Contract employees often face a unique set of challenges when it comes to managing their expenses.

Traditional expense management methods can be time-consuming, confusing, and prone to errors. This can lead to delayed reimbursements, inaccurate financial reporting, and potential tax issues.

Imagine having to sift through a mountain of receipts at the end of each month, trying to remember the details of each transaction.

Or worse, losing a receipt and being unable to claim a legitimate business expense. These issues can cause unnecessary stress and take time away from your core work.

This is where an expense card for contract employees comes into play. An expense card can streamline the expense management process, making it easier, faster, and more accurate.

It allows contract employees to track their expenses in real time, eliminating the need for manual data entry and receipt collection.

Plus, it provides a clear, auditable record of expenses, which can be invaluable during tax season.

In this article, we’ll delve deeper into the benefits of using an expense card for contract employees and how it can revolutionize how you manage your business expenses.

Understanding Contract Employees’ Expense Management Challenges

Managing expenses can be a daunting task for contract employees. Unlike traditional full-time employees, contract workers face unique challenges when handling their expenses effectively.

These challenges stem from the nature of their work arrangements and the absence of comprehensive employee benefits packages.

This article will delve into the intricacies of contract employees’ expense management challenges and explore potential solutions.

One of the primary hurdles contract workers face is the lack of a standardized expense management system their employers provide.

Without access to a centralized platform or support from an in-house finance team, contract employees must navigate a complex landscape of tracking, reporting, and reimbursing their expenses independently.

This decentralized approach can lead to inefficiencies, errors, and delays in expense reimbursement.

Another key challenge is the need for meticulous record-keeping. Contract workers must maintain detailed records of their expenses, ensuring they have all the necessary documentation for compliance purposes.

This can be particularly burdensome as expenses vary widely across projects, clients, and locations.

Moreover, contract employees often face delayed reimbursements, adding to their financial strain.

Unlike their full-time counterparts, who typically receive regular paychecks, contract workers rely on timely reimbursement to cover expenses. Delays in the reimbursement process can disrupt their cash flow, leading to potential financial hardships.

To overcome these challenges, contract employees can adopt various strategies. Utilizing technology such as expense tracking applications can simplify and automate the expense management process.

Maintaining clear communication channels with clients or employers regarding expense policies and reimbursement timelines can help mitigate delays and ensure smoother operations.

In conclusion, contract employees’ expense management challenges require a proactive and disciplined approach.

By addressing these challenges head-on and implementing effective strategies, contract workers can streamline their expense management processes and improve their overall financial well-being.

What is an Expense Card?🤷♂️

An Expense Card, often called a business or corporate card, is a specialized financial instrument designed to streamline the process of managing and tracking business-related expenditures.

Unlike traditional credit or debit cards, an Expense Card is specifically tailored to meet the unique needs of businesses, particularly those with many employees or contract workers.

The primary function of an Expense Card is to facilitate the seamless recording and reconciliation of business expenses.

It eliminates the need for employees to pay out-of-pocket for business-related costs, subsequently submitting receipts for reimbursement. Instead, expenses are directly charged to the Expense Card, which is typically linked to a company account.

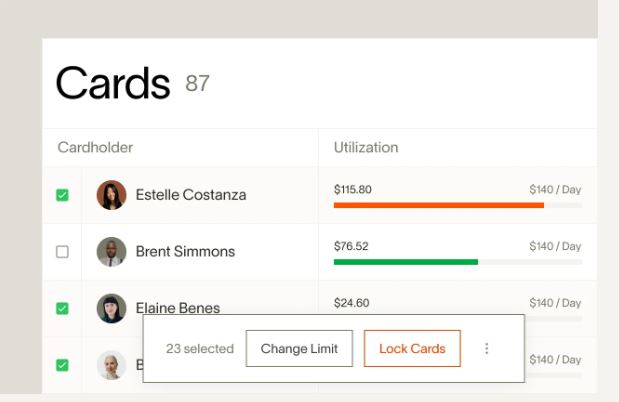

Moreover, an Expense Card often comes equipped with advanced features such as real-time expense tracking, spending limit controls, and integration with accounting software.

These features enhance financial transparency and significantly reduce the administrative burden associated with expense management.

An Expense Card is a powerful tool that can transform how businesses handle expense management, offering a more efficient, accurate, and hassle-free solution.

It is an indispensable asset in modern business, where agility and efficiency are paramount.

Benefits of an Expense Card for Contract Employees

In expense management for contract employees, having an expense card can offer many advantages.

These specialized cards are designed to address contract workers’ unique needs and challenges, providing them with a convenient and efficient solution for managing their expenses.

This article will explore the significant benefits of an expense card for contract employees.

First and foremost, an expense card simplifies the process of tracking and recording expenses.

Contract employees can easily separate their personal and work-related expenses with a dedicated card specifically designated for business-related transactions.

This segregation eliminates the arduous task of sifting through numerous receipts and bank statements, resulting in streamlined expense management.

Furthermore, an expense card provides a centralized platform for expense management.

Contract workers can consolidate all their business expenses onto a single card, eliminating the need for multiple reimbursement requests or the hassle of managing various payment methods.

This centralized approach enhances transparency and efficiency and reduces the administrative burden associated with expense reporting.

Another significant benefit is the real-time visibility of expenses. Contract employees can instantly view and monitor their spending activities by using an expense card linked to an online portal or mobile application.

This visibility enables them to stay within budgetary limits and make informed decisions regarding their expenditure, promoting fiscal responsibility.

Moreover, expense cards often come with additional features such as expense categorization, automated reporting, and integration with accounting software.

These value-added functionalities simplify the expense management process, saving time and effort for contract employees.

In conclusion, an expense card offers a range of benefits for contract employees, from simplified expense tracking to enhanced visibility and efficiency.

