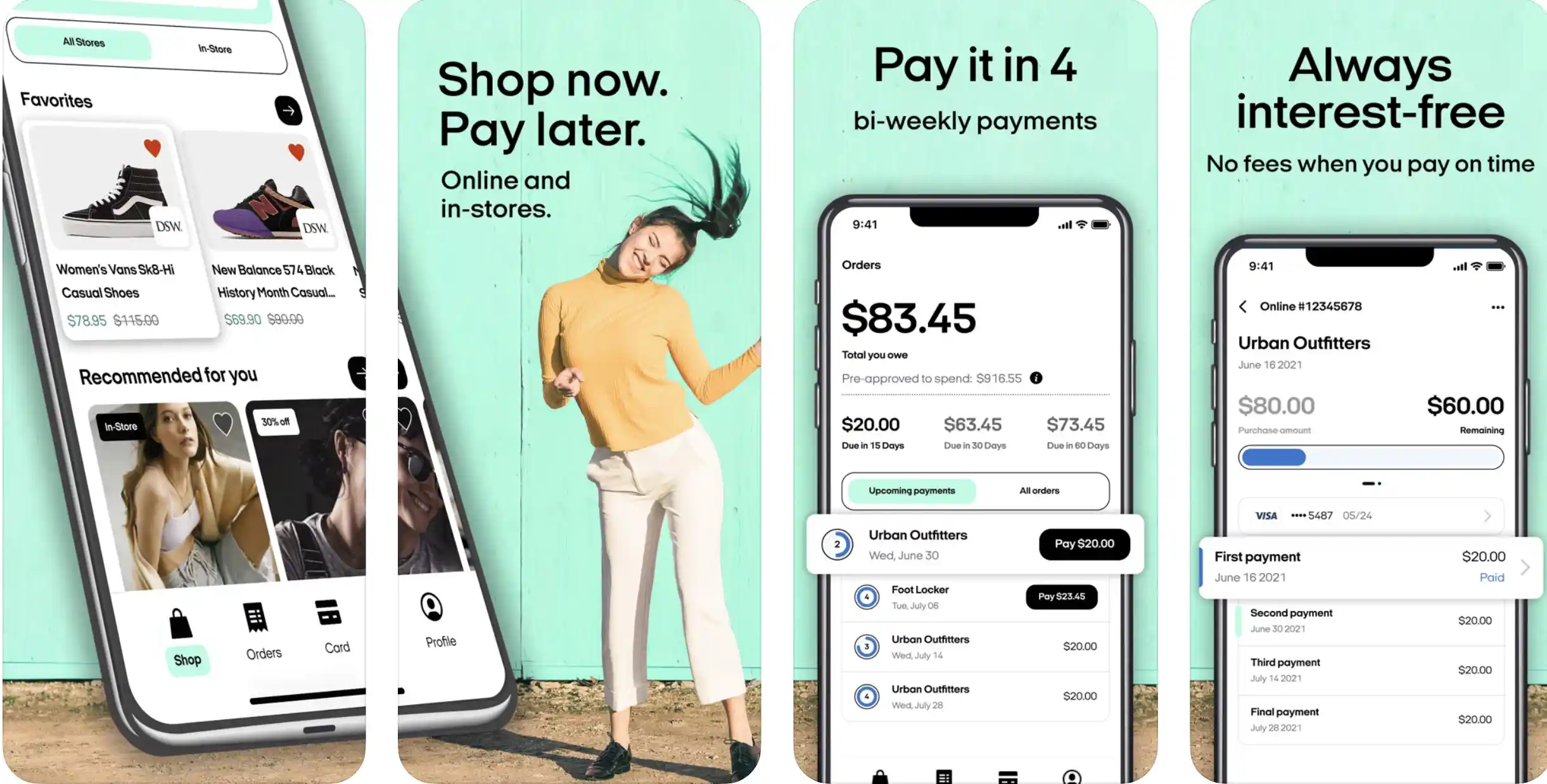

3. Afterpay: Buy now, pay later. Easy online shopping

Very familiar features can be seen in Afterpay, one of the leading names in the list of apps like Klarna. The app also reminds users of Four (later talked about in detail), another app that can very well replace Klarna and fulfill the demands of people looking for alternatives for Klarna.

The app allows users to purchase items and then pay the amount in 4 equal installments. But these installments should be paid in the time span of 2 weeks. According to the app, two weeks are enough to sough out money and pay the amount back.

And the most attractive feature of Afterpay is its partnership with over 11000 vendors from where users never go without finding something valuable to them. Apart from the payment deals, users are getting a lot of options to choose from.

But there is a caveat that, the users will either get approval or rejection whenever they will buy something from the app.

To continue shopping through Afterpay, you have to make sure that your purchase does not get rejected and the simple way to avoid rejection is to pay back within the time limit.

