In today’s fast-paced world, managing finances can be a cumbersome task. Traditional banking services often fail to provide real-time access to funds, and unexpected expenses can leave you stranded between paychecks. This has led to a growing need for innovative solutions.

Klover, a financial app that offers advances on paychecks and other features, has been a go-to for many. But what if you’re seeking something different, whether it’s due to personal preferences or specific financial requirements that Klover may not fully cater to? The frustration builds as you realize that finding a reliable alternative isn’t as straightforward as it seems.

Look no further! Our comprehensive guide analyzes the top “Apps Like Klover,” exploring features, benefits, and usability to help you easily navigate your financial needs.

Whether searching for more budgeting tools, lower fees, or a different user experience, our detailed examination of Klover’s alternatives will guide you to the perfect fit.

Join us as we explore this vital space in financial technology, ensuring that your money management is efficient and tailored to your unique needs.

Why Look For Alternatives To Klover?

In financial innovation, Klover emerges as a distinctive platform, offering a slew of unparalleled features that cater to the evolving needs of modern investors.

Fueled by advanced algorithms, its smart portfolio customization mechanism optimizes investment allocations and tailors them to individual risk appetites. Klover’s intuitive AI-driven dashboard empowers users to monitor their investments in real-time, granting them unprecedented control over their financial journey.

However, even as Klover dazzles with ingenuity, a discerning eye must acknowledge certain potential limitations. The complexity of algorithmic decision-making might deter those seeking a simpler approach to investment.

Moreover, while Klover champions customization, lacking the human touch in investment advisory services might appeal less to investors valuing personal interaction.

General interest in diversifying financial tools: Amidst the rapidly shifting landscape of finance, a growing fervor for diversification has sparked interest in expanding the toolbox of financial instruments. Klover, as an embodiment of this trend, exemplifies how investors are embracing new-age technology to augment their portfolios.

The allure of spreading risk across diverse assets, from traditional stocks to digital assets like cryptocurrencies, has prompted a quest for versatile platforms like Klover that facilitate such expansion.

As we stand on the cusp of a financial future driven by innovation, Klover stands as a beacon of possibility. Its unique fusion of algorithmic prowess and personalized investing beckons to both the cautious traditionalist and the adventurous risk-taker.

Nevertheless, the road ahead for Klover must involve a delicate balance between technological sophistication and the human element, ensuring that even as it surges ahead, it doesn’t lose sight of the irreplaceable value of human connection.

In a world where financial landscapes are continually reshaped, Klover’s role as a pioneer underscores the importance of adaptability, innovation, and the perpetual quest to refine the art of investment.

Key Features To Consider in an Alternative App

The quest for the ideal investment platform is ceaseless in the financial technology landscape. As you explore alternatives to Klover, a discerning investor should meticulously evaluate key features that can make or break your financial journey.

Here, we delve into the critical aspects that demand your attention when seeking a robust Klover alternative app.

1. Customization Capabilities:- An ideal alternative to Klover should empower users with tailored portfolio customization. Look for platforms that offer a seamless interface to adjust your investment allocations to your risk tolerance and financial goals.

2. Comprehensive Data Analytics:- Unearth an app that doesn’t just present data but transforms it into actionable insights. Robust analytics tools should empower you to make informed decisions, harnessing real-time market data and predictive algorithms to your advantage.

3. Diverse Asset Selection:- While Klover may offer a range of assets, a noteworthy alternative should elevate this diversity. Seek platforms that extend beyond traditional stocks and bonds, offering access to alternative investments like real estate, commodities, and even emerging cryptocurrencies.

4. User-Centric Interface:- The user experience is paramount. Look for an app that boasts an intuitive, user-centric interface. Navigation should be effortless, and features should be accessible even to those less familiar with the intricacies of investing.

5. Robust Security Measures:- In an era of cyber threats, stringent security protocols cannot be compromised. Your chosen alternative app must exhibit advanced encryption, two-factor authentication, and regular security updates to safeguard sensitive financial information.

6. Seamless Integration with Financial Goals:- Investing should align with your life’s financial objectives. The alternative app should facilitate this alignment by offering tools to track and align your investments with short-term aspirations and long-term ambitions.

7. Educational Resources:- Beyond investing, an exceptional alternative should empower you with educational resources. Whether you’re a seasoned investor or a novice, access to expert insights, webinars, and learning modules can significantly enhance your investment acumen.

8. Customer Support:- Even with advanced technology, human support remains invaluable. Seek an alternative app with responsive customer support, ready to assist with any queries or concerns that may arise during your investment journey.

As you search for the perfect alternative to Klover, these key features stand as guiding lights. The investment landscape is ever-evolving, and with the right app, you can navigate it with confidence, innovation, and a strategic edge.

Review of The Best Similar Apps Like Klover

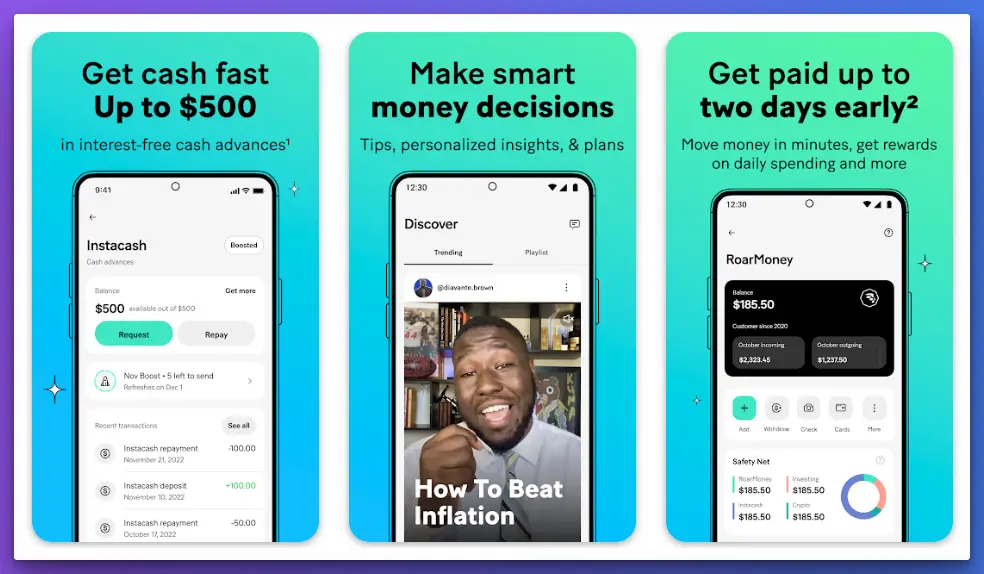

1. MoneyLion

In the dynamic financial technology landscape, obtaining quick cash can be pivotal in navigating unforeseen expenses. In this regard, MoneyLion emerges as a compelling contender, mirroring the attributes of Klover while presenting its unique features for obtaining rapid cash of up to $500.

Available for download on Google Play and the Apple App Store, MoneyLion is a potent alternative app that aligns with Klover‘s essence of facilitating swift financial solutions.

MoneyLion catalyzes obtaining quick cash up to $500, much like Klover. Its streamlined processes and user-friendly interface ensure users can access the required funds promptly and hassle-free.

While similar to Klover, MoneyLion offers its own set of unique attributes. The app’s features are finely tuned to cater to the modern user’s need for rapid access to smaller amounts. This emphasis on speed and convenience sets it apart in financial technology.

Moreover, MoneyLion extends its value beyond just an avenue for quick cash. It champions financial empowerment by offering tools and resources that foster better financial literacy. This holistic approach enhances users’ ability to make informed decisions despite unexpected financial challenges.

In pursuing apps like Klover to get cash fast up to $500, MoneyLion is undoubtedly a strong contender. Its commitment to accessibility, quick cash solutions, and financial education underscore its relevance in an era where financial agility is paramount.

As financial technology landscape continues to evolve, platforms like MoneyLion and Klover exemplify the fusion of innovation and empowerment, reshaping how individuals approach their financial needs.

Pros:-

Swift Access: MoneyLion shines in its quick access to cash up to $500. The streamlined process ensures that users can secure funds promptly when faced with urgent expenses.

User-Centric Interface: The app’s user-friendly interface ensures that both tech-savvy users and those less familiar with financial apps can easily navigate its features.

Financial Education: MoneyLion offers educational resources alongside quick cash solutions. Users gain valuable insights and tools to improve their financial literacy and decision-making skills.

Personalization: MoneyLion’s features are tailored to address the need for smaller, short-term cash advances. This focus on personalized solutions aligns with the specific financial challenges users might encounter.

Cons:-

Limited Loan Amount: While ideal for smaller expenses, MoneyLion’s cap at $500 might not suffice for larger, unexpected financial emergencies.

Availability: MoneyLion’s services might not be available in all locations, limiting accessibility for some users seeking quick cash.

In obtaining quick cash up to $500, MoneyLion and Klover present viable solutions. MoneyLion’s emphasis on financial education and personalized solutions appeals to those seeking more than immediate funds, while Klover’s wider availability might suit users seeking accessibility. Ultimately, the choice between these platforms rests on individual financial circumstances and preferences.

