In today’s digital economy, transactions have become more accessible and quicker, but you still have to pay a lot for it. Online buying has become a widespread practice that helps both buyers and sellers these days.

This made Quadpay a popular solution for people or businesses that want to accept e-currency payments but have no idea which platform would benefit them the most.

Quadpay is one of the excellent tools for anyone looking to make regular small payments on services online. Use it to divide the expenses of your office supplies, pay off your bills, or fund your child’s savings account. It allows you to make numerous cash transfers to use up to your linked credit or debit card limit.

Make a difference in your industry and look at our recommendations to make a better decision. If you are serious about Quadpay, then you have landed on the right page. Saving time has never been easier, thanks to this handy guide.

If you are looking for apps like Quadpay, you will find the below tools are great alternatives. These alternatives can provide information that may help you build your business.

Best Apps Like Quadpay – Our Top Pick

1. Paypal – Pay in 4

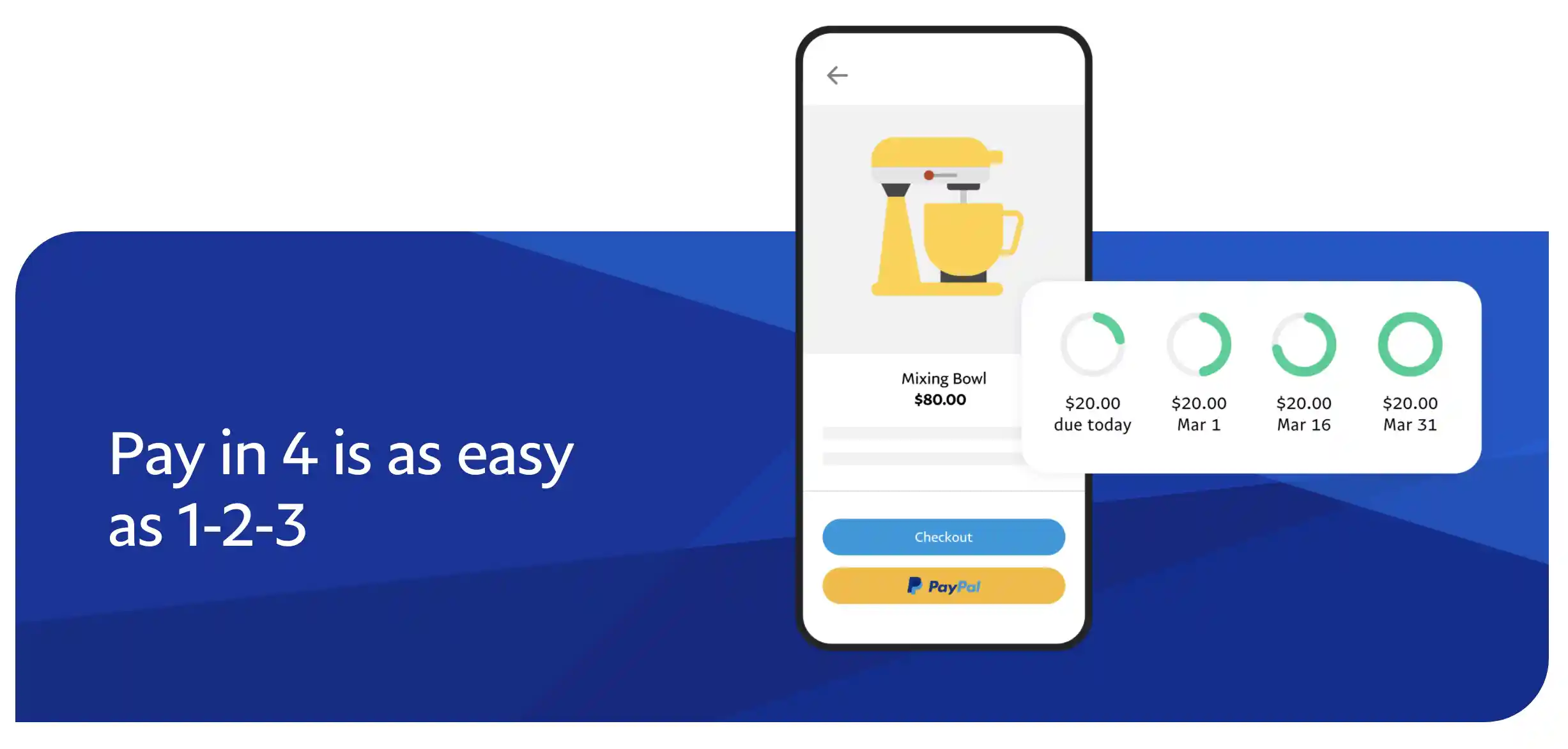

Do you require additional finances to address an unusual event? Pay in 4 offers you the opportunity to receive your funds faster. If approved, the money is available in your account almost immediately.

You can then choose how much you want to pay each month for four weeks. The payment amount will be due before the interest-free period expires. The remaining amount is payable in full after 30 days.

Pay in 4 is a personal installment loan program offered by PayPal, which can be used to pay for more expensive purchases than your budget will allow. Available to Account holders with a PayPal balance, it’s possible to split payments into four installments.

By selecting Pay in 4 during checkout at thousands of online retailers, you will receive your order immediately, without incurring interest or financing charges.

You can start splitting your payments in as little as two days. Using this method, there is no credit check, and the application process is straightforward.

Download App on Google Play Store

Download App on Apple App Store

2. FuturePay

FuturePay is yet another one of the best apps like Quadpay and a way to pay for goods and services online from sellers who accept FuturePay as a payment method.

With this platform, you can make substantial savings on your purchases by spreading the total cost over several months.

FuturePay is a payment channel that allows you to pay only the money customers desires to spend. i.e., you can purchase SIM Online with zero balance and then pay the amount in monthly installments.

There are no hidden fees or conditions attached to FuturePay transactions, making it easily affordable for everyone concerned. FuturePay is simple because you only pay for what you use.

With FuturePay, you can quickly pay off your credit balances on time without hurting your budget. You can even pay them off earlier with amounts ranging from $25 to $100.

FuturePay has an exciting business model, giving both merchants and customers unprecedented flexibility in their billing terms. It charges only a small fee to manage this arrangement.

And it’s much more transparent than similar payment solutions, which allow you to track all your transactions easily.