The app can be yours if you go to App Store or Play store as this is one of the apps that both Android and iOS users can access.

Download the App on Google Play Store

Download the App on Apple App Store

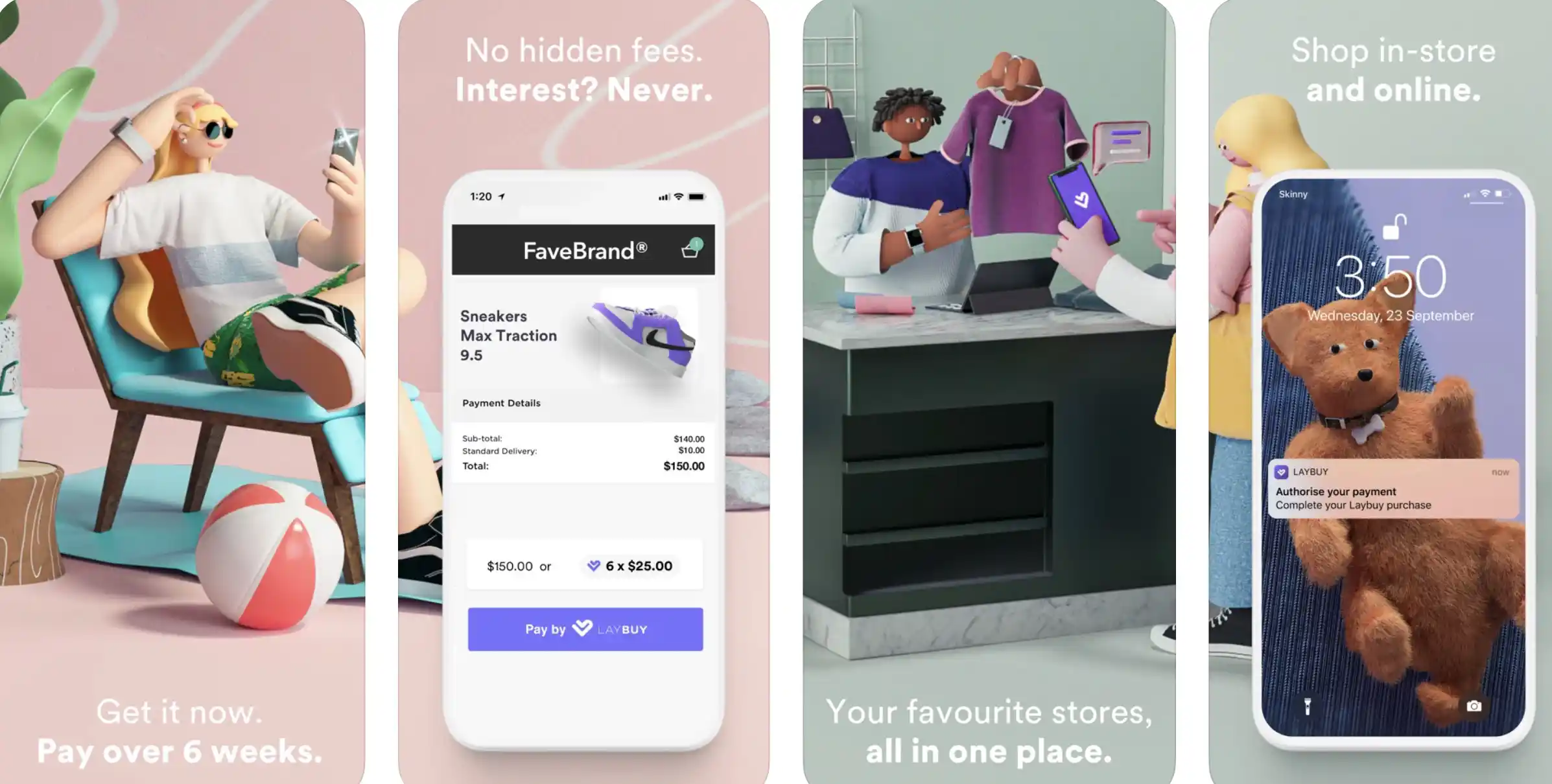

4. Laybuy

Moving on with our next alternative to Klarna is Laybuy which has claimed its place in the heart of its loyal users due to its reliability. The app is housing items from in-store as well as online retailers thus benefitting both of them.

Fashionistas will love this platform as a major of the company’s vendors belong to the fashion industry and showbiz. It has an exclusive feature that allows any person to pay the installments, and that is the total amount of any item will be divided into six installments.

Users will be getting five weeks to pay back the amount but one out of the six installments has to be paid at the time of checkout.

But to stop your daydreaming, this platform is only exclusive for New Zealand buyers, and the app will only accept cards from New Zealand banks.