Download The App From Google Play Store

Download The App From Apple App Store

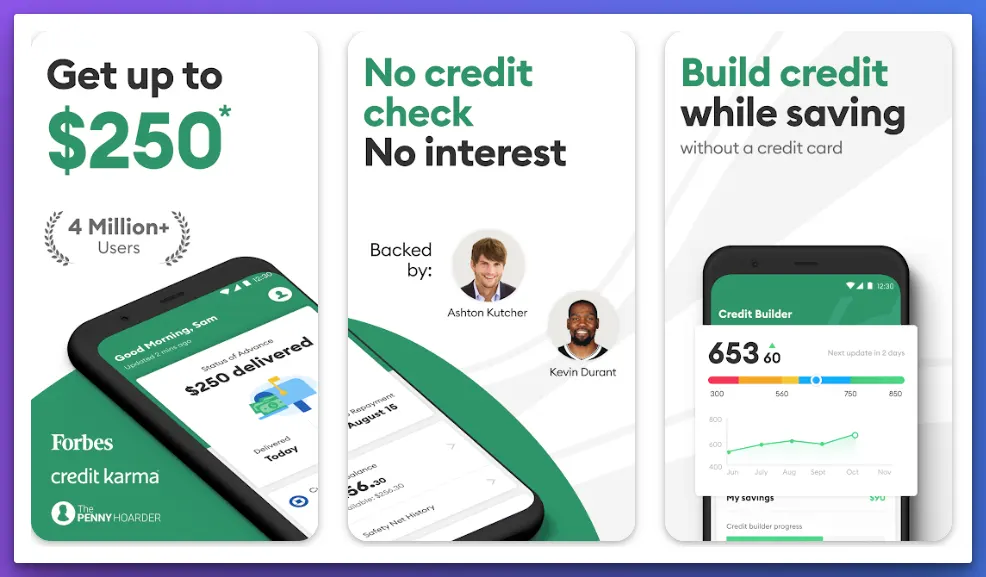

2. Brigit: Get $250 Cash Advance

In financial technology, where immediate financial solutions are paramount, finding an app that provides rapid cash access is a critical quest. Much like the renowned Klover, Brigit emerges as a prominent alternative, delivering quick cash solutions of up to $250 while offering unique attributes.

Accessible on Google Play and the Apple App Store, Brigit positions itself as a parallel player to Klover in addressing the immediate financial needs of users.

Brigit serves as a reliable solution for securing swift cash up to $250, reminiscent of the offerings provided by Klover. Its simplified application process and user-centric interface ensure users can access the necessary funds promptly.

However, Brigit stands on its own merits as well. The app caters to individuals seeking smaller-scale financial assistance, similar to Klover. This focus on providing quick solutions for immediate needs aligns with the modern user’s requirements.

Beyond the realm of quick cash, Brigit introduces a unique financial dimension. It offers insights into users’ financial situations, imparting guidance and recommendations to help individuals manage their finances more efficiently.

In the category of apps like Klover, Brigit occupies a prominent position as a reliable contender. Its accessibility, prompt solutions, and commitment to financial well-being make it an appealing choice for those needing immediate financial support.

As the landscape of financial technology continues to evolve, platforms like Brigit and Klover illustrate the convergence of innovation, accessibility, and empowerment in addressing the pressing financial needs of today’s users.

Pros:-

Quick Cash Access: Brigit provides rapid access to up to $250. Its streamlined process ensures users can secure funds swiftly for unforeseen expenses.

User-Centric Interface: Similar to Klover, Brigit boasts a user-friendly interface designed to make navigation and use accessible to all users, regardless of their familiarity with financial apps.

Financial Insights: Beyond quick cash, Brigit offers insights into users’ financial health, enabling individuals to make informed decisions and better manage their finances.

Cons:-

Loan Limit: While suitable for smaller-scale financial needs, Brigit may not be adequate for individuals requiring more substantial financial assistance beyond $250.

Limited Availability: Brigit’s accessibility might be restricted based on geographical location, limiting its usability for certain users.

In the realm of obtaining quick cash up to $250, both Brigit and Klover offer viable solutions. While Brigit emphasizes financial insights, Klover stands out for its accessibility and versatility.

The choice between these platforms depends on individual financial needs and preferences, as each app strives to provide efficient and timely solutions to address the immediate financial challenges of users.

Download The App From Google Play Store

Download The App From Apple App Store

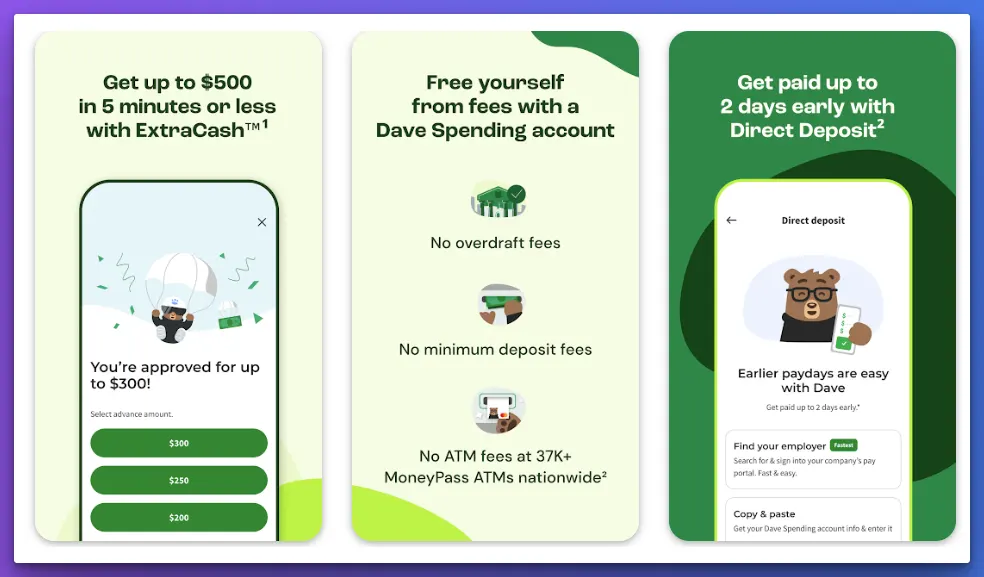

3. Dave – Banking & Cash Advance

Securing rapid cash for unforeseen expenses has become necessary in the ever-evolving realm of financial technology. Enter Dave, a compelling app like Klover that allows individuals to access up to $500 easily.

Let’s delve into how Dave aligns with the essence of Klover, while presenting its unique approach to providing efficient financial solutions. Accessible on both Apple App Store and Google Play, Dave emerges as a parallel contender to Klover, catering to individuals seeking quick access to funds.

Dave serves as a dependable avenue for obtaining swift cash up to $500, akin to the offerings of Klover. Its streamlined application process and user-centric design ensure users can secure the necessary funds without hassle.

Like Klover, Dave emphasizes its commitment to assisting users in financial need. The app’s focus on providing up to $500 aligns with the modern user’s requirement for a convenient and efficient solution.

Beyond rapid cash solutions, Dave introduces its unique features. It offers tools that help users predict upcoming expenses, ensuring better financial management and planning.

Dave establishes itself as a notable player in the spectrum of apps like klover that cater to obtaining swift cash up to $500. Its accessibility, swift solutions, and tools for financial foresight make it a compelling choice for those requiring timely financial support.

As the landscape of financial technology continues to evolve, platforms like Dave and Klover showcase the convergence of innovation, convenience, and empowerment in addressing the diverse financial needs of modern individuals.

Pros:-

Swift Cash Access: Dave excels in providing quick access to up to $500, aligning with the essence of Klover. Its streamlined process ensures users can secure funds promptly for unforeseen expenses.

Low Fees: Dave prides itself on its low-cost model, often waiving fees or offering membership at a nominal cost, making it an appealing option for those seeking quick cash without high associated costs.

Financial Planning: Beyond quick cash, Dave introduces users to tools that predict upcoming expenses, helping users better manage their finances and avoid financial stress.

Cons:-

Membership Fee: While many features of Dave are cost-effective, its membership fee might not be suitable for users seeking quick, fee-free cash advances.

Limited Availability: Dave might not be accessible in all locations, limiting its availability for some users seeking quick cash solutions.

In the quest for quick cash up to $500, both Dave and Klover provide viable solutions. While Dave emphasizes its low-cost approach and financial planning tools, Klover stands out for its accessibility and versatility.

The choice between these platforms depends on individual financial needs and preferences, as each app seeks to provide efficient and timely solutions to address the immediate financial challenges users face.

