Trying to find the Best PayPal Alternatives To Make Your Transactions Hassle-Free in 2022? 🤔 You’re in the right place.

We collected 11 of the best alternative services for you in this post.

Let’s get started. 🤑

We all have used financial technology one time or the other for making payments through encrypted transactions. With the advancement in technology, more financial payment systems have now emerged in the market that can provide you better services than others.

For many, Paypal is the safest of all, but everybody wants to have a big fish on their plate, so most of the scammers around the world try to scam and hack Paypal users only through a number of ways.

Some of the methods from which the information of the user can be ripped out from their Paypal account is by using identity theft, HTML interception, server breaching, along with a point of sale attacks.

In a lot of cases, we don’t even know, but we are providing our information to the identity theft hacker. As a result, it is more of poor customer practices than hackers using advanced means to get your information out. Any payment that happens on the internet can be compromised if the user willingly gives it a fraudster.

These can be done when you are buying something online, and the website is not trustworthy, or you are paying your bills online, etc. The risk of losing your money or your identity being stolen can occur with any type of payment at any point in time.

So you always have to be careful when you are making a transaction and check if there are any other tabs that are opening and look fishy.

Paypal was one of the first websites that allowed the international transfer of money via bank accounts. They try to mitigate some of the risks that we have discussed above, but now and then, hackers get past through the security protocols of the website and get your data.

In that case, what are the alternatives one needs to look for? Payment methods can be used both in the international market as well as a national market too.

Whatever payment gateway you are using, you need to be careful and cautious while you fill in your information for the payment and always check if the website has an SSL certificate on it.

Why Don’t You Want To Have Your Transactions Done In PayPal?

We know online shopping and purchasing clothes, books, and electronic devices while sitting in your cozy bed is a great idea. It gives you ample time to think while still letting you purchase products while you stay in your comfort zone.

According to research, around 65% of people prefer purchasing products online. Each day new users are getting connected with the internet, and the first thing they do is shop for the product they want so badly, which isn’t available in their town.

A person sitting in India can order the official merchandise of European football clubs while he’s having breakfast in the morning. That’s how simple it is to purchase things online.

In 2020, the internet has seen the highest surge in the number of users worldwide, with daily users hitting the new records.

More than 4.25 billion people are using internet services and surfing the world of the internet without any restrictions. China, India, and the United States are the leading countries with the highest number of users on a daily basis.

A world without the internet is unimaginable for many of us, and billions of dollars of companies can go out of business in just a few days if the internet went off suddenly. By 2024 online transaction payment is estimated to be $ 3, 081 Billion. Yes, this is just the amount of online transactions.

So you can see how a lot of hackers are trying their best to get their hands on this much money. Even 1% of this number is a considerable amount and a significant loss to someone.

There are certain disadvantages that you get when you are using Paypal for your transactions. Given below, we have mentioned some of them that will make you think if Paypal is the safest option for online transactions or not?

Lack Of Good Customer Care:-

If you have ever used Paypal, you know it can take up to 15 minutes for a customer care representative from Paypal to attend your call. Yes, 15 minutes is the average time.

If you choose the other option, which is mailing them your problem, you will only get automated replies rather than genuine advice that can help you solve your problem.

On the other hand, if you have a dispute regarding the payment or the transaction that has been done on Paypal, it could take days before it gets resolved. Their arbitration process of handling the conflict can take forever to complete.

Paypal Verification System:-

In case you don’t know, you need to link your bank account with your Paypal. It does not make a virtual wallet in the first place. In addition to this, if you are not someone from a technical background and don’t know much about computers and technology, this verification process could take some time.

First, you need to link the bank account. After that, you have to wait for Paypal to send you some amount which will take 2-3 days before it gets transferred to your account.

After that, you will have to tell Paypal about the amount which is being transferred by Paypal. Once all of this is done, you are ready to go and use the online payment platform.

PayPal Restrictions:-

If you are using a personal account on Paypal, chances are you won’t cross the threshold of the maximum amount that can be transferred.

But if you have a business account, you will be charged a nominal fee for your usage, and you need to pay a small amount of transaction fee to Paypal every time you receive or send money. Moreover, for business accounts, the amount of money that can be moved is also restricted.