Again Laybuy is available for both Android and iOS users, no need to get disappointed.

Download the App on Google Play Store

Download the App on Apple App Store

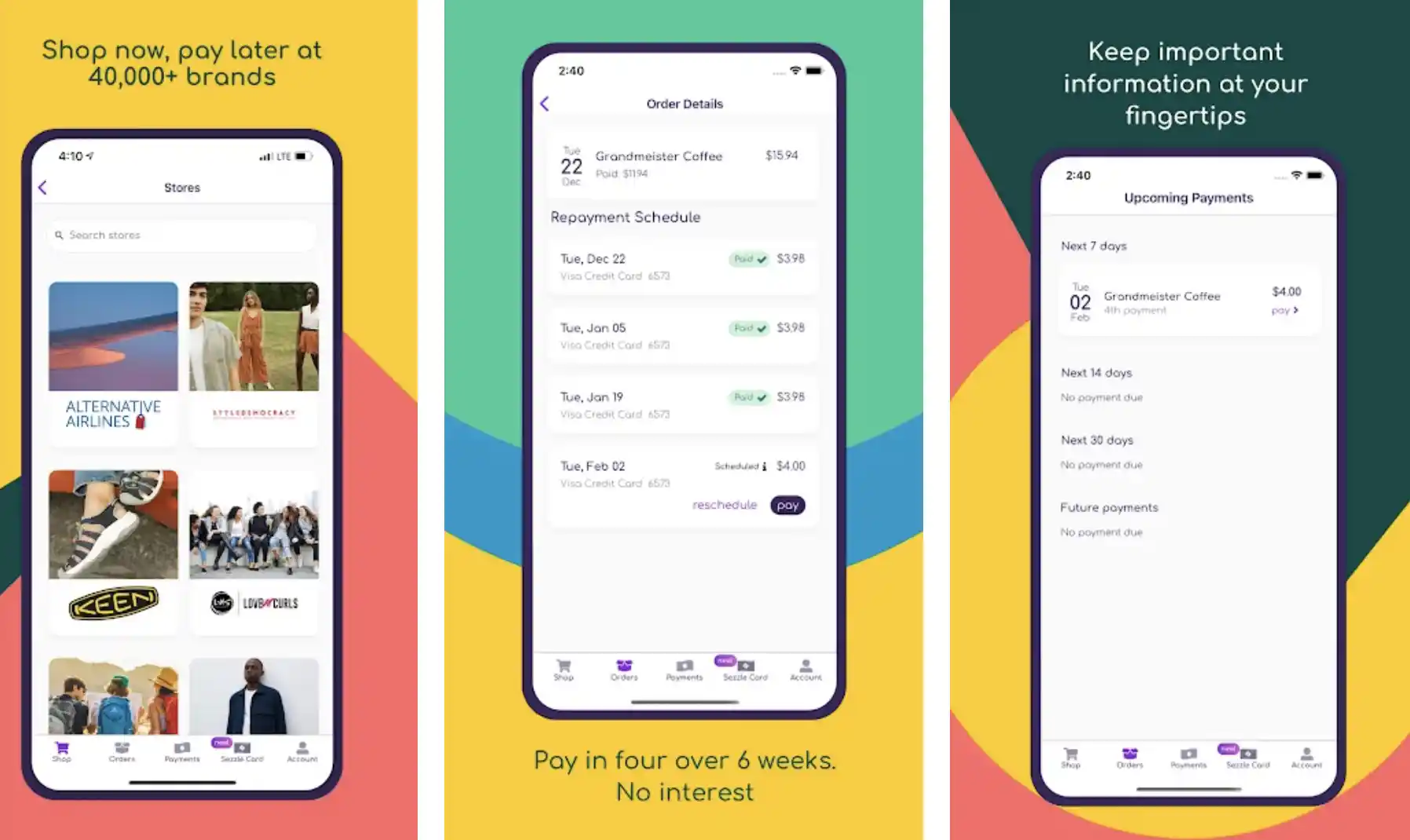

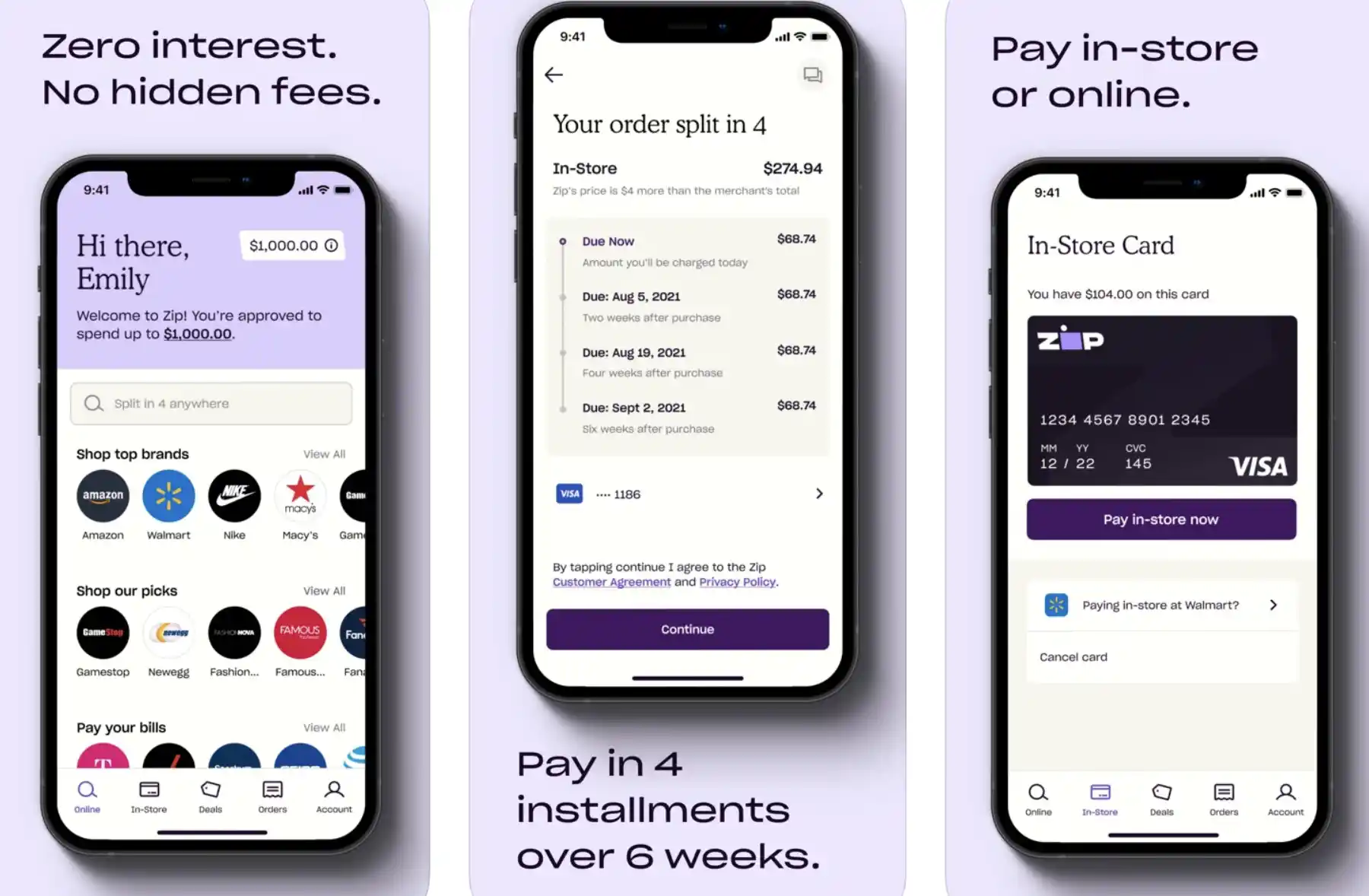

5. Quadpay

Quadpay is an excellent, versatile platform that satisfies the need of the crowd looking for apps like Klarna. Again it is one of the instances where users will find similar installment policies like Four and Sezzle.

The amount will be split into 4 equal installments but the users will every time have to ask for approval during the purchase and that will be done with the help of soft credits. These swift approvals will then allow you to enjoy obstacle-free shopping.

But the app does not follow the footsteps of most of the alternatives to Klarna as failing to pay installments on time influences the credit approval rating. It is not a bad thing as they are limiting approval rates based on failing to pay installments.

The app has made this rule so that people would pay back the amount of the item and no one would love having piled up interests on them, so all in all a good step was taken by QuadPay to make people pay the credit.

If you want to download this alternative then directly download it from either the PlayStore or App Store. This app is available for both Android and iOS.