Download App on Google Play Store

Download App on Apple App Store

3. Viabill

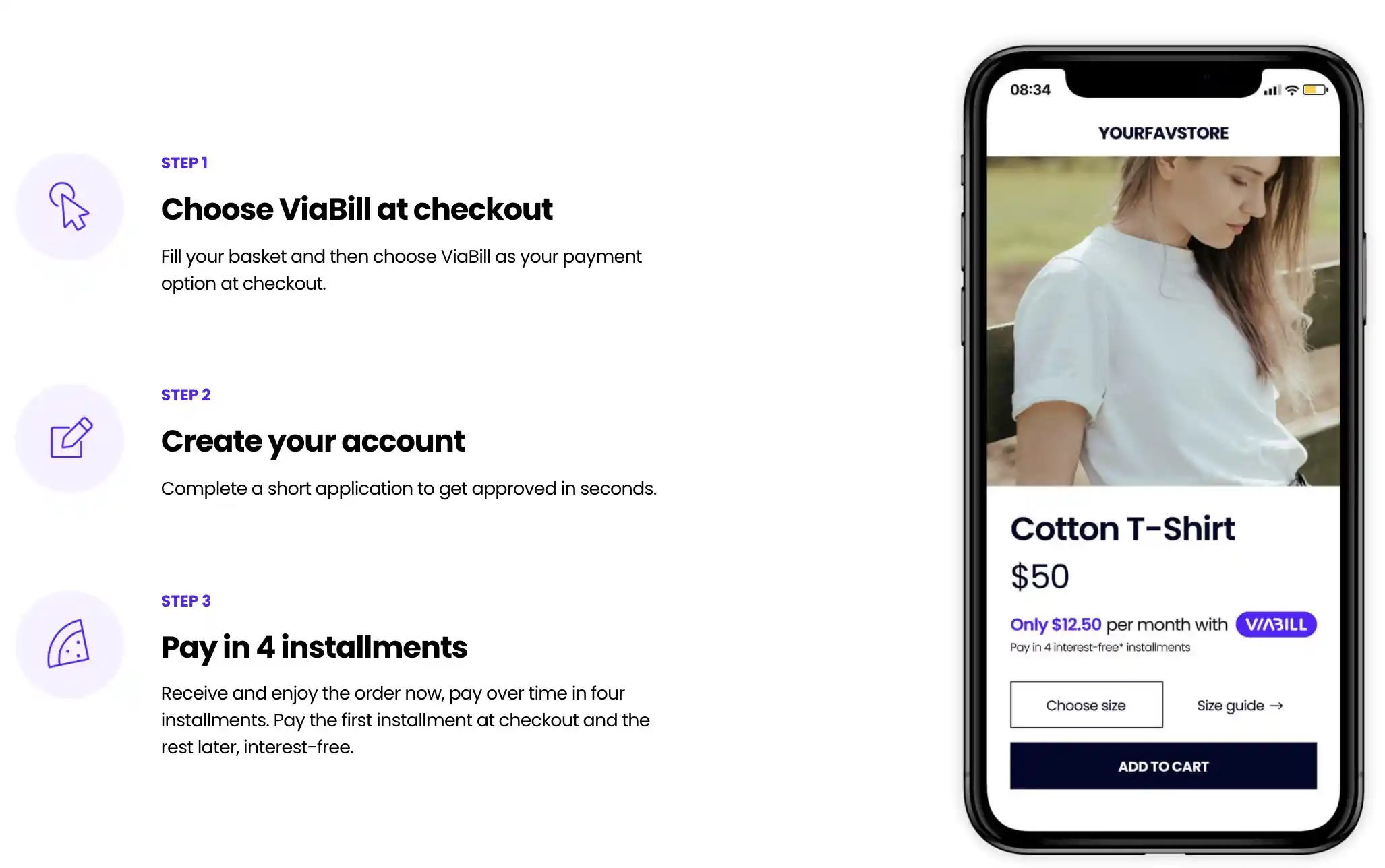

ViaBill makes it easy to pay now and pay later! Are you tired of dealing with traditional financing companies? Then you’ll love ViaBill. ViaBill is a modern way of paying for your purchases.

There are many subscription models available for online shoppers, but here at Viabill, they offer a plan that stands out. Because everything is automated, there is never any hassle in making your payments on time.

Viabill is an alternative payment method to paying for your purchase in cash. With Viabill, you pay for each item you want in four installments without interest. This allows you to get what you want now and pay later.

ViaBill’s installment system is easy to use. Shoppers can choose from a menu of products, whether online or offline and enter the amount they want to purchase. Then, Viabill calculates the equivalent monthly payment according to the customer’s budget.

As soon as the contract is signed, Viabill will immediately deduct the first monthly installment from the customer’s credit card account. Shoppers may acquire what they want now and pay later in this manner.

4. Paypal Credit

PayPal Credit is one of the best Buy Now Pay Later services since it is integrated with PayPal. It’s available in various formats like PayPal Credit Card, PayPal Business card, and the Personal Loan. These are the three different tools that PayPal Credit gives you to use their service.

PayPal Credit is without a doubt one of the best apps like Quadpay. Both are used to make bulk purchases online at Walmart, Home Depot, USPS, Apple, Domino’s Pizza, Chewy.com, Wayfair.com, Lowe’s, and many others.

They can be helpful and convenient for online shoppers who would rather not use their credit cards and instead pay for their purchases with a single monthly payment or in installments.

If you are not completely satisfied with your purchase, they will make it easy to file a dispute if problems arise.

While you use PayPal Credit, you don’t have to be concerned about having a tiny amount of money on hand when making purchases or about late payment costs.

5. Littlewoods

If you liked the way Quadpay worked but liked the bonus features of Littlewoods, Littlewoods essentially is your perfect replacement. Littlewoods is a leading company recognized for its success in various industries across the U.K.

From clothing to electronics to baby products and everything in between, Littlewoods offers a wide variety of products to suit any consumer.

Take advantage of a shopping experience that prioritizes customer satisfaction and provides a comprehensive selection of goods.

Littlewoods brand is committed to offering payment options that are easy on your wallet. Littlewoods Online has got all of you sorted from making interest-free payments over 20 weeks or interest-free payments over 52 weeks to spreading the cost of some purchases through the new 0% finance scheme and paying for some purchases through weekly installments.

Buy Now Pay Later allows you to take home your purchase today and pay for it in four or eight low monthly payments. The terms depend on the item, but these installment options allow you to choose your furniture item and pay the rest in a snap.

Download App on Google Play Store

Download App on Apple App Store

6. Atokes

Again, this is entirely up to you and your needs. Atokes and Quadpay can both be viable alternatives to your usual payment processor for Square.

