The online industry has experienced a sudden boom in recent years. Today, every consumer market is shifting online due to its numerous benefits. Hence, the previous payment methods, like writing a cheque or taking money from the bank, have become outdated.

Due to this, many people are shifting to online payment methods, free from any mess. Even the other financial transactions like shopping or paying bills are taking place online nowadays. It is essential to have a source that provides a gateway for the payment for completing the online payment.

Skrill is one of the most famous names when it comes to online payments. It is a platform that allows the users to make transactions without the need of cheque or bank transfers.

All you need to have is an account on Skrill on both the sender’s and receiver’s end for making transactions. However, it is a fact that nothing is perfect in this world. Skrill also has some disadvantages, like the other money transfer companies.

It charges high transaction fees from the customers. Hence, many people are looking for suitable Skrill alternatives that can provide better results.

Many companies on the internet claim themselves as the best Skrill alternatives. However, most of them don’t provide the proper features for making online payments. Therefore, it can be challenging for users to find the best alternative for Skrill.

In this article, we have provided the best online transaction companies that can act as the best Skrill alternatives. We have also given the features of the below services to help you select the best one. Hence, you must not miss reading this article until the last.

Best Skrill Alternatives For Money Transfer 👌

1. Payoneer

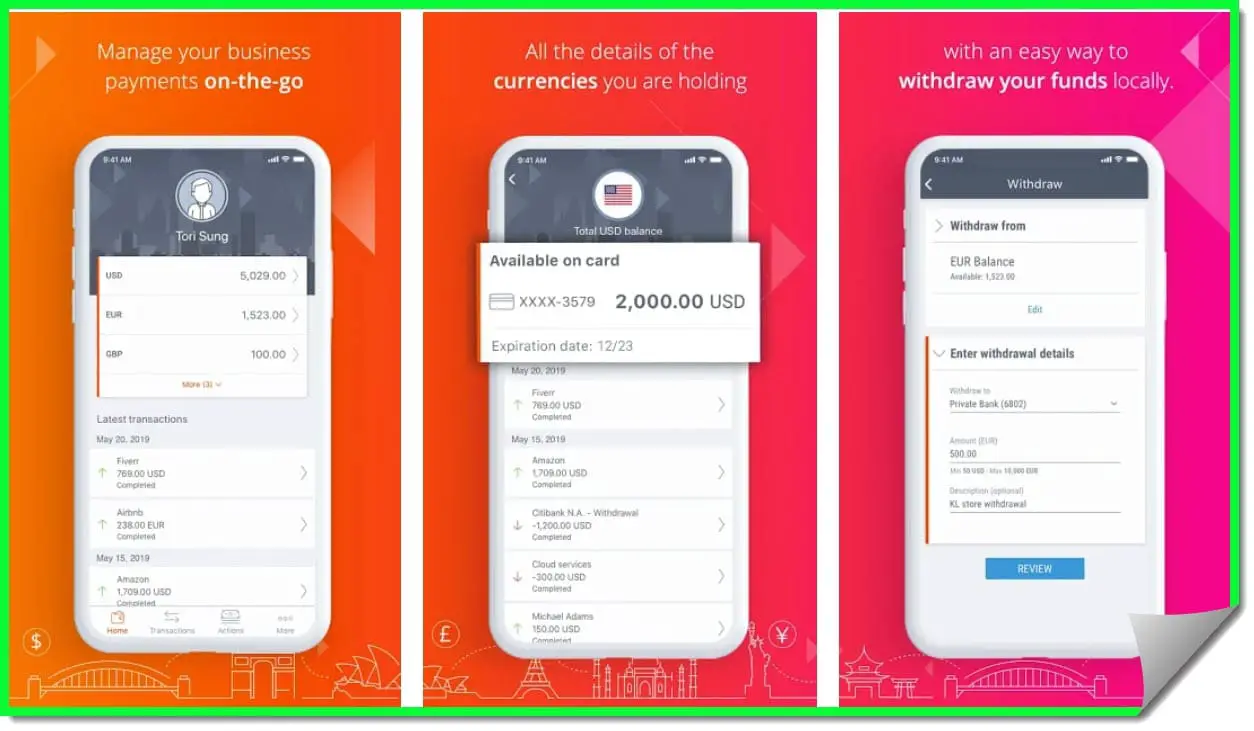

If you are a freelancer or professional who wants to receive money from other countries, Payoneer (Signup Here) can be an excellent option. This online payment system operates in more than 200 countries in the world.