Download the App on Google Play Store

Download the App on Apple App Store

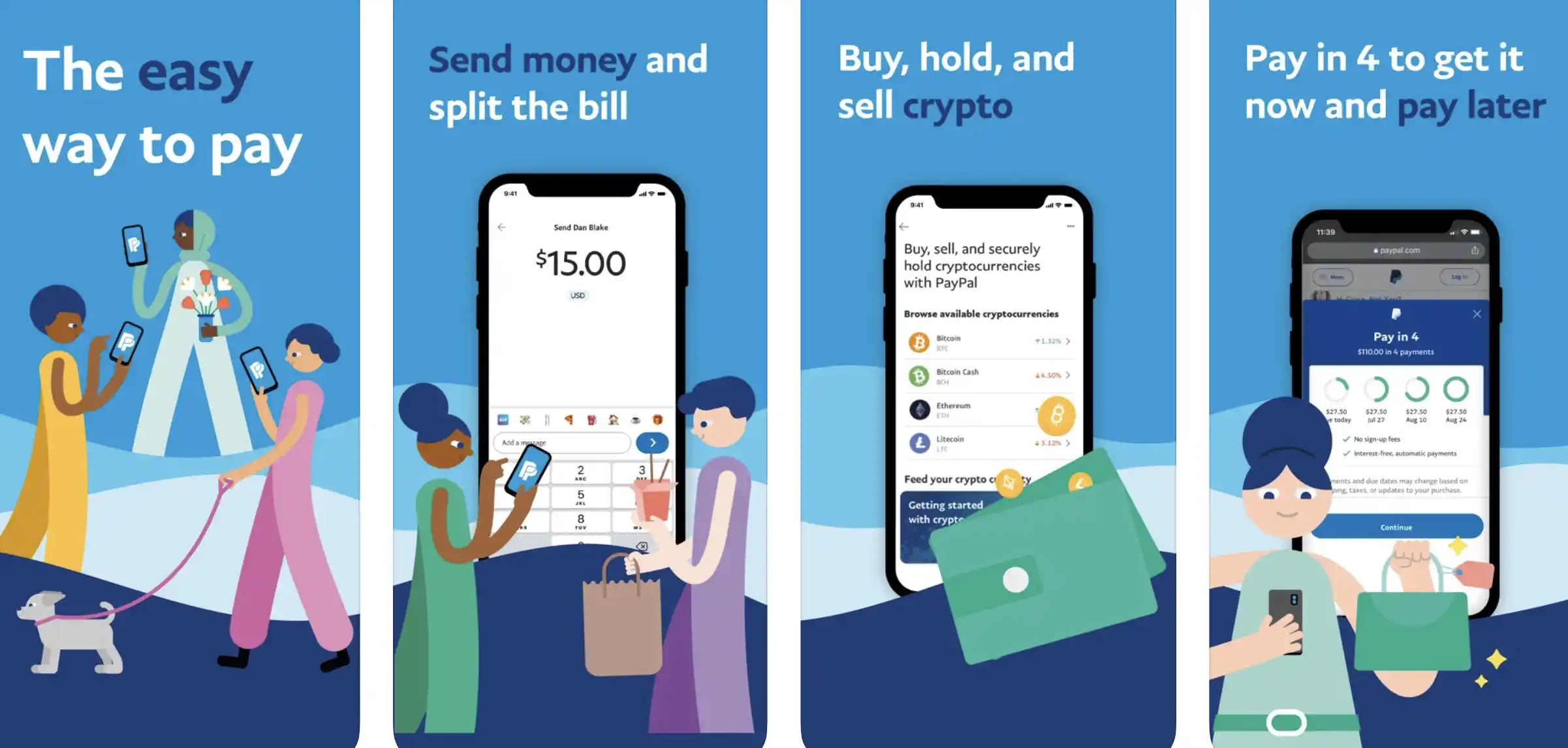

6. PaypalCredit

Paypal Credit has made its name in the field of platforms that can be used for convenient sending and receiving payments. It is one of the platforms that has collected its popularity due to worldwide usage.

Paypal is one of the recently launched platforms that offer revolving credit cards. It in return allows accessing a reusable credit line that is connected with users’ PayPal accounts. These credits can then allow you access to online buying and paying them off in installments.

The perfect replacement for Klarna can be Paypal and is also the best bet for PayPal users. But also keep in mind that the interest rate of installments is a little bit more pricey than some of the other apps on the list.

However, there will be no interest on purchases over the cost of $99 or higher than that, but only if all the cash is paid fully before the time span of 6 months. It can be used on the Android operating system or iOS operating system.