Use Atokes to purchase any product online! Enroll in automatic payments, prearrange credit limits, and make installments on products you need through the internet.

With credit limits ranging from $500 to $3,000, Atokes offers a cost-spreading service. There are no hidden costs and no interest on purchases!

Open up new worlds of possibilities with your credit card that you can use to pay for everyday goods and services. With Atokes, users are empowered with affordable credit. The more income documents they submit as proof of income, the higher their credit limit.

Each user begins with a meager monthly payment, which they can pay on the 30th of every month. And for a good repayment history, they can be eligible for ten interest-free payments.

7. OpenPay

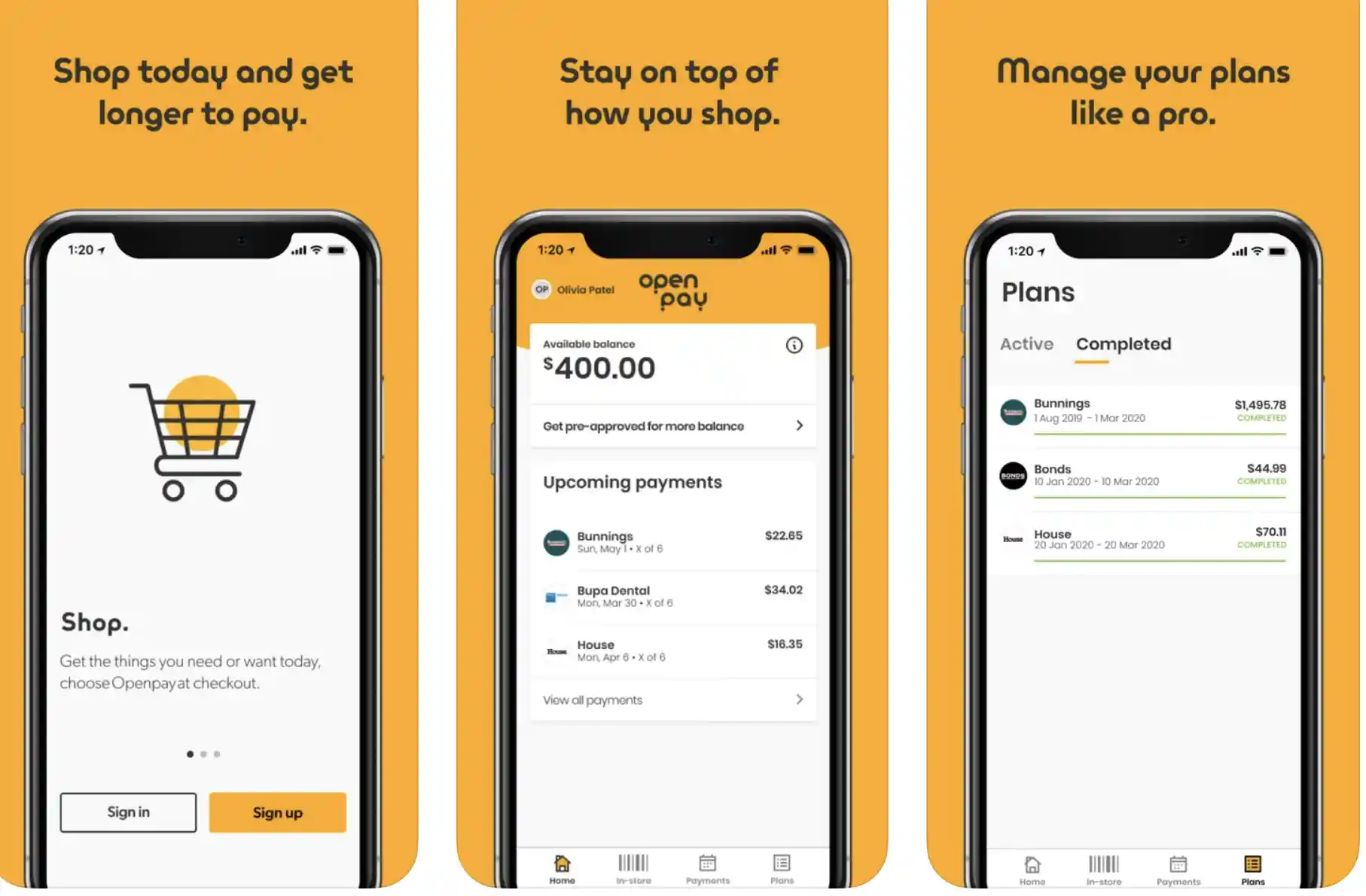

OpenPay is a company that provides another alternative to using Quadpay. You can think of it as an equivalent too. OpenPay app offers an all-in-one mobile shopping payment platform.

The app combines merchant profiles, simple purchasing options, offers and deals, money transfers, and much more. The innovative Openpay allows users to purchase items up to $10,000 and finance them for 12 months.

OpenPay works for you. Apply online and get approved within minutes. Apply for a plan that fits your budget; make the first payment today, the rest in a fortnight or a week, depending on the payment option you choose and reap the rewards knowing a full meter is ready to go.

