We keep transferring money to people residing in different countries. The reason behind this could be anything like transferring to your near ones or for business purposes.

However, the matter is many people believe in taking help from banks for such purposes as they are not aware of different online ways to transfer money throughout the world.

According to the data given by the World Bank, around $625 million were transferred back in 2017 from the US to their family or friends.

Today it has become easy to send money, and even you can buy the property or rent it. Sitting remotely, you can make payment for tuition fees, school fees, or also send gifts.

Moreover, for the transfer, you need not pay the payment and taxes of a large fee. There are different offering you the best services in transferring money internationally. These are secure to use without any terrible transaction rates.

Here given below, we mention different and the best way to transfer money internationally.

Explain Some Different Ways Of Sending Money Internationally

As in how you send money to each other locally within your country, there are different techniques of transferring cash to people sitting abroad outside the country.

With the digital era, transferring money has become easy, and here we are to discuss the different ways to transfer money to people sitting in other countries.

Cash-to-Cash Transfer

While transferring money, you need to convert your currency into the currency of the country you want to transfer money. Thus with this, you will transfer money to the service location. In the same manner, Cash-to-Cash Transfer works. People sitting abroad will receive cash as per their local currency.

Bank-to-Bank Transfer

If your bank has a branch in the country where you want to make the transfer, you can quickly transfer money from a bank and send it internationally. The only details for this you need are the account and routing numbers. Rest the bank do other processings.

Account-to-Cash Transfer

Suppose you have money in your bank; you can make a transaction through it and send money internationally overseas to someone who does not have an account. The recipient will pick the quick cash from the desired location.

The best way in such transfer the money includes the Western Union counter. However, not everyone can do it as your bank should ensure working with this option.

Debit-to-Debit Transfer

As the name suggests debit-to-debit money transfer, you can use the debit card or your credit card to transfer money overseas to the recipient’s credit or debit card. However, the option is not accessible to all of us.

Digital Wallet

In some areas, people don’t have a good form of the traditional banking system; in those countries, Digital Wallets work. However, in those countries, people use digital wallets to transfer money internationally.

The very popular digital wallet money transfer overseas includes Venmo, Samsung Pay, and M-Pesa. It is a secured method for transferring money to the people who have the same digital wallet to receive it.

Best Way To Transfer Money Internationally 👌

1. Wise (Formerly TransferWise)

Sending money abroad can trouble you because of all the rates and fees companies charge. TransferWise (Signup Here) has proved to be the best way to transfer money internationally.

Developed in Estonia, this money transfer service company allows you to transfer money from one country to another without distressing through hidden transfer fees.

Apart from it, TransferWise converts your money at a rate of mid-market exchange as compared to other transferring companies.

Explain the Working of TransferWise?

TransferWise is famous for keeping the cost of money transfer usually low. It directs the payment route uniquely, which is not costly for you to use. It can easily convert your traditional currency quickly.

TransferWise keeps a check on sending your money, but it keeps track of other users who are doing the same as you, but currency transfers in the opposite direction.

Thus TransferWise itself need not cost you much for the currency conversion. This way, if they found a match for the same, there will be no incurring expenses for you.

Benefits Of Using TransferWise:-

- Instead of using a regular street bank, you can send money abroad eight times cheaper with TransferWise without earning interest.

- Unlike other providers, TransferWise does not attach a markup to the real exchange rate and the fee. That is why; transaction costs are transparent with TransferWise.

- It allows you to make payments with a stress-free bank transfer like debit or credit card.

- Depending on the country you live in, it’s easy to make transfers from your smartphone using Apple Pay with the TransferWise iOS app.

- The plus point is that TransferWise operates rapidly, and the money transfer takes one to four days to reach the recipient’s bank account.

Can You Securely Send Money With TransferWise?

Are you transferring money online for the first time? Wondering if it is safe to send money online or not? Don’t worry; if it’s TransferWise, then you are completely secure.

The company is a licensed, certified electronic money institution, which implies that TransferWise is regulated in the UK by both the Financial Conduct Authority and Majesty’s Revenue and Customs.