Download The App From Google Play Store

Download The App From Apple App Store

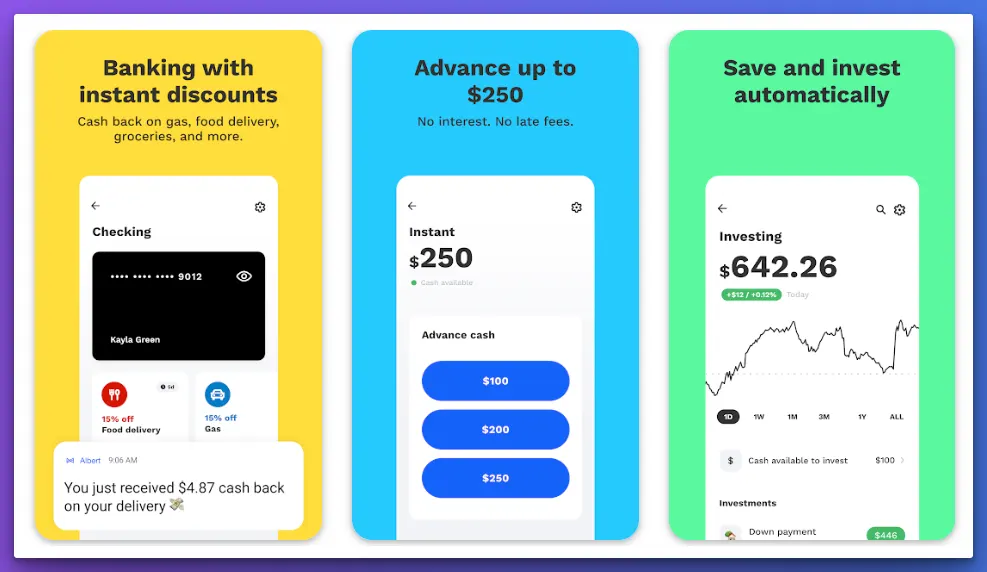

4. Albert

Accessing rapid cash for unforeseen expenses is paramount in innovative financial technology solutions. Albert, akin to Klover, stands as an alternative app that empowers users to secure up to $250 quickly.

Let’s delve into how Albert aligns with Klover while showcasing its unique approach to efficient financial solutions.

Accessible on both Google Play and the Apple App Store, Albert emerges as a parallel contender to Klover, catering to the modern individual’s need for prompt financial assistance.

Albert serves as a dependable avenue for obtaining swift cash up to $250, echoing the offerings of Klover. Its intuitive application process and user-friendly interface ensure that users can secure the necessary funds with ease and convenience.

Like Klover, Albert emphasizes its commitment to assisting users during financial challenges. The app’s focus on providing up to $250 aligns with the contemporary need for quick and reliable financial solutions.

Beyond mirroring Klover, Albert introduces its unique features. It incorporates tools that help users optimize finances, providing insights and recommendations to bolster financial well-being.

Albert asserts itself as a noteworthy contender in the realm of apps akin to Klover, delivering swift cash up to $250. Its accessibility, efficient solutions, and emphasis on financial empowerment make it an appealing choice for individuals requiring timely financial support.

In a world where financial technology continually advances, platforms like Albert and Klover exemplify the convergence of innovation, accessibility, and empowerment, addressing the diverse financial needs of modern individuals.

Pros:-

Efficient Cash Access: Albert stands out for its ability to provide quick access to up to $250, aligning closely with Klover. Its streamlined process ensures users can secure funds rapidly when unexpected expenses arise.

Financial Optimization: Going beyond immediate cash, Albert introduces tools to help users optimize their finances. This empowers users to make informed decisions that contribute to overall financial well-being.

Budgeting Assistance: With a focus on financial health, Albert assists users in budgeting and financial planning, encouraging responsible money management.

Cons:-

Loan Limitation: While Albert is an efficient solution for smaller-scale financial needs, its cap of $250 might not be sufficient for more substantial emergencies.

Availability: Albert might not be accessible in all regions, limiting its availability for some users seeking quick cash solutions.

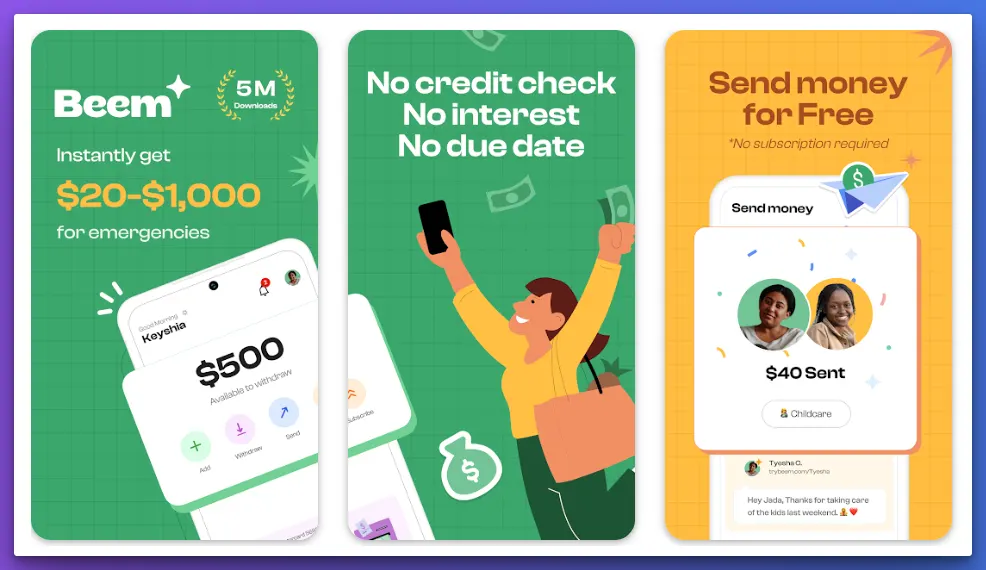

5. Beem

In the financial technology landscape, accessing instant cash has become a necessity. Much like Klover and Dave, Beem offers a solution for those seeking quick financial relief, instantly providing access to cash ranging from $20 to $1,000.

Let’s delve into how Beem aligns with its counterparts while showcasing its distinctive approach to delivering efficient financial solutions.

Available on both Google Play and the Apple App Store, Beem emerges as a contender among apps similar to Klover and Dave, addressing the immediate financial needs of users.

Beem serves as a reliable avenue for obtaining instant cash ranging from $20 to $1,000, echoing the offerings of Klover and Dave. Its intuitive application process and user-friendly interface ensure users can secure the necessary funds promptly and conveniently.

Comparable to Klover and Dave, Beem emphasizes its commitment to assisting users in financial need. The app’s focus on providing instant cash aligns with the need for quick and reliable financial solutions.

Beyond mirroring its counterparts, Beem introduces its unique attributes. It offers various cash advance options, catering to diverse financial needs and preferences. This versatility ensures that users can access the amount they require, whether a smaller sum or a larger cash advance.

In the realm of apps similar to Klover and Dave, offering instant cash ranging from $20 to $1,000, Beem is a noteworthy contender. Its accessibility, swift solutions, and flexible cash advance options make it a compelling choice for individuals seeking timely financial support.

As financial technology continues to evolve, platforms like Beem, Klover, and Dave exemplify the fusion of innovation, accessibility, and empowerment, addressing the various financial needs of modern individuals.

Pros:-

Instant Cash Variety: Beem shines with its diverse cash advance options, allowing users to instantly access anywhere from $20 to $1,000, catering to various financial requirements.

User-Friendly Interface: Much like its counterparts, Beem offers an intuitive application process and user-friendly interface, making it easy for users to secure funds promptly.

Versatility: The flexibility in cash advance options ensures that users can access the exact amount they need, making it suitable for small emergencies and larger financial needs.

Cons:-

Availability: Beem might not be accessible to all users globally, limiting its reach for those seeking instant cash solutions.

Terms and Fees: While offering a range of cash advance options, users should carefully review the terms and fees associated with each option to ensure it aligns with their financial circumstances.

Download The App From Google Play Store

Download The App From Apple App Store

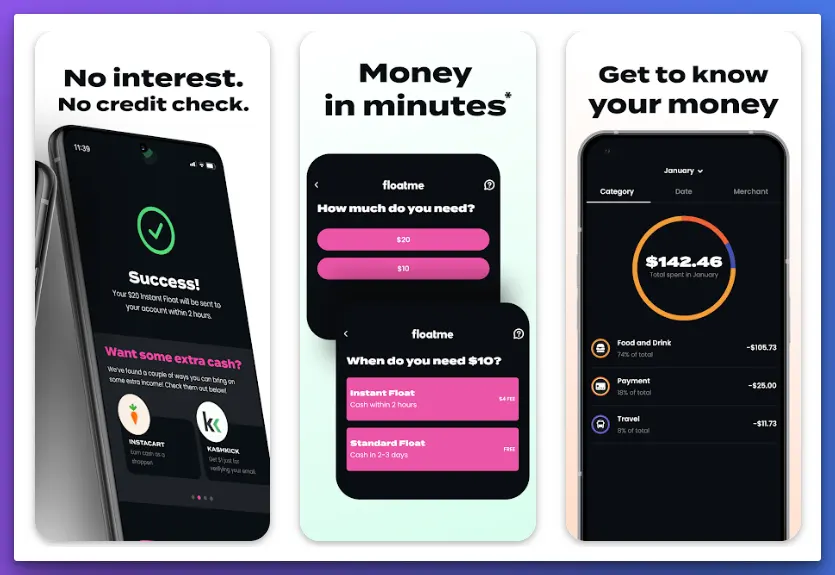

6. FloatMe

Quick and reliable financial assistance is a paramount need in the ever-evolving landscape of financial technology. FloatMe, much like Klover, emerges as a solution that caters to users’ financial requirements, providing a safety net during unforeseen circumstances.