Download App on Google Play Store

Download App on Apple App Store

8. Afterpay: Pay over 6 weeks. Never pay interest

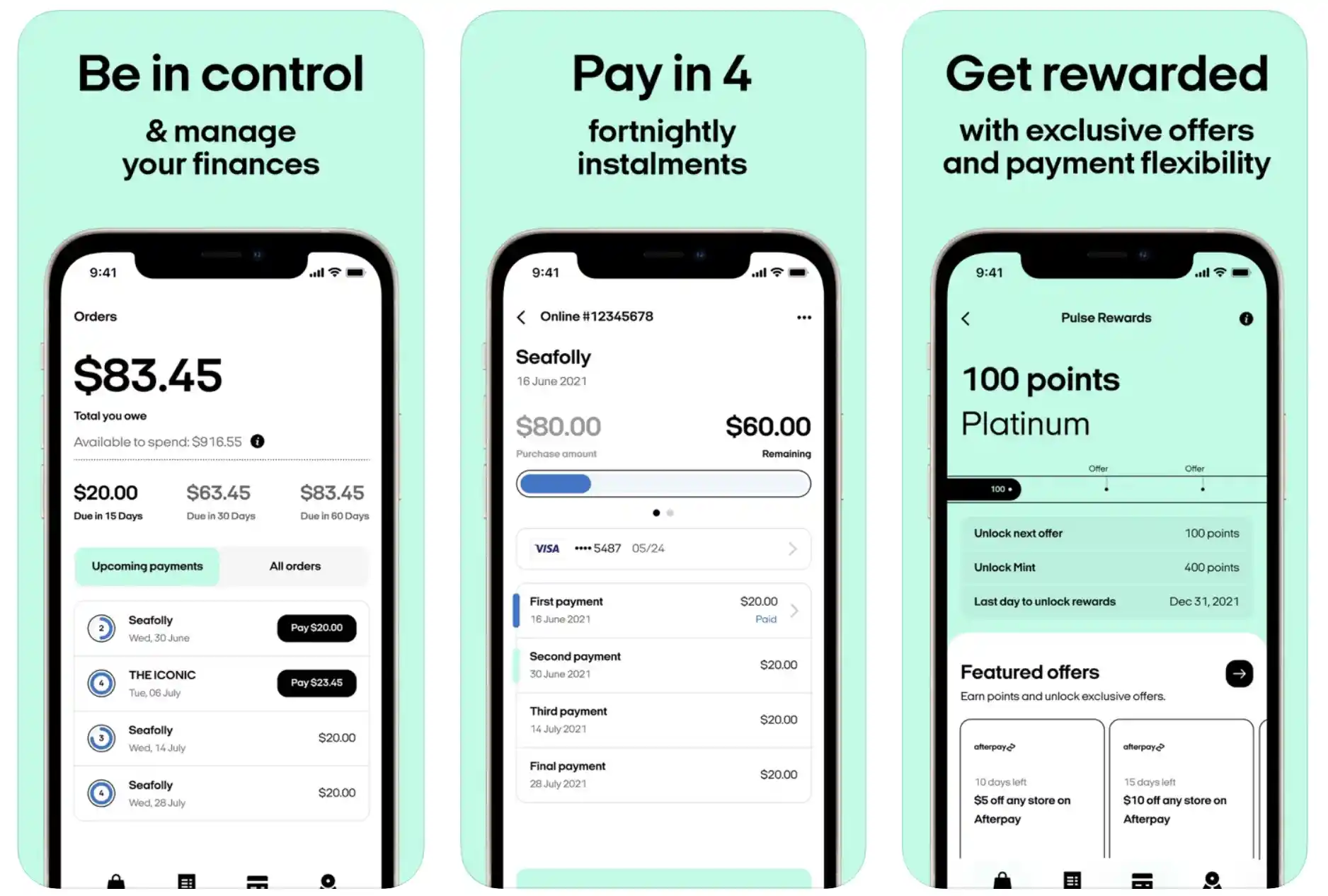

Afterpay is a service that gives shoppers more freedom to buy what they want when they want it. It offers thousands of merchants over the world who cut out the credit card processing fees.

Afterpay is an online network that allows you to pay for your goods in four installments after making a deposit.

Customer assistance on the internet is typically swift, and the AfterPay sales agent has given clear instructions on how to transfer money from your card to the merchant.

When you want to make some big-ticket buys but don’t have the cash flow to pay them off immediately, you can permanently settle for 0% EMI schemes. However, 0% of EMI schemes are limited to certain products.

Thankfully, Afterpay is here to offer interest-free EMI on multiple categories like Flat Screen T.V.s, Mobiles, Fashion Wear, and much more. This enables you a lot of flexibility regarding what you can buy and where you can get it.