Moreover, it is encrypted by 256-bit SSL along with a 2048-bit signature that shows that the website is 100% trustworthy and secure. All the client’s funds are stored individually into separate business accounts. In case, if something happens in the event, still your money will stay protected entirely.

Cons For Transferring Money Through TransferWise

- TransferWise is not instantaneous to transfer money.

- For personal transfers, the daily money transfer limit through TransferWise is $50,000. Also, for the annual money transfer, you can transfer a maximum of $250,000.

- For business transfers, you can transfer a maximum of $250,000 daily and $1 million for the year.

2. PayPal

When it comes to money transfer, Paypal (Signup Here) proves to be the best way to transfer money internationally. Its partnership with eBay offers both individuals and businesses the means to transfer payment online and access that money instantly.

Moreover, it provides a handful of valuable features to supervise and access your money effectively.

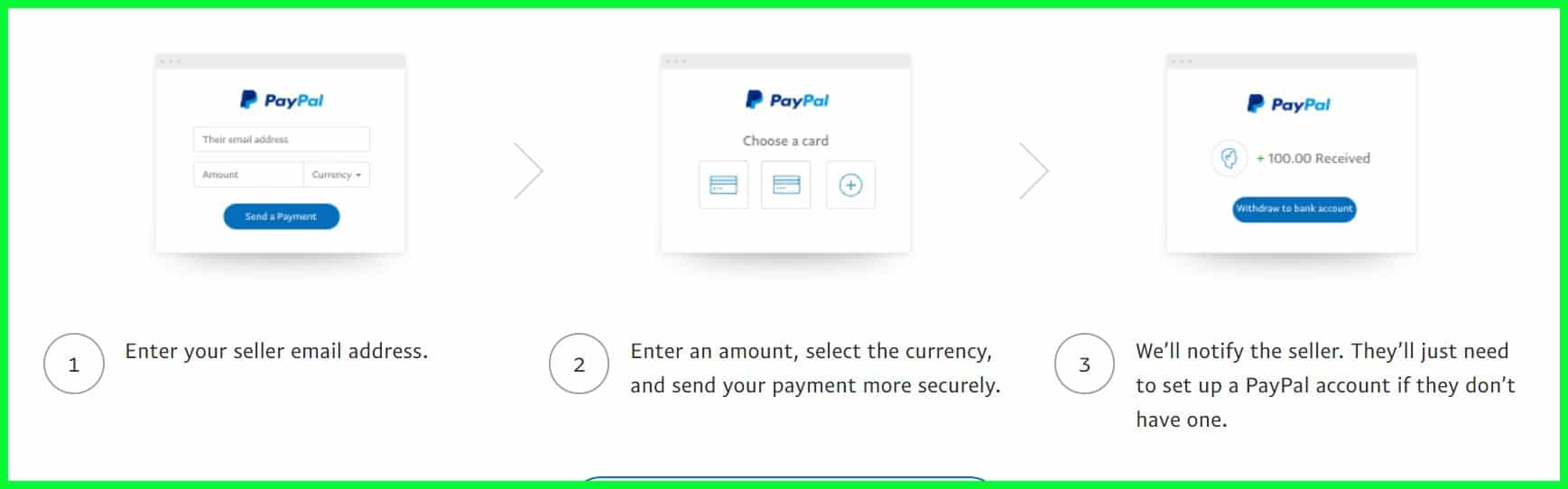

How Does Paypal Work?

- To start using Paypal, you need to first register to it on its official website.

- For registration, fill in your complete details regarding the credit card, bank account details, including account number and IFSC Code.

- Whenever you use Paypal, you get an option if you want to pay through your card or account. Also, with this, you may even set a default method for it.

- Business Paypal accounts are also there to use for making payments. Now a businessperson can use it for accepting and sending business payments.

Advantages Of Using PayPal:-

Stress-free Online Payments

Getting paid online is no more complicated if you consider PayPal. It allows customers to pay through credit cards and merchants to make money for other PayPal accounts. No matter where you are, it’s entirely hassle-free to pay or transfer money with it.

Straightforward Access To Funds

Once you receive payment through PayPal and approved access to it, transferring and using it is unproblematic. So, whether you need to send money to a local friend or across the globe, PayPal users can transfer money directly with just a click.