By leveraging the advantages of an expense card, contract workers can optimize their expense management practices and focus more on their core tasks, ultimately improving their productivity and financial well-being.

Top Providers For Expense Card For Contract Employees

1. Wallester

When it comes to choosing an expense card provider for contract employees, one name that stands out is Wallester.

Renowned for its exceptional services and innovative features, Wallester has emerged as a top choice for contract workers seeking a reliable and efficient solution for managing their expenses.

This article will explore why Wallester is considered a top expense card provider for contract employees.

One of the key advantages of Wallester is its user-friendly interface. The platform is designed with simplicity and intuitiveness, ensuring that even non-technical users can navigate the system effortlessly.

This ease of use allows contract employees to quickly adapt to the expense management process, saving time and reducing frustration.

Moreover, Wallester offers robust expense tracking and reporting capabilities. The platform provides comprehensive tools for capturing and categorizing expenses, making it easier for contract workers to monitor their spending habits.

Wallester’s advanced reporting features enable users to generate detailed expense reports with just a few clicks, ensuring accuracy and compliance with accounting standards.

Furthermore, Wallester’s expense card integrates seamlessly with popular accounting software, streamlining the reconciliation process.

This integration eliminates the need for manual data entry and reduces the chances of errors, improving efficiency and accuracy in expense management.

Additionally, Wallester prioritizes security and data privacy. The platform employs advanced encryption techniques to safeguard sensitive financial information, giving contract employees peace of mind when using their expense cards for transactions.

In conclusion, Wallester has established itself as a top-tier expense card provider for contract employees.

With its user-friendly interface, robust tracking and reporting capabilities, seamless integration with accounting software, and commitment to security, Wallester offers a comprehensive solution that empowers contract workers to manage their expenses effectively and efficiently.

Features:-

User-friendly interface: Wallester offers an intuitive platform that is easy to navigate, ensuring a seamless user experience.

Expense tracking and categorization: Contract employees can effortlessly capture and categorize their expenses, enabling efficient monitoring of spending habits.

Advanced reporting capabilities: Wallester provides robust reporting tools that generate detailed expense reports with just a few clicks, ensuring accuracy and compliance.

Integration with accounting software: The expense card seamlessly integrates with popular accounting software, simplifying the reconciliation process and eliminating manual data entry.

Enhanced security measures: Wallester prioritizes the security and privacy of users’ financial information, employing advanced encryption techniques to safeguard sensitive data.

Real-time expense visibility: Contract employees can access real-time updates on their spending activities, promoting better budget management and informed decision-making.

Convenient expense reimbursement: Wallester streamlines the reimbursement process, ensuring timely and hassle-free reimbursements for contract employees.

Customer support: The Wallester team provides dedicated customer support to promptly address any queries or issues, ensuring a smooth user experience.

Mobile accessibility: The Wallester platform is accessible through mobile devices, allowing contract employees to manage their expenses on the go.

With these notable features, Wallester stands out as a top choice for contract employees seeking a comprehensive and efficient expense management solution.

Pros:-

User-friendly interface: Wallester offers an intuitive and user-friendly platform, making it easy for contract employees to navigate and manage their expenses.

Robust expense tracking and reporting: Wallester provides comprehensive tools for capturing, categorizing, and generating detailed expense reports, ensuring accuracy and compliance.

Seamless integration with accounting software: The expense card integrates smoothly with popular accounting software, simplifying the reconciliation process and reducing manual data entry.

Enhanced security measures: Wallester prioritizes the security and privacy of users’ financial information, employing advanced encryption techniques for data protection.

Real-time expense visibility: Contract employees can access real-time updates on their spending activities, allowing for better budget management and informed decision-making.

Efficient expense reimbursement: Wallester streamlines the reimbursement process, ensuring timely and hassle-free reimbursements for contract employees.

Dedicated customer support: Wallester offers dedicated customer support to promptly address any queries or issues, providing assistance when needed.

Mobile accessibility: The Wallester platform is accessible through mobile devices, allowing contract employees to conveniently manage their expenses.

Cons:

Limited acceptance: As with any expense card, the acceptance of Wallester may vary depending on merchants and locations, which could potentially restrict its use in certain instances.

Cost considerations: Depending on the pricing structure, there may be associated fees or costs for using Wallester’s expense card service, which should be considered.

Overall, the pros of using Wallester, such as its user-friendly interface, robust tracking capabilities, seamless integration with accounting software, enhanced security measures, and dedicated customer support, make it a strong choice for contract employees.

However, it’s important to consider any limitations regarding acceptance and potential costs associated with the service.

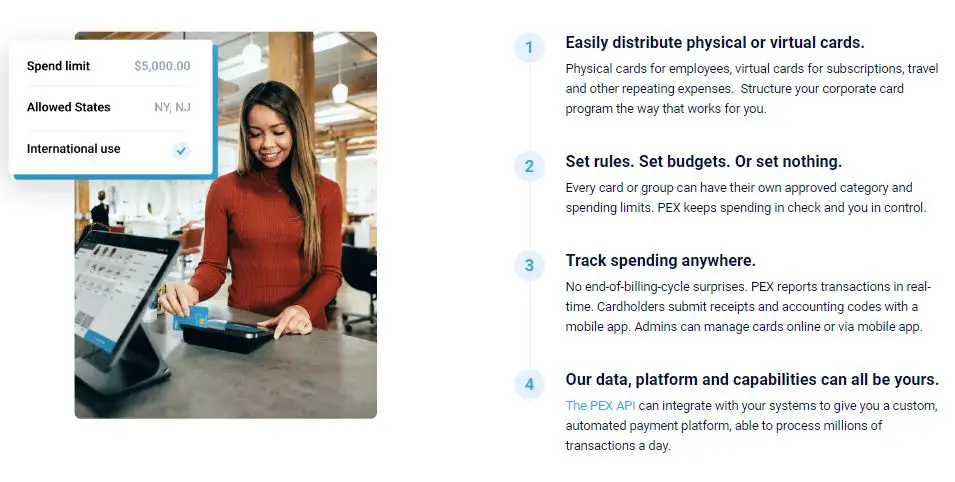

2. PEX

In the realm of expense management for contract employees, PEX emerges as a powerful solution that streamlines the process and empowers workers to take control of their financial transactions.