Delay In Deposits:-

A lot of times, you get money in your wallet, and when you transfer it to your bank, it could take up to 5 days.

Likewise, if you are not using Internet banking services, you have to wait for almost a month to receive a postal statement to check the transferred amount.

Excluding Currency:-

Paypal is known worldwide as a money transfer platform, but Paypal doesn’t know it, even in 2020. Still, there are 23 currency types in which you send and revise the money.

But it excludes some of the important currencies that are growing rapidly in terms of online transactions. One of the most prominent examples of this exclusion is Rupee from India. The money will be converted into Rupee, but it must first be transferred in the form of another currency.

Vulnerability To Fraud:-

In this case, if you are a seller, you need to think twice before you deliver the product to a buyer. A lot of times, a refund gets initiated even if the seller has dispatched the order.

When you complain, you are stuck on the telephonic loop for more than 10 minutes before connecting with a real customer representative of Paypal.

Strict Rules:-

If Paypal has the slightest suspicion on your account, they can suspend it without warnings. We already told you how terrible the customer service is, so it takes a long time for them to investigate and reopen your account for transactions.

You can expect your money to be locked up in Paypal for a long time. It won’t go away, but you won’t be able to use it till the suspension is revoked.

Nobody Is On The Phone:-

When you call to find out how to solve an issue, you will be blown away by how much time you have to wait to be able to talk with a person, but sometimes that call gets cut, and you have to repeat the whole process.

There have been reports of accounts being debited automatically without any prior knowledge to the holder, and there is no way to find out what happened and where did the money go.

These are some of the issues with Paypal, making it hard for people to use it and transfer the money from it.

Best PayPal Alternatives: Our Top Pick 👌

Now, here’s a list that can help you answer your question: What can I use instead of Paypal? Even we used to do transactions from Paypal back in those days when these portals were not available.

Paypal’s learning curve was an acute one, and a lot of people don’t know how to receive money from around the world. In India, due to a dispute between Paypal and RBI, many people could not use all the services that Paypal has to offer to its customers.

So we searched for the other options digging deep in the world of the internet to find the answer to our question, and the result we get is on this list.

You can use any of these anytime you want, some of them may look better to you, and some might not. According to use, these are the top 15 best PayPal alternatives that you can find on the internet to handle your transaction and money transfers online.

1. Payoneer

Payoneer (Signup Here) is the right choice for many of us as a Paypal alternative, and we will tell you why it is so. You will find out that Payoneer is said to be one of the best transaction portals that you could find online in many situations.

But still, it might not be right for you for some reason. We will show you why it’s a better option than others and see if you can find anything helpful for your business.

Payoneer was aimed at digital marketers, freelancers, content writers, and basically for the community of digital nomads, people who travel the world and earn while exploring different countries.

It provides currency conversions, direct payment options, and other useful integration that will help your business to pay up the contracts, employees, and other people.

It gets integrated with Upwork, Fiverr, Freelancer, and other pay-per-hour portals to transfer the amount from your client to your bank account.

If you are a small business and want to sell your goods in the international market, you need Payoneer, and it will make things easy for you, so you don’t have to spend hours and hours figuring out how to get money from your clients.

On the other hand, if you run a business and sell products online then Payoneer is an online portal that will help you get your money transferred from one country to the other at a much lower cost than Paypal.

If you are looking to provide money to your family and friends or think about paying up the amount of a product you bought from an online store, then we are sorry to say, but Payoneer isn’t made for you.

If one is paying you from Payoneer, you can only accept the specific limit of the amount. For example, 15,00 USD is the upper limit one has to keep in mind when sending E-checks via Payoneer.

When you are trying to get money from your clients using Payoneer, it will send the mail to your client requesting the amount that needs to be paid to you and the different methods they can use to pay you.

Once the client sends you the payment, it gets transferred to your account from there, and you can withdraw it to your bank account in 3-4 days.

Making the payment is free for all on Payoneer. If you are paying check E-check, it will take 1% as a fee. For credit cards, that would be 3%, and in the case of the local bank transfer, it will be 1%.

Likewise, if you are sending money to someone, Payoneer would ask if you want to pay the transfer fee or let the recipient pay. If the client of yours is based in an EEA country, the fee will be automatically charged to him by the portal.