Security

While signing up for a PayPal account, you need to add some information about credit cards or other bank accounts that you wish to use.

Once you are done with it, you never again have to reveal your credit card information online. Thus, by transferring money with PayPal, you can keep your bank account safe and secure.

Cost-free

One of the primary reasons that many merchants and consumers use PayPal is that it is cost-free. There is no fee requirement of annual membership, not for the processing fee, and neither includes any service charges.

The businesses and individuals using it get access to all the powerful benefits of the service without paying any additional costs.

Get Paid Faster

You will receive money faster using Paypal. Once the transaction is complete with Paypal, you will get the details for it in your bank account in the least time. Thus the transfer that you make is directly from your bank account.

All such advantages of transferring money online with PayPal are enough to promote you to give it a try. If you have never created an account of PayPal, go ahead and transfer money internationally from any part of the world.

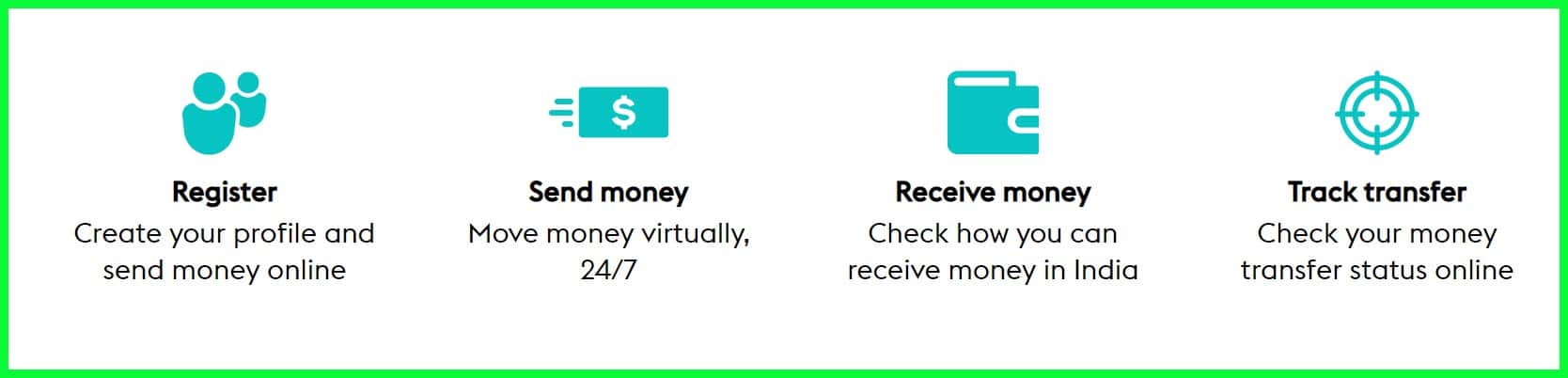

3. Payoneer

Now sending money to the outer countries has become convenient with the Payoneer option (Signup Here). It is the best way to transfer money internationally for professional use, freelancers, or business owners.

In the present time, it is quite challenging to search for a trusted method of transferring money until you have used Payoneer for it. Headquarters in New York City, around 3 million users have registered for it to date.

Over 200 countries have been using this method of transfer. The best part is you can use Payoneer in 150 different currencies very conveniently.

How Can You Use Payoneer?

- If you want to start with Payoneer money transfer, you first need to register yourself in it. You need to register with complete details.

- The details include your bank account number with mobile number, postal code, address, IFSC Code, etc. These are the necessary details you need to register with Payoneer.

- Also, you will see a column for different security questions too. You need to fill them along with a security answer.

- According to the rules, you also need to describe the type of business you want to register with Payoneer.

- After you have registered as a new user to Payoneer, your account will activate in 1-2 days after complete verification.

Now you are entirely eligible to use Payoneer and transfer money using your currency.

What Are The Benefits Of Using Payoneer?

Fast Payment Transfer:-

In your local bank, money arrives in less time, and you can withdraw as quickly you want. However, the maximum time taken for money transfer is within 1-3 working days.

Flexibility:-

You can quickly transfer money to another person sitting globally. Money can be transferred through US Automated Clearing House, International Wire Transfers, and the local Bank Transfers.