With its innovative features and user-friendly interface, PEX offers a comprehensive platform designed specifically for the unique needs of contract employees.

Let’s delve into the intricacies of PEX and explore how it simplifies expense management.

At its core, PEX is an expense management system that provides contract employees with a prepaid card.

This card is a dedicated financial tool, allows workers to make business-related purchases and efficiently manage their expenses.

The beauty of PEX lies in its simplicity and convenience, enabling contract employees to separate their personal and business expenses seamlessly.

One of the standout features of PEX is its real-time expense tracking capabilities.

Through the PEX platform, contract employees can monitor their spending activities in real-time, gaining valuable insights into their financial habits and ensuring better control over their budgets. This visibility empowers workers to make informed decisions and avoid overspending.

Additionally, PEX offers robust expense categorization and reporting functionalities. Contract employees can easily categorize expenses, facilitating accurate and organized expense management.

Furthermore, the platform’s reporting tools generate detailed reports, simplifying the reimbursement process and providing clear documentation for accounting purposes.

Furthermore, PEX prioritizes security. The platform utilizes cutting-edge encryption and authentication measures to protect sensitive financial data, giving contract employees peace of mind when making transactions.

In conclusion, PEX serves as a game-changer in expense management for contract employees.

With its prepaid card, real-time tracking capabilities, expense categorization, reporting features, and robust security measures, PEX simplifies the complexities of managing expenses, empowering contract employees to navigate their financial obligations easily.

Features:-

Prepaid card: PEX provides contract employees with a dedicated prepaid card for business-related transactions.

Real-time expense tracking: Contract employees can monitor their spending activities in real-time, gaining valuable insights into their financial habits.

Expense categorization: PEX allows for easy categorization of expenses, ensuring organized and accurate expense management.

Detailed reporting: The platform generates detailed expense reports, simplifying the reimbursement process and providing clear documentation for accounting purposes.

Separation of personal and business expenses: With PEX, contract employees can easily separate personal and business expenses, promoting better financial organization.

Enhanced budget control: Real-time tracking and categorization features empower contract employees to exercise better control over their budgets.

Security measures: PEX prioritizes the security of sensitive financial data, utilizing advanced encryption and authentication measures to protect users’ information.

Convenient expense management: PEX simplifies the complexities of managing expenses, offering a user-friendly interface and streamlined processes.

Financial insights: The platform provides contract employees valuable financial insights, enabling informed decision-making and better financial planning.

These features make PEX an excellent choice for contract employees seeking a comprehensive and efficient expense management solution.

Pros:-

Simplified expense management: PEX streamlines the process of managing expenses, offering a dedicated prepaid card and user-friendly platform.

Real-time tracking: Contract employees can track their spending activities in real-time, gaining better visibility and control over their financial transactions.

Expense categorization: PEX allows for easy categorization of expenses, promoting accurate record-keeping and streamlined reporting.

Detailed reporting: The platform generates detailed expense reports, simplifying the reimbursement process and providing clear documentation for accounting purposes.

Separation of personal and business expenses: PEX enables contract employees to separate personal and business expenses, ensuring financial clarity and organization.

Enhanced budget control: With real-time tracking and categorization features, PEX empowers contract employees to exercise better control over their budgets.

Security measures: PEX prioritizes the security of users’ financial information, utilizing advanced encryption and authentication measures to protect sensitive data.

Convenience: PEX offers a convenient and efficient way to manage expenses, saving time and effort for contract employees.

Financial insights: Contract employees gain valuable financial insights through the platform, facilitating informed decision-making and better financial planning.

Cons:-

Limited acceptance: Like any expense management solution, the acceptance of PEX may vary among merchants and locations, potentially limiting its usability in certain instances.

Card fees: Depending on the pricing structure, there may be associated fees for using the PEX prepaid card, which should be considered.

The pros of using PEX, such as simplified expense management, real-time tracking, expense categorization, detailed reporting, and enhanced budget control, make it a valuable tool for contract employees.

However, it’s important to be mindful of any limitations regarding acceptance and potential card fees associated with the service.