Hence, it allows you to transfer money to almost any part of the world. Even the big corporations of the world, including Gettyimages and Upwork, trust this company.

It provides many services by which users can receive funds from different countries with ease. This platform uses a peer-to-peer system to ensure the safety of the users.

The best thing about Payoneer is that it provides free receiving account details in various currencies, including USD, EUR, and AUD. Hence, it gives the ability to bank like locals for the customers.

It also includes two-factor authentication that ensures proper safety from any kind of fraud. Payoneer also provides a reloadable credit card for individuals. Users can use it at any place when required. The billing service is another incredible feature of this payment system. It lets the users set up requests for payment from customers.

Payoneer also has a relationship with many freelancing sites that makes it excellent for freelancers. It has various services for individuals as well as businesses.

Transfer fees and commission of Payoneer depend on many different factors. It includes your location and the currency you are using for transactions.

Pros:-

- Payoneer is a popular payment system that is available in around 200 countries.

- It can process transactions in more than 100 different currencies. Hence, you can easily use overseas payments.

- It provides payment services for individuals as well as businesses.

- This payment system uses two-way authentication to ensure the safety of the users.

- It provides a prepaid credit card that is easy to use anywhere.

Cons:-

- It has a variety of fee levels that can vary due to different factors.

- The fee of the credit card can be high for some individuals.

If you want to try this Skrill alternative, then you can start using it here.

2. Wise ( Formerly TransferWise)

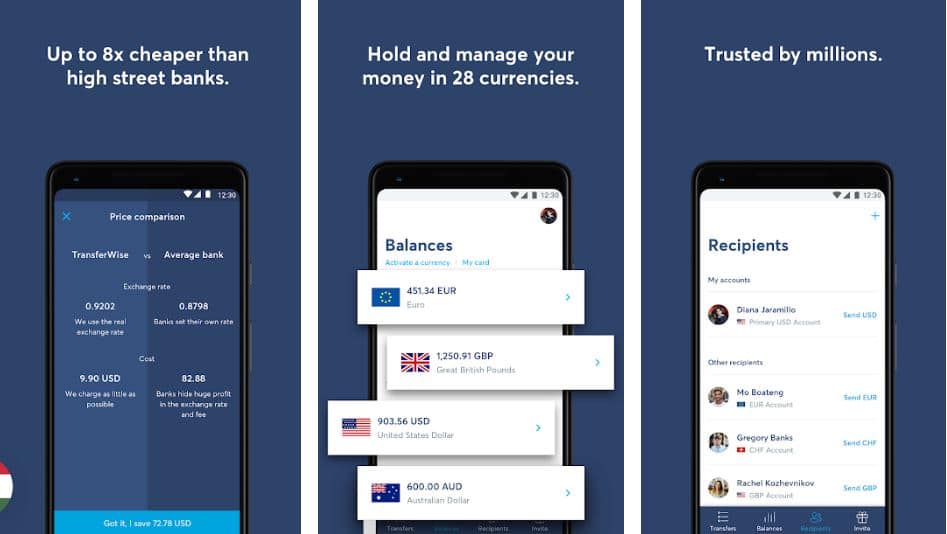

Whether you are a business or an individual, you can’t ignore Transferwise (Signup Here) when it comes to online payment systems. It provides international bank transfers at very low prices and great exchanges.

This online payment system offers excellent services to individuals as well as businesses. It uses a peer-to-peer system that makes it stand out in the crowd. Hence, the processing speed of transactions via TransferWise is much faster than many other payment systems.