User-friendly:-

You can easily access Payoneer through its website or App. You easily use both of these methods. If you face any problem while transferring money, you have complete customer support 24/7 in multiple languages.

If you worry about hidden fees while transferring money through Payoneer, you need not worry about it. Payoneer does not charge you any hidden fees and taxes for making the transfer.

Secure And Safe Transfer:-

You need not worry about the money transfer security through Payoneer as the website and application are both SSL certified and also verified by Digicert.

Low Fees:-

Payoneer is all for transferring money internationally and connecting through the global banking network. As compared to other methods of money transfer, Payoneer is the best option with low charges in the transfer.

Payoneer is a highly recommended company to register for transferring money internationally. It has saved unwanted taxes and fees.

So, it has helped in saving your money to a great extent. The fees for transferring money through Payoneer are the least as compared to other modes. Also, the currency conversion is good and speedy.

4. OFX

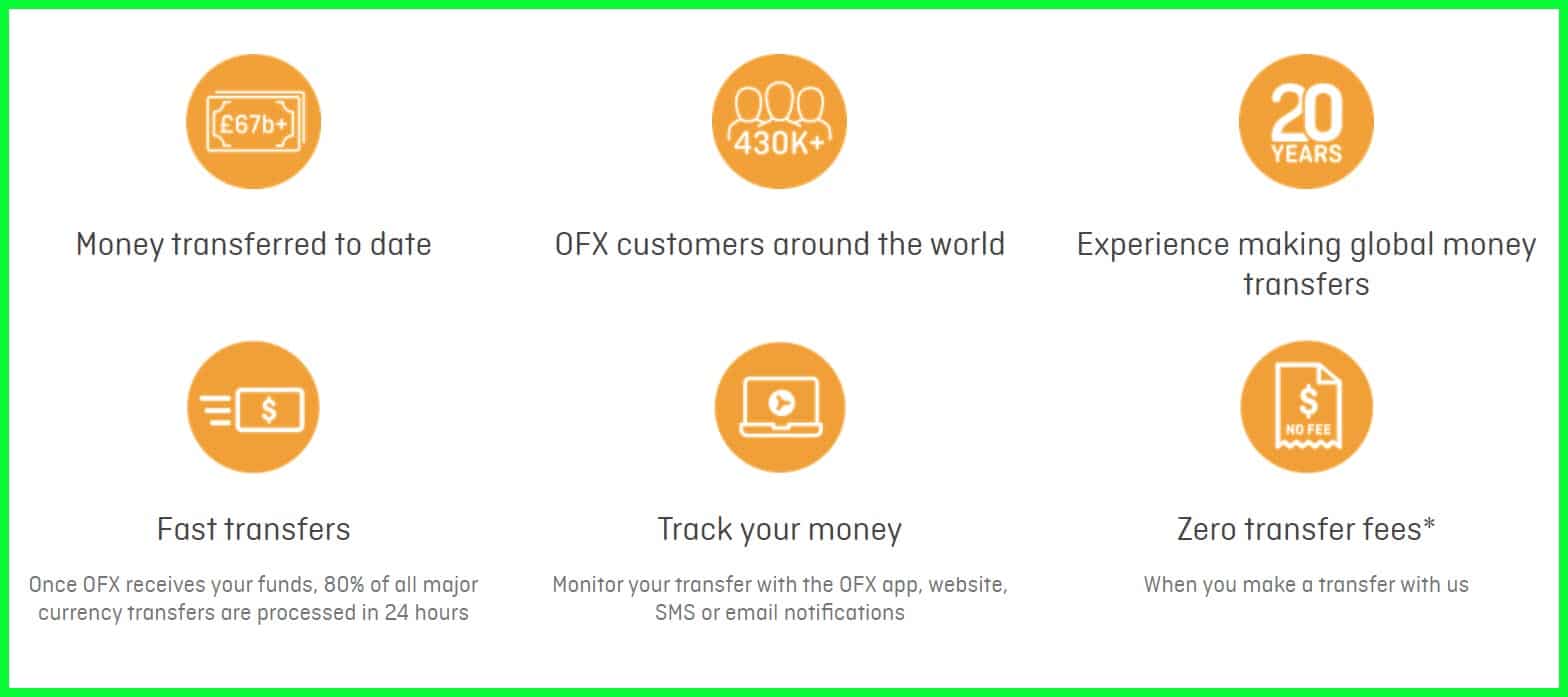

Introducing to the Australian-based company and the best way to transfer money internationally – OFX (Signup Here). With its previous version, OFX was named as OzForex. It is the smartest way to transfer money without any additional charges.