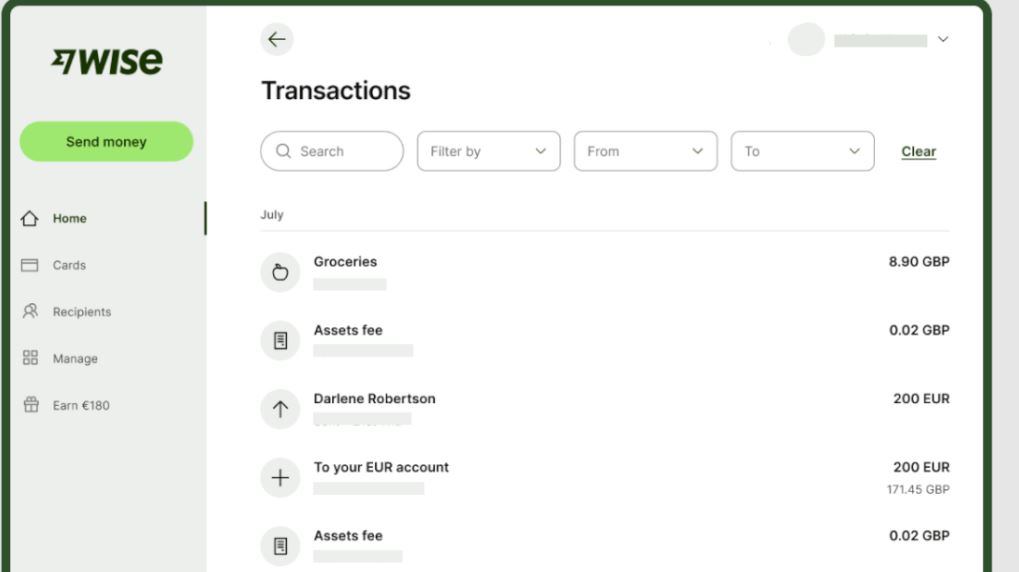

3. Wise

Regarding efficient employee expense management, Wise employee expense cards emerge as a powerful tool that empowers individuals to take control of their financial transactions.

With its innovative features and user-friendly interface, Wise offers a comprehensive solution to simplify and streamline the expense management process.

Let’s explore how Wise employee expense cards contribute to financial control and efficiency.

One of the key advantages of Wise is its ease of use. The platform provides employees personalized expense cards that can be easily managed through a user-friendly interface.

This simplicity allows employees to track and monitor their spending activities effortlessly, promoting better financial control and budget management.

Moreover, Wise employee expense cards offer enhanced security features. With advanced encryption protocols and secure transactions, employees can have peace of mind knowing their financial information is well-protected.

Furthermore, Wise cards provide flexibility and convenience. Employees can purchase and pay globally using Wise’s low foreign exchange rates and transparent fee structure. This allows for seamless international transactions without incurring unnecessary costs.

Another standout feature of Wise is its integration with expense management software and accounting systems.

This integration enables smooth and automated expense reporting, saving time and effort for employees and finance departments.

In conclusion, Wise employee expenses cards provide employees with a powerful tool for financial control and efficiency.

With user-friendly interfaces, enhanced security measures, global accessibility, and seamless integration, Wise empowers employees to manage their expenses with ease and accuracy.

By leveraging Wise employee expense cards, organizations can enhance their expense management processes and promote a culture of financial responsibility.

Features:-

Personalized expense cards: Wise provides employees with personalized expense cards for easy management of their expenses.

User-friendly interface: The platform offers a user-friendly interface that simplifies the expense tracking and management process.

Enhanced security: Wise employee expenses cards employ advanced encryption protocols and secure transactions to ensure the safety of employees’ financial information.

Global accessibility: Employees can make purchases and payments globally, taking advantage of Wise’s low foreign exchange rates and transparent fee structure.

Integration with expense management software: Wise seamlessly integrates with expense management software and accounting systems, automating the expense reporting process.

Real-time spending monitoring: Employees can track and monitor their spending activities in real-time, promoting better financial control and budget management.

Low-cost international transactions: Wise’s expense cards offer low foreign exchange rates, enabling employees to make international transactions without incurring excessive costs.

Automated expense reporting: Integration with expense management software allows for automated expense reporting, saving time and effort for employees and finance departments.

Efficient reimbursement: Wise streamlines the reimbursement process, making it easier and faster for employees to receive their expense reimbursements.

These features make Wise employee expense cards a valuable tool for promoting financial control, simplifying expense management, and enhancing organizations’ overall efficiency.

Pros:-

Simplified expense management: Wise employee expense cards provide a user-friendly interface that simplifies managing and tracking expenses.

Enhanced financial control: Real-time spending monitoring empowers employees to exercise better financial control and budget management.

Global accessibility: Wise offers low-cost international transactions with favorable foreign exchange rates, making it convenient for employees working across borders.

Secure transactions: Wise prioritizes the security of employees’ financial information through advanced encryption protocols, ensuring their data is protected.

Integration with expense management software: The seamless integration with expense management software automates expense reporting, saving time and effort for both employees and finance departments.

Efficient reimbursement: Wise streamlines the reimbursement process, enabling employees to receive their expense reimbursements quickly and conveniently.

Cons:-

Limited acceptance: Wise employee expenses cards may have limited acceptance in certain locations or with certain merchants, which could restrict usability.

Additional fees: Depending on the pricing structure, there may be associated fees for certain transactions or card usage, which should be considered.

Overall, the pros of using Wise employee expense cards, such as simplified expense management, enhanced financial control, global accessibility, secure transactions, integration with expense management software, and efficient reimbursement, make it a valuable tool for employees and organizations.

However, it’s important to be aware of any limitations regarding acceptance and potential fees associated with the service.

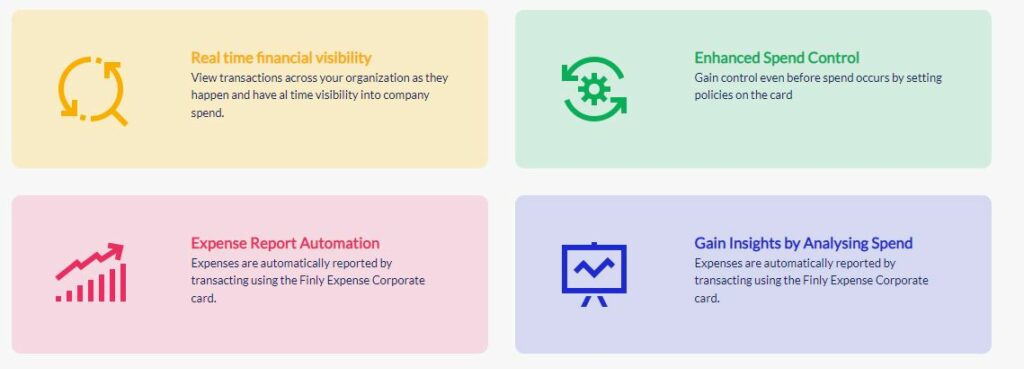

4. Finly

When it comes to efficient expense management, Finly emerges as a leading solution that empowers businesses to streamline their financial processes.