Download App on Google Play Store

Download App on Apple App Store

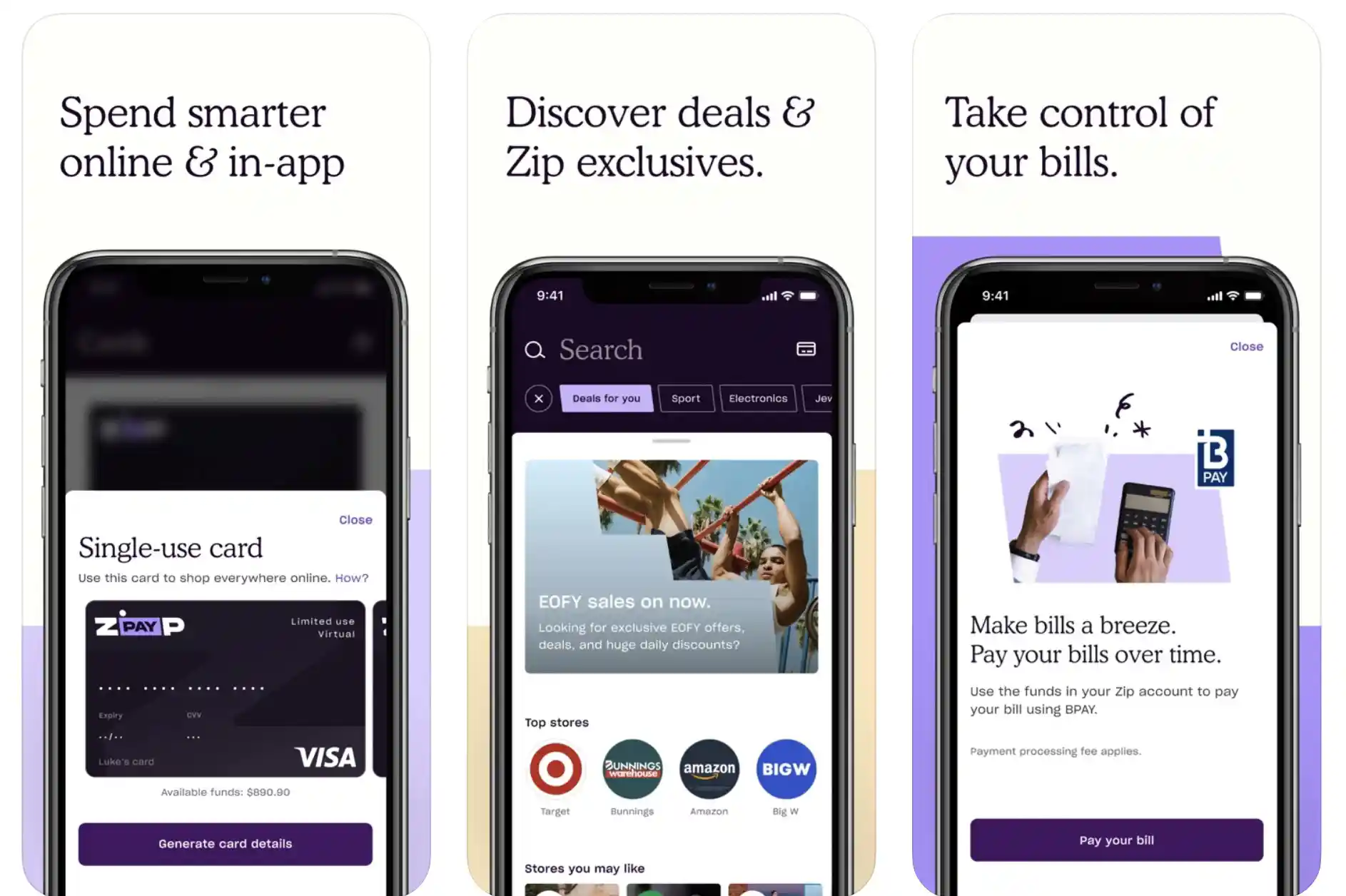

9. Zip – Shop Now, Pay Later

ZIP is an electronic wallet that allows you to pay online. The ZIP Electronic payment solution makes a quick and straightforward way to complete the purchase on a website while maintaining the highest standards of security and confidentiality. So buying from the ZIP platform will be easy and safe.

Zip payments help us make purchases on websites with an integrated payment button that is far easier than entering credit card information. Shop online, then pay later at your convenience with Ziplock payments.

Just say no to the hassle of applying for a credit card or waiting days to approve the payment. Information is kept safe & secure, and you are free to make payments any time of the day or week. It is an Australian-owned store that has been around for a long time.

Download App on Google Play Store

Download App on Apple App Store

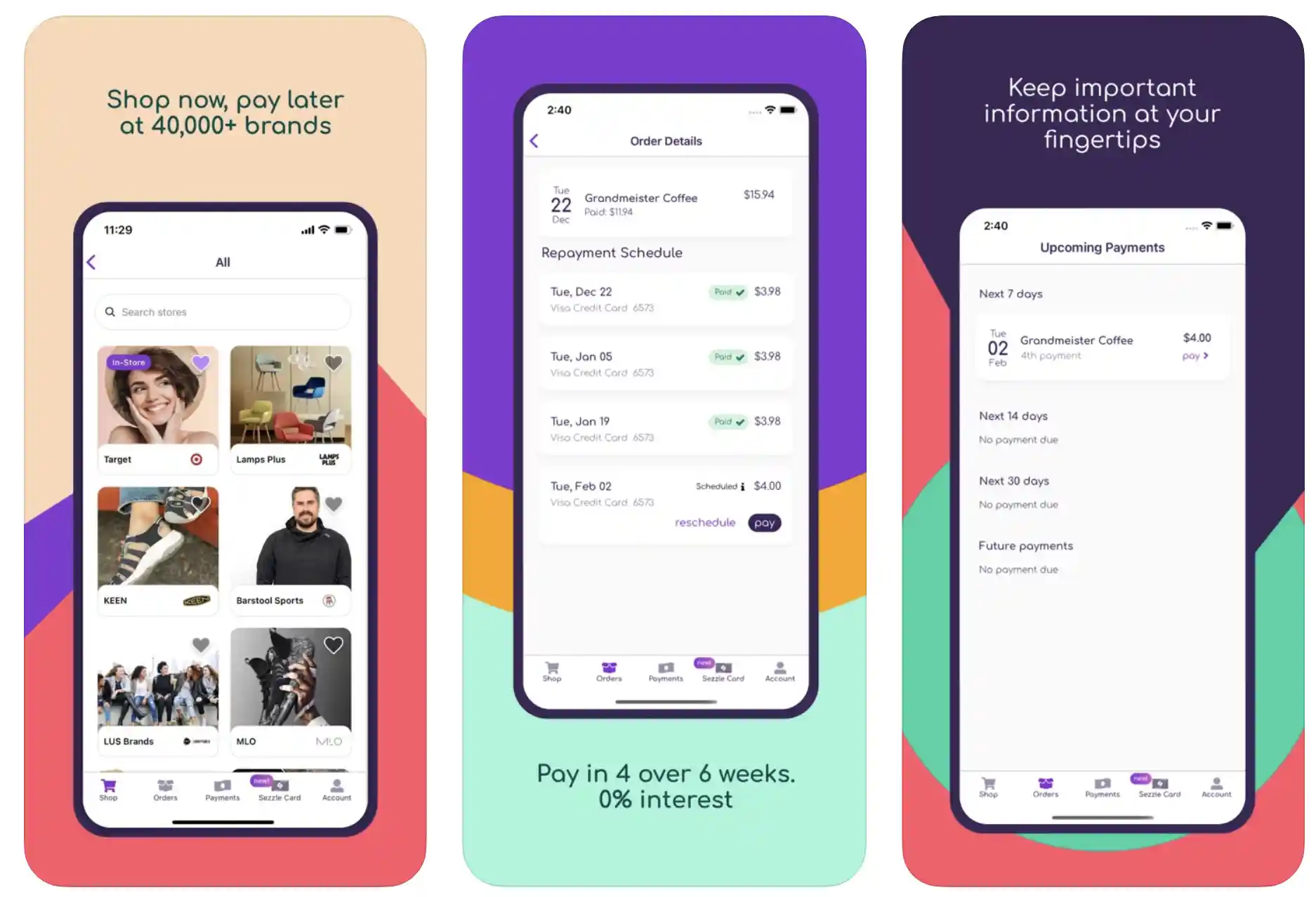

9. Sezzle

Sezzle is a payment processing service that’s been trending as an alternative to Quadpay. It is a credit option for delivering the ultimate convenience.

Sezzle allows you to spread your payments over four interest-free months while still getting all the things you love to do online.

Sezzle provides an easy way to make all your payments in one place. If you are still making purchases online, Sezzle is the perfect tool for you.

Customers may pay in installments and spread the expense of their purchases with Sezzle, making it a handy and inexpensive alternative. Their system is accountable and visible on the internet, so they guarantee responsible and timely actions.

Download App on Google Play Store

Download App on Apple App Store

10. Splitit

Splitit has become a powerful and preferred choice for promoting their products and building their online business. Splitit is the one-stop solution to split up your payments with friends on purchases and bookings over time.

Splitit gives you back control of your finances, allowing you to settle bookings and payments in smaller installments over time. Its users get a higher limit without fees and can pay back their credit using a bank account or a debit card.