TransferWise also allows customers to open borderless accounts. It helps individuals or businesses to save money when trading in 15 different currencies.

You can also use it to receive payments for personal use as it doesn’t contain any minimum transfer limit. The best thing about this online payment system is that it allows you to make transactions through credit cards.

TransferWise has offices in various countries, including the UK, Australia, Japan, the US, Singapore, etc. Moreover, its website is available in different languages like French, Dutch, Italian, etc. Hence, it can provide an excellent service experience to the customers. It also allows the users to sign up with Google or Facebook accounts.

Pros:-

- TransferWise is a digital bank that provides international bank transfers at low prices as compared to Skrill.

- It allows users to sign up as individuals or businesses.

- Users can also sign up using Facebook or Google accounts.

- It uses a peer-to-peer system and has no minimum transfer limit, which makes it great for personal use.

- The processing speed of TransferWise is much faster than many other online payment systems.

- It allows the users to make transactions through the debit card.

Cons:-

- It only allows customers to transfer money to bank accounts.

- The cost of transfer may vary due to different factors, including destinations, currency, etc.

- The individuals who want to try this online payment system can start it here.

3. Paypal

Paypal is one of the most used third-party payment providers in the world. It has numerous features that make it an excellent Skrill alternatives. It lets the users make online transactions without the requirements of bank transfer or cheque.

Whether you are a retailer or a consumer, Paypal has something unique to offer to all its users. Paypal has more than 100 million active accounts that can work in more than 200 markets.

Paypal allows the users to make the transaction through Paypal balance as well as a linked bank account. It also lets you use international debits and credit cards for making transactions, including MasterCard.

This online payment system uses a high level of encryption to prevent any fraud. Paypal allows the customers to create and send invoices directly through the account to avoid any mess. The best thing about this online payment system is that it is easy to set up and use.

Paypal also lets the users set recurring payments for their customers. You can also integrate with many shopping cart systems that make it excellent for online shopping. It also keeps the record of your transactions to make your business less stressful.

You can access Paypal in many different languages, including English, Chinese, Japanese, Spanish, etc. It charges around 2.9 percent, along with some extra charges while receiving money.

Pros:-

- Paypal is easy to set up and use as well.

- It allows the users to send or receive money anytime at any place.

- This online payment system uses a high level of encryption to ensure the safety of the users.

- The Paypal website is available in many different languages.

- It keeps the data of the transactions that make the business stress-free.

- It has many active users all over the world. Hence, you can transfer money to almost any part of the world using Paypal.

- Users can link their debit card, credit card or even their bank account to Paypal for making transactions.

- It has excellent customer support available in different languages.

Cons:-

- The charge of Paypal can be high, which makes it unsuitable for small businesses.

- Paypal can sometimes hold the payment under review.

- It is not available in some countries, including Bangladesh, Pakistan, etc.