Download the App on Google Play Store

Download the App on Apple App Store

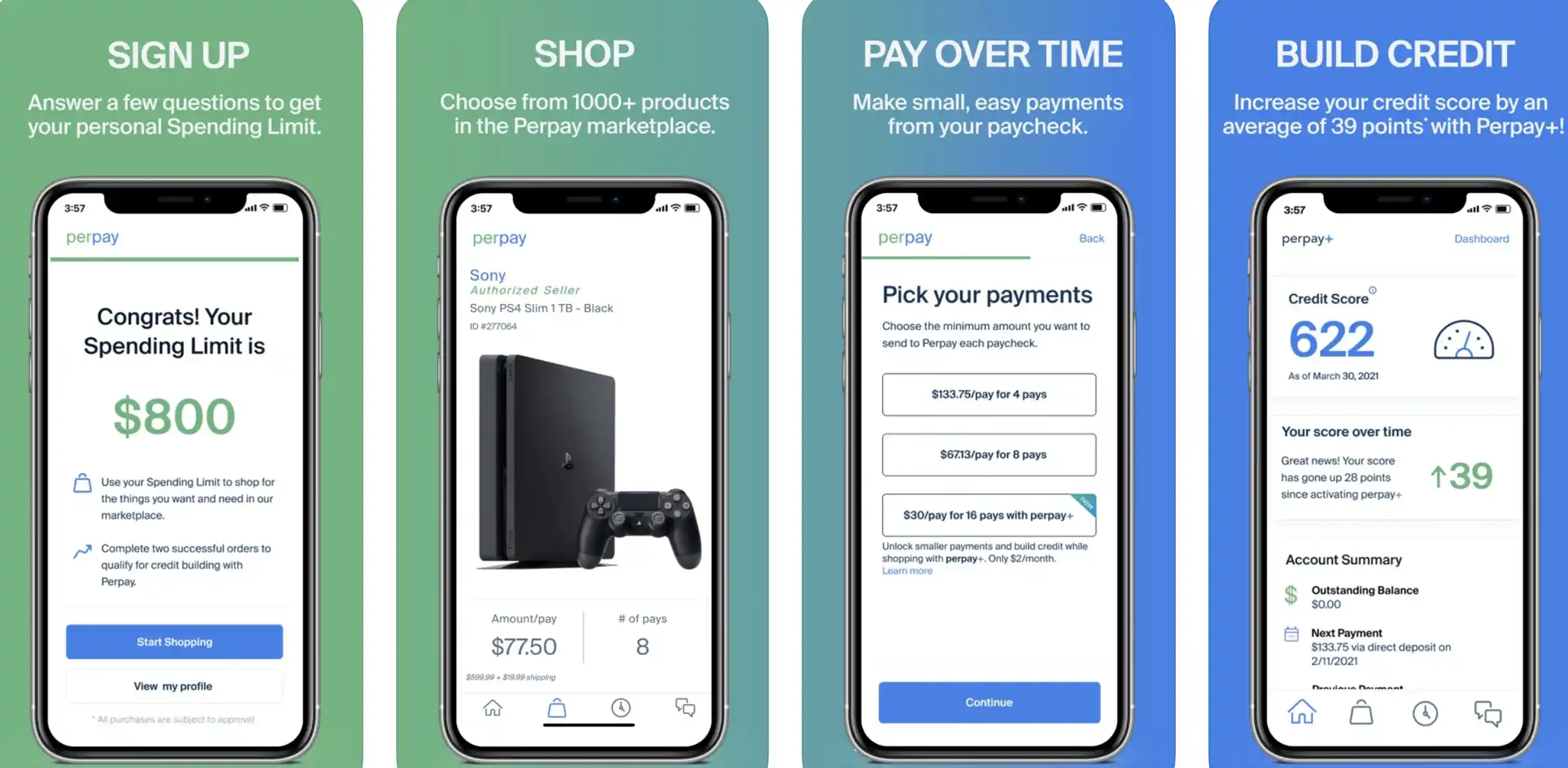

7. Perpay – Buy Now, Pay Later, Build Credit

Perpay has broadcasted its name by saying that is one of the platforms that have convenient means of payment gateways. After signing up with Perpay, shoppers will be asked some questions that will later decide their spending limit.

Generally, these spending limits range from $500 to a maximum of $2500 which is more than enough for any shopper in my opinion. Once you finish answering these questions, you are free to go all out, checking items from numerous shops.

Perpay has a policy of paying one installment at the time of purchasing the item and this payment will be deducted from the total installments.

Also, the app has the tendency to reduce installments automatically from the paychecks, therefore, no need to fret about forgetting the date.

And to increase this limitation, users have to be frequent and loyal Perpay users. The spending limits depend upon users using the app. Undoubtedly, Perpay is one of the musts to have in the apps’ collections.

Download the App on Google Play Store

Download the App on Apple App Store

8. Future Pay

A platform that can provide comfort to both the purchaser and marketer is Future Pay.

A very convenient platform that is making it easier for businesses to thrive, and Future Pay is doing by helping the businesses to recover the amount invested in the product by making full money back and allowing users to shop without the need to pay up the whole sum.

The app claims to be an innovative platform for both purchasers and marketers. The app has an intuitive 9nterface that comes fully packed with tools that make check-out processes simple. With the help of Future Pay, now buyers can have what they wanted from both small and established businesses alike.

And sometimes, shoppers can also bag deals without paying a single dime at the check-out process. Again it is one of the instances where the developers wanted to please both android and iOS users therefore they made Future Pay available on both operating systems.