OFX is supported to work in 80 different countries. Global money transfer has never been so easy without using OFX. OFX deals with a small margin for the exchange rate as it does not charge fees so that you can transfer a considerable amount of money through this.

Learn about the usage, working, and advantages of transferring money through this platform.

How To Use OFX?

With three easy steps, you will learn to register and use OFX.

- Verify your details by registering to OFX and then log in to your account.

- Add the complete bank details and then lock in the transfer.

- Now you are all ready to send the funds with the help of BPAY or using Electronic Funds Transfer.

The funds are delivered to the recipient in the less possible time after currency conversion.

How OFX Works?

The reason why OFX is highly preferred and used is the markup rate. The markup rate for money transfer using OFX is less than any other company.

The markup rate for OFX is around 1%. On the other hand, the markup rates for the banks are nearly 7%, which is quite high.

Why Should You Use OFX?

The high ratings of OFX make it the perfect choice to transfer money internationally. The customer support with fewer markup fees for sending money to the person sitting abroad is why people prefer using OFX. This Australian setup for money transfer has different advantages as follows:

Fast and Secure Money Transfer

OFX is a highly trusted company for secure transactions and money transfers internationally. More than 160,000 customers have registered themselves with it.

Good Exchange Rates

The best reason why people prefer using OFX is its exchange rates. You can now send money overseas setting no upper and lower limits.

Best Customer Support Services

You have complete availability of customer support 24/7 with OFX.

No OFX Fees

Usually, when you transfer money internationally, there is a high fee for transfer and conversion rates. However, using OFX, you will not face this problem ever. There are zero OFX Transfer fees.

55 Currencies

Using OFX, you can transfer money with 55 different currencies. Thus OFX is supported by around 197 countries in the world. OFX supports a big range of different worldwide currencies.

Drawbacks of Using OFX:-

- For the recipient, he needs an account for receiving funds through OFX. But if he does not have an account in the bank, he cannot use this way of money transfer.

- There is a minimum transfer of the money through OFX. Suppose you want to send money internationally, the minimum transfer that you can make is $1,000.

If you want to use OFX through the application from Google PlayStore and App Store, you can download and log in to it.