Splitit is easy to use, works with most merchants, and makes booking and paying off your financial commitments online a little less stressful. It is a new innovative service that gives users the ability to select a payment plan that meets their budget needs and pay over a fixed period.

Unlike other services which charge interest, Splitit charges a transaction fee. Some payment plans are free. The site’s convenient interface makes it easier for people to explore the realm of buy-it-now-pay-in-the-future services.

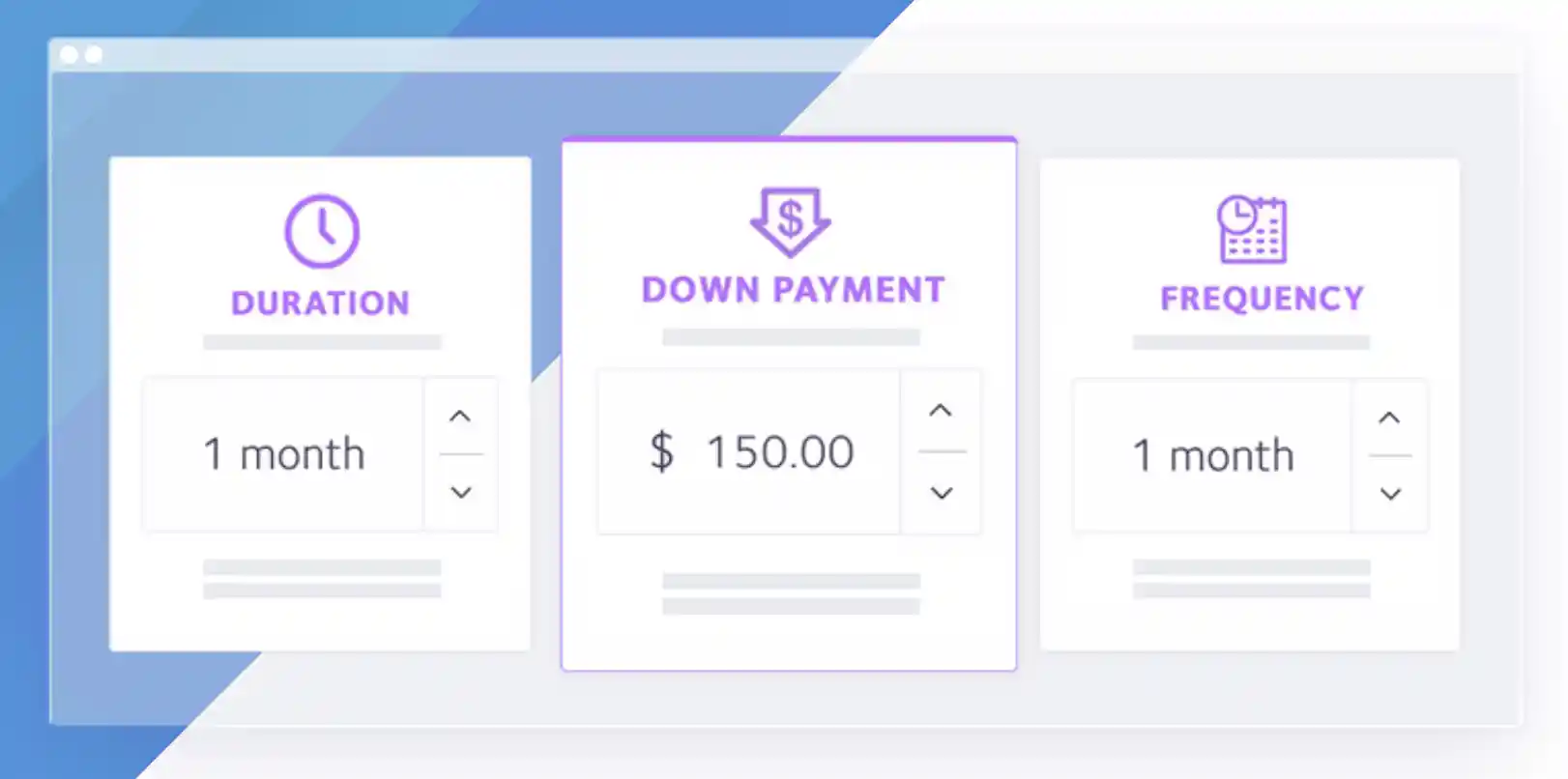

11. Partial.ly

Partial.ly is an online platform designed to provide flexible payment options for businesses and their consumers. The interface makes it easy to see the total cost of ownership, view the product you’re purchasing, and select the payment plan that fits.

Their solution is aimed at the highest possible partner conversion rate, hence making it ideal for the business to gain the opportunity to offer its clients more flexible payment plans. It was created to allow partners to receive automatic payments from their customers over a long period.

With Partial.ly, retailers can offer flexible payment plans, partial refunds, and alternative incentives to allow customers to pay them back in small chunks over time.

12. ZestMoney – Apps Like Quadpay In India

ZestMoney is a direct lending platform that offers credit to consumers who do not have any credit card or borrowing history.

Based on a ZestMoney user’s creditworthiness, installments and EMIs will be offered from a network of over 1000 participating lending partners. The installment amount and interest rate are determined in real-time based on the perceived risk of the borrower.

Signing up with ZestMoney is easy with your mobile phone number. Once ZestMoney has verified your KYC information and established a credit limit, you’ll be able to shop at your favorite brands using their app or website. Get access to the Credit Limit and buy what you want, when you want.

ZestMoney aims to provide convenient, fast, and affordable credit at your doorstep. Using Machine Learning-based Fair Credit Assessment, the company’s vision is to democratize formal credit access across India.

It aims to make India a Fair Credit country where low-income families can smoothly transition to sustainable livelihoods through fair means.