Download the App on Google Play Store

Download the App on Apple App Store

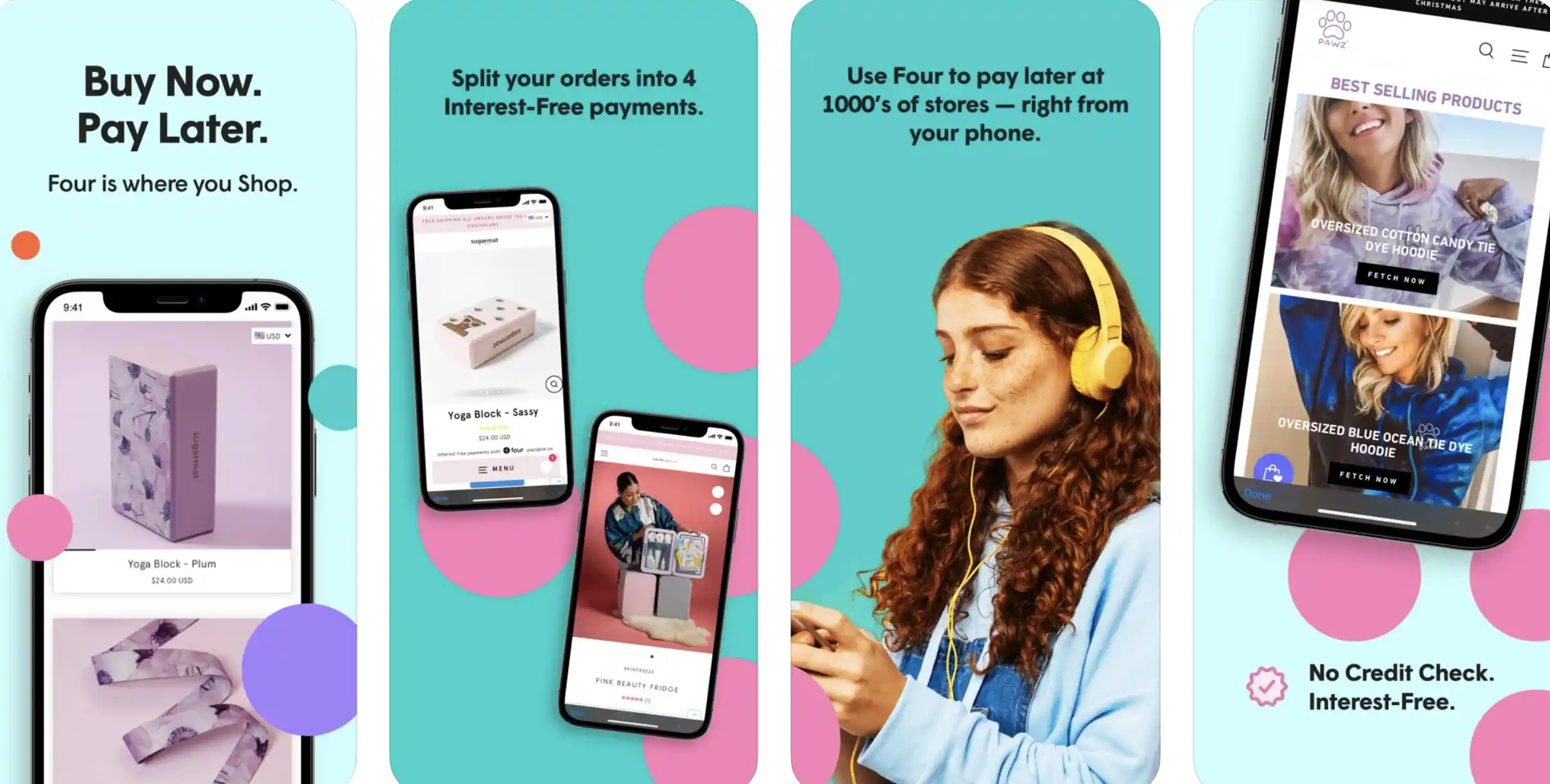

9. Four | Pay Later

Four is an all-in-one platform for a person looking for conversions, sales, and a powerful platform for retailers.

And the sole purpose of Four is to provide a payment option in which a purchaser can pay back the amount in four installments, therefore, you can guess why the developers selected the word Four for their app.

It has a pretty simple and easy checkout procedure that promises no hassles and obstacles when it comes to credit checks, and form fill-outs. And to say the least, users can easily access the app as there are no hectic procedures.

This is one of the alternatives for Klarna that is accessible on both operating systems: Android and iOS.

Download the App on Google Play Store

Download the App on Apple App Store

10. Splitit

A perfect choice among the best apps like Klarna for shoppers who do not like the line of credit with the enterprise or in general terms do not like limitations on buying is Splitit. The simple and easy method is integrated for users.