In terms of currency exchange fees, you will have to pay 0.5% of the total cost of the exchange above the mid-market range. This is one of the reasons why people stay away from Payoneer and use other services.

2. Wise (Formerly Transferwise)

At number second, we have one of the favorite transaction portals named Wise (Signup Here). Wise is an excellent option if you are into sending and receiving international payments.

If Paypal has a customer service catastrophe, Transferwise is a godsend to you. The speedy transfer of this portal makes it unique and stands out from the rest of the crowd.

What makes it even better? Well, we are glad that you asked, it’s the user experience, also if you are not someone who is always on the internet, still, it will be easy for you to navigate yourself through the wise online portal and app.

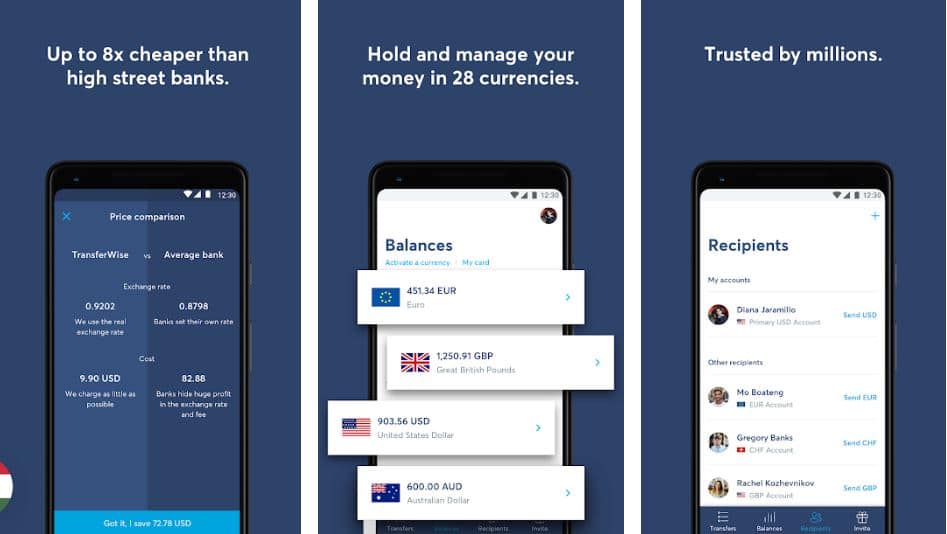

Once you join Transferwise, you can start a borderless account and also get a prepaid MasterCard for yourself. The borderless account will enable you to get money from around the world in different currencies like GBP, Euro, US dollar, and Australian dollar along with 50 other currencies.

It’s more like having an account in the US, Australia, the UK, and Europe all at the same time, and all of them connected to each other.

One more advantage of using a Borderless account is that you can transfer your money in a different currency. The inbuilt calculator will show you how much you are going to send in that particular currency. As a result, it could be the difference between saving money and spending it without knowing how much you are paying.

Wise used to operate from P-2-P meaning from peer-to-peer service, and no third party was involved during the transaction of the money.

But now they are shifting their focus and moving out from P-2-P service. It is still unclear why this change has happened, and we are waiting to see if the change results in any fruit.

On the other hand, the portal hasn’t lost its root, making it famous in the first place; it is a lower cost of transactions.

There are two ways this Paypal alternative portal works when you are asking for the transaction of funds. The first one is the pre-approval in the case of larger amounts.

When you transfer more significant amounts such as USD 7000 or CAD 9500, you need approval for the transfer as per the regulations set by Anti-terrorism and Money Laundering laws.

As a result, you need to provide extra information when you are doing such a massive transfer. It doesn’t stop you from doing them, but it needs to check why such a significant amount is transferred. Usually, these checks are based on your government ID.

Portal also asks you before your sign-up is complete about how much money is going to transfer on an average, and according to it will ask you to provide extra documents, so you don’t have to provide them with each larger sum transfer.

Service is the second method by which Transferwise takes care of your transactions. The beauty of having an excellent transaction portal is that the portal is partially responsible for your money is transferred safely to your bank account.

It works great when you are using it online, and when required, any troubleshoot portal does a great job. For a small amount, the transfer will be done in no time. Human intervention is possible in case of a more substantial sum, which is built-in so that it won’t take much time.