Download App on Google Play Store

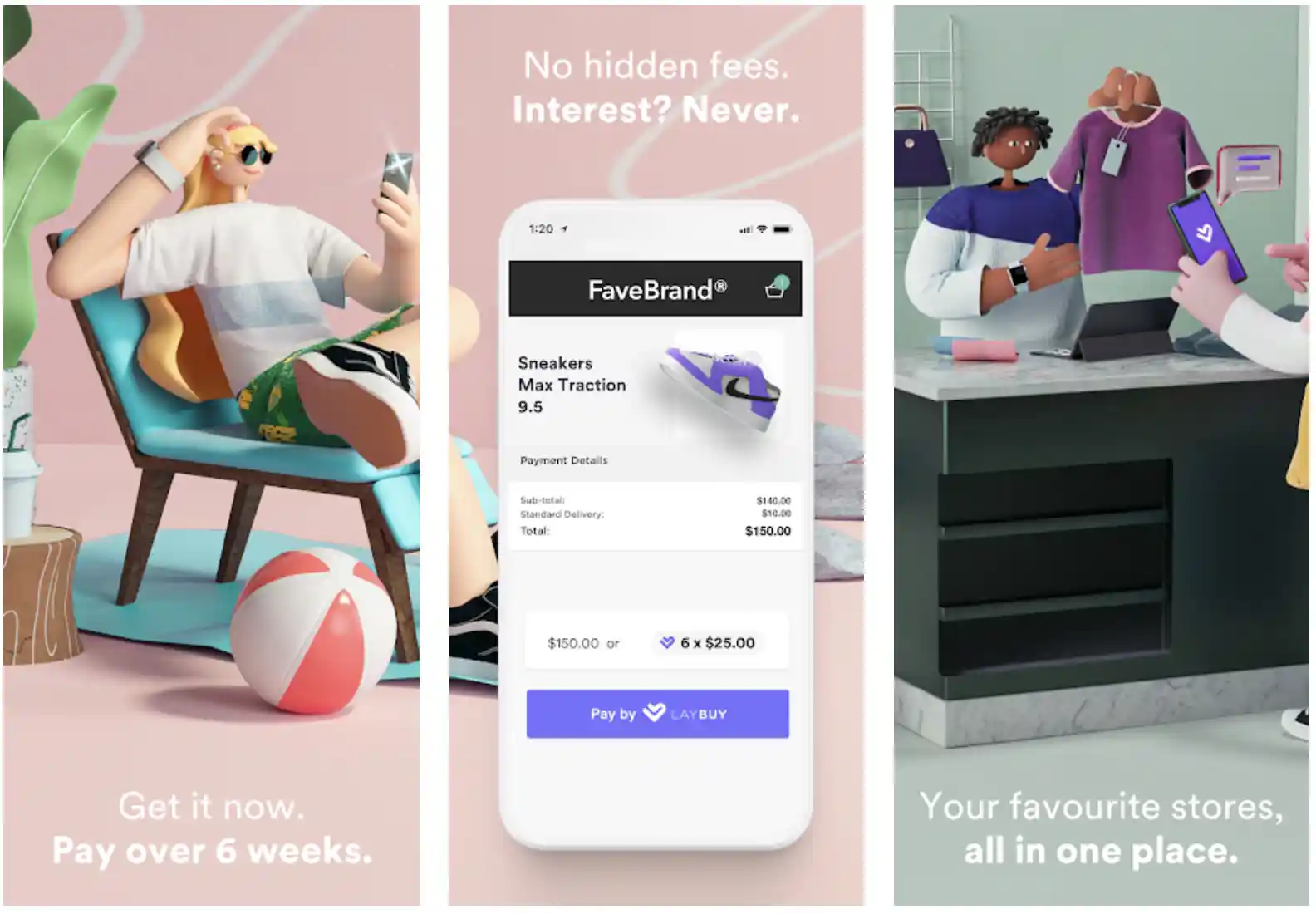

13. Laybuy

Laybuy is a convenient and straightforward way to pay for the things you need. One should buy what you want from one of our many retailers and pay in four easy installments, with no hidden fees or fine print.

Whether it’s a brand-new appliance or a teeny tiny pair of baby booties, four interest-free payments are arranged by you at a time that fits into your budget. We all deserve a little more flexibility in life. Now you have it.

When you use the Laybuy app, you’ll be able to spread payments out into more manageable chunks. You can place orders as standard, and they will request your payment after you’ve made your first purchase. If you pay on time, they’ll charge nothing extra.

However, if they don’t receive payment on time, there is a 10% default fee applied and an additional 5% charge on top of that if payment is still overdue.

