Sending money with just a few clicks via online transfer services is much more than it meets the eye. They’re an integral part of the global payments system and a convenient way for people to keep their cash safe.

The demand for digital remittance has been growing rapidly across all demographics, from countries with a low GDP to areas where brick-and-mortar banks simply aren’t available — such as Southeast Asia.

Sending money overseas is no trouble with digital remittance. Transactions that used to take weeks can be made more quickly, too: through online banking, one can send funds in just a few clicks.

In 2017, Statista projected that digital remittance would be worth $106.925 billion worldwide — an annual growth of 12.6 percent indicates the increasing popularity of digital remittance payment methods and therefore makes the discussion on Remitly vs Xoom interesting.

In this case, two of the most popular international money transfer services are Remitly and Xoom. And to understand them, we need to know everything starting from the exchange rate margins to the number of transfers so that it will help us decide which company is best suited to your needs.

Remitly and Xoom – Overview

Remitly vs Xoom is an industry-wide debate, where both are reliable names in international money transfers, known for providing a quick and convenient service to send money around the world. They provide the best solution.

They offer a quick and convenient way to send money, receiving high praise for their prices. With a user-friendly interface, Remitly allows users to send their money to other countries, with Xoom providing an easy way to get more cash in your hands.

What is Remitly? 🧐

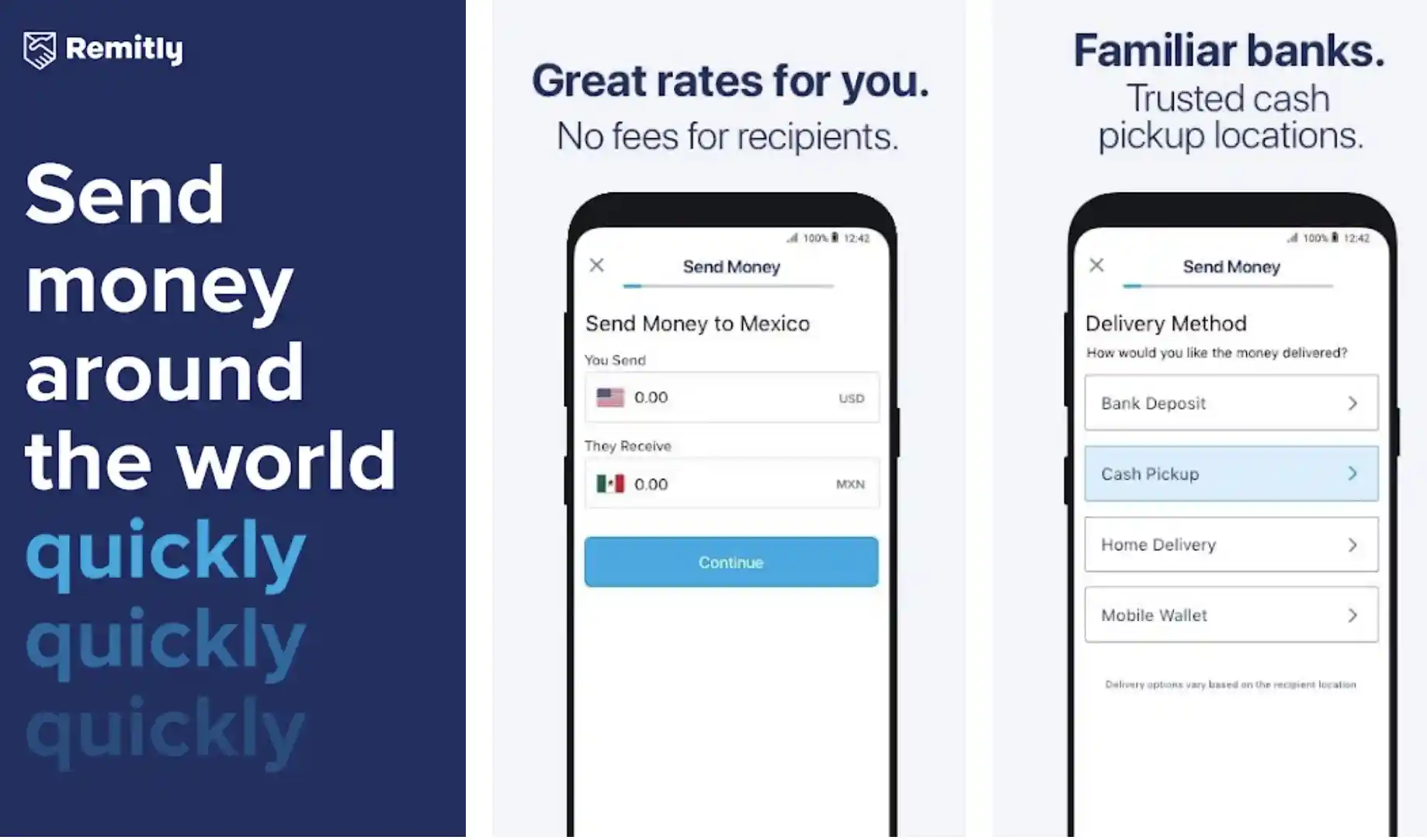

Remitly is the leading global company for mobile money transfers. Founded in 2011, the tech company now operates in 17 countries and 57 destinations, making it possible for people to send money anywhere in the world using only a mobile phone.

Remitly offers a cost-effective alternative to banks and other money transfer services that allows you to send money overseas quickly, easily, and securely.

Whether you need to transfer money on a regular basis or have an emergency need for cash, Remitly is your best choice for getting the job done affordably.

Remitly has a well-equipped team of more than 100 employees. Recently, Bezos Expeditions, TomorrowVentures, DFJ, Trilogy Equity Partners, Founders’ Co-Op, DN Capital, and QED Investors have shown confidence in Remitly by coming aboard as their investors.

These funds are set to support the development of an innovative service that is changing the way people send money abroad.

Download App on Google Play Store

Download App on Apple App Store

What is Xoom?