With its intelligent features and user-friendly interface, Finly offers a comprehensive platform to simplify expense tracking, reporting, and reimbursement.

Let’s explore how Finly is revolutionizing the way businesses manage their expenses.

At the heart of Finly lies its intelligent expense management system. The platform leverages advanced algorithms and automation to analyze and categorize expenses, eliminating the need for manual data entry.

This intelligent feature saves businesses time and reduces the risk of errors, enhancing overall efficiency.

One of the standout features of Finly is its powerful analytics dashboard. The platform provides businesses with insightful data and visualizations, enabling them to gain valuable insights into spending patterns, identify cost-saving opportunities, and make data-driven decisions.

Moreover, Finly offers seamless integration with accounting software and enterprise resource planning (ERP) systems.

This integration enables businesses to sync their expense data effortlessly, ensuring accurate and up-to-date financial records.

Furthermore, Finly provides robust policy enforcement and approval workflows. Businesses can define expense policies and customize approval hierarchies, ensuring compliance and reducing unauthorized spending.

Additionally, Finly prioritizes security and data privacy. The platform employs advanced encryption techniques to safeguard sensitive financial information, ensuring peace of mind for businesses.

In conclusion, Finly revolutionizes expense management for businesses through its intelligent solutions.

With intelligent expense categorization, powerful analytics, seamless integration, policy enforcement, and robust security measures, Finly empowers businesses to simplify their financial processes, optimize spending, and enhance overall efficiency.

Features:-

Intelligent expense management: Finly utilizes advanced algorithms and automation to analyze and categorize expenses, eliminating manual data entry.

Analytics dashboard: The platform provides businesses with powerful data analytics and visualizations to gain insights into spending patterns and make data-driven decisions.

Integration with accounting software and ERP systems: Finly seamlessly integrates with existing accounting software and ERP systems, ensuring accurate and up-to-date financial records.

Policy enforcement and approval workflows: Finly allows businesses to define expense policies and customize approval hierarchies, ensuring compliance and reducing unauthorized spending.

Enhanced security measures: Finly prioritizes the security of sensitive financial information, employing advanced encryption techniques to safeguard data.

Mobile accessibility: The platform is accessible via mobile devices, allowing users to manage expenses on-the-go.

Automated expense reporting: Finly automates the expense reporting process, saving time and effort for businesses and employees.

Receipt capture and management: The platform offers tools to capture and manage receipts digitally, reducing paperwork and ensuring organized records.

Multi-currency and multi-language support: Finly supports transactions in multiple currencies and languages, facilitating global business operations.

These features make Finly a comprehensive expense management solution that simplifies financial processes, enhances analytics capabilities, ensures policy compliance, and provides robust security for businesses.

Pros:-

Intelligent automation: Finly utilizes advanced algorithms and automation to streamline expense management processes, saving time and reducing manual effort.

Powerful analytics: The platform provides businesses with insightful data analytics and visualizations, enabling informed decision-making and cost optimization.

Seamless integration: Finly seamlessly integrates with accounting software and ERP systems, ensuring accurate and up-to-date financial records.

Policy enforcement: The platform allows businesses to define and enforce expense policies, ensuring compliance and reducing unauthorized spending.

Enhanced security: Finly prioritizes the security of sensitive financial information, employing advanced encryption techniques to protect data.

Mobile accessibility: Finly offers mobile accessibility, allowing users to manage expenses on-the-go and improving flexibility.

Automated expense reporting: Finly automates the expense reporting process, reducing manual effort and improving efficiency.

Receipt capture and management: The platform provides tools for capturing and managing receipts digitally, reducing paperwork and promoting organization.

Multi-currency and multi-language support: Finly supports transactions in multiple currencies and languages, facilitating global business operations.

Cons:-

Learning curve: Adopting and adapting to a new expense management system may require some initial learning and adjustment for businesses and employees.

Dependency on technology: Reliance on technology means that any technical issues or disruptions could temporarily hinder access to the platform and its features.

Overall, the pros of using Finly, such as intelligent automation, powerful analytics, seamless integration, policy enforcement, enhanced security, and mobile accessibility, make it a valuable tool for businesses seeking to simplify their expense management processes.

However, it’s important to be mindful of the learning curve associated with adopting a new system and the potential dependency on technology for platform accessibility.

5. Pleo

In modern expense management, Pleo stands as a game-changing solution that simplifies and streamlines how businesses handle their expenses.

With its innovative features and user-friendly interface, Pleo offers a comprehensive platform to enhance financial control and efficiency.

Let’s delve into the intricacies of Pleo and explore how it is revolutionizing expense management.

At the core of Pleo lies its smart spending platform. Pleo empowers employees with Pleo cards, enabling them to make business-related purchases while maintaining control and visibility over company expenses.

The Pleo platform automates expense tracking, categorization, and reconciliation, eliminating the need for tedious manual processes.

One of the standout features of Pleo is its real-time expense insights. Businesses can access detailed data and visualizations through the platform, providing valuable insights into spending patterns, budget utilization, and cost-saving opportunities. This real-time visibility enables proactive financial decision-making.

Moreover, Pleo simplifies expense reporting and reimbursement. Employees can capture and submit receipts digitally, eliminating the hassle of paper-based processes.

Managers can easily review and approve expenses, streamlining the reimbursement workflow.