Download App on Google Play Store

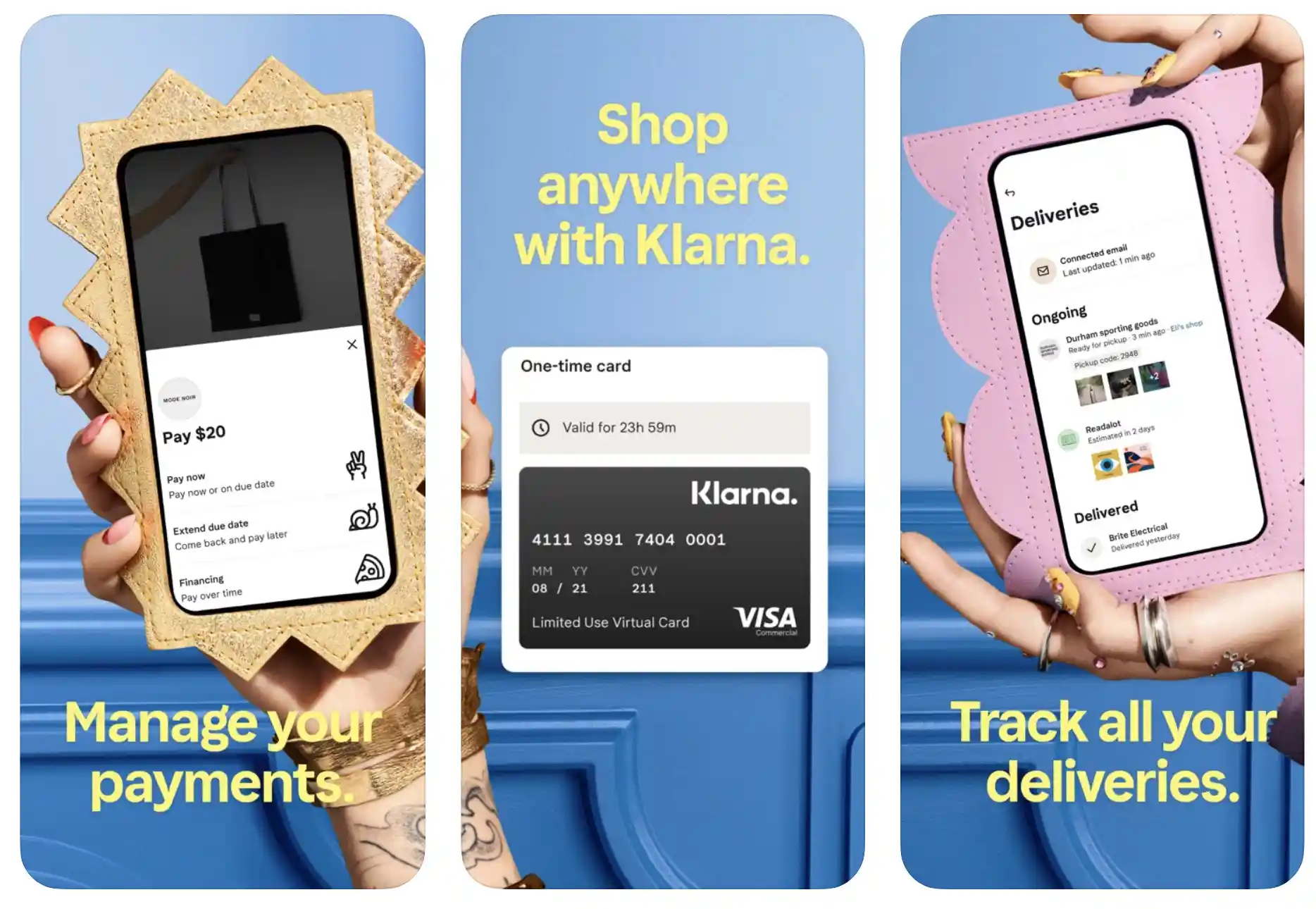

14. Klarna

Klarna is widely used as an alternative to Quadpay. It is a global payments company that provides an online payment solution. By using the Klarna payment, you can skip the hassle of entering your card details as it works as a one-click installation.

Klarna is a global payment platform trusted by 250,000 online stores. Acquirers include some of the biggest companies in the world.

They offer multiple payment methods, including credit cards, direct debits, and one-time payments that are charged whenever you feel like it. Both purchases and refunds are assigned to the account discreetly at low prices.

Klarna is a global, online risk-free installment payment service where you can purchase items on any eCommerce website worldwide.

One of Klarna’s most significant advantages is that there are no hidden interest rates, and if you pay your payments on time, your credit score will not be harmed.

Download App on Google Play Store

Download App on Apple App Store

15. Affirm

When you are planning to purchase an item, finding the best payment option for you is essential. It is an excellent alternative to QuadPay that does not charge any extra fees. It helps you pay for your purchase by breaking it down into smaller amounts over an extended period.

Affirm provides a line of credit for specialty items and services that typical banks do not approve. There is no need to put off ordering your next gadget—Affirm can help you buy them with no credit checks or hidden fees.

As an independent company, they base their operations on the belief that all money has the same value and deserves to be treated fairly. The Affirm application process takes less than 10 minutes, and you can get approved without a hard pull on your credit report!

Download App on Google Play Store

Download App on Apple App Store

16. Fingerhut

Open an account with Fingerhut to get access to all your favorite products for less. Please browse through the exclusive inventory to find the best deal, and order it online.

They offer high-quality items at affordable prices so that you can receive more value for your money. Make the most of your online purchases without worrying about large credit card payments or high-interest rates.

Place your purchase in seconds with Fingerhut. The intuitive website guides you through the shopping process, making it simple to find the right products for your lifestyle.

Shop an extensive selection of electronics like laptops and home theater equipment, accessories like watches and perfumes, and women’s clothing and toys for both adults and children.

Fingerhut has a large assortment of products to suit your individual needs. Whatever you are looking for, you are bound to find it at Fingerhut.

Those who prefer to shop with credit can apply for an account through Fingerhut that will help them purchase the product at low monthly payments or an option that will enable them to pay zero down payment upfront.

Frequently Asked Questions

1. What is Quadpay?

Quadpay is a zip company that provides the financial services you need to manage your purchases. If you’ve ever shopped online or at other participating merchants, you can pay for your goods using Quadpay.

It’s the next generation of convenient payment methods because it gives shoppers more freedom and flexibility to pay later anywhere with its buy now pay later platform.

2. What is the Process of Quadpay?

Once you’ve been accepted for QuadPay, your payment method will be automatically charged every time you purchase QuadPay.

QuadPay will email you once your initial order has been completed, verifying the current sum outstanding. This money will be debited from your specified payment method within two weeks.

3. What are the eligibility requirements for Quadpay?

To apply, you must be at least 18 years old and a U.S. citizen. There are no minimum income criteria, but you must make payments using a valid, verified cell phone number and U.S.-issued credit or debit cards.

You can use any EIN-registered company to accept payments, but we require proof of business and an account and tax I.D. to register with QuadPay.

4. Is Quadpay an interest-bearing account?

You only pay the installments on your line of credit and late fees if you default. You can even use the QuadPay Checkout feature to make payments without charging interest.

5. When Is Quadpay Due To Be Paid?

Late fees are added to your order when it’s not paid in full by the due date. At the end of each month, QuadPay charges your credit card $7 plus $7 for each week that your payment is late. After 14 days, an extra $7 fee will be charged to your account. A maximum of $14 in additional costs can be charged per order.

For example, if you bought an item for $100 on the 5th and chose a payment plan of 4 equal payments, with a free grace period, your next payment is due on the 15th. If that payment is not received, a late fee of $7 will be charged on the 21st.

6. Is There A Limit To Quadpay?

Quadpay is a digital payment network and software that allows you to spend and earn money wherever and anywhere you choose. This innovative program tracks your shopping behavior and rewards you with money from your unused balance.

Users can conduct transactions with any accessible balance; the only restriction is the amount of spending power in their account.

7. Does Quadpay Have an Impact on Credit Scores?

Ans:- In the case of instant approval offers, it does not matter whether a customer chooses QuadPay or a conventional credit card merchant processor.

The only significant impact QuadPay has on a customer’s credit rating is that it makes it easier for a business to offer instant approval offers as a selling point to their customers.

Conclusion

The world is transforming at lightning speed, and online buying is going the same way. But, paying for it still seems to be an immense pain.

There are specific platforms such as Quadpay that provide merchants and buyers with an easy and reliable payment method through multiple leading cryptocurrencies across the globe.

Today, shopping for products has become extremely easy. The platform you choose is ultimately up to you, but it’s essential to be aware of your options. Apps like Quadpay can help you save money on your purchases when finances are tight.

Every website needs to accept online payments. Accepting credit card payments has become one of the main features of eCommerce companies.

For website owners, it is virtually impossible to run a successful business without such functionality. It also provides flexibility and minimizes financial risks.

To help you easily navigate the process of finding Quadpay alternatives, above is an overview of the topmost similar services worth considering. I hope this guide enables you to choose the best apps like Quadpay for your business needs.