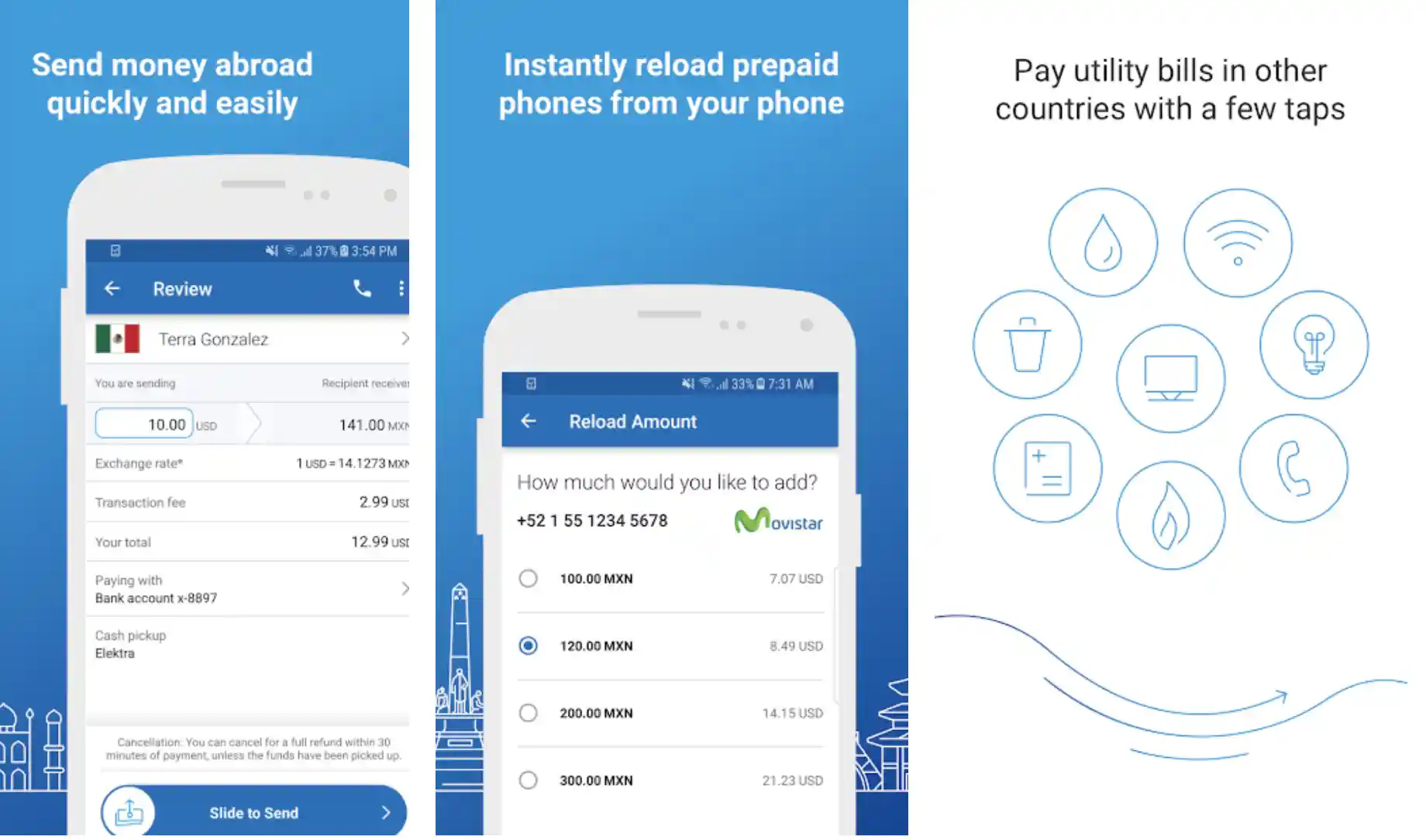

Xoom revolutionized international money transfers. Founded in 2001 by 2 American entrepreneurs, the service was later acquired in 2015 by PayPal. Since the acquisition, Xoom has continued to thrive as a separate service under the PayPal family.

The service lets customers transfer funds and pay bills easily and affordably for more than 1.5 million users across the globe. Xoom has made international money transfers easier and safer to do.

Xoom is ideal for sending quick cash to friends and family members abroad, paying bills, and topping up your phone card balance – all at a fraction of traditional bank transfer costs. Xoom supports more than 90 currencies and offers competitive exchange rates that keep your funds competitive.

Download App on Google Play Store

Download App on Apple App Store

Remitly Vs Xoom: A Detailed Comparision

Transfer Fees:-

When comparing the cost of transfer services, you need to take into consideration transfer fees. The given table will help us to compare the fee structures of two of the most popular international money transfer service providers — Remitly vs Xoom so that we can make an informed decision and understand which one is better.

Remitly:- Remitly’s delivery fee depends on your transfer destination, size of the transfer, and your delivery method. For example, if you’re sending money from the United States to Argentina, you’ll pay a flat fee of $0.49 for Economy Delivery.

For Express Delivery, you’ll pay a fee depending on the amount you’re sending: anywhere from $2.99 to $14.99. Remitly’s fee structure is simple to understand — they charge a dollar-based rate for each transaction and bundled fees for sending money.

If you send money once a week, it’ll cost you $19. If you send it twice a month, it’ll cost $10. Either way, you know exactly how much you’re spending with Remitly before you make the transfer.

Remitly also offers discounts to new users who send more than $500 in their first month. The transfer fees may change without notice, but you can always refer to their website for the latest information.

Xoom:- Xoom offers competitive transfer fees for transfers to an extensive list of countries — regardless of the destination, bank method, or card type, you can expect no more than $5 in fees.