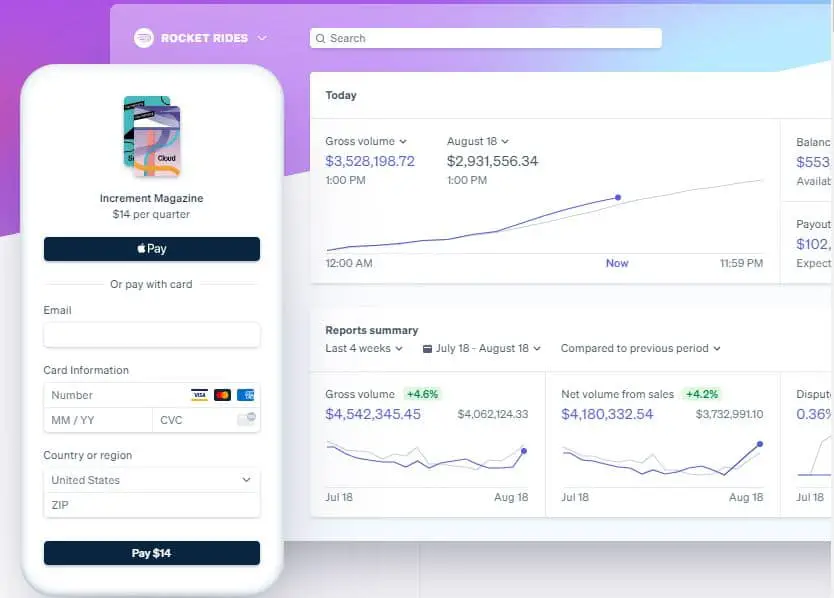

4. Stripe

If you are looking for a simple way to accept payment from customers, Stripe can be an effective option. It can be a great Skrill alternatives for the people in the US as well as the Canada-based countries.

This online payment system is entirely transparent and provides the best solutions to online businesses. The best thing about Stripe is that it lets users use a variety of payment methods. It includes cards including MasterCard, Visa, American Express, and many others.

Stripe is easy to set up that allows users to create an account in minutes. This online payment system can process payments in more than 100 currencies. Stripe will charge 2.9 percent plus 30 cents as commission for every successful transaction.

There is no additional fee to set up the Stripe account. It comes with many integration options that make it highly customizable.

Stripe ensures the safety of the customers by using high levels of encryption. It can work in around 19 countries, including the US and Canada.

Hence, you can use it easily to make international payments even with a few touches. Stripe also supports numerous payment options, including Bitcoin, Android Pay, Apple Pay, and even ECT and EHT transfers.

Pros:-

- Stripe is simple to set up and use, making it excellent for people with less technical knowledge.

- Stripe doesn’t charge any additional or hidden fees for account setup or maintenance.

- It is highly customizable due to the presence of many integration options.

- It can process payments in more than 100 currencies that make it excellent for international transactions.

- The advanced methods used by this payment processing platform ensure the proper safety of the customers.

- It has flat-rate fees for any kind of transaction.

Cons:-

- It is available only in the US and Canada-based countries.

- It is not great for personal payments due to its high charges.

The individuals who want to try this effective online payment system can check it here.

5. Dwolla

Dwolla is another excellent alternative to Skrill that allows you to send money to anyone. This online payment system is very similar to Paypal. However, it doesn’t offer card processing solutions like Paypal.

It lets the users make transactions by linking their bank account. The objective of Dwolla is to help everyone to send money at the lowest possible prices. Hence, the cost of transactions using Dwolla is very low as compared to its competitors, including Skrill.

Dwolla doesn’t charge any processing fees below transactions of $10. Therefore, it can be excellent for small businesses. Unlike other online payment systems, Dwolla charges flat $0.25 above transactions of $10.

It makes this source impressive for companies as well as individuals. It also specializes in ACH bank transfers that make it an excellent Skrill alternatives. Therefore, the bank transfer will not be messy using this payment system.

Dwolla Masspay is one of the most impressive features of this payment system. It allows users to make thousands of payments at a time. Earlier, it was also a popular source for Bitcoin exchanges.

However, the company stopped using Bitcoins in Oct 2013 due to some reason. Dwolla also has apps for Android as well as IOS apps that make it more user-friendly.

Pros:-

- Dwolla is easy to set up and use due to its user-friendly interface.

- It specializes in ACH bank transfers, which allow users to make bank transfers with ease.

- It includes a Masspay option by which users can automate mass payouts.

- This online payment system doesn’t charge any processing fee for payments below $10. The processing fee above $10 is flat $0.25, which is lower than most of the payment systems.

- It only asks for an email address and phone number, which reduces the chances of theft or fraud.

Cons:-

- The acceptance of Dwolla is low as compared to Skrill and Paypal.

- It doesn’t allow users to link credit or debit cards.

- It is available only for people living in the US.

6. 2Checkout

If you are a merchant who has to accept payments from all across the globe, then 2Checkout can be the right Skrill alternatives for you. It allows the merchant to receive payment in 87 currencies.

2Checkout has awesome receives for merchants as well as receivers. It has more than 50,000 active accounts that prove that this payment system provides reliable services to users.