Furthermore, Pleo integrates seamlessly with accounting systems and provides powerful expense analytics. This integration ensures accurate and up-to-date financial records.

At the same time, the analytics capabilities allow businesses to gain deeper insights into their expenses, optimizing budgets and identifying trends.

Additionally, Pleo prioritizes security. The platform employs advanced encryption and secure authentication measures to protect sensitive financial data, ensuring compliance with data protection regulations.

In conclusion, Pleo revolutionizes expense management for modern businesses.

With its smart spending platform, real-time insights, simplified expense reporting, seamless integrations, and robust security measures, Pleo empowers businesses to take control of their expenses, enhance financial visibility, and drive overall efficiency.

Features:-

Pleo cards: Employees are provided with Pleo cards for making business-related purchases while maintaining control and visibility over company expenses.

Automated expense tracking: Pleo automates expense tracking, categorization, and reconciliation, eliminating manual processes.

Real-time expense insights: The platform provides detailed data and visualizations, offering real-time insights into spending patterns, budget utilization, and cost-saving opportunities.

Simplified expense reporting: Employees can capture and submit receipts digitally, streamlining the expense reporting process and eliminating paper-based workflows.

Reimbursement workflow: Pleo simplifies the reimbursement workflow, enabling managers to easily review and approve expenses.

Seamless integration with accounting systems: Pleo seamlessly integrates with accounting systems, ensuring accurate and up-to-date financial records.

Powerful expense analytics: The platform offers powerful expense analytics capabilities, allowing businesses to gain deeper insights into their expenses and optimize budgets.

Data security: Pleo prioritizes security, employing advanced encryption and secure authentication measures to protect sensitive financial data.

Compliance: Pleo ensures compliance with data protection regulations and industry standards.

These features make Pleo a comprehensive expense management solution that simplifies expense tracking, offers real-time insights, streamlines expense reporting, and reimbursement, integrates with accounting systems, provides powerful analytics, and prioritizes data security and compliance.

Pros:-

Simplified expense management: Pleo automates expense tracking, categorization, and reconciliation, simplifying the overall expense management process.

Real-time insights: The platform provides real-time data and visualizations, offering valuable insights into spending patterns and cost-saving opportunities.

Streamlined expense reporting: Pleo allows employees to capture and submit receipts digitally, streamlining the expense reporting workflow and eliminating paper-based processes.

Seamless integration: Pleo integrates seamlessly with accounting systems, ensuring accurate and up-to-date financial records.

Powerful analytics: The platform offers powerful expense analytics capabilities, enabling businesses to gain deeper insights and optimize budgets.

Data security: Pleo prioritizes data security, employing advanced encryption and secure authentication measures to protect sensitive financial data.

User-friendly interface: Pleo provides a user-friendly interface, making it easy for employees and managers to navigate and utilize the platform.

Cons:-

Dependency on technology: Pleo relies on technology, which means any technical issues or disruptions could temporarily hinder access to the platform and its features.

Limited acceptance: The acceptance of Pleo cards may vary among merchants and locations, potentially limiting usability in certain instances.

The pros of using Pleo, such as simplified expense management, real-time insights, streamlined expense reporting, seamless integration, powerful analytics, data security, and a user-friendly interface, make it a valuable tool for businesses.

However, it’s important to be mindful of the potential dependency on technology and the varying acceptance of Pleo cards when considering its implementation.

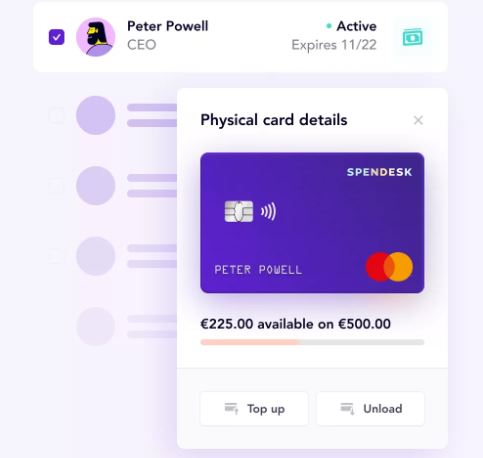

6. Spendesk

When it comes to efficient expense management, Spendesk takes the lead as a comprehensive solution that empowers businesses to streamline their financial processes.

With its innovative features and user-friendly interface, Spendesk offers a seamless platform to enhance control, visibility, and efficiency.

Let’s explore how Spendesk is revolutionizing expense management.

At the core of Spendesk lies its integrated spend management system. The platform provides businesses a centralized hub to manage expenses, Spendesk cards, and automate payment workflows.

This integrated approach simplifies the expense management process, reducing manual effort and improving accuracy.

One of the standout features of Spendesk is its real-time visibility.

The platform offers real-time spending data and analytics, enabling businesses to gain insights into their expenses, track budget utilization, and make data-driven decisions.

This real-time visibility empowers finance teams to manage expenses and optimize spending proactively.

Moreover, Spendesk simplifies expense reporting and reimbursement. Employees can effortlessly capture and submit receipts through the platform, reducing the reliance on paper-based processes.

The automated workflows streamline approval processes, ensuring timely reimbursement and improving employee satisfaction.

Furthermore, Spendesk offers seamless integration with accounting software and enterprise resource planning (ERP) systems.

This integration ensures accurate and synchronized financial data, reducing the risk of errors and improving financial reporting.

Additionally, Spendesk prioritizes security and compliance. The platform utilizes advanced encryption techniques and secure payment gateways to protect sensitive financial information, ensuring data privacy and regulatory compliance.

In conclusion, Spendesk revolutionizes business expense management with its integrated spend management system, real-time visibility, simplified expense reporting, seamless integration, and robust security measures.

By leveraging Spendesk, businesses can streamline their financial processes, gain better control over expenses, and drive overall efficiency in their operations.