Bank transfers are charged at a flat $3.99, while payments via PayPal balance cost $2.99 per transaction. Any other payment method costs $5 per transaction; however, the amount will be capped at $10. Xoom requires a $25 transfer fee. Check their website for the latest details on both.

Decision

While Xoom offers a lower fee per transfer, Remitly offers exclusive discounts and promo codes that help users save big on their transfers.

Remitly also has an excellent program for frequent transfers: each additional transfer pays only a small fee. If you are looking to make more than three or four transfers each month, Remitly is a much better option.

Easy Usage:-

A user-Friendly services platform is the need of the hour. Both Remitly and Xoom are expected to provide a great user experience.

Remitly:- It has become easier than ever to send money to loved ones with the help of platforms like Remitly.

With features like instant purchase, flexible payout channels, and real-time transaction updates, the company offers an intuitive user experience that makes it easy to do business with them. Just enter the amount, the recipient’s information, the sender’s details, and a payment method — and you’re on your way!

Xoom:- Xoom is easy to use and straightforward, with a clean dashboard that makes it simple to oversee your account and transfer money.

Decision

The decision of Remitly vs Xoom throws out both as winners in their respective spaces. They offer easy-to-use platforms that customers can log into and set up an account in a matter of minutes — no questions asked or prior experience needed.

Exchange Rates:-

Any international transfer through most platforms attracts an above the mid-market rate margin to convert your currency when you make an international transfer.

So what are your choices? There’s a growing number of digital money transfer services such as Xoom and Remitly. But comparing these popular payment services can be complicated — there’s a wide variety of fees, rates, and currencies to consider.

Remitly: Remitly charges a small fee between 0.4% and 3.0% on top of the amount you transfer. When sending Indian rupees, its Express Delivery option will set you back 0.87%, while its Economy Delivery will cost you 0.42%.