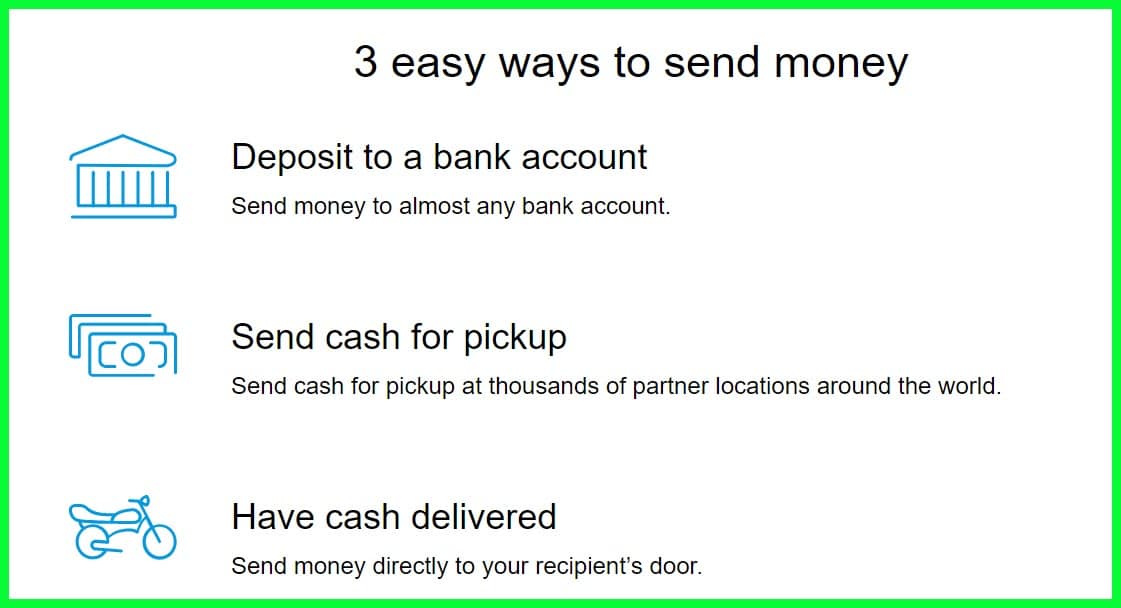

5. Western Union

Transferring money internationally is now accessible using Western union (Signup Here) for the same. You can now quickly send money to a person sitting abroad at some time. For that, you need to once go-through the official website of Western Union.

Also, many people prefer to use their apps available on Google Play Store and the App Store. In case you need to transfer over $5,000 using Western union, you can easily do it using the website.

An even more convenient way of transfer is using the cash, credit, or debit card you prefer. Learn why you should use Western Union for international money transfers and how you can transfer money internationally to the person sitting abroad.

How To Use Western Union For Transferring Money Internationally?

Learn the simple steps to use Western Union for transferring money internationally.

- Unlike other companies, you need not first fill in your bank account details for sending money to another country if you are using Western Union.

- Visit the branch of Western Union if you have the availability of cash or debit or credit card. Also, many people like to send money using their banks.

- You need to fill forms with the details for the transfer and to whom you want to transfer.

- Finally, the money will reach the recipient very conveniently.

- Your recipient will need only the ID and code for tracking the status of the money.

How does Western Union work?

If you visit the branch of Western Union, they will charge you some fees for sending money to the recipient sitting internationally. However, the costs depend upon the location of the sending and the location of the recipient.

Also, it depends upon the time limit within which you want your recipient to receive money. Sending Fees is the primary way that Western Union applies to use its services for the people.

Why is Western Union the Best Way to Transfer Money Internationally?

Western Union is unique from all other ways of international money transfer. If your recipient does not have a bank account at his location, he can also receive money through this platform.

Here are the reasons why should you prefer using Western Union is International Money Transfer:

No Hidden Fees

Usually, banks charge a considerable amount for sending money abroad. However, there are no hidden fees with Western Union during the transfer of the money.

Low Fees

The fee for sending money to your friend or family is not much, and thus Western Union is not expensive to use. Thus the Western Union proved to be the best way to transfer money internationally.

Low Exchange Rates

The fee for sending money to your friend or family is not much, and thus Western Union is not expensive to use. Thus is the prominent type for international money transfers.

Uses Cash for Transfer

The best feature of using Western Union for international money transfer is you can cash-to-cash transfer. In case you don’t have your bank account or a debit or a credit card, Western Union helps you send money in the form of direct cash.

User-Friendly

The best reason why people prefer using Western Union is the ease of transfer. You only need to deposit money at the branch of Western Union in your country, and the rest of the professionals do all the work.

6. Xoom

Supporting your family sitting abroad with money has now become easy. Now you need not wait for long hours in the lines for the money transfer.

The bank services for money transfer abroad could be good for security reasons, but what if you need to send urgent money? Xoom (Signup Here) is there to help you. In terms of fast money delivery, Xoom proved as the best way to transfer money internationally.

For the first time, Xoom worked in 2001 and was later acquired by Paypal. Learn how it works, how you can use it for money transfer, and various advantages of using Xoom for international money transfer.

How Does Xoom Work?

You can easily send money through Xoom, applying some transaction fees. The fee charges start from $4.99, which is the exchange fee.

If you want to send money using Xoom, it is only possible to debit cards, account details, or credit cards. However, you cannot use cash for sending money. However, the receiver can get it through cash or bank deposit.

How can you use Xoom?

If you want to transfer money through Xoom, follow the below steps:

- Create an account at Xoom.com with the necessary details required.

- Now select the option to make a transfer internationally, which includes the name of the recipient name and the country amount. Also, you need to mention the method for delivering the money.

- Enter the complete recipient’s information along with his full name, account number, bank name, and address.