Let’s delve into how FloatMe aligns with the spirit of Klover, while presenting its unique approach to delivering efficient financial solutions.

Available on both Google Play and the Apple App Store, FloatMe stands as a contender among apps that share similarities with Klover, addressing the immediate financial needs of users.

FloatMe serves as a dependable avenue for obtaining assistance, just like Klover. Its streamlined application process and user-friendly interface ensure users can access financial support promptly and conveniently.

Like Klover, FloatMe emphasizes its commitment to helping users during financial challenges. The app’s focus on providing financial assistance aligns with the contemporary need for reliable solutions when facing unexpected expenses.

Beyond echoing Klover’s essence, FloatMe introduces its unique attributes. It offers tools and features to help users better manage their finances, contributing to long-term financial stability.

In the realm of apps like klover, catering to users’ financial well-being, FloatMe establishes itself as a noteworthy contender. Its accessibility, efficient solutions, and focus on empowering users to achieve financial peace make it appealing for individuals seeking timely financial support.

In the evolving world of financial technology, platforms like FloatMe and Klover represent the fusion of innovation, accessibility, and empowerment, addressing the diverse financial needs of modern individuals.

Pros:-

Immediate Financial Aid: FloatMe stands out for its ability to provide quick financial assistance, much like Klover. Its streamlined process ensures users can access funds promptly during unexpected expenses.

User-Friendly Interface: With an intuitive application process and user-friendly interface, FloatMe makes it easy for users to navigate and secure financial support swiftly.

Financial Management Tools: Beyond immediate assistance, FloatMe offers tools and features to help users manage their finances more effectively, contributing to long-term financial stability.

Cons:-

Loan Limits: FloatMe might restrict the amount of financial assistance available to users, which could be a limitation for those requiring larger sums.

Availability: While accessible to many users, FloatMe might not be available in all regions, which could restrict its accessibility for some individuals.

Both FloatMe and Klover offer viable solutions for individuals seeking financial assistance. While FloatMe provides additional financial management tools, Klover focuses on flexibility in repayment options.

The choice between these platforms depends on your financial needs and preferences, as each app aims to provide efficient and timely solutions for addressing immediate financial challenges.

Download The App From Google Play Store

Download The App From Apple App Store

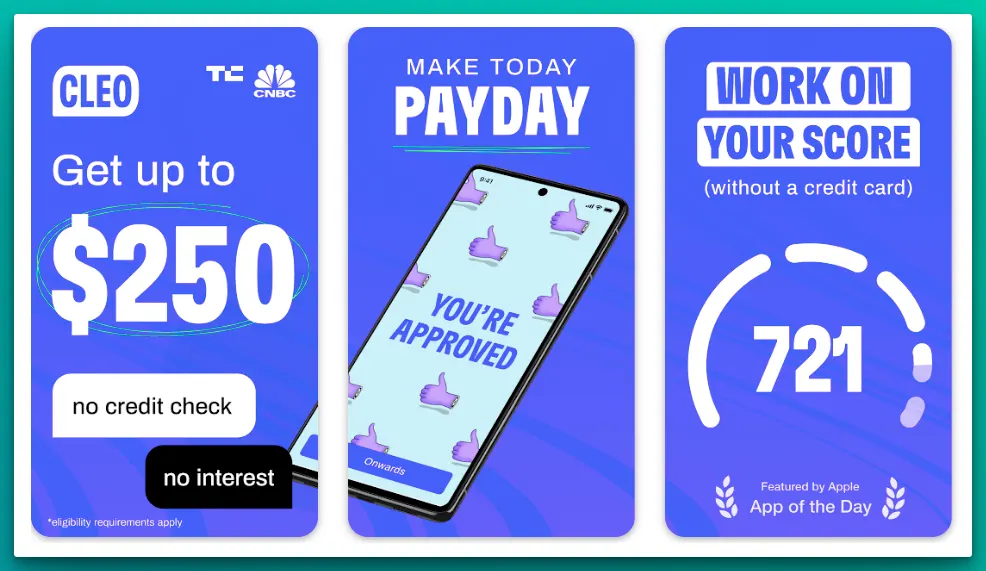

7. Cleo: $250 Fast Cash Advance

In financial technology, securing fast cash advances has become a crucial need. Like Klover and Dave, Cleo emerges as an app that addresses this need, providing users with quick access to $250 cash advances.

Let’s delve into how Cleo aligns with its counterparts while showcasing its distinctive approach to delivering efficient financial solutions.

Accessible on both Google Play and the Apple App Store, Cleo stands as a contender among apps that share similarities with Klover and Dave, addressing users’ immediate financial needs.

Cleo serves as a reliable avenue for obtaining fast cash advances of $250, echoing the offerings of Klover and Dave. Its streamlined application process and user-friendly interface ensure users can secure the necessary funds promptly and conveniently.

Comparable to Klover and Dave, Cleo emphasizes its commitment to assisting users during financial stress. The app’s focus on providing fast cash advances aligns with the contemporary need for swift and reliable financial solutions.

Beyond echoing its counterparts, Cleo introduces its unique attributes. It offers tools and features that empower users to track their spending, manage budgets, and make informed financial decisions.

Cleo asserts itself as a noteworthy contender in apps like klover and Dave, offering fast cash advances of $250. Its accessibility, efficient solutions, and emphasis on financial empowerment make it appealing to individuals seeking timely financial support.

As financial technology continues to evolve, platforms like Cleo, Klover, and Dave exemplify the fusion of innovation, accessibility, and empowerment, addressing the diverse financial needs of modern individuals.

Pros:-

Fast Cash Access: Cleo excels in providing quick access to $250 cash advances, aligning closely with Klover and Dave. Its streamlined process ensures users can secure funds rapidly.

Budget Management: Beyond immediate cash assistance, Cleo offers tools and features to help users track spending, manage budgets, and improve overall financial management.

Financial Insights: Cleo provides insights into users’ financial habits, enabling them to make informed decisions about their spending and budgeting.

Cons:-

Loan Limitation: Like Klover and Dave, Cleo might have restrictions on the number of cash advances available, which could be limiting for those requiring larger sums.

Availability: While accessible to many users, Cleo might not be available in all regions, which could restrict its accessibility for some individuals.

Download The App From Google Play Store

Download The App From Apple App Store

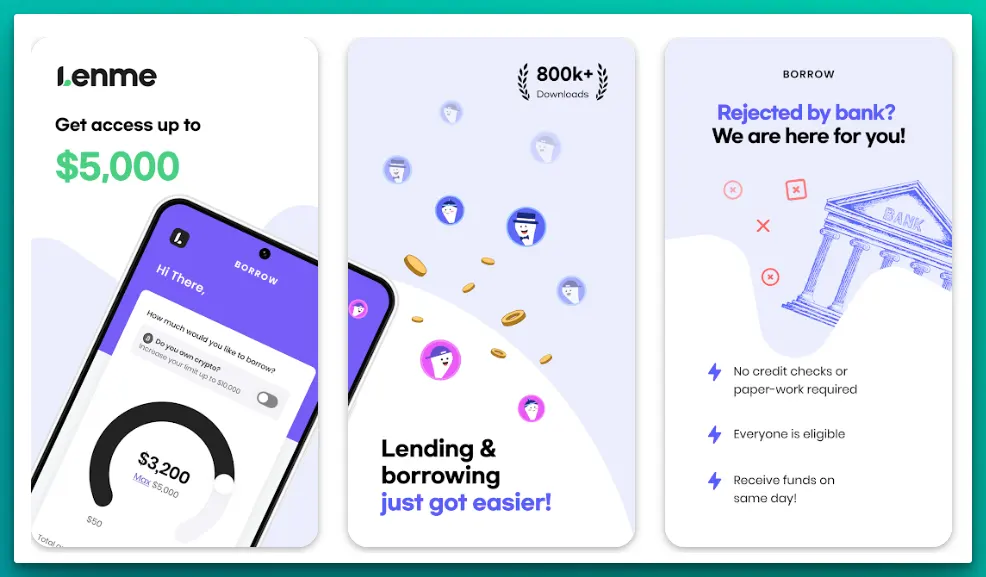

8. Lenme – Access to up to $5,000

In financial technology, the ability to access funds swiftly has become an essential facet of modern life. Lenme, much like Klover, presents itself as an application that addresses this need, offering users access to up to $5,000.

Let’s delve into how Lenme aligns with its counterparts while showcasing its unique approach to providing efficient financial solutions.

Available on both Apple App Store and Google Play, Lenme emerges as a contender among applications akin to Klover, catering to users’ financial aspirations.

Lenme serves as a reliable channel for obtaining funds, much like Klover. Its streamlined application process and user-friendly interface ensure users can access the required funds swiftly and conveniently.

Echoing the spirit of Klover, Lenme prioritizes helping users bridge financial gaps. The application’s focus on providing access to up to $5,000 aligns with the growing demand for efficient and dependable financial solutions.