The best thing about 2Checkout is that it doesn’t charge any monthly or setup fees. Hence, it can be great for small merchants or businesses. The PCI Data Security Standard of 2Checkout is Level 1 certified, ensuring merchants’ security and customers’ security.

Users can also integrate this online payment platform to a variety of shopping carts, including the popular ones like Shopify.

2Checkout supports multiple payment methods, including MasterCard, Paypal, Visa, JCB etc. It also lets the users set the recurring payments if required.

This online payment system is available in 15 languages that make it more accessible for people of many countries. The payment charges of 2Checkout are 2.9 percent plus $0.30 for the US people. However, it can vary if the user lives in any other location than the US.

Pros:-

- 2Checkout is easy to use and doesn’t charge any monthly or maintenance fees.

- It allows the users to use various payment methods for making transactions, including credit cards, Debit card,s and Paypal.

- It is available in 15 languages and 87 currencies.

- 2Checkout uses advanced fraud protection methods to ensure the complete security of the users.

- Users can integrate 2Checkout in more than 100 online carts, including Shopify, e-commerce, etc.

- It lets the users set up recurring payments, which makes it excellent for people looking to automate their businesses.

Cons:-

- It charges high fees from users outside the US.

- It doesn’t allow the direct transfer of funds between the users.

7. WePay

WePay is an excellent online payment system that offers numerous unique services to its customers. This card processing system uses an API-based technology that makes it stand out in the crowd.

Unlike other payment systems, WePay allows the users to set up a way to receive payments directly from your website. Even your customers need not to leave your site for making payments. Hence, it can be excellent for individuals who are running an online business.

WePay supports most of the international cards that allow users to use it as a great Skrill alternatives. The best thing about this online system is that it doesn’t contain any hidden fees.

It will charge a fee of 2.9 percent plus $0.30 if you process your payment with a card. The bank transfers through WePay are much cheaper than many other online payments systems. It will charge only 1 percent plus $0.30 for ACH bank transfer.

No online payment system is comparable to Wepay when it comes to online crowdfunding. All the features of this API-based payment system make it highly optimized for this kind of payment. It is also ideal for small businesses, software, and the marketplace.

Pros:-

- WePay uses API-based technology, which makes it user-friendly.

- It lets the users set up the account easily in minutes with just a few clicks.

- It supports various payment methods, including cards and bank transfers.

- The commission charges for the transactions via bank transfers through WePay are very low.

- It doesn’t charge any setup or monthly fees.

- It allows the users to set up the payment method by which customers can pay even without leaving the website of the users.

- It allows the users to make payments via most international cards.

Cons:-

- It doesn’t allow the users to pay through Paypal.

- The charge for making the transactions through cards is high.

The individuals who want to try this impressive payment system can start using it here.

8. Square

It is impossible to ignore Square when it comes to the best alternatives to Skrill. Square not only works as a payment processor but also provides many other services to the users.

The card reader provided by this online payment processing system can work in Android, iPhone, and even iPad. You can use this free card reader anywhere for processing your payments with a few simple clicks of your smartphone.

This Skrill alternatives has a user-friendly interface that doesn’t require much technical knowledge. It also lets the users create an online store that makes it unique from other payment systems.

Square supports numerous types of payment methods, including Visa, MasterCard, American Express etc. It is accessible in many countries, including Canada, Australia, UK, US, and Japan.

Square also provides many services like shopping cart integrations and invoicing. It also offers many add-on solutions, including payroll and employee management. This online payment system charges flat fees of 2.75 percent for in-store card processing.

The invoicing payment charges of this platform are 2.9 percent plus $0.30, which is equal to Paypal’s processing fee. Users can also use the POS and mPOS integrations for free for card processing.

Pros:-

- Square is an all-in-one online payment solution that provides various services to users.

- It allows the users to make an online store and also provides a free domain.

- It supports various payment systems, including MasterCard, Visa, etc.