- Now choose the method by which you want to transfer money.

- Take a review of the details, and you can now further confirm the money transfer.

Once you have logged in to your account on Xoom, you can quickly send money internationally. Use your gadgets to transfer the money.

How Xoom Proved To Be The Best Way To Transfer Money Internationally?

As we compare Xoom with Western Union, it is the best way to offer a money-back guarantee. In case your recipient is unable to reach sent money, it will come back to your account.

Thus it is a comprehensive way to reach and has a robust way of transferring money. Read about its various benefits:

Low Price

It is the best advantage of using Xoom. It costs you the least in sending money from Xoom as compared to using Western Union and MoneyGram.

No Hidden Cost

While you send money through Xoom, there is no hidden cost associated with Xoom. Thus there is a clear-cut display for the fees it will cost you.

Money Back-Guarantee

In case your transaction fails, other modes of transferring money might not refund your money back as in Western Union. However, Xoom will make the refund back to your account.

What Are The Drawbacks of Using Xoom for Money Transfer?

- Xoom is extra safe for you to use. However, then it creates an extra hassle for you.

- Also, Xoom takes a lot of time while transferring money abroad while other methods are a bit fast.

- Many People criticize Xoom for its higher fees than other modes.

- Only people sitting in the US and Canada can use Xoom. No matter 131 countries act as recipients.

7. MoneyGram

MoneyGram (Signup Here) has earned global reach to different countries, earning a good reputation. MoneyGram has proved to be the best way to transfer money internationally with fast transactions.

It has similar functioning as of Western Union. So, the people who do not have bank accounts but want to make the money orders can use this platform for sending money.

The services of MoneyGram are highly prevalent in pharmacies and the supermarket. Learn more about the working and different advantages of using MoneyGram.

How MoneyGram Works?

If you choose MoneyGram to transfer money, you may do it using cash, credit or debit cards, or a bank account. You have to give money to MoneyGram along with the additional charged fees.

Now MoneyGram will deliver money to your destination, and the recipient will have to wait for it until he receives a notification. The recipient will have to visit the local branch with the number given to you by MoneyGram. Thus MoneyGram works in the way your local bank does for you.

Why Should You Use MoneyGram?

MoneyGram is famous for its fast money delivery to the recipients of another country. Also, it helps in the in-person transfer of money. Read below to know the various benefits of MoneyGram.

Cost:-

The upfront cost for transferring money internationally through MoneyGram could be very low compared to other companies supporting international transfers.

Speed:-

If you want to transfer money on the same day, there is no other better way than MoneyGram. Now you need not spend a long time in banks asking for the transfer.

24/7 Customer Support Services:-

In case you face any problem, there is a live chat and email support option to clear your doubts from the professionals regarding the money transfer.

Cash Usage:-

The working of MoneyGram is very flexible, as you can also use your cash if you don’t have an account to make a transfer to MoneyGram.

Cons of Using MoneyGram?

- There is a need for high compliance in the transfer of money with MoneyGram. Hence it leads to losing many customers and clients.

- If you plan to send money through MoneyGram, it might be costly for you. The rate of conversion is high, along with the service to send on the same day.

- Many people also faced safety issues with no money-back guarantee.

Is There Any Extra Fee or Charges To Send Money Internationally?

Any platform you choose to send money internationally, it will cost you a bit. The fact is companies take money conversion rate charges from one currency to another.

However, the fee for sending money internationally is not much. It can be a maximum of 5-10%, depending upon the type you choose for it. This fee can be bank charges, conversion rates, or the money is processed for sending.

However, you can follow up on some strategies to minimize this money costing internationally.

Fees:-

Suppose you have planned to send money overseas, so the institution you choose to send money to could charge you a fee for the transfer. The institution must have set some fixed amount on a specific transfer or keep a certain percentage rate on it.

This transfer fee could be little as a few dollars of maximum up to $50 for a one-time transfer of the money.

However, many other companies charge you a different fee depending upon the currency you want to make the transfer. Suppose you planned to send US dollars to some other country using the same dollars, then it might not charge you much as there is no rate in currency conversion.