3. Skrill

Skrill (Signup Here), is a payment gateway for the new internet. It does have some history as a lot of merchants use to think of it as a scam or a site that takes your money and transfers it to their accounts.

Being one of the cheapest options, Skrill provides a lot of features that you use to get from Paypal.

There are specific issues with Skrill in the United States, but otherwise, it works perfectly all over the world. The fees are often less than desirable.

This happens a lot of times when you are using Skrill because Skrill doesn’t want to risk any supporting merchants that don’t have support from Paypal in the first place or any other well-known online transaction processors.

Skrill is used mostly for transferring and storing your gambling money, which takes place online. The company, in its early days, used to be called Moneybookers.

In the past few years, the company has shifted its goal towards making a portal for sending and receiving money. Gambling is still supported, but with time the company has evolved to the website and new branding.

The main advantage that you get when you are using Skrill is how easy it is to transfer the money and accept it if someone is sending it to you. It allows payments from a vast number of countries and currencies.

The main earning for Skrill comes from the transactions, and that’s why if some business seems to be a bit risky, Paypal won’t allow for transactions to always go for Skrill without any worries.

You will have much more ease of partnering with Skrillas as a Paypal alternative than it will take you to join the Paypal merchant community. All the services and the products that Skrill offers are almost identical to Paypal.

As a result, you are not getting anything extra from it. The pricing is what makes all the difference here, which is low. On the other hand, Skrill tags € 0.49 for each refund that you initiate as a merchant. So you better be good with your products, or you will have to find some other transaction portal.

If you find something worth paying for, you can just click on one button, and the money will be sent to the merchant. It is quite similar to what Amazon does on their website.

In addition to this, if you want to send money to a lot of people at the same time who are sitting around the world, you can do that too. This can come in handy when you are working with several manufacturers and suppliers.

4. Stripe

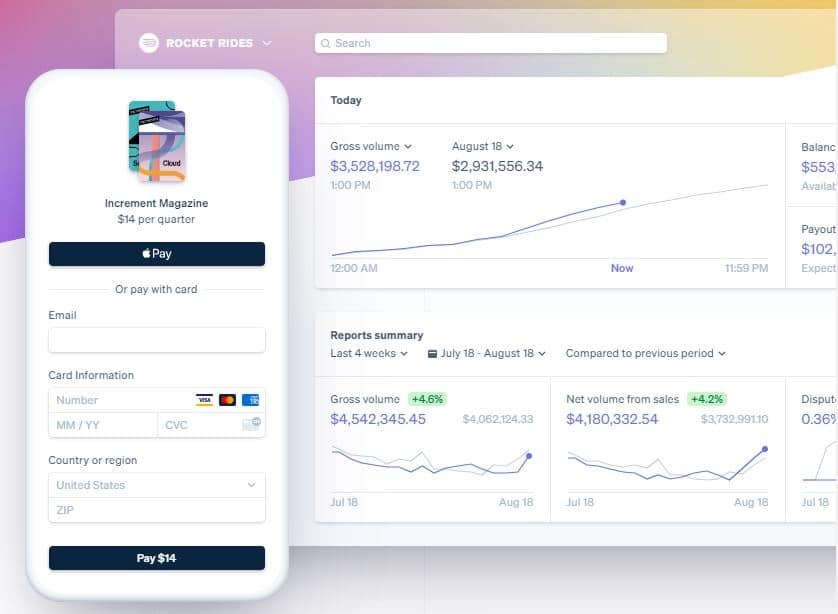

When an online payment system is built around one idea, that is to make it easy for companies to do business online. Then you know it is undoubtedly going to benefit businesses.

It doesn’t stop at processing the credit card. That’s just too dull for Stripe. Stripe is Paypal alternative which is accepting credit card transfers is only a secondary benefit from the wide variety of its features.

It doesn’t matter what people think of Stripe. In terms of development and features, this online payment system is groundbreaking along with the documentation which exceeds no limits.

You can use it for monthly billing subscriptions or running a marketplace that is looking for an easy way to split payments, and Stripe has got you covered.

In addition to this, Stripe knows many people who are in business are not tech-savvy individuals. As a result, the UI is easy to navigate and getting your account open on Stripe will take about 3 minutes in total.