- This online payment system provides a free card reader that is easy to access on any smartphone.

- It doesn’t charge any maintenance fees or setup fees.

- It also comprises many add-on solutions like employee management and payroll.

Cons:-

- This online payment platform is accessible only in five countries that are Canada, Australia, the UK, the US, and Japan.

- It has lower acceptance than other popular online payment processing systems.

9. Payline

If you are a merchant looking to receive payments for your online store, Payline can be an excellent option. The interchange-plus pricing model used by Payline makes it attractive for businesses.

Hence, users have to pay the processing fees according to the type of card used for payment. Payline is much more flexible than many of the other payment processing systems, including Skrill. Therefore, it can act as a great Skrill alternatives for business owners.

Payline is more transparent than most of the other payment processors. It keeps the data of the previous transactions that you can check in a few clicks. It has a user-friendly interface that anyone can use easily.

This online payment system lets users choose the package that suits them best according to their business model. The Spark and Surge package offered by Payline also provides a card reader that is accessible in smartphones. Hence, it allows you to make payments through mobile with a few simple clicks.

Users can also make offline transactions with Payline. It has a fixed charge of 2.7 percent for offline transactions. Payline also charges monthly fees according to the package that you choose.

Pros:-

- Payline uses a plus pricing structure, which charges the fees according to the type of card used for payment.

- The transparent processing offered by Payline makes it excellent for big companies.

- It supports online payment by which you can make payments in a few simple clicks.

- The offline transaction fee of Payline is much cheaper than other online payment platforms.

- It consists of numerous packages that users can choose according to their requirements.

Cons:-

- It is only available in the US.

- There is no fixed fee of Payline, which can sometimes build confusion.

The individuals who want to try this online payment platform can start using it here.

10. TorFX

TorFX can be an excellent online payment system for individuals or businesses that have to globally send large sums of money. It is a company registered by the Finance Conduct authority that follows proper regulations for the processing of payments. Hence, security and trust will not be an issue for users using TorFX.

Many offices of TorFX are present worldwide to provide impressive services to the users. It allows users in most parts of the world as it deals in more than 60 currencies. TorFX doesn’t charge any hidden fee from the customers for making transactions.

However, the minimum transfer amount using TorFX is $200. Hence, it is not great for personal use. But if you want to pay huge sums of money in any country, then TorFX can be the right option for you.

The excellent service support provided by TorFX makes it apart from others. It has also received several awards due to its excellent customer support and service. The charge of money processing can vary according to your location, currency rates etc.

The interface of TorFX is also easy to use. Hence, people with less technical knowledge can also use TorFX without any issues.

Pros:-

- TorFX allows users to register as businesses or individuals.

- It provides excellent currency exchange rates as compared to its competitors, including Skrill.

- It has excellent customer support available through email and phone.

- After signing up in TorFX, it provides you with a dedicated account manager who will assist you in making transactions.

- It can process the money in more than 60 currencies.

- TorFX doesn’t charge any hidden fees for making transactions.

Cons:-

- Users can not use TorFX for amounts below $200.

- It doesn’t support any payment method other than bank transfer.

Individuals who want to try TorFX for making bank transfers can check it here.

11. WorldPay

WorldPay is an online payment processing system that can simplify your online transactions. It consists of various tools that allow users to make payments through multiple methods.

It includes debit cards, credit cards, and even offline methods like cheques. If you are looking for a payment method that allows your customers to pay through the mode that suits them best, WorldPay is the best option. Hence, you can spend more time expanding your business and services.

WorldPay has something unique for you, whether you are an individual or a business. It lets you make online transactions by integrating it with many sources, including Paypal and ApplePay.

Hence, it can be excellent for the people involved in the e-commerce business. WorldPay also offers excellent customer support that ensures a smooth customer experience. The friendly user interface of WorldPay helps users to receive payment without any mess.

WorldPay also supports offline card transactions due to which it is more accessible than other payment gateways. Other impressive features of this online payment system are ATM processing, POS system, and mobile payment function.