Purchasers can shop via Splitit by using their pre-existing Visa or credit or debit card and then pay back the buying cost in installments. This tool provides a way for users to make a plan that is convenient for them.

If a person is purchasing something from the app’s partner then there will be an option available to use Splitit as one of the paying options, but using Splitit, users can decide the number of installments in which he/she will return the amount.

And you won’t have to be worried about missing installment dates, as the company will automatically detect the amount from the bank per month, but it does come with a limitation on debit cards as the maximum purchase is up to $400.

11. ViaBill

The next name on our list is accessible for more than 5,500 sites and do note the name, ViaBill.

But if you are not too kind about sharing personal details with the app then you have to select any other app from the list, as to access ViaBill, entering important information such as email address, credit or debit card number, and phone number are necessary.

If someone does not agree with this condition then their checkout will not be completed but in my opinion, it is worth entering the data when all the process is taking in real-time. And after the approval of check out, the purchaser has to pay up the amount in four equal installments.

And note that the first installment has to be paid at the time of purchase checkout. The platform has some matching features like Klarna that make users love ViaBill more as a Klarna alternative.

But in ViaBill, users won’t get credit checks and even interest is not that much to make a buyer fret about it.

After using the site, many people have only good remarks regarding the features and app in itself. So if you are thinking of not giving it a try, then make your mind after giving it a shot.

12. GoCardless

GoCardless claims to have a partnership with over 55,000 vendors thus no sacrifice in providing services as fast as it can be. The app has payment gateways and while using this app, users can not access big established names but also small recently launched brands.

The app has bagged the title of processing purchases that cost over $15 billion per year. One of the simplest payment procedure layouts can be seen in GoCardless and apart from this, users will also have an automatic installment payment on due dates.

It let users go through hassle-free checkouts, and if there is some problem occurring in payment procedures then the user is entitled to bill securities. Weel, it can become one of your most-loved sites that can function well as the like Klarna if you check it out.

13. J2store

When we talk about Klarna, the only thing that comes to our mind is we can purchase things without caring about paying up at the moment, and that is what J2store is also trying to provide to its users.

The platform name’s come in the list of Asia’s leading brands that offer to purchase now pay later policy. It has some exclusive paying methods for users thus making the life of users much easier and simpler.

The app recently has joined hands with over 70 payment gateways and with a long list of shipping plugins.

It is one of the compatible platforms for entrepreneurs who are starting their enterprises because the app allows exclusive payment methods that a business can use for opening and getting to more customers.

Some of the best built-in features of J2store are coupons, discount codes, vouchers, SEO optimization for customers, user group pricing, and many more.

The list does not end here as you will be getting more if you decide to go with J2store such as multi-currency, language support, mobile user support, one-page user checkouts, free shipping services and so much more.

14. Zebit

To begin with, let me tell you that this platform, Zebit has one of the most widespread usages around the globe, with approximately 3 million users. And it has such strong attraction that even a person with good resistivity will also check it once.

What attracted most users is the accessibility of loaning up interest-free credit up to $2,500 using Zebit. I do not think that even a person who can not control their shopping expenses will need more amount than that limit.

And to get started with this app, users are only required to fulfill certain criteria and these are being of age meaning you have to be an adult, and at the time of using the app, you are being paid, i.e, employed or being retired with a saving.

What makes Zebit, a good bet to replace Klarna is its 0 interest shopping plans, and free sign up and membership, so do give Zebit a try.

15. Partial.ly

Partial.ly is the last but not the least app like Klarna but it allows free usage of the app by free-of-cost signup and no monthly subscription. The app is one of the best platforms for the market to make their invoicing rich and allow more revenue to generate.

At the current time, Partial.ly is one of the apps like Klarna that is catering its services in more than 20 countries and over 130 global currencies can be accessed via this app. The platform is paving its way with great fervor.

It is allowing the users to reduce the stress and amount of installment by offering them a tool that has notable payments methods thus no stress when dealing with such situations of buying.

It has some of the noted features such as merchant portals, custom payment plans, automated payments, and many more that comes with Partial.ly, making it delectable as an alternative for Klarna.

Wrap-up

After getting to know all these alternatives for Klarna that can be on your desktop as best apps like Klarna, you can select from the above-mentioned apps according to your own convenience and their features.

Paypal Credits is one of the names amongst apps that is providing 6-month installment plans whereas Afterpay, Quadpay, Sezzle, and Four allow users to pay up the credits in the span of 4 installments.

Most of the names present in the list are accessible on both the operating systems, Android and iOS. There is no app better than the other so I can not say which one would be the ideal deal to go for as each one of them has different credibilities.

According to your paying needs, select the right one from the list. But if some of the best apps like Klarna that you use frequently are missed out on the list of best shopping apps like Klarna, then do not feel shy and let us know the names.