Features:-

Integrated spend management system: Spendesk offers a centralized platform to manage expenses and automate payment workflows.

Real-time visibility: The platform provides real-time spending data and analytics, enabling businesses to gain insights and make data-driven decisions.

Spendesk cards: Businesses can issue Spendesk cards to employees for convenient and controlled spending.

Simplified expense reporting: Spendesk simplifies the expense reporting process, allowing employees to capture and submit receipts effortlessly.

Automated approval workflows: The platform automates approval processes, streamlining reimbursement and ensuring timely payments.

Seamless integration: Spendesk seamlessly integrates with accounting software and ERP systems, ensuring accurate financial data synchronization.

Enhanced security measures: Spendesk prioritizes data security, utilizing advanced encryption techniques and secure payment gateways.

Compliance: The platform ensures regulatory compliance, adhering to data privacy and financial regulations.

Expense analytics: Spendesk offers powerful expense analytics capabilities, providing businesses with deeper insights into their spending patterns.

Mobile accessibility: Spendesk is accessible through mobile devices, enabling on-the-go expense management.

These features make Spendesk a comprehensive expense management solution, empowering businesses with an integrated platform, real-time visibility, simplified reporting, automated workflows, seamless integration, enhanced security, compliance, expense analytics, and mobile accessibility.

Pros:-

Integrated platform: Spendesk provides a centralized platform for managing expenses, streamlining payment workflows, and improving efficiency.

Real-time visibility: The platform offers real-time spending data and analytics, empowering businesses with insights to make informed decisions.

Simplified expense reporting: Spendesk simplifies the expense reporting process, allowing employees to capture and submit receipts effortlessly.

Automated approval workflows: Spendesk automates approval processes, reducing manual effort and ensuring timely reimbursements.

Seamless integration: Spendesk seamlessly integrates with accounting software and ERP systems, ensuring accurate financial data synchronization.

Enhanced security measures: Spendesk prioritizes data security, utilizing advanced encryption techniques and secure payment gateways.

Compliance: Spendesk adheres to data privacy and financial regulations, ensuring businesses comply with industry standards.

Expense analytics: The platform offers powerful analytics capabilities, enabling businesses to gain insights and optimize spending.

Mobile accessibility: Spendesk is accessible via mobile devices, allowing for convenient on-the-go expense management.

Cons:-

Learning curve: Adopting a new expense management system like Spendesk may require some initial learning and adjustment for businesses and employees.

Dependency on technology: The reliance on technology means that any technical issues or disruptions could temporarily impact access to the platform and its features.

Overall, the pros of using Spendesk, such as the integrated platform, real-time visibility, simplified expense reporting, automated workflows, seamless integration, enhanced security measures, compliance, expense analytics, and mobile accessibility, make it a valuable tool for businesses.

However, it’s important to be mindful of the learning curve of implementing a new system and the potential dependency on technology when considering its adoption.

7. Ramp

In the realm of intelligent expense management, Ramp emerges as a dynamic solution that empowers businesses to optimize their financial processes.

With its innovative features and cutting-edge technology, Ramp offers a comprehensive platform to enhance control, visibility, and efficiency.

Let’s explore how Ramp is revolutionizing expense management.

At the core of Ramp lies its intelligent expense management system.

Leveraging advanced algorithms and automation, Ramp analyzes and categorizes expenses in real time, eliminating the need for manual data entry. This intelligent feature saves businesses time, reduces errors, and improves accuracy.

One of the standout features of Ramp is its comprehensive spend management capabilities.

The platform enables businesses to track and control expenses through customizable spending policies, real-time budget monitoring, and automated expense approval workflows. This promotes financial discipline and reduces overspending.

Moreover, Ramp simplifies expense reconciliation with seamless integration into accounting systems. By syncing financial data, businesses can easily reconcile expenses, simplify the financial reporting process, and ensure accurate financial records.

Furthermore, Ramp offers robust analytics and reporting features. The platform gives businesses detailed insights into spending patterns, vendor analysis, and cost-saving opportunities.

This empowers finance teams to make data-driven decisions, optimize budgets, and maximize efficiency.

Additionally, Ramp prioritizes security and compliance. The platform utilizes advanced encryption techniques and secure data storage to protect sensitive financial information, ensuring data privacy and regulatory compliance.

In conclusion, Ramp revolutionizes business expense management with its intelligent system, comprehensive spend management capabilities, seamless integration, powerful analytics, and robust security measures.

By leveraging Ramp, businesses can streamline their financial processes, gain better control over expenses, and drive overall efficiency in their operations.

Features:-

Intelligent expense management: Ramp utilizes advanced algorithms and automation to analyze and categorize expenses in real time, improving accuracy and reducing manual data entry.

Comprehensive spend management: The platform offers customizable spending policies, real-time budget monitoring, and automated expense approval workflows, promoting financial discipline and control.

Seamless integration: Ramp seamlessly integrates with accounting systems, simplifying expense reconciliation and ensuring accurate financial records.

Robust analytics and reporting: The platform provides detailed insights into spending patterns, vendor analysis, and cost-saving opportunities, enabling data-driven decision-making and budget optimization.

Enhanced security measures: Ramp prioritizes security, utilizing advanced encryption techniques and secure data storage to protect sensitive financial information.

Policy enforcement: Ramp allows businesses to define and enforce spending policies, ensuring compliance and reducing unauthorized expenses.

Automated expense approval workflows: The platform automates expense approval processes, reducing manual effort and streamlining the reimbursement workflow.

Real-time budget monitoring: Ramp provides real-time monitoring of budgets, enabling businesses to track spending and stay within budget limits.

Mobile accessibility: Ramp is accessible via mobile devices, allowing for convenient on-the-go expense management.