If you are a software or an application developer and want to enable an in-app purchase system for your client, you can use this transaction system to make the money transfer fast and reliable.

There is no denying the fact that Stipe is a buzz media fantasy that came alive. With the list of co-founders such as Partick Collision, who won the 41st young scientist award for his tremendous work in Lisp.

On the other hand, if we talk about his brother John Collision, he scores the highest ever marks on the Irish leaving certificate exam before he went to MIT in the states after dropping out from his last year of high school.

As a result, Stipe was an innovation to make the internet a better and safer place for online transactions. The developer-first focus approach was used to make Stripe happen; first of all, it’s a third-party payment processing portal.

Thus, Stripe isn’t protected from the same problems that Paypal and other transaction portals face. If you look for the Stripe review on the internet, we can guarantee you that you will find some unhappy customers who’re banned from using Stipe, and their account has been blocked for any further transactions for no reason at all.

When it comes to billing, Stipe will not charge you anything until you reach 1 million in recurring transactions. Once you pass that out, the company starts to charge you 0.4% of the total transactions and the processing costs.

The UI is relatively easy to use, but still, the primary intended audience is developers. For others, they can learn how to use Stripe, or they can hire a developer that can help them with their transactions and payments. Lastly, there is no early termination fee that you need to pay once you stop using its services.

5. Venmo

CDs, DVDs, and floppy disks are now being extinct from our modern world in the same way physical cash payments are also becoming the victim of online payments.

Earning money is already hard in the first place, and keeping it safe from hackers and predators is much more complicated than earning it. No one wants to do the maths with their money if they are earning a lot, and writing a check to a friend or family is almost antiquated as cursive.

This brings us Venmo. It is one of the best peers to peer mobile payment portals, which can be run on your mobile phone. As a result, it solves several problems with just one solution.

It does have some flaws like it shows your transaction to the world on Venmo’s social network. Thus, if you are making large transactions from this app, you can be a target for Ransom attacks or hacks. But you have the ability to turn the feature off and keep yourself safe.

The clear focus that we get to see on Venmo, along with strong execution, makes it one of the best payment methods that you can use anytime on your mobile phone. Venmo is platform-independent, meaning you can use it on IOS, Android, and the web without showing you any difficulty or lag.

Once you are done with the initial account setup, you need to provide information about your credit or debit card and bank account details to authenticate it. Now you are all set up and can receive or send money to your friends and family.

The monthly cap of transfer ranges from $300 to $3000 for this Paypal alternative. We know this is much lower than that of Google Wallet, which is $10,000, and that too every week. Venmo is more accessible than most of the other payment portals.

Unfortunately, we have to bring that up for you, and there’s no way you can keep yourself away from a 3% fee or funds that the company requires from your credit cards or non-major debit cards.

But when we check other payment options, we see the same pattern of fees. In case you are thinking about transferring money to some business, you need to use the NFC payment app present on both Ios and Android devices.

There are several new features that have been added to Venmo services. First things, first, the company made its goal to reach most of the platforms that require online payment. As a result, it is competing straight to Paypal.

But that’s not a big deal for Venmo cause the company is owned by PayPal. The other advantage that you get from Venmo is splitting the cost and sharing your activity with the audience and friends.

There are Venmo codes that you can scan from your device for payments. Thus, you don’t need to type in the name of the person. Emojis are a big thing on the internet, a message sent without an emoji might feel like something is wrong on the other side. So Venmo added emojis with your payments.

Also, a group account is now a thing on Venmo; it’s still in beta state, but this feature lets the organization collect any dues that their employees might have along with other multi-individual transactions.

6. Authorize.Net

Authorize.Net is the old player in the online transaction market, and the company first started making online payments for eCommerce back in 1996.

The company has provided a payment gateway for more than 400,000 happy customers since it first came online on the internet.

Before we get into Authorize.Net’s features, we need to make one thing clear for our readers. This is not a merchant account provider system. It does provide payment gateways along with several ancillary services that integrate with it. You can set up a merchant account if you don’t have one.

There are two methods from which you can ask for a payment gateway from Authorize.Net. First, it is a bit easy because you only need to sign up on their website.

It works best if you already have your merchant account up and running in other payment gateways. The second method is a bit tricky, but you can use it without any problem.