WorldPay doesn’t charge flat fees, unlike its other competitors. It charges a monthly amount depending on your transactions and average processing payments.

However, it is a fixed fee for offline transactions. Users have to pay 2.9 percent plus $0.30 for each offline payment made through WorldPay.

Pros:-

- WorldPay has an extensive payment network that is present all across the globe.

- The processing fee of the WorldPay is flexible, which depends on the transaction history and average monthly payments.

- It supports various payment methods, including credit and debit cards.

- Users can integrate WorldPay with other payment gateways like PayPal and ApplePay.

- It also supports offline transactions that make it apart from others.

- WorldPay uses advanced technology to prevent users from any frauds for ensuring complete safety.

- It provides 24/7 customer support that ensures a smooth user experience.

Cons:-

- It is essential to commit to a contract of three years for using WorldPay.

- Early service termination can cost you $295. Hence, it is not great for the people involved in small businesses.

If you want to try WorldPay for processing your transactions, you can start it here.

12. Selz

If you are a blogger or freelancer who sells services through the blog, then Selz can be a great option for you. It has many features that make it suitable for small businesses as well as merchants.

This payment gateway helps you to receive payment through numerous modes. Selz is the favorite choice for many bloggers and freelancers due to its multiple benefits and offerings.

It also allows users to sell their stuff through their social media pages. These features make it a great Skrill alternatives for bloggers and freelancers.

Selz allows users to create an online store in minutes. Users can also incorporate it into their existing e-commerce store with the help of plugins without any mess. It lets you transfer the received amount directly into the bank account or PayPal.

Selz can be an excellent payment gateway for growing merchants. It offers various different plans that users can choose according to their requirements. The fees charged by this online payment system depend on the selected pan.

The best thing about Selz is that you don’t require any contracts for using it. Hence, you can cancel the billing if you find the service of Selz helpful for your business. It also offers discounts if you pay the subscription fees yearly.

Pros:-

- Selz has a simple-to-use interface that doesn’t require much technical knowledge.

- Users can easily incorporate it into their online store using plugins.

- It can process transactions in numerous currencies all over the world.

- It lets the users transfer the received payments directly to the bank accounts.

- This payment gateway is excellent for bloggers and freelancers.

- It allows the users to sell the products even from the social media page.

- It helps you to keep track of every sale and transaction.

Cons:-

- It is not great for people to receive vast amounts of money.

- Selz is not available in many countries, including India, Pakistan, Vietnam, and many others.

Individuals who want to try this Skrill alternatives can check it here.