These features make Ramp a comprehensive expense management solution, empowering businesses with intelligent expense management, comprehensive spend management capabilities, seamless integration, robust analytics and reporting, enhanced security measures, policy enforcement, automated workflows, real-time budget monitoring, and mobile accessibility.

Pros:-

Intelligent expense management: Ramp utilizes advanced algorithms to automate expense categorization and improve accuracy, saving time and reducing manual data entry.

Comprehensive spend management: The platform offers customizable spending policies, real-time budget monitoring, and automated expense approval workflows, promoting financial control and discipline.

Seamless integration: Ramp seamlessly integrates with accounting systems, simplifying expense reconciliation and ensuring accurate financial records.

Robust analytics and reporting: Ramp provides detailed insights into spending patterns, enabling data-driven decision-making and budget optimization.

Enhanced security measures: Ramp prioritizes data security, utilizing advanced encryption techniques and secure data storage.

Policy enforcement: Businesses can define and enforce spending policies, ensuring compliance and reducing unauthorized expenses.

Automated workflows: Ramp automates expense approval processes, reducing manual effort and streamlining the reimbursement workflow.

Real-time budget monitoring: The platform enables real-time monitoring of budgets, helping businesses track spending and stay within budget limits.

Mobile accessibility: Ramp is accessible via mobile devices, allowing for convenient expense management.

Cons:-

Learning curve: Adopting a new expense management system like Ramp may require some initial learning and adjustment for businesses and employees.

Dependency on technology: Reliance on technology means that any technical issues or disruptions could temporarily impact access to the platform and its features.

Overall, the pros of using Ramp, such as intelligent expense management, comprehensive spend management capabilities, seamless integration, robust analytics and reporting, enhanced security measures, policy enforcement, automated workflows, real-time budget monitoring, and mobile accessibility, make it a valuable tool for businesses.

However, it’s important to be mindful of the learning curve of implementing a new system and the potential dependency on technology when considering its adoption.

Factors to consider when choosing an Expense Card For Contract Employees

Choosing the right expense card is crucial for effective expense management.

To make an informed decision, it is essential to consider several factors that can greatly impact the overall experience and benefits of using an expense card.

1. Acceptance and Accessibility

Before selecting an expense card, it is important to assess its acceptance and accessibility. Ensure that merchants widely accept the card and work seamlessly across various locations.

2. Integration

Look for an expense card that integrates smoothly with existing financial systems or expense management software. This integration facilitates easy data synchronization, streamlines processes, and reduces manual effort.

3. Spending Controls

Consider the level of spending controls offered by the expense card. Look for features like spending limits, category restrictions, and real-time spending notifications to promote responsible spending and prevent unauthorized transactions.

4. Reporting and Analytics

The ability to generate detailed expense reports and access analytics is crucial. Opt for an expense card with comprehensive reporting capabilities, enabling better financial visibility and informed decision-making.

5. Security

Prioritize security when selecting an expense card. Ensure the card provider implements robust security measures, such as encryption and two-factor authentication, to protect sensitive financial data.

6. Customer Support

Evaluate the quality and availability of customer support the card issuer provides. Prompt and helpful customer support can assist with troubleshooting issues and assist when needed.

7. Fees and Pricing

Consider the fee structure associated with the expense card, including any transaction fees, annual fees, or foreign exchange fees. Compare the pricing models of different providers to determine the most cost-effective option for your needs.

By carefully considering these factors when choosing an expense card, businesses can ensure they select a solution that aligns with their requirements, promotes efficient expense management, and enhances financial control.

How to Implement an Expense Card System

Implementing an expense card system can bring numerous benefits to businesses, including streamlined expense management and improved financial control.

It is important to follow a well-thought-out process to implement such a system successfully.

Here are key steps on how to implement an expense card system:-

1. Define Objectives and Requirements

Clearly outline the objectives you aim to achieve with the expense card system. Identify the specific requirements, such as spending limits, approval workflows, and integration with existing systems.

2. Research and Select a Provider

Conduct thorough research to identify reputable expense card providers that align with your requirements. Evaluate their features, security measures, pricing models, and customer support.

3. Set Up Policies and Guidelines

Establish clear policies and guidelines regarding card usage, spending limits, expense categories, and documentation requirements. Communicate these policies to employees and ensure they understand the expectations.

4. Plan the Implementation Process

Develop a detailed plan for implementing the expense card system. Consider factors such as timeline, employee training, card distribution, and data migration, if applicable.

5. Communicate and Train Employees

Communicate the purpose and benefits of the expense card system to employees. Provide comprehensive training on card usage, expense reporting procedures, and adherence to company policies.

6. Configure and Customize

Work closely with the expense card provider to configure the system according to your specific requirements. Customize expense categories, spending limits, and approval workflows to align with your business processes.

7. Test and Evaluate

Conduct thorough testing of the expense card system before full implementation. Identify and resolve any issues or challenges that arise during the testing phase.

8. Rollout and Monitor

Roll out the expense card system to employees, closely monitoring their usage and providing ongoing support. Continuously evaluate the system’s effectiveness and make adjustments as needed.

By following these steps, businesses can effectively implement an expense card system, enabling efficient expense management, enhanced financial control, and improved overall operational efficiency.

Conclusion

In conclusion, managing expenses doesn’t have to be daunting for contract employees. With the right tools, such as an expense card, you can transform this often tedious process into a streamlined, efficient, and accurate system.

An expense card for contract employees simplifies expense tracking and provides a clear, auditable record of all transactions. This can save you time, reduce stress, and help ensure all your legitimate business expenses are accounted for.

So, why use traditional, time-consuming methods when a more efficient solution is available? Embrace the change and experience the difference an expense card can make in your professional life.