It’s just that the second method has more steps than the first one. You can get a merchant account from many providers that have partnered with Authorize.Net.

Some of the most trusted merchant providers are Payment Depot and CDGcommerce. You can choose any of these two methods. It totally depends on your requirement and how you are going to use Authorize.Net.

It doesn’t matter how you will use the payment gateway; it will provide you full security in all cases. Likewise, a lot of times, people purchase a product and then return it. As a result, the merchant has already shipped the product, but the refund gets initiated. Well, that’s not the case of Authorize.Net.

The company has seen the scams being developed in front of them as they are present since 1996. So you will get fraud detection along with a simplified checkout system.

Furthermore, you can opt for automated recurring billing, customer information managers, and QuickBooks to keep all things in one place to make it hassle-free for you to manage your merchant account.

Furthermore, with the help of Authroize.Net, you can convert your home computer into a virtual terminal as it provides (VPOS) software and USB connected card reader. You can add eCheck processing to your existing merchant account.

The only plan for eChecking is 0.75% per check. But you would be happy to hear that you are going to pay even less than 0.75% for credit and debit card transactions.

One of the most powerful features of authorize.Net is the customer information manager. Using this feature, you can safely store your customer’s information, such as their billing address, shipping address, and preferred payment options.

A lot of payment portals don’t provide this feature as it requires credit card information, which they can’t protect from hackers. But that’s not the case for this portal. On the other hand, as we have seen a lot of times, with excellent security comes the expense of data portability.

If you are looking to open a merchant account only then, it can provide you flat-rate pricing. Here’s a tip, you should find resellers that have partnered with Authorize.Net to get the merchant account as it will be much easier for you to pay.

One more thing, you are making huge sales in terms of money and quantity you need to get the merchant account.

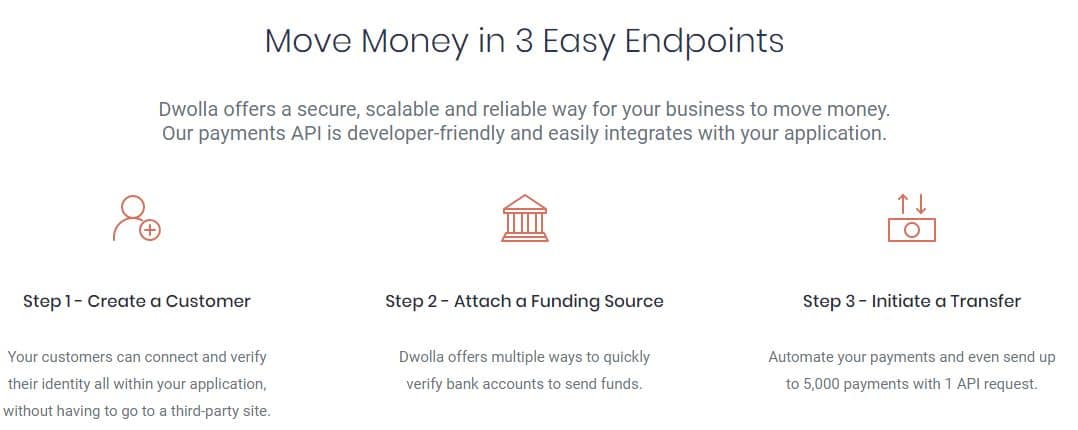

7. Dwolla

Dwolla, which you see right now on the internet, has been changed a lot of times since its inception. The company was founded in the year 2008, and since then, the developers have been working to make this platform one of the best payment gateways.

Over the years, it has been changed from being both merchant and consumer-friendly services to mostly focused on merchants having a large business that needs B2B handling of transactions.

It can be beneficial for the companies that are looking for an alternative to support their mass payouts.

Before we dig deep and tell you about its features and benefits, we need to discuss how Dwolla is not for you to use. Like most of the merchant service providers that we know on the internet don’t allow credit or debit card processing for a merchant account.

Likewise, the company doesn’t provide you a merchant account or a payment service provider. On the other hand, all the transfers take place by bank accounts.

This business method is used to keep the high interchange fees minimal and almost avoid them at all costs. As a result, Dwolla won’t have credit card terminals or point of sale systems embedded in its features.