Beyond mirroring its counterparts, Lenme brings its unique offerings to the table. It emphasizes a platform that connects lenders and borrowers directly, fostering a sense of financial community and transparency.

In the landscape of applications like Klover, offering access to up to $5,000, Lenme solidifies its position as a noteworthy contender. Its accessibility, prompt solutions, and emphasis on fostering financial connections set it apart.

As financial technology continues to evolve, platforms like Lenme, Klover, and others exemplify the intersection of innovation, accessibility, and empowerment, addressing the diverse financial needs of modern individuals.

Pros:-

Higher Loan Limit: Lenme distinguishes itself by offering access to a substantial sum of up to $5,000, accommodating larger financial needs.

Direct Lender-Borrower Connection: The platform’s emphasis on connecting lenders and borrowers fosters transparency and community within the financial ecosystem.

Flexibility: Lenme offers various borrowing options, allowing users to choose the loan terms that suit their financial situation.

Cons:-

Availability: Lenme might not be accessible to users in all regions, limiting its availability for those seeking higher loan limits.

Loan Approval Process: While emphasizing direct connections, the application’s approval process might vary in speed and ease for different users.

Lenme and Klover provide viable solutions for individuals seeking access to up to $5,000. While Lenme offers a higher loan limit and a direct connection between lenders and borrowers, Klover focuses on immediate assistance and ease of use.

Your choice between these platforms should be based on your financial requirements and preferences, as each app aims to provide efficient and timely solutions for addressing diverse financial challenges.

Download The App From Google Play Store

Download The App From Apple App Store

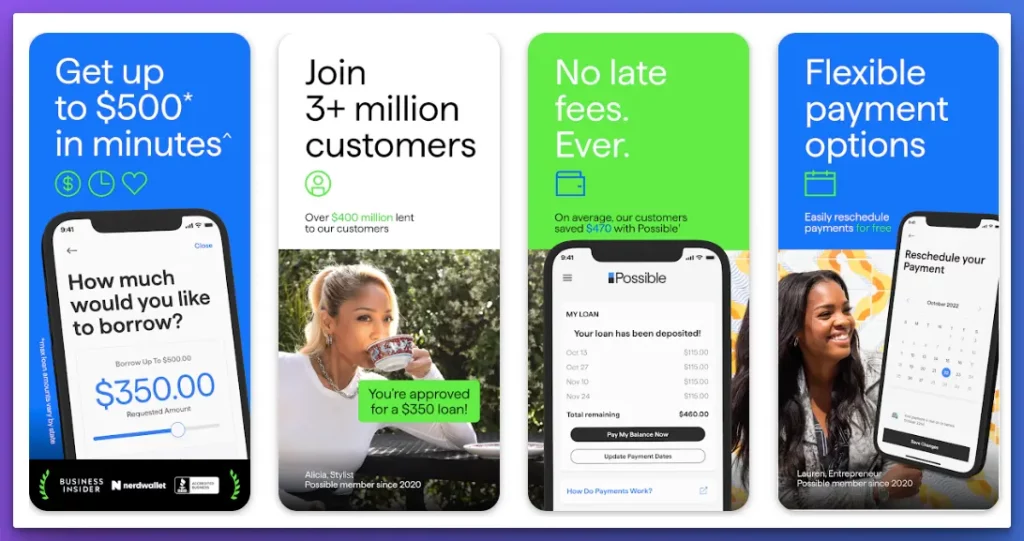

9. Possible Finance

In the realm of quick financial solutions, Possible emerges as an application that allows users to borrow up to $500 instantly. Like Klover, Possible addresses the pressing need for immediate funds during financial uncertainty.

Let’s delve into how Possible aligns with its counterparts while showcasing its unique approach to delivering swift financial assistance.

Accessible on both Google Play and the Apple App Store, Possible stands as a contender among apps that share similarities with Klover, offering a lifeline for users needing quick cash.

Possible is a reliable channel for obtaining immediate funds, much like Klover. Its streamlined application process and user-friendly interface ensure users can secure the necessary funds promptly and conveniently.

Reflecting the essence of Klover, Possible prioritizes helping users navigate their financial challenges. The app’s focus on providing instant access to up to $500 resonates with the contemporary need for swift and dependable financial solutions.

In addition to mirroring its counterparts, Possible introduces its unique attributes. It offers features such as credit-building options, fostering a sense of financial empowerment among its users.

In the landscape of apps similar to Klover, offering instant borrowing up to $500, Possible solidifies its position as a noteworthy contender. Its accessibility, prompt solutions, and emphasis on financial empowerment set it apart.

As financial technology evolves, platforms like Possible, Klover, and others exemplify the fusion of innovation, accessibility, and empowerment, addressing the diverse financial needs of modern individuals.

Pros:-

Instant Funds: Possible excels in providing immediate access to up to $500, addressing urgent financial needs like Klover.

Credit-Building Features: The app offers credit-building options, allowing users to enhance their financial standing while obtaining necessary funds.

User-Friendly Interface: With a streamlined process and user-friendly interface, Possible ensures users can secure funds swiftly and conveniently.

Cons:-

Loan Limit: While providing instant access to funds, the borrowing limit of up to $500 might not be sufficient for users with larger financial requirements.

Availability: Possible might not be accessible in all regions, limiting its availability for some users.

Download The App From Google Play Store

Download The App From Apple App Store

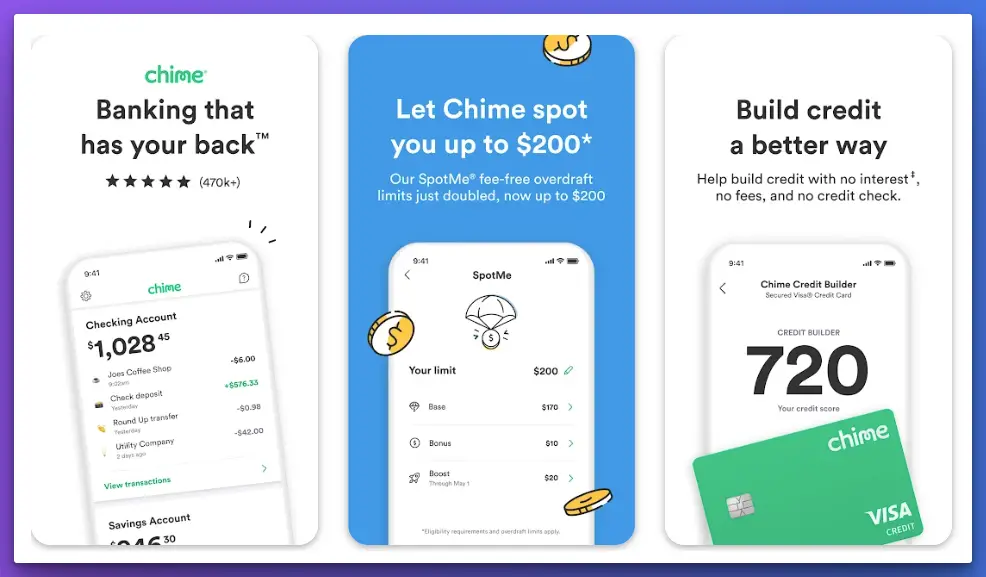

10. Chime

In the ever-evolving landscape of mobile banking, Chime emerges as an app that resonates with the essence of Klover. With its innovative approach and customer-centric features, Chime redefines the banking experience.

Let’s delve into how Chime aligns with its counterparts while showcasing its distinctive attributes that elevate the mobile banking journey.

Available on both Google Play and the Apple App Store, Chime stands as a testament to the transformative power of financial technology, making it a worthy contender in the realm of apps similar to Klover.

Chime functions as a comprehensive mobile banking platform, mirroring the concept of financial empowerment that Klover embodies. Its user-friendly interface and diverse services, including direct deposits, savings options, and fee-free transactions, cater to modern users seeking efficient and accessible financial solutions.

Reflecting the principles of Klover, Chime focuses on eliminating unnecessary fees and offering seamless financial services to its users. With early direct deposit options and innovative savings features, Chime empowers users to take control of their finances and build a secure financial future.

Distinct from other platforms, Chime also offers round-up features that enable users to effortlessly save spare change, further enhancing the app’s appeal among individuals seeking to enhance their savings habits.

In the realm of apps similar to Klover, Chime emerges as a frontrunner, offering users a holistic banking experience that is both innovative and empowering. Its accessibility, commitment to transparency, and customer-centric approach make it a standout choice for those seeking a modern and efficient banking solution.

As the landscape of mobile banking continues to evolve, platforms like Chime and Klover exemplify the fusion of technology and financial empowerment, addressing the diverse financial needs of contemporary individuals.

Pros:-

Fee-Free Transactions: Much like Klover, Chime takes a stand against unnecessary fees, offering users fee-free transactions and overdraft protection, allowing for a more transparent and cost-effective banking experience.

Early Direct Deposit: Chime offers early access to direct deposits, giving users the advantage of receiving their funds ahead of traditional banking timelines, which can be especially beneficial during financial emergencies.