In case you are sending money through mobile, many banks may charge you extra than using their website. So, if you want to transfer money overseas to a different country, you might have to pay some extra charges for it.

Prepaid Debit Cards:-

Charging fees on debit cards also depend on the type of card you are using. Different Debit Cards will charge you uniquely. However, you need to make sure regarding the fee charged for money transfer using a particular debit card.

The fees could be dependent on various factors if you are using a debit card. It can be a monthly fee or annually, depending upon the card.

Exchange Rate:-

Banks and companies have earned maximum customers to themselves. The actual reason behind this is the low exchange rate. The company which will offer the least exchange rate will naturally build a good customer base.

The exchange rate here refers to the cost spent upon the conversion of currency at the moment. Forex declares the random change in exchange rates of the currency. Thus it lets us know what the current situation is and how expensive it is to purchase a particular currency.

📗 Frequently Answered Questions

(Q) How long would it take for you for transferring money long-distance internationally?

If you want to send money overseas to your family member or friend, the recipient will receive it in 2-5 days. However, it depends upon the processing speed with the currency conversion rate.

One other factor which affects the money transfer is a holiday in your bank. suppose on Sunday you initiated the transfer, your bank will reflect its processing when a working day starts.

Also, it depends upon currency cut-off time. However, the rest depends upon the platform you choose to transfer your money. Eventually, you must not forget that the process is not instantaneous to let you send money in a day.

(Q) Is the money taxable that you send internationally?

The exchange rate of the currency keeps changing with time. However, the final decision is made by Forex. It decides what the present currency conversion is for you.

However, sending money depends upon Foreign Wire Transfer, which needs not be taxable always. However, the company or any financial institution that you choose for transfer could reflect some fee for their service offered to you.

However, it depends if the money may have or not the liability on the taxes. Suppose someone sent you money as a gift, there is no tax in such a case.

(Q) How much money can you transfer internationally in one day?

Suppose you have planned to send money internationally, you must be aware of the limit to send in a day. For every financial institution or a bank, the money transfer per day limit is different. For many, it is around $5,000 in a day, while others offer $10,000 in a day.

However, regardless of the upper limit, many institutions have even set the lower limit of transfer, like if they want to send money, they will have to transfer at least $1,000 in a day. So, all it depends upon the upper and lower limits of the transfer.

(Q) What way will be the best to choose and transfer money overseas?

There are different ways of money transfer internationally. However, the best ways that cost you least are TransferWise, Paypal, and Payoneer. The reason behind this is a fast and reliable transfer of money.

You can safely process your transactions to the person online overseas within 1-2 days. Thus money transferring online is no more a headache and no more a chance of theft.

All three are trusted platforms for transferring. Gone are the days when you had to spend full days in line for approval in the transfer. The digital platform has made it easy for you to conveniently send money from anywhere to any part of the world.

(Q) Is it better to use TransferWise instead of Paypal?

In the overall result of transferring money, we search for the best and the cheapest way to make a transaction. In case you think of TransferWise, it is a cheaper way than using Paypal.

It does not transfer money without seeing if any exchange is possible so that it does not cost you for conversion rate. Thus the overall fee for the transfer is less in TransferWise rather than Paypal.

It is the simplest and easiest way of sending money. Moreover, Paypal needs time for verification. Thus it can take two days, a week, or more to verify your account details, and only then do you send money.

Final Words

Now in the present digital era, you have developed a lot with time. Now gone are the days when you have to stand in your bank lines to send money to the people sitting abroad.

There are great choices available online for you. In the above article, we have presented the different ways of sending money internationally. All of them have different processing of the transfer.

However, you need to choose the one depending upon your preferences and look into many factors before transferring money. You can read about the exchange rates and the fee that a particular company applies to you.

However, no matter which option you choose, you must be sure about the person you are sending money to. The fact is you need to feel secure for your payment to the right person.

Before you confirm your transaction, it is important to check the entire details and then proceed ahead. It is the best way to transfer money internationally by avoiding scams.

While you choose the best platform for transferring your money, don’t forget to look upon the time a particular company will take to transfer your money in minimal time. It is to make sure your recipient gets money on time or before the deadline.

Never you should forget regarding the transfer rate. Consider the rate a company imposes on you to send the money.