No check scanners are present in this payment gateway. As a result, you won’t be able to convert the paper check into eCheck and send it over the internet to your friend or family or even to other merchants.

Affordability to run Dwolla with your business is a significant setback for many users as you need to pay 2,000 per month to use its services for your business.

Thus, companies with high turnover can use it and get their transactions done in time. What Dwolla provides you with such monthly fees is a complete white-label payment system customized according to your needs.

8. Quickbooks Payments

This payment method is a blessing for those who are already using Quickbooks accounting software.

With the help of Quickbooks payments now, you will have a mobile credit card processor as it can sync with your Quickbooks accounts seamlessly and take your payment data from your accounting software.

Thus, giving you sales data in real-time. There is no issue with a long-term contract that binds the user with the service.

Also, the company charges flat processing fees. When you are using this payment portal, you will be able to accept credit and debit cards from a person by using a mobile credit card reader, which is attached to your phone.

Or you can go for online invoices whatever suits your requirement the best. The app of Quickbooks payment is compatible with both IOS and Android.

There are a number of pricing options for Paypal alternative to make it easier for small businesses so the portal can be more accessible and have higher user traffic.

The best option which you can opt for if you are a small business is pay-as-you-go. As a result, you don’t need to pay monthly fees. On the other hand, it’s a good idea if you consider monthly plans as they are lower than your pay-as-you-go. If your monthly transactions are more than $7500, monthly payments are best for you.

Also, the monthly fee structure of processing rates depends on your QuickBooks plan, how you use it, and your method of accepting payments, which are either in person or through online transactions via the internet.

There are 15 different plans for you to choose from, yes! Fifteen is the number, that’s what we get to know from one of their customer representatives.

If you are not using QuickBooks for managing your accounts, there is no point for you to get this payment portal. But in case you do, it is going to make your life a lot easier in terms of handling your transactions and keeping up with your invoices and accounts.

As you can already see, this works on a monthly payment system, so terms and conditions are a bit flexible. There is no termination fee that you need to pay when you are shutting down your working with the payment portal.

Also, you can stop using the Quickbooks payment portal while still, you will be able to use your Quickbooks account management software without any restrictions.

The company has put up all the different terms that need to be accepted by merchants, along with different processing fees and monthly payment structures. So it’s better to analyze each of them before you sign up for their services.

There are three different methods from which you can use Quickbooks, and The first one is via an application that can be installed on your phone.

The second one is the software which you open on your computers and laptops. The final method to use this portal is via website or browser.

9. Google Pay

Google just wants world dominance at this point. More than 95% of the entire internet is under Google. All your ins and out in the online world are being tracked by Google.

There is no denying the fact that we have made Google an important part of the internet, and we can’t really get rid of it. To make things worse, Google launched Google Pay, and this app just straight up crushes any other Paypal alternatives that do the same work, which is providing a portal for payment.

Whether it’s the user interface or the integration with your bank account, Google pay does it seamlessly without taking much of the time. The customer service of GooglePay is far better than any other app that you see on Google’s App Store.

It makes you make your payment with your phone using NFC as well as you can purchase anything that you want on the internet using this app.

It’s not available for the desktop system or for Windows, and you cannot access your account of Google Pay on a browser. So you have to rely only on your mobile phones to make the payments.

There are certain areas where this application lags, for example, Samsung Pay’s ability to get the information and money transfer using magnetic-strip credit card machines.

Also, it cannot store your account information for person-to-person transactions. As a result, if you are a small business, you still need to manage your account manually.

You don’t need to pay a single dime to use its services. That’s the beauty of this application—no virtual wallet for you to transfer your money so you can use it for online translation.

Your bank account is linked to it, and you can shop with the money that is present in your bank account using Google pay. As a result, you don’t need to run and find your card when making online payments.

The application is quite small and takes not more than 30 Mb of space on your phone. The storage requirements will be different for different devices. But it is undoubtedly less than Venmo’s 50 Mb and Paypal’s 195 Mb.

Also, you can earn from Google Pay, it’s not much, but it does reward you with scratch cards when you make payments using Google Pay. The amount can range from 5 Rs to 1000 Rs. In recent months one new item came out that showed how an individual from India won 1,00,000 Rs as a scratch card price from Google pay.

In addition to this, the company does have some discount and cashback offers from the merchants with whom they have tie-ups.