Automated Savings: The round-up feature allows users to save spare change from transactions effortlessly, encouraging healthy savings habits without requiring extra effort.

User-Friendly Interface: The app’s interface is designed for convenience, enabling easy navigation and access to various features, making it suitable for tech-savvy and novice users.

Access to ATMs: Chime provides access to a network of fee-free ATMs, offering users the convenience of cash withdrawals without additional charges.

Cons:-

Limited Customer Support: While Chime emphasizes its digital features, some users might find limited customer support options compared to traditional banks.

No Physical Branches: Chime operates exclusively as a digital platform, which might not suit users who prefer in-person banking experiences.

Availability: Although Chime is accessible to many users, its availability might be restricted in certain regions.

Savings Account Interest: While Chime offers automated savings features, its savings account interest rates might be lower compared to some traditional banks.

In modern mobile banking apps like Klover, Chime stands out with its commitment to fee transparency, early access to funds, and innovative savings options.

The platform’s focus on enhancing user financial well-being through user-friendly interfaces and technology-driven solutions makes it a popular choice among those seeking a seamless and empowering banking experience.

Download The App From Google Play Store

Download The App From Apple App Store

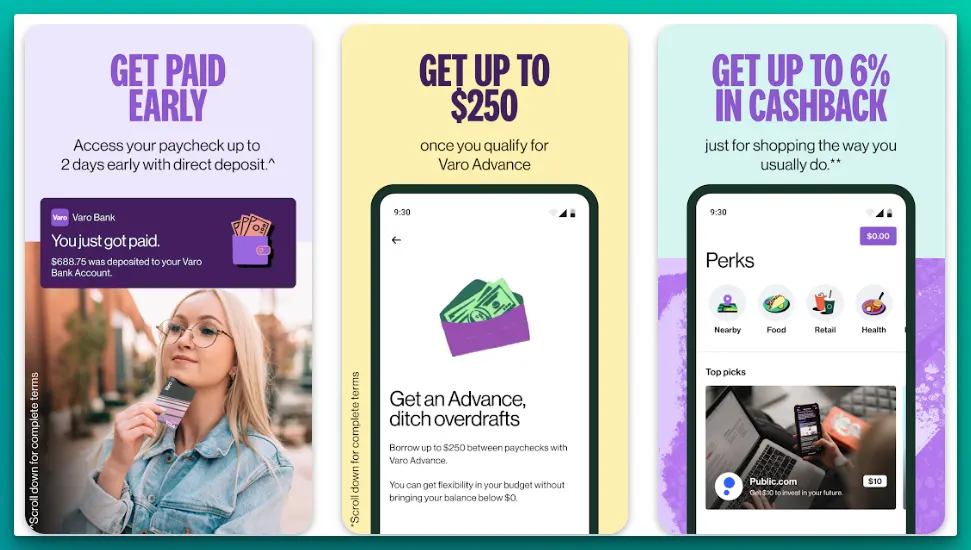

11. Varo Bank

In modern banking applications, Varo Bank stands as a platform that closely aligns with the attributes of Klover. With its innovative approach and user-centric features, Varo Bank allows users to borrow sums ranging from $20 to $250 upon meeting the necessary criteria.

Let’s delve into how Varo Bank fits into the financial technology landscape, highlighting its distinctive attributes that resonate with users seeking quick financial assistance.

Available on both the Apple App Store and Google Play, Varo Bank emerges as a strong contender among applications similar to Klover. It caters to users’ immediate financial needs with its accessible and user-friendly platform.

Varo Bank functions as a comprehensive mobile banking solution, mirroring the concept of financial empowerment that Klover embodies. By offering borrowers the ability to access sums from $20 to $250, Varo Bank addresses the need for small-scale immediate financial solutions.

Reflecting the principles of Klover, Varo Bank also emphasizes user-friendly interfaces and streamlined processes. Its user-centric design ensures that users can navigate the application effortlessly, making it suitable for tech-savvy individuals and those new to mobile banking.

One noteworthy feature of Varo Bank is its emphasis on responsible borrowing and financial wellness. The application evaluates users’ financial stability before granting them the ability to borrow, promoting responsible financial behavior.

In the landscape of apps like klover, Varo Bank stands out as a reliable platform for individuals seeking small-scale immediate borrowing. Its accessibility, user-friendly design, and commitment to responsible borrowing make it attractive for those looking to bridge small financial gaps.

As financial technology advances, platforms like Varo Bank and Klover exemplify the fusion of innovation, accessibility, and empowerment, addressing the diverse financial needs of modern individuals.

Pros:-

Small-Scale Borrowing: Varo Bank addresses small-scale financial gaps, allowing users to borrow as low as $20 up to $250, catering to immediate financial needs.

User-Friendly Interface: The app’s user-centric design ensures easy navigation, making it accessible for users with varying levels of technological familiarity.

Responsible Borrowing: Varo Bank evaluates users’ financial stability before granting borrowing access, promoting responsible behavior and financial wellness.

Transparent Terms: The platform offers clear terms and conditions for borrowing, allowing users to understand the costs and expectations associated with the borrowing process.

Cons:-

Limited Borrowing Range: While suitable for small financial needs, Varo Bank might not be the best choice for users seeking larger sums beyond the $20 – $250 range.

Availability: Varo Bank might not be accessible in all regions, potentially limiting its availability for users seeking its borrowing services.

Qualification Criteria: Qualifying for borrowing might involve certain criteria that some users might find restrictive.

App-Only Platform: Varo Bank operates exclusively as a mobile app, which might not cater to individuals who prefer in-person banking experiences.

In the landscape of financial apps like Klover, Varo Bank shines as a platform offering quick and accessible borrowing for small financial needs. Its commitment to responsible borrowing, user-friendly interface, and transparent terms make it a viable choice for individuals looking for a seamless way to address small-scale financial gaps.

As technology continues to shape the financial landscape, platforms like Varo Bank and Klover embody the fusion of innovation and accessibility, catering to the diverse financial needs of modern individuals.

Download The App From Google Play Store

Download The App From Apple App Store

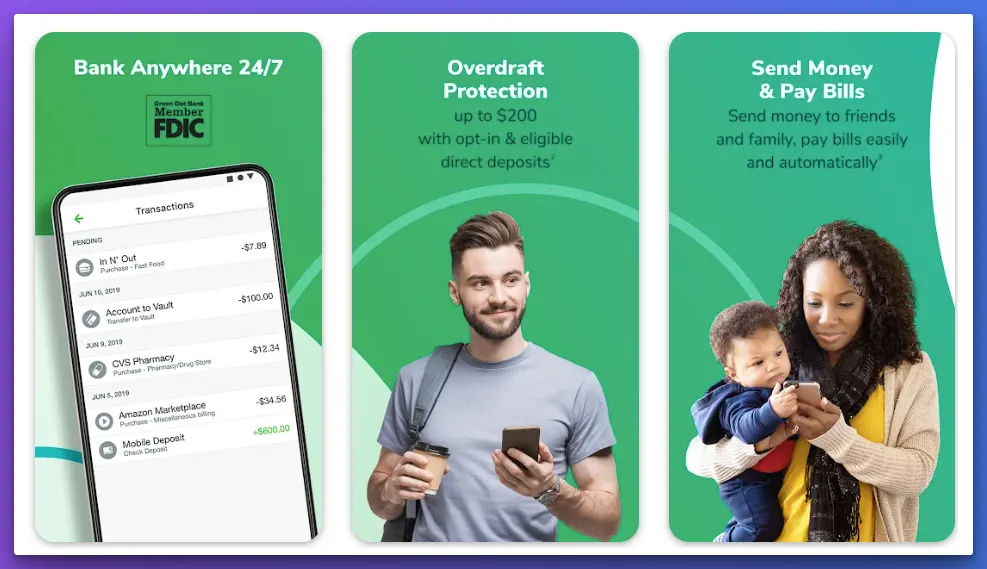

12. Green Dot

In the dynamic landscape of mobile banking, Green Dot stands out as an app that resonates with the essence of Klover. With its innovative features and user-centric approach, Green Dot transforms how users manage their finances.

Let’s explore how Green Dot aligns with its counterparts while showcasing the unique attributes that set it apart in financial technology.

Available on both Google Play and the Apple App Store, Green Dot emerges as a formidable contender among apps similar to Klover. It addresses users’ financial needs with its accessible and intuitive platform.

Green Dot functions as a comprehensive mobile banking solution, much like Klover. Its user-friendly interface, fee transparency, and diverse services cater to the modern user seeking efficient financial management.

Reflecting the principles of Klover, Green Dot emphasizes accessibility and convenience. Users can manage their finances, view transactions, and even deposit checks through the app, enhancing their financial control.

One of Green Dot’s unique attributes is its focus on helping users build their credit scores. This feature resonates with individuals seeking to improve their financial well-being while managing their banking needs.

In the realm of apps similar to Klover, Green Dot is a testament to the fusion of innovation, accessibility, and empowerment. Its commitment to transparency, diverse offerings, and credit-building features make it a noteworthy choice for those who manage their finances effectively.