Xoom: Xoom charges a margin for international transfers. The higher the amount you spend, the less margin you pay per unit.

Decision:-

The decision of Remitly vs Xoom gives out the two best mobile money transfer services for customers who regularly transfer larger amounts of money across borders.

Both brands have competitive rates at higher transfer amounts ($250+) and charge no transfer fees. However, Remitly has a leg up with its 1% flat fee on all money transfers at a low exchange rate when it comes to pricing.

Service and Coverage:-

Let’s check out the best Coverage and Service between Remitly vs Xoom.

Remitly:- Remitly supports money transfers for more than 60 currencies into more than 100 countries. Remitly sends money internationally in more than 17 languages.

They also help users send cash to family and friends with a few clicks. Bank transfer and mobile wallet are great if you want to send a recipient money from your account or smartphone.

However, cash pick-up and home delivery are better for recipients who might prefer to receive their money as cash.

Xoom:- Xoom lets you transfer money to more than 157 countries from the US, Canada, and Europe. Its over 150,000 agent locations offer an easy, convenient way for anyone to receive funds from abroad.

Despite being a global solution, Xoom supports only four currencies: CAD, EUR, GBP, and USD. Xoom allows customers to send money to friends and family internationally at competitive exchange rates.

There are three delivery methods: bank deposit, cash pick-up, or direct home delivery via courier. Cash pick-ups can be arranged in any currency at a nearby Western Union agent location.

Users also can pay international bills and reload prepaid mobile phones. Xoom sends an SMS notification when money has arrived and alerts both customer and recipient via email of the transfer’s progress.

Decision:-

In this services and coverage section, the debate of Remitly vs Xoom Is interesting. Xoom is better suited for international payments, while Remitly is better suited for domestic payments.

The former supports over 60 currencies and 4 delivery options, while the latter supports 25 currencies and only 3 delivery options. Xoom works best for individuals that are sending money across borders, while Remitly works best for individuals sending money just around town.

Xoom and Remitly offer their services for international money transfers, but they differ in several ways. In the service category “Local Money Transfer,” Xoom wins with over 150 supported countries, while Remitly covers only 99.

Both services support popular languages, like Spanish, Hindi, Arabic, Hebrew, and Tagalog — but Xoom’s translation service is better: it covers 15 languages to Remitly 11. So, there’s a stalemate in this section.

Payment Options:-

Remitly vs Xoom: The payment options for both services.

Remitly:- Remitly has an expansive list of payment methods: credit cards, debit cards, and bank accounts. Using a credit card will affect the delivery time — it takes two business days to complete a transaction.

If you use a bank account, your money is debited right away. However, extra fees might be attached to the transaction if you’re sending money internationally using a bank account.

Xoom:- Xoom makes it easy to accept payments online, but you can do even more than that. Accept all major payment methods on your website — from credit and debit cards to bank accounts, PayPal, and even cash-on-delivery.

Xoom’s fast and secure API gives you complete control over your payments with the ability to customize or limit payments as you see fit.

Decision

Xoom supports all the payment methods offered by Remitly: Interac e-Transfer, bank transfer, PayPal, and cash pick-up.

Customer Satisfaction:-

Remitly vs Xoom debate is incomplete without understanding their respective Customer satisfaction.

Remitly:- Remitly received over 21 million page views from users in the US, Canada, and India during the past three months. The majority of people landed on the site via organic search (about 67%), with referrals responsible for a further 21%.

Remitly also has a high average time on site; that’s how they make money. Remitly has earned a reputation among its users for excellence in customer service. That’s why no surprise the service is used by many customers.

Xoom:- Xoom’s visitor engagement numbers are impressive. The global money transfer service has garnered over 36 million visits in the past four months — but they need to delve deeper if they want to understand the quality of those interactions and how the company can use that information to improve its own conversion rate.

As technology keeps changing, the methods brands use to keep users engaged must change as well.

Decision:-

Xoom’s engagement numbers are jaw-dropping and here it becomes the winner. The company knows how to convert its users into loyal fans.

Their average number of messages sent and received per month is approximately 40,000, which speaks to a deep level of engagement. This level of communication via messaging apps is unheard of in today’s business landscape.

Security:-

Remitly:- Remitly is a money-transfer service aimed at helping people send cash to their friends and family in other countries. They’re one of the fastest ways to transfer funds around the world without the hassle and expense of standard bank transfers.

Apart from offering competitive fees, they also provide 24/7 customer support and a fast, easy transaction process. Remitly maintains a high level of security, trust, and protection with an effective verification procedure.