As with all the other payment apps that don’t transfer your credit card number but generate an encrypted code for each of your cards, Google Pay does the same thing. The encrypted code gets transferred to the card issuer for verification.

Google also boasts how they keep your transactions completely safe via a number of security layers, so only you and the person whom you sent the money will be able to see your transaction and its history.

10. Square

If you want the best of the low-fee credit card processing service without having to pay for the monthly and the annual account maintenance fee, then Square is the right Paypal alternative for you.

All you have to pay is the flat rate over your transactions, that’s it nothing more. In addition to this, it doesn’t have a chargeback fee either, which is a welcome feature that you don’t get to see even in mobile credit card processing companies.

The best thing about the Square payment service is it makes it easy for all types of businesses to be able to have their transactions online.

Even micro businesses can benefit from it. It has an application that can be downloaded in just a few minutes, and it is entirely free, along with that you can download a free credit card swiper for each of your accounts, no contact, and no simple flat rates.

On the other hand, it does charge you some rates depending on your requirement and how many transactions you are doing per week and month along with their total amount.

But for most cases, you will need to pay flat rate prices, which gives you a precise estimation of how much money you need to pay for the processing of the fee.

The fee structure is available on their website, and you can see how much you are going to pay. Thus, every payment that you do on Square is entirely transparent to you.

Furthermore, square doesn’t care about what type of card you are using or the issuer of the card. It charges the same rate for debit, credit, rewards, and corporate cards.

Besides, you get to pay the same rate even if your customer is using different cards to make the payments. In case your customer is paying you for the service via reward points from business or American Express cards, you might be able to save some money by using the Square payment portal.

If your customer has a card and that card can be read by the machine, the square terminal will charge 2.6% + 0.10$ for each payment.

On the other hand, cards that are accepted by using the Square portal or Square appointment will be charged 2.5% + $0.10.

In order to have customer rates available for your business, you need to process more than $250,000 annually from the square account. Also, you need to have an average ticket price, which should be more than $15.

The terms and conditions on which your Square payment system works are user agreements, meaning if you are going to terminate your work with them, you don’t need to pay the termination fees.

This is one of the best advantages that you get from a traditional payment processing contract where the user needs to pay some amount to the portal before they can stop their monthly payment cycle.

There is no account maintenance fee whatsoever. Yes, if someone tells it to you there just straight up tell them it’s not true. You don’t need to pay monthly fees or annual fees or PCI compliance fees, nor are there any minimum monthly transactions that you need to make to keep it all free of charge.

Moreover, if you are creating a website using Square’s online website creator, you don’t need to pay for the payment gateway if you install it on your website. Square’s lack of fees makes it a good option for being a Paypal alternative.

If your company is still young and you are trying to save every dime possible on your payments, then Square is the option for you and your business.

Even though you may find that Square is just a mobile credit card processing company, they provide lots of services in payment processing such as business solutions for brick and mortar companies along with platforms for online businesses.

Square’s setup is quite easy; all you need to enter your necessary information of yours and the business in the app. There isn’t a credit check to make things difficult for you, and you are not required to submit any kind of documentation for the verification of your account.

There are add-one services that can help you if you need something special, some of these are appointment tickets, invoices, loyalty rewards, marketing, and payroll. This way, you don’t have to find other software to keep up with your employees’ accounts and salaries.

You can have an ad at minimal cost, and it will just work fine, and you will have fewer things to worry about.

Once you are on their payment platform, you can opt for Fee point-of-sale software, and this software can help you store your payment and invoices. You can get it from the app store of both Ios and Android devices. Also, you can use this software on your tablet.

Conclusion

So there you have it, these are some of the best alternatives that we could find for the Paypal payment system. We know you might be using Paypal for so long that you are now comfortable with it. But it’s time to find something new.

Paypal’s most significant disadvantage was its crappy customer service, which could be a problem for a lot of people as the transactions can be delayed sometimes, and you need to know the reason.

But if there is no one on the other side of the call, you are never going to get your issues resolved. With the help of these payment portals, we tried to make things easy for you.

Each of these payment methods can be used anywhere in the world, and you can get money from them across nations. So don’t worry about not being able to transfer your money to your family, who is living on the other side of the globe.