As financial technology continues to evolve, platforms like Green Dot and Klover exemplify the convergence of innovation and financial empowerment, addressing the diverse needs of contemporary individuals.

Pros:-

Fee Transparency: Like Klover, Green Dot emphasizes fee transparency, ensuring that users understand the costs of their financial transactions.

Accessible Banking: Green Dot allows users to manage their finances, view transactions, and even deposit checks through its user-friendly mobile app.

Credit Building: One of Green Dot’s distinctive features is its emphasis on helping users build their credit scores, contributing to users’ long-term financial well-being.

Varied Services: Green Dot offers diverse services, ranging from managing finances to direct deposits, catering to the comprehensive financial needs of users.

Cons:-

Limited Physical Presence: Unlike traditional banks, Green Dot lacks physical branches, which might not appeal to users who prefer in-person banking experiences.

Qualification Criteria: Some services, such as credit building, might have specific qualification criteria that not all users can easily meet.

App-Only Platform: Green Dot operates exclusively as a mobile app, which might not cater to users who prefer desktop or web-based banking.

Availability: Green Dot might not be accessible in all regions, limiting its availability for potential users.

In modern mobile banking platforms akin to Klover, Green Dot shines as a platform that emphasizes accessibility, fee transparency, and credit-building features. Its commitment to empowering users to manage their finances effectively and build their credit scores makes it a valuable choice for individuals looking for a seamless and comprehensive financial solution.

As financial technology continues to evolve, platforms like Green Dot and Klover exemplify the fusion of innovation and accessibility, catering to the diverse financial needs of modern individuals.

Download The App From Google Play Store

Download The App From Apple App Store

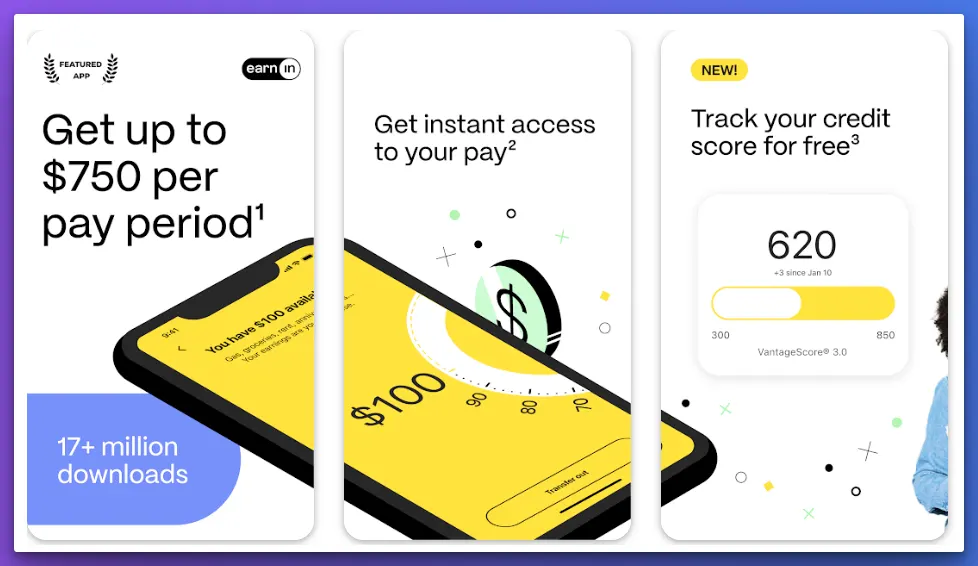

13. EarnIn

In the realm of innovative financial apps, EarnIn shines as a platform that closely mirrors the attributes of Klover. With its unique approach and user-centric features, EarnIn redefines how individuals manage their finances.

Let’s delve into how EarnIn aligns with its counterparts while showcasing its distinctive attributes that cater to the modern user seeking financial flexibility.

Available on both Google Play and the Apple App Store, EarnIn emerges as a prominent contender among apps similar to Klover. It empowers users by granting them access to a portion of their earned wages before payday.

EarnIn functions as a dynamic financial solution, much like Klover. Its revolutionary concept of allowing users to access up to $750 per paycheck is a testament to its commitment to providing immediate financial assistance.

Reflecting the principles of Klover, EarnIn focuses on reducing financial stress by allowing users to access their earnings when needed. This approach empowers users to bridge financial gaps without using high-interest loans or credit card debt.

One of EarnIn’s unique features is its commitment to responsible financial behavior. The platform encourages users to tip what they think is fair to help sustain the service, promoting a community of mutual support.

In the realm of apps like klover, EarnIn stands out as a beacon of financial empowerment. Its accessibility, commitment to responsible financial behavior, and the ability to access a portion of earned wages before payday makes it a standout choice for those seeking a flexible and holistic financial solution.

As financial technology continues to evolve, platforms like EarnIn and Klover exemplify the fusion of innovation and financial empowerment, addressing the diverse financial needs of contemporary individuals.

Pros:-

Flexible Financial Access: EarnIn empowers users to access a portion of their earned wages before payday, providing financial flexibility to cover immediate needs.

No Interest or Fees: Unlike traditional loans, EarnIn doesn’t charge interest or fees. Users can tip what they think is fair to sustain the service.

Community Support: The platform fosters community by encouraging users to help each other through tips, creating a culture of mutual support.

Financial Empowerment: EarnIn reduces the reliance on high-interest loans or credit cards, promoting responsible financial behavior and empowering users to manage their finances better.

Cons:-

Qualification Criteria: To access the benefits of EarnIn, users need to meet specific qualification criteria, which might limit its availability for some individuals.

Income Verification: Users might need to provide income verification to use the platform, which could inconvenience some.

Limited Withdrawal Amount: While EarnIn offers flexible access to earned wages, the maximum withdrawal limit of $750 per paycheck might not cover larger financial needs.

Payroll Integration: Users need to link their bank accounts and payroll information to utilize EarnIn, which might not appeal to those concerned about privacy.

In the landscape of apps like Klover, EarnIn is a platform that emphasizes financial flexibility and responsible behavior. Its unique approach of offering users access to earned wages before payday, without interest or fees, promotes a sense of empowerment and mutual support.

While EarnIn might not cover all financial scenarios, its focus on immediate needs and fostering a community-driven approach make it a compelling choice for individuals seeking to manage their finances more effectively.

Download The App From Google Play Store

Download The App From Apple App Store

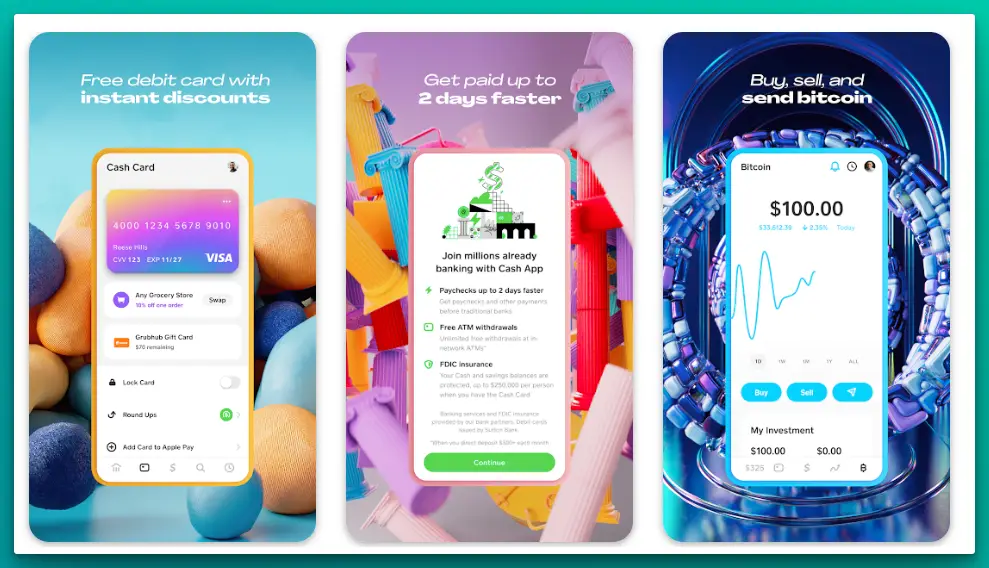

14. Cash App

In modern financial applications, Cash App emerges as a platform that closely mirrors the attributes of both Klover and FloatMe. With its innovative features and user-centric approach, Cash App redefines how individuals manage their financial transactions.

Let’s explore how Cash App aligns with its counterparts while showcasing its distinctive attributes catering to contemporary users seeking seamless financial solutions.

Available on both Google Play and the Apple App Store, Cash App stands as a formidable contender among applications similar to Klover and FloatMe. It empowers users to easily manage their finances, send money, and even invest.

Cash App functions as a comprehensive platform, much like Klover and FloatMe. Its user-friendly interface, swift money transfers, and investment options cater to the modern user seeking seamless financial management.

Reflecting the principles of Klover and FloatMe, Cash App emphasizes accessibility and convenience. Users can easily link their bank accounts, debit cards, and credit cards to facilitate quick and secure financial transactions.

One of Cash App’s unique attributes is its Cash Card, a customizable debit card linked to the app. This feature enables users to purchase and withdraw money from ATMs, enhancing their financial flexibility.