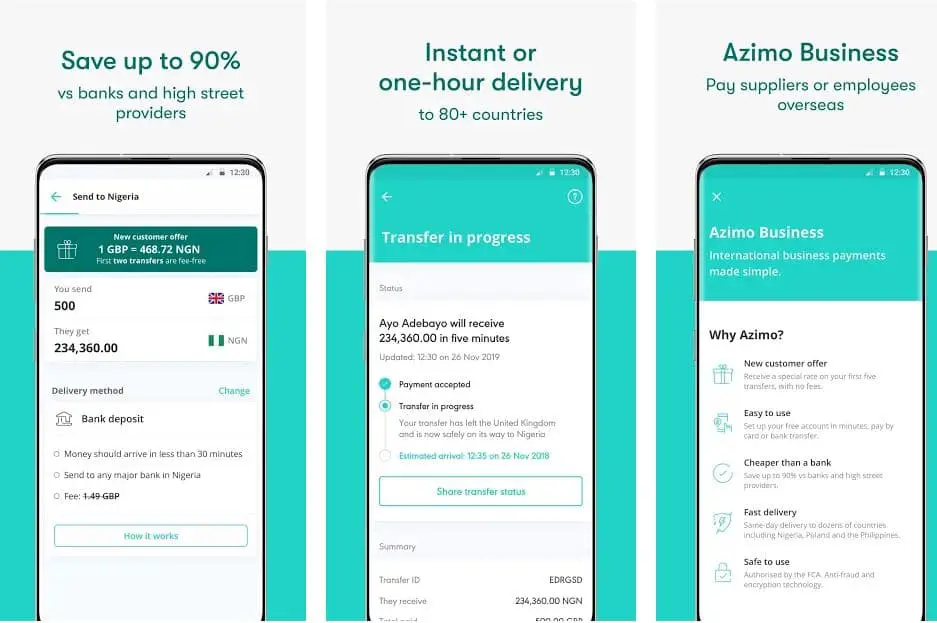

13. Azimo

If you are looking for a convenient online money transfer service platform, you cannot ignore Azimo. It is available in more than 200 countries due to which makes it more accessible than many other online payment systems.

The currency exchange rates offered by Azimo are much better than its competitors. Hence, it can be an excellent Skrill alternatives for people looking to send money overseas.

The transfer done by Azimo is fast and straightforward as compared to its competitors. The best thing about this online payment system is that there is no minimum limit of sending money.

Hence, users can easily use it to send small amounts of money to any part of the world. It is also great to send money to your friends or family for personal use. Azimo is really flexible when it comes to payment methods.

You can send money through Azimo with different payment methods, including debit cards, credit cards,s, and bank transfers.

Azimo can charge between 1-3 percent per transaction, depending on your payment method and currency exchange rates. It doesn’t have any hidden fees, unlike the other online money transfer services.

It is available in the form of websites as well as mobile applications. Its website is accessible in eight popular languages, including Italian, Spanish, English etc.

Pros:-

- Azimo is a great online money transfer service platform without any minimum limit amount. Hence, users can even use it to send $1 to anywhere in the world.

- It is available in more than 200 countries due to which it has a vast customer base.

- The fee charged by Azimo is 1-3 percent per transaction, which is much lesser than its competitors.

- Azimo supports various payment methods, including debit cards, credit cards,s, and bank transfers.

- It has a simple interface that allows users to process transactions in minutes.

- It is available in eight languages, including English, Spanish and Italian.

Cons:-

- It may take a few days to receive the money into the receiver’s bank account using Azimo.

- The customer support of Azimo is not available 24/7.

If you want to try an impressive online money transfer service of Azimo, you can start using it here.

14. PayOP

PayOP is one of the recognized online payment processing platforms in many parts of the world. It allows users to send and receive payments with ease. This online payment system has some incredible features for individuals as well as businesses.

This Skrill alternatives has a significant customer base due to its fast service. The best thing about PayOP is that it is available in more than 170 countries, including the developing ones. Hence, you can easily use this platform if you want to extend your business all over the world.

The interface offered by PayOp is easy to use. Another impressive feature of PayOp is that it can accept or send money through various methods, including bank transfers and Bitcoins.

It also supports various credit and debit cards, making it convenient for senders and receivers. PayOp also lets the users design their API, which makes it excellent for e-commerce store owners.

PayOp supports 200 currencies, which allow the users to make overseas payments easily. The fees charged by this online payment processing system depend on many factors, including location, currency, etc. PayOp uses different algorithms to keep its customers safe from fraud.

Pros:-

- PayOp offers a simple and easy-to-use interface to its users.

- It has a huge customer base due to its secure payments and fast service.

- This payment processing system uses advanced methods to ensure secure transactions.

- It lets users use different payment methods for sending or receiving money, including Bitcoin and bank transfers.

- It is available in 170 countries and supports around 200 currencies.

- PayOp lets the users customize the API, which they can easily incorporate into their online store.

Cons:-

- It doesn’t have good customer support.

- The fees charged by the PayOp can be high for various currencies.

If you want to try PayOp to send or receive money, you can start it here.

Final Words

Skrill is a great online payment processing platform to make online transactions. However, it has some downsides due to which many people are looking for its alternative. Many online payment platforms present on the internet are not reliable.

Hence, it is not easy to find the right Skrill alternatives that suit you best. In the above article, we have described the pros and cons of various alternatives to Skrill. From the above list, you can choose the one that suits you best according to your business model.