It allows you to create unique passwords for each account to prevent unauthorized access while providing support for those who wish to report any suspicious activities taking place on their accounts.

Xoom:- Xoom provides the financial industry’s highest level of data transfer security. With secured networks, encrypted servers, and a team of highly trained staff behind all transfers, your money is in capable hands.

Xoom data centers are stored in an all-electronic environment with biometric access controls, electronic intrusion detection, video monitoring, and social media monitoring.

Decision:-

Xoom and Remitly are both great platforms where you can find the best cash transfer services with the highest level of data transfer security. They’re both winners; you just need to be looking for something specific to make the final call.

Customer Support:-

Remitly:- Remitly’s support team is available to assist you during designated business hours by phone or via chat. In addition, Remitly offers a comprehensive support library and 24/7 email support.

One of the best aspects about Remitly’s customer service is that it’s available in 11 languages — demonstrating the company’s commitment to connecting with people from around the world.

Xoom:- Xoom’s live chat support is one of its key customer service strengths. Agents are available at any time via email or live chat to help with any problems or questions you might have. They also provide customers with guides and FAQs to help them get started using the Xoom service.

Decision:-

For this reason, Remitly’s online customer service is better than Xoom, with live chat support, a comprehensive knowledge base, and complete language support.

Mobile App:-

Remitly:- Remitly’s apps provide an excellent way to transfer money using your mobile phone. The easy-to-use platform allows you to transfer money to someone who has never used a Remitly transaction before — whether they’re across the street or on the other side of the world.

The apps boast over 360,000 downloads and an app store rating of 4.8 out of 5 stars. Remitly’s Android app got about 9.4 percent of its download traffic in November from referrals — a number that could be improved by focusing on the positive experiences its users are having with the app.

Xoom:- Xoom has impressive numbers — over 718 iPhone users rate the app 4.8/5, over 5 million Android users have downloaded the application, and over 111,300 Google Play users have rated it 4.7.

The app is simple to use, a breath of fresh air for anyone who dreads long banking sites or slow customer service calls. Xoom makes international money transfers as easy as sending an email.

Xoom’s referral program has been so successful because it gives real value to users. When a user refers to a friend, that friend gets free internet for one year.

Both the referrer and the new user can get up to one gigabyte of mobile data every month from Xoom for the next 12 months, too. This has helped Xoom grow to more than 1 million users in less than half a year.

Decision:-

When it comes to cross-border money transfers, Xoom is the undisputed champion: since January 2016, no other service has been able to match its extraordinary performance.

Xoom is always at the top of the list regardless of how you measure it — by most transactions, by most revenue, or by most customer feedback.

Remitly vs Xoom – Advantages

| Xoom | Remitly |

| Xoom transfer fees are reasonable | Remitly simplifies cross-border payments, allowing users to send money to family and friends in over 70 countries at competitive fees. |

| Xoom provides email support | They provide 24/7 live chat support. |

| Xoom users can top up the phone credit of their loved ones from their website. The brand also allows customers to pay their bills directly from the same page. | Remitly’s exchange rates are as good as its SMS notifications, which enable users to track their transfers. |

| It has an extensive coverage area | For successful referrals remitly offers a $20 reward |

| Users can send up to 100,000 $ with Xoom | The service supports over 60 currencies for its users, all of which can be saved in the wallet. In addition, the service also has various promotions and incentives to help users save more money. |

| Xoom sends notifications to both the sender and the receiver when the money is transferred; it also allows users to track their transfers in real-time. | Free transfers are offered for limited countries |

Remitly vs Xoom – Disadvantages

| Xoom | Remitly |

| It has only 3 delivery options | Its limit is only $60,000 |

| It supports only 4 currencies and does not offer any free transfers or discounts | Transfer fees are expensive |

| It does not support live Chat | Cannot pay bills with Remitly or reload phones |

Conclusion

Xoom and Remitly are two great digital tools to send money overseas. Xoom has clear advantages in the tech sphere, with a focus on ease-of-use and a choice of delivery methods — cash pick-up, deposit to bank account, or mobile wallet.

Remitly is cheaper than Xoom but only available as a mobile app (which might not be suitable for all users). Xoom offers services in addition to money transfers, such as phone reloads, utility bill payments, and more.

However, when it comes to coverage area, Remitly is the most extensive. When you’ve got a need to send money, using Xoom or Remitly both are a great choice!

Thus the discourse of Remitly Vs Xoom clearly shows that there are distinct advantages to using both platforms and therefore it falls upon the user to make the right choice for themselves.