In the realm of applications similar to Klover and FloatMe, Cash App stands out as a testament to the fusion of innovation, accessibility, and empowerment. Its commitment to streamlining financial transactions, offering investment options, and even providing a tangible Cash Card highlight its versatility.

As financial technology continues to evolve, platforms like Cash App, Klover, and FloatMe exemplify the convergence of innovation and financial empowerment, catering to the diverse financial needs of modern individuals.

Pros:-

Swift Money Transfers: Like Klover and FloatMe, Cash App allows users to send and receive money instantly, facilitating seamless transactions between friends, family, and businesses.

Investment Opportunities: Cash App allows users to invest in stocks and Bitcoin, allowing users to grow their wealth through investment.

Cash Card Convenience: The Cash Card feature enables users to purchase and withdraw money from ATMs, enhancing financial flexibility and convenience.

User-Friendly Interface: Cash App boasts an intuitive design that makes it easy for users to navigate and engage with various financial activities.

Cons:-

Limited Services: While versatile, Cash App might not offer the same breadth of financial services as traditional banks, which could be a drawback for users seeking a comprehensive banking experience.

Security Concerns: As with any financial app, users might have concerns about their transactions and personal information security.

In-App Purchases: Cash App offers additional services such as the Cash Card, which might lead to in-app purchases, potentially impacting users’ overall expenses.

Customer Support: Some users might find that customer support response times could be improved, which could be frustrating in case of urgent issues.

In modern financial solutions, Cash App shines as a platform combining convenience, investment opportunities, and streamlined financial transactions. Its commitment to accessibility, user-friendly design, and investment options make it a valuable choice for individuals looking to manage their finances efficiently.

As financial technology continues to evolve, platforms like Cash App, Klover, and FloatMe exemplify the fusion of innovation and accessibility, addressing the diverse financial needs of contemporary individuals.

Download The App From Google Play Store

Download The App From Apple App Store

Tips For Choosing the Right Apps like klover

In the dynamic landscape of modern financial technology, the quest for the perfect app that aligns with your financial needs is akin to finding a needle in a digital haystack.

As you search for apps similar to Klover, armed with the desire for efficient financial management and empowerment, it’s crucial to employ a discerning approach.

Here are some insightful tips to guide you in choosing the right app that resonates with your financial aspirations.

1. Assess Your Needs and Goals: Consider your financial needs and goals before delving into the available options. Whether you seek instant cash advances, investment opportunities, or streamlined money management, understanding your objectives will narrow your choices.

2. Comprehensive Feature Analysis: Different apps have varying features, from cash advances and budgeting tools to investment platforms. Scrutinize the features offered by each app and ascertain their alignment with your financial requirements.

3. User-Friendly Interface: An intuitive user interface enhances your experience with a financial app. Opt for apps that boast a user-friendly design, enabling you to navigate seamlessly through various functions.

4. Fee Structure and Transparency: Transparency in fee structures is paramount. Analyze the fees associated with transactions, cash advances, and any additional services the app offers. Choose an app that maintains a transparent fee structure.

5. Security Protocols: The security of your financial information is non-negotiable. Prioritize apps employing robust security protocols, including encryption and multi-factor authentication, to safeguard sensitive data.

6. Compatibility and Accessibility: Ensure the app is compatible with your operating system. Additionally, check if the app is accessible in your region, as some financial apps might have geographical restrictions.

7. User Reviews and Ratings: User reviews and ratings provide valuable insights into the app’s functionality, user experience, and customer support. Research what other users are saying to gauge the app’s performance.

8. Customer Support Quality: If you encounter issues or have questions, efficient customer support is crucial. Look for apps that offer responsive and helpful customer support channels.

9. Integration with Banking Services: An app’s integration with your existing banking services can streamline financial management. Evaluate if the app can link with your bank accounts, debit cards, or credit cards.

10. Trial Period Exploration: Consider utilizing trial periods to test the app’s features and functionalities. This firsthand experience will help determine if the app aligns with your preferences.

In pursuing apps similar to Klover, meticulous evaluation is your greatest ally. By meticulously analyzing features, assessing security measures, and considering compatibility, you’ll be equipped to make an informed decision.

Remember, the ideal financial app should enhance your money management and empower you to navigate your financial journey confidently.

Emerging Trends in Financial Apps

In the ever-evolving landscape of financial technology, staying attuned to emerging trends in financial apps is crucial to harness the power of innovation and secure your financial journey.

As traditional banking paradigms shift, financial apps are emerging as pivotal tools that transcend the boundaries of convenience, accessibility, and personalized financial management.

Let’s delve into the fascinating tapestry of these trends reshaping the future of finance.

1. Decentralized Finance (DeFi): The rise of DeFi is a paradigm shift in the financial world. DeFi apps leverage blockchain technology to provide decentralized lending, borrowing, trading, and more. DeFi fosters financial inclusion by removing intermediaries and empowers users with greater control over their assets.

2. Embedded Finance: The convergence of technology and finance gives rise to embedded finance, where financial services seamlessly integrate with non-financial platforms. From e-commerce sites offering instant credit to ride-sharing apps enabling payments, embedded finance redefines how we interact with money.

3. AI-Powered Personalization: Artificial Intelligence (AI) transforms financial apps into personalized financial assistants. These apps analyze user behavior, transactions, and preferences to offer tailored recommendations, investments, and budgeting strategies.

4. Contactless Payments: The pandemic expedited the adoption of contactless payments, and it’s here to stay. Apps equipped with Near Field Communication (NFC) technology enable users to make secure payments with a mere tap of their smartphones, reducing physical contact and enhancing convenience.

5. Cryptocurrency Integration: Cryptocurrency acceptance of cryptocurrencies has prompted financial apps to integrate crypto functionalities. From allowing users to buy, sell, and trade crypto to offering crypto-backed loans, these apps cater to the growing crypto-savvy population.

6. Biometric Security: The conventional password gives way to advanced security measures like biometric authentication. Apps utilize fingerprints, facial recognition, and even voiceprints to ensure secure access to financial information.

7. Gamification of Saving and Investing: To encourage healthy financial habits, apps are gamifying saving and investing. Users earn rewards, badges, or even small cash incentives for achieving financial goals, transforming financial management into an engaging experience.

8. Sustainable Investing: The rise of sustainable investing has led to the emergence of apps that enable users to align their investments with their ethical values. These apps offer access to portfolios centered around environmentally friendly and socially responsible companies.

9. Open Banking and API Integration: Open banking regulations fuel collaboration between financial institutions and third-party apps. This integration empowers users to aggregate financial data from various sources, enabling a comprehensive view of their finances.

10. Instant Payments and Real-Time Settlements: Financial apps revolutionize payment processing with instant payments and real-time settlement capabilities. This trend ensures that transactions are processed swiftly, enhancing liquidity and financial flexibility.

As the financial app ecosystem continues to evolve, these emerging trends redefine the way we manage, invest, and interact with money. From blockchain-powered decentralized finance to personalized AI-driven financial assistants, the future of finance is becoming increasingly innovative and inclusive.

By embracing these trends, users stand to benefit from enhanced financial empowerment, security, and accessibility in a rapidly changing financial landscape.

📗FAQ’s

What apps are similar to Klover?

Several apps similar to Klover offer instant cash advances and financial assistance. Examples include MoneyLion, Brigit, Earnin, Chime, and Albert. These apps allow users to access funds quickly and manage their finances efficiently.

What apps lend you money instantly?

Apps like Klover, MoneyLion, Brigit, Earnin, and Dave are among the platforms that offer instant money-lending services. These apps typically allow users to access a portion of their earned wages or offer small loans that can be deposited directly into their accounts.

Can you get 2 advances from Klover?

Yes, Klover often allows users to get multiple advances, depending on their financial circumstances and repayment history. However, it’s important to note that the eligibility criteria and terms may vary, so it’s advisable to review the specific policies of the app.

How to borrow money from a cash advance app like MoneyLion?

Borrowing money from a cash advance app like MoneyLion involves a straightforward process. After downloading the app and signing up, you may need to connect your bank account and provide relevant information.

The app evaluates your financial activity to determine your borrowing limit. Once approved, you can swiftly request an advance, usually deposited into your account. Repayment is typically deducted from your next paycheck or linked bank account.

Conclusion

We started with a common challenge many faces: the need for financial apps that offer flexibility, accessibility, and user-friendliness beyond what Klover provides. This problem led us to an exhaustive search for alternatives that match various individual requirements.

Our exploration of “Apps Like Klover” uncovered options catering to diverse financial needs, preferences, and goals. Whether you were seeking more advanced budgeting tools, faster access to funds, or a fresh approach, we hope our guide has enlightened you on the top alternatives available in the market.

In the ever-evolving financial technology landscape, staying informed and aligned with your unique needs is paramount. The alternatives to Klover we’ve discussed are more than mere replacements; they represent a broad spectrum of solutions that empower you to take control of your financial life.

We encourage you to explore these apps further, test them out, and discover the one that resonates with you best. Remember, your finances are personal and should be your financial management tools.

